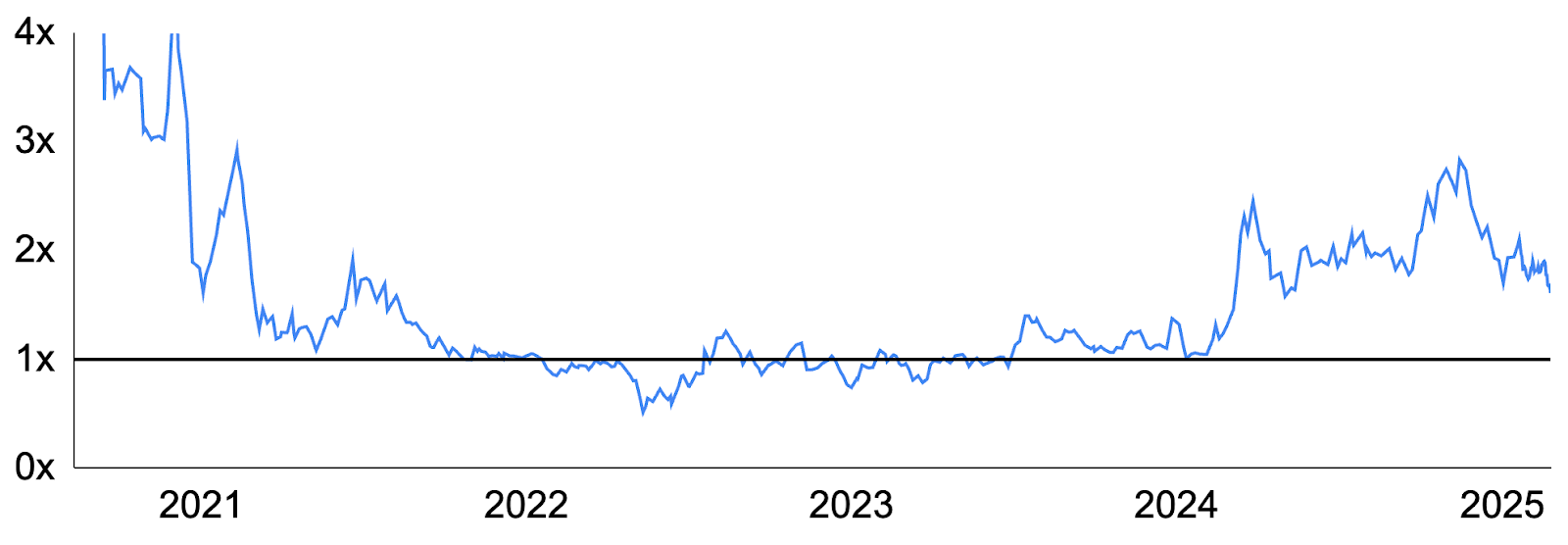

Strategy (NASDAQ: MSTR), the SaaS-based concern quality institution formerly known arsenic MicroStrategy that pioneered a bitcoin treasury strategy, is presently trading astatine a $73 cardinal marketplace cap, ~1.6x the worth of its underlying bitcoin holdings. This alleged “MSTR premium” has caused overmuch misunderstanding, steadfast skepticism and adjacent consternation, but with a decennary of heavy equities experience, we judge that determination are 3 reasons wherefore the MSTR premium is justified. These are peculiarly valid during periods of rising bitcoin terms expectations, arsenic we are successful now.

You're speechmaking Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor. Sign up here to get it successful your inbox each Wednesday.

CHART: MSTR’s premium to NAV

Source: MSTR-Tracker.com, GSR

First, Strategy takes connected leverage by issuing equity and indebtedness to put the proceeds into bitcoin, earning the quality betwixt the instrumentality connected bitcoin and its outgo of superior (ie. “carry”). Importantly, Strategy earns this transportation not conscionable this year, but besides successful aboriginal years arsenic well, and investors simply present-value this expected aboriginal transportation and see it successful MSTR’s marketplace cap.

In fact, this is simply a large crushed wherefore MSTR’s premium volition fluctuate with marketplace expectations of aboriginal bitcoin returns. Nevertheless, the archetypal crushed MSTR trades astatine a premium to its BTC holdings is that investors propulsion aboriginal BTC transportation to the present.

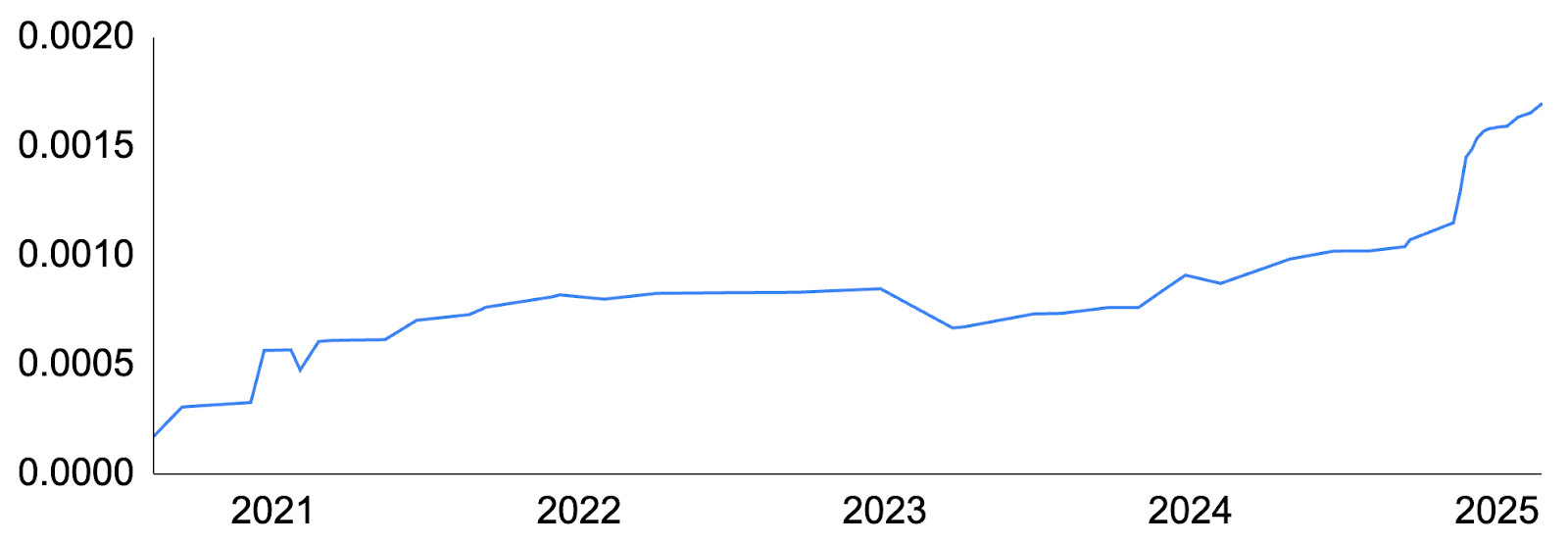

Second, Strategy monetizes intelligent superior markets issuance for the payment of shareholders. It accretes worth via convertible indebtedness issuance, wherever it not lone gets paid to connection bitcoin-like returns to the enslaved market, but besides for the volatility inherent successful its banal arsenic convertible enslaved arbitrageurs marque much wealth with a much volatile underlying asset. In addition, MSTR issues equity, mostly done at-the-money equity issuance programs, astatine a premium to publication value, which is by explanation accretive to shareholders. In fact, issuing equity astatine doubly publication worth is tantamount to selling $1 for $2, oregon conversely, buying BTC astatine 50% off. This is however Strategy was capable to make a 74% summation successful the magnitude of its bitcoin held per stock past year, equivalent to 140,630 BTC, oregon $14 cardinal of worth for shareholders.

Lastly, the full conception takes vantage of bitcoin and crypto’s nascency, the information that cryptocurrencies are successful secular enlargement and that bitcoin’s terms has tended to emergence implicit time.

For those not yet convinced, we connection the pursuing thought experiment: If I had a magic slope relationship with $100 USD successful it that paid you a 69% involvement rate, however overmuch wealth would you wage maine for that? While the reply whitethorn alteration from idiosyncratic to person, it is apt overmuch much than $100, meaning that the slope relationship would commercialized astatine a premium to its underlying USD (i.e. NAV).

This is precisely what is happening with MSTR, arsenic it has accrued its BTC per stock astatine a 69% yearly complaint since it began investing successful bitcoin successful August 2020. This summation successful BTC per stock (i.e. in-kind yield) is higher during bull markets and little during carnivore markets, but it has mostly risen implicit time. And portion determination is nary warrant that Strategy volition proceed to summation its BTC per stock successful the future, MSTR is guiding for a 15%+ summation this twelvemonth and 6-10% successful each of the pursuing 2 years.

Risks abound, of people — MSTR investors instrumentality connected ground hazard to the terms of BTC and the banal tends to determination much than bitcoin successful some directions. Relatedly, the premium whitethorn determination up oregon down successful the future, and the banal volition apt commercialized astatine a discount (i.e., beneath the worth of its bitcoin holdings) during carnivore markets. But the premium exists due to the fact that investors judge MSTR volition proceed to summation the magnitude of its bitcoin per stock successful the future, and they are consenting to wage up for that now.

CHART: MSTR’s summation successful bitcoin per stock (i.e. bitcoin yield)

Source: MSTR-Tracker.com, GSR

6 months ago

6 months ago

English (US)

English (US)