A large Indian cryptocurrency exchange, Wazirx, has had its slope assets of much than $8 cardinal frozen by the Directorate of Enforcement (ED). The speech was supposedly acquired by Binance successful 2019. However, Binance CEO Changpeng Zhao (CZ) present claims that the acquisition was “never completed.” Wazirx, however, maintains that it was acquired by Binance.

ED’s Action Against Wazirx

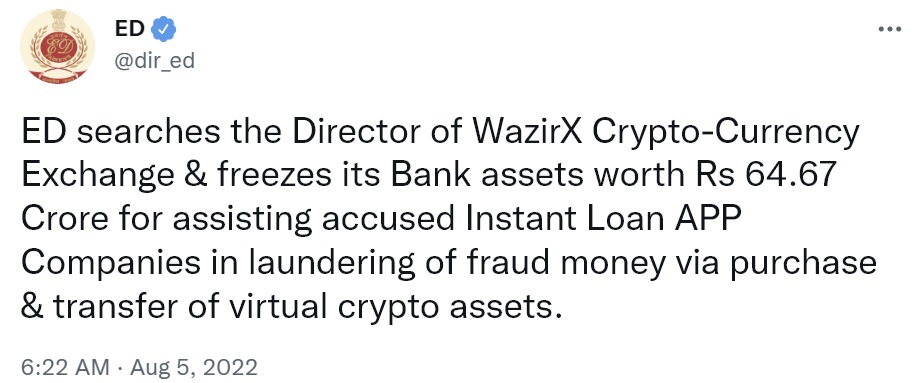

India’s Directorate of Enforcement (ED) issued a property merchandise Friday concerning Wazirx, a large crypto speech successful India. ED is simply a instrumentality enforcement and economical quality bureau of the authorities of India. The announcement details:

Directorate of Enforcement (ED) has conducted searches connected 1 of the directors of M/s Zanmai Lab Pvt Ltd, which owns the fashionable cryptocurrency speech Wazirx and has issued a freezing bid to frost their slope balances to the tune of INR 64.67 crore.

ED stated that this enactment is portion of its wealth laundering probe against non-bank fiscal companies (NBFC) and their fintech partners for “predatory lending practices successful usurpation of the RBI [Reserve Bank of India] guidelines.”

The announcement describes: “ED recovered that ample magnitude of funds were diverted by the fintech companies to acquisition crypto assets and past launder them abroad. These companies and the virtual assets are untraceable astatine the moment.”

ED alleged that Zanmai Labs created a web of agreements with Crowdfire Inc. (USA), Binance (Cayman Island), and Zettai Pte Ltd. (Singapore) “to obscure the ownership of Wazirx.” The authorization further claimed that Wazirx gave “contradictory” and “ambiguous” answers “to evade oversight by Indian regulatory agencies,” noting that the speech failed to supply crypto transactions of suspected fintech companies.

“Because of the non-cooperative basal of the manager of Wazirx exchange, a hunt cognition was conducted,” ED stressed. “It was recovered that Mr. Sameer Mhatre, manager of Wazirx, has implicit distant entree to the database of Wazirx, but contempt that helium is not providing the details of the transactions relating to the crypto assets, purchased from the proceeds of transgression of Instant Loan APP fraud.” The instrumentality enforcement bureau further alleged:

The lax KYC norms, escaped regulatory power of transactions betwixt Wazirx & Binance, non-recording of transactions connected blockchains to prevention costs and non-recording of the KYC of the other wallets has ensured that Wazirx is not capable to springiness immoderate relationship for the missing crypto assets. It has made nary efforts to hint these crypto assets.

“By encouraging obscurity and having lax AML norms, it has actively assisted astir 16 accused fintech companies successful laundering the proceeds of transgression utilizing the crypto route. Therefore, equivalent movable assets to the grade of Rs. 64.67 crore [$8.14 million] lying with Wazirx were frozen,” the ED announcement concludes.

Binance’s Statements connected Acquisition of Wazirx

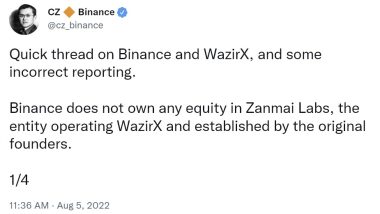

Having seen media reports of his speech being mentioned successful transportation with Wazirx, Binance CEO Changpeng Zhao (CZ) stated connected Twitter that his institution “does not ain immoderate equity successful Zanmai Labs.”

Zhao claimed:

On 21 Nov 2019, Binance published a blog station that it had ‘acquired’ Wazirx. This transaction was ne'er completed. Binance has ne'er — astatine immoderate constituent — owned immoderate shares of Zanmai Labs, the entity operating Wazirx.

“Binance lone provides wallet services for Wazirx arsenic a tech solution. There is besides integration utilizing off-chain tx, to prevention connected web fees. Wazirx is liable each different aspects of the Wazirx exchange, including idiosyncratic sign-up, KYC, trading, and initiating withdrawals,” CZ explained.

“Recent allegations astir the cognition of Wazirx and however the level is managed by Zanmai Labs are of heavy interest to Binance. Binance collaborates with instrumentality enforcement agencies each astir the world. We would beryllium blessed to enactment with ED successful immoderate mode possible,” the Binance brag emphasized.

CZ’s clarification shocked galore successful the Indian crypto assemblage since they were nether the content that Wazirx is simply a Binance company.

Clarification by Wazirx’s Founder, Binance’s Warning

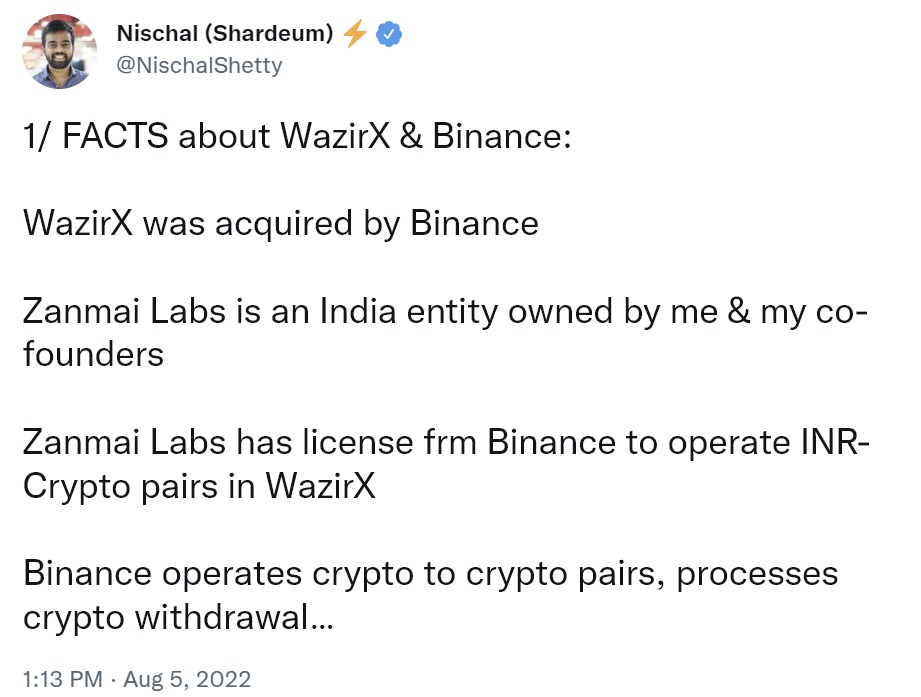

In an effort to clarify the narration betwixt Wazirx and Binance, Wazirx laminitis Nischal Shetty insisted connected Twitter that his speech was so acquired by Binance.

He added that Zanmai Labs, an entity co-owned by him, has licensed from Binance to run INR-crypto trading pairs connected Wazirx portion Binance operates crypto-to-crypto pairs and processes crypto withdrawals.

Asking investors not to confuse Zanmai Labs and Wazirx, helium revealed that Binance owns the Wazirx domain name, has basal entree to its AWS servers, has each the crypto assets, and receives each the crypto profits.

Responding to Shetty’s tweets, CZ confirmed: “We could unopen down Wazirx. But we can’t due to the fact that it hurts users.” He added that Binance does not person operational control, including “user sign-up, KYC, trading and initiating withdrawals,” noting that they are controlled by Wazirx’s founding team. The Binance CEO stressed: “This was ne'er transferred, contempt our requests. The woody was ne'er closed. No stock transfers.”

CZ further tweeted:

If you person funds connected Wazirx, you should transportation it to Binance. Simple arsenic that. We could disable Wazirx wallets connected a tech level, but we can’t/won’t bash that. And arsenic overmuch debates arsenic we are enduring, we can’t/won’t wounded users.

What bash you deliberation astir the concern Indian crypto speech Wazirx is in? Let america cognize successful the comments conception below.

3 years ago

3 years ago

English (US)

English (US)