Bitcoin (BTC) is adjacent to forming a existent bottommost aft an full period of trading beneath its realized price, according to Glassnode’s latest weekly report.

According to the report, existent marketplace conditions suggest that marketplace bottommost enactment is near.

A bottommost enactment usually happens erstwhile determination are “large affirmative swings successful unrealized nett and loss” owed to capitulation and coin redistributions.

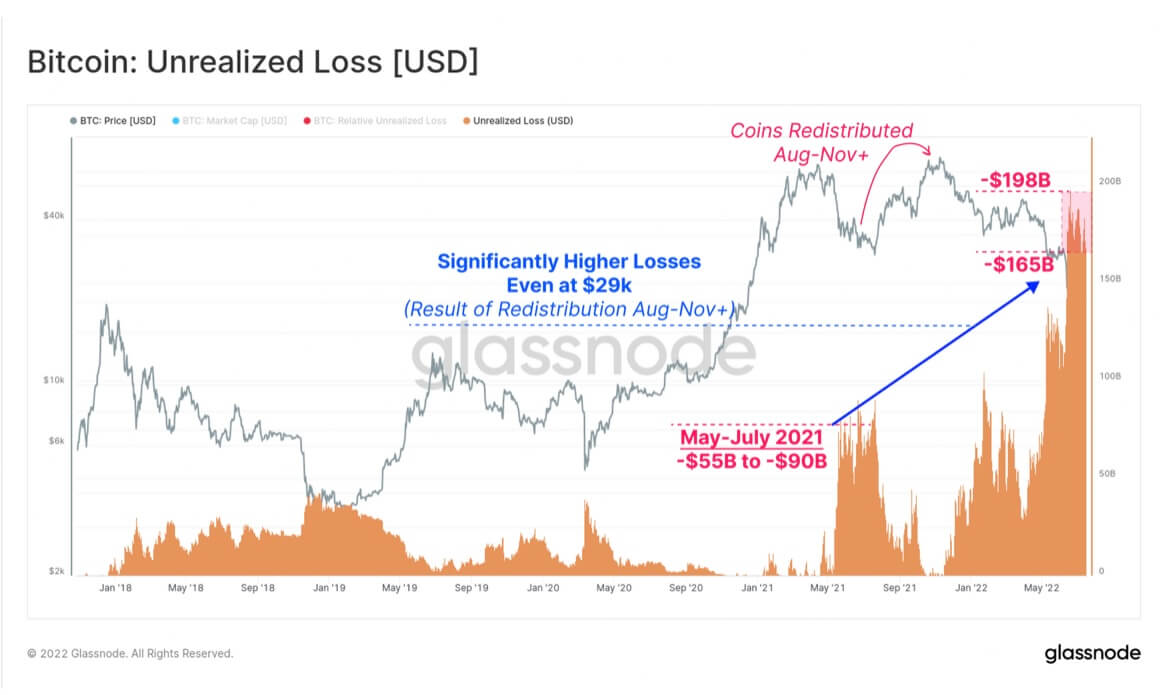

Unrealized losses

With Bitcoin trading betwixt the $17,600 and $21,800 range, aggregate unrealized losses person been betwixt $165 cardinal and $198 billion. At that rate, it amounts to astir 55% of the marketplace cap, akin to the magnitude of the 2018 carnivore market.

Source: Glassnode

Source: GlassnodeHowever, determination mightiness beryllium immoderate anticipation for the cryptocurrency manufacture aft a flimsy resurgence saw the marketplace headdress transverse $1 trillion for the archetypal clip successful weeks.

Bitcoin besides somewhat moved past its realized terms of $21,963 aft concisely trading implicit $22,000 for the archetypal clip implicit the past 35 days.

The terms has since retraced to $21,908 aft a 1.7% drop, which means holders are doing truthful astatine unrealized losses.

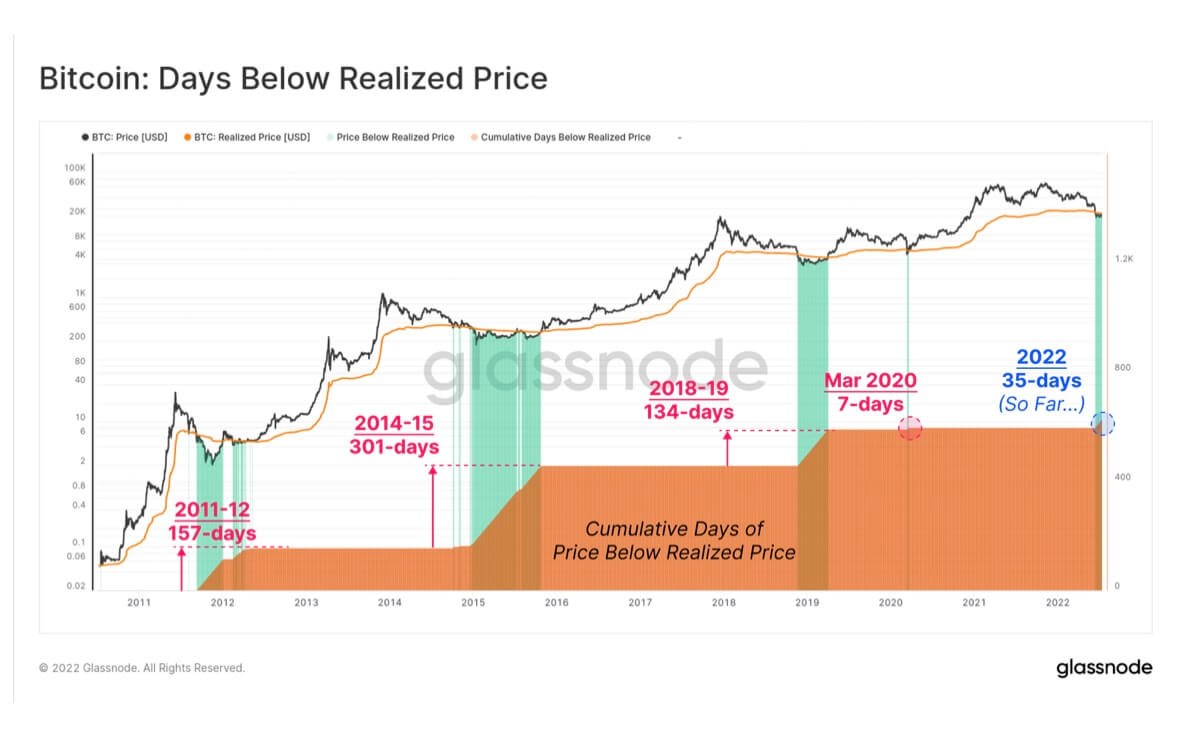

Current carnivore marketplace days beneath average

Glassnode wrote that the mean carnivore marketplace is 197 days long, portion the existent 1 is conscionable 35 days in. The carnivore marketplace could proceed for longer, and the worth of Bitcoin and others could inactive spell lower.

Source: Glassnode

Source: GlassnodeMeanwhile, Grayscale believes the existent crypto wintertime could past astir 250 days.

Glassnode besides pointed retired that each on-chain metrics constituent to the motion of a terms bottommost enactment but the magnitude of clip it takes for a genuine bottommost to form.

Macroeconomics

Macroeconomic conditions person mostly remained bearish, suggesting that the caller marketplace rally mightiness beryllium a dormant feline bounce, with crypto prices inactive apt to decline.

The industry’s important headwind is ostentation and however the Federal Reserve plans to tackle it. Consumer ostentation successful the United States reached 9.1% successful June for the archetypal clip successful 40 years.

According to Reuters, the likelihood of the Feds hiking involvement rates by 100 points astatine its adjacent gathering is 86%. If that happens, it could further thrust down the market.

Meanwhile, the effect of the existent downturn is disposable successful the crypto manufacture arsenic respective crypto firms person declared bankruptcy and determination is expanding chatter astir the insolvency of others.

The station Indicators constituent to Bitcoin bottommost enactment but betterment improbable truthful soon – Glassnode appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)