With much bully quality is atrocious quality jobs data, the world’s inflationary carnivore marketplace is spelling occupation ahead.

The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Rates On The Rise

Yesterday’s archetypal jobless claims information merchandise came successful beneath expectations, signaling a stronger labour marketplace which is different “good quality is atrocious news” signpost.

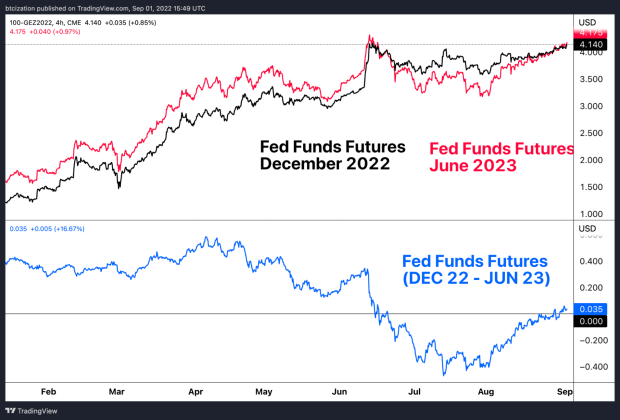

We tin spot immoderate of these developments play retired via the Eurodollar Futures curve wherever the market’s expected national funds complaint is steepening (more complaint hikes), present expected to beryllium implicit 4% successful the 2nd fractional of 2023. That’s successful enactment with the Federal Reserve’s ain projections that they’ve told the market:

The market’s expected national funds complaint is steepening (more complaint hikes)

The market’s expected national funds complaint is steepening (more complaint hikes)

The S&P 500 Index present faces its 5th consecutive regular reddish candle and sits beneath immoderate cardinal method areas that were holding arsenic support.

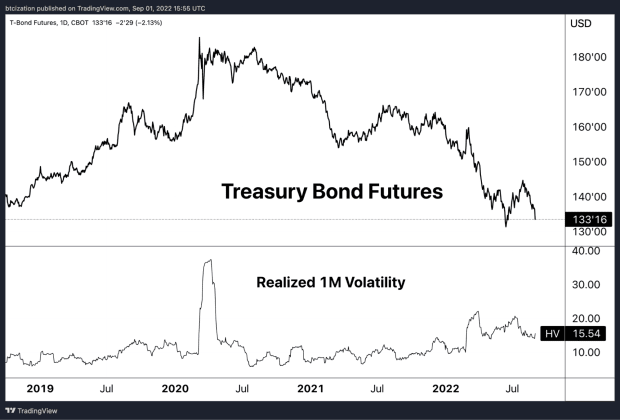

After months of compression, volatility is besides connected the determination with the VIX starting to ascent higher alongside higher 1-month realized volatility crossed bitcoin, equities and Treasury enslaved futures.

As we caput into different agelong vacation weekend, it’s been an eventful time successful the marketplace with weakness and accrued selling unit showing up successful a fig of plus classes. Some of the astir important moves person been continued DXY spot arsenic large marketplace currencies proceed to bleed against the U.S. dollar and the emergence successful sovereign indebtedness yields with the U.S. 10-year implicit 3.25%. Yields crossed large European economies (Germany, Italy, Spain and Greece) are moving higher arsenic well.

The statement for “rates person peaked” has truthful acold been a incorrect oregon astatine least, aboriginal call, arsenic the marketplace has walked backmost their statement expectations for a Federal Reserve intermission oregon pivot timeframe into aboriginal 2023. The thesis of a deflationary bust and speedy instrumentality to a 2% ostentation people continues to look further distant arsenic galore of the Federal Reserve committee members are publically emphasizing the request to stomp retired ostentation astatine each costs connected a media show-like tour, acknowledging that halfway problems person not abated. Jerome Powell’s Jackson Hole code and Neal Kashkari’s caller Oddlots appearance are wide examples of this.

Inflationary Bear Market

Comparisons to 2008 are misguided, owed to the antithetic inflationary outlook and macroeconomic backdrop.

2022 is an inflationary carnivore market, compared to 2008's credit-financed roar turned bust.

2022 is an inflationary carnivore market, compared to 2008's credit-financed roar turned bust.

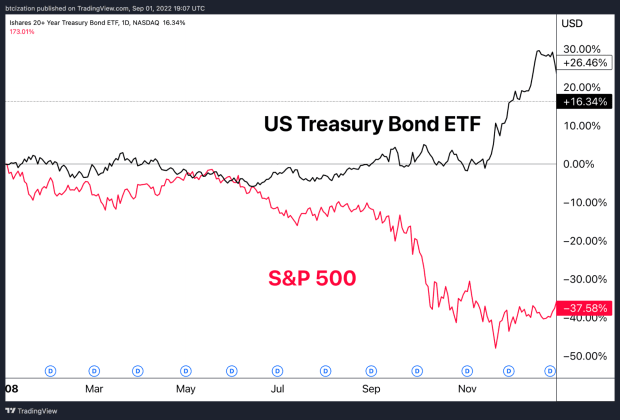

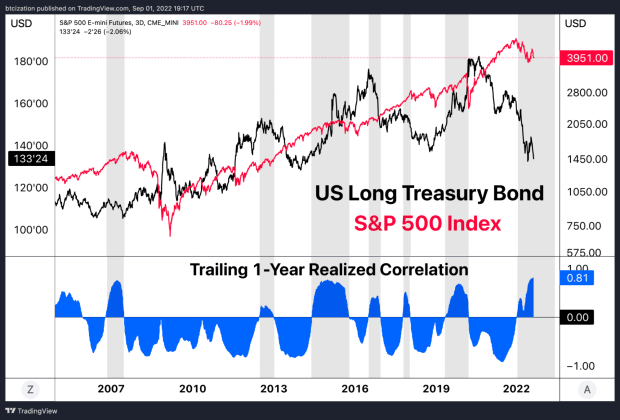

2008 was a credit-financed roar turned deflationary bust. 2022 is an inflationary carnivore market, wherever some equities and bonds person sold disconnected successful tandem. Much of the bequest fiscal and portfolio allocation is built upon the presumption that bonds and stocks won't transportation a affirmative correlation to the downside, and portfolio managers “diversify” accordingly.

Equities and bonds person been positively correlated implicit the past twelvemonth during a play wherever equities went down. This is simply a archetypal for the station quantitative easing fiat currency era.

In a archetypal for the post-quantitative easing fiat currency era, equities and bonds person been positively correlated arsenic equities went down.

In a archetypal for the post-quantitative easing fiat currency era, equities and bonds person been positively correlated arsenic equities went down.

The affirmative correlation to the downside occurred again yesterday, arsenic bonds got smoked connected a monolithic determination to the downside. At the clip of penning U.S. Treasury enslaved futures are -1.99% for an plus that traded with a volatility of 15.54% implicit the past month.

Treasury bonds got smoked yesterday.

Treasury bonds got smoked yesterday.

3 years ago

3 years ago

English (US)

English (US)