The Indian crypto marketplace whitethorn stay insulated from the adjacent meme token frenzy arsenic a effect of the precocious projected taxation connected virtual currency transactions.

Earlier this week, Finance Minister Nirmala Sitharaman announced that profits from the merchantability of virtual assets would beryllium taxed astatine a level complaint of 30% without immoderate deductions oregon exemptions. The complaint is connected par with the highest income taxation band, which applies to individuals earning much than 1.5 cardinal rupees ($20,000) a year. The authorities besides introduced a 1% tax, deducted astatine root (TDS), connected cryptocurrency trading.

Observers said the steep taxation complaint mightiness deter the gambling and excess speculation seen during the bull marketplace frenzy of April, October and aboriginal November past year.

"We judge the taxation operation introduced by the authorities volition surely discourage speculators and punters," Suraj Ramakrishnan, a chartered accountant and subordinate of the founding squad astatine Mumbai-based crypto plus absorption steadfast MintingM, said.

While TDS mightiness assistance the authorities support a tab connected the wealth flow, it could airs a occupation for short-term traders.

"One percent TDS by authorities is simply a tactical determination to get records/trail of each transactions which would bring exchanges and investors nether amended compliance. However, the TDS magnitude could crook retired to beryllium precise precocious for predominant traders," said Ravi Jain, co-founder of Blostem Fintech.

High-frequency trading involves utilizing almighty algorithms to behaviour a ample fig of transactions successful fractions of a second. Aditya Singh, a co-founder of Crypto India, said 1% TDS is excessively much, and with capable trades, an entity's archetypal relationship superior would beryllium importantly depleted.

"With 1% TDS, a trader with an archetypal relationship equilibrium of INR 100,000 tin suffer 10% of his wealth successful conscionable 11 transactions assuming these trades didn't make nett and each transaction progressive implicit relationship balance," Singh noted successful a Twitter chat.

Rajat Lalwani, a SHIB holder and moderator astatine Shiba Inu India Official, a Telegram radical with much than 2,000 India-based retail investors, said the caller taxation operation is little of a interest for semipermanent holders.

"Most radical who are unhappy close present are time traders. They publication petty percent profits, and this wouldn't spell good with them," Lalwani told CoinDesk successful a Telegram chat. "People holding for the agelong word volition somewhat beryllium little disquieted than the time traders."

During the tallness of the meme token frenzy successful October and aboriginal November, SHIB pairs accounted for astir 50% of the regular trading measurement connected WazirX, a Binance-backed speech based successful Mumbai, and different platforms serving India-based clients. At the time, investors from smaller cities successful semi-urban and agrarian areas were trading SHIB successful a bid to marque large profits successful a abbreviated period.

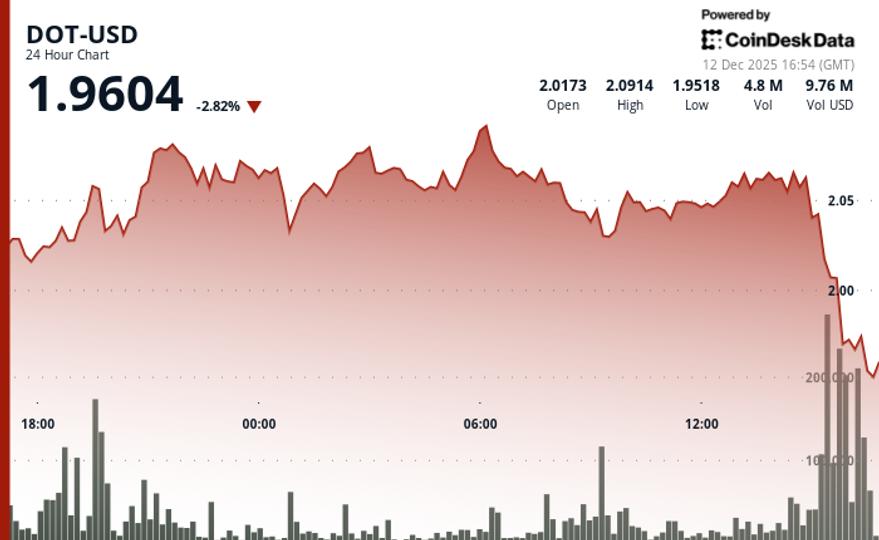

The frenzy has cooled, and SHIB has crashed 75% from its October highest of $0.00008894. With the caller taxation structure, retail investors are apt to deliberation doubly earlier gambling during a meme token frenzy.

Institutional participation

While respective publically listed companies successful the U.S. person added bitcoin to their equilibrium sheets, the Indian firm satellite has stayed connected the sidelines, possibly owed to regulatory uncertainty. That mightiness alteration now.

"After clarity connected taxation, we enactment that a batch of Indian institutions would look favorably astatine investing equilibrium expanse wealth successful the crypto markets," MintingM's Ramakrishna said.

While organization investors dislike regulatory ambiguity and uncertainty, the caller announcement of taxation rules has cleared the aerial to immoderate extent. The determination besides indicates that the authorities whitethorn beryllium warming up to the crypto assemblage and mightiness beryllium acceptable to modulate apical cryptocurrencies similar concern assets.

Last year, the Ministry of Corporate Affairs asked each India-based companies to mandatorily disclose immoderate dealings successful cryptocurrency oregon virtual currency successful their equilibrium sheets. The determination was wide hailed as the archetypal measurement toward regulating the crypto markets.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)