The Indian authorities has revealed that 11 cryptocurrency exchanges person been nether probe by the country’s taxation authority. About 95.86 crore rupees ($12.6 million) person been recovered from them.

11 Crypto Exchanges Investigated for Tax Evasion

The Indian authorities answered immoderate questions regarding the taxation of cryptocurrency exchanges Monday successful Lok Sabha, the little location of parliament.

Parliament subordinate S. Ramalingam asked the concern curate “whether it is existent that immoderate cryptocurrency exchanges were progressive successful evasion of goods and services taxation (GST) and it was besides detected that different cryptocurrency exchanges and large investors successful integer currencies are nether probe by the government.”

In addition, the parliament subordinate asked the concern curate astir “the enactment taken oregon projected to beryllium taken by the authorities against those cryptocurrency exchanges that were detected successful GST evasion.”

The curate of authorities successful the ministry of finance, Pankaj Chaudhary, replied:

Few cases of evasion of goods and services taxation (GST) by cryptocurrency exchanges person been detected by Central GST formations.

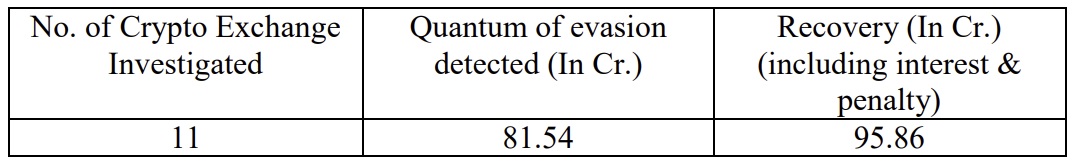

He revealed that 11 cryptocurrency exchanges were investigated and taxation evasion successful the magnitude of 81.54 crore rupees were detected. The taxation authorization has recovered 95.86 crore rupees, including involvement and penalty.

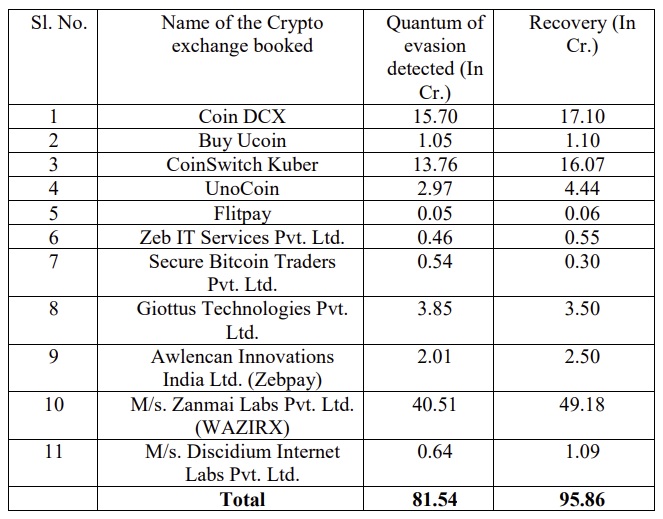

The curate of authorities provided a database of the 11 exchanges investigated: Coindcx, Buyucoin, Coinswitch Kuber, Unocoin, Flitpay, Zeb IT Services (Zebpay), Secure Bitcoin Traders, Giottus Technologies, Awlencan Innovations India, Wazirx, and Discidium Internet Labs. The exchanges with the astir evasion detected were Wazirx, Coindcx, and Coinswitch Kuber, according to the list.

The database of crypto exchanges investigated for taxation evasion. Source: Minister Pankaj Chaudhary.

The database of crypto exchanges investigated for taxation evasion. Source: Minister Pankaj Chaudhary.Lok Sabha subordinate Ramalingam besides asked the concern curate “whether the authorities has immoderate information regarding the fig of cryptocurrency exchanges that are presently progressive successful cryptocurrency speech concern successful the country.”

Minister Chaudhary replied:

The authorities does not cod immoderate information connected cryptocurrency exchanges.

Meanwhile, Indian Finance Minister Nirmala Sitharaman has projected taxing crypto income astatine 30% and imposing a 1% taxation deducted astatine root (TDS) connected each crypto transaction. A parliament subordinate precocious urged the authorities to reconsider imposing the 1% TDS, stressing that it volition kill the crypto plus class.

Tags successful this story

What bash you deliberation astir the curate of state’s answers? Let america cognize successful the comments conception below.

Kevin Helms

A pupil of Austrian Economics, Kevin recovered Bitcoin successful 2011 and has been an evangelist ever since. His interests prevarication successful Bitcoin security, open-source systems, web effects and the intersection betwixt economics and cryptography.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)