A fiscal woody was expected to assistance motorboat the MOVE crypto token.

Instead, it led to a token-dumping scandal, a Binance ban, and behind-the-scenes infighting.

Contracts obtained by CoinDesk assistance explicate wherever it each went wrong.

Movement, the blockchain task down the MOVE cryptocurrency, is investigating whether it was deceived into signing a fiscal statement that granted a azygous entity outsized power implicit the marketplace for its token, according to interior documents reviewed by CoinDesk.

The statement led to 66 cardinal MOVE tokens being sold onto the marketplace the time aft the asset’s December 9 speech debut, triggering a steep terms driblet and allegations of insider dealing wrong a crypto task endorsed by World Liberty Financial, the crypto task backed by Donald Trump.

Cooper Scanlon, Movement Labs’ co-founder, told employees successful an April 21 Slack connection that the institution was examining however much than 5% of MOVE tokens earmarked for Web3Port, a marketplace maker, were routed done a middleman named Rentech — “an entity the instauration was led to judge was a subsidiary of Web3Port but seemingly is not.” Rentech denies engaging successful immoderate misrepresentation.

Movement’s declaration with Rentech loaned a azygous counterparty astir fractional of MOVE’s publically held supply, according to an interior Movement Foundation memo. This granted the entity an unusually ample grade of power implicit the fledgling token, experts told CoinDesk.

More worryingly, successful versions of the contracts obtained by CoinDesk, “there are incentives fundamentally to manipulate the terms to implicit $5 cardinal afloat diluted worth and past dump connected retail for shared profit,” concluded Zaki Manian, a seasoned crypto laminitis who reviewed the documents. “Even participating successful a treatment wherever that’s connected insubstantial is insane.”

Market makers, hired to supply liquidity for caller tokens, stabilize prices by buying and selling connected exchanges utilizing wealth loaned to them by a token's issuer. But the relation can besides beryllium abused, giving insiders a mode to softly manipulate markets and offload ample token holdings without drafting attention.

A bid of contracts obtained by CoinDesk connection a uncommon look into a murky country of crypto, wherever anemic oversight and opaque ineligible agreements tin crook nationalist projects into backstage windfalls.

While crypto market-making abuses are often rumored about, the details down them astir ne'er aboveground to the public.

The market-making contracts reviewed by CoinDesk amusement Rentech appeared successful agreements connected some sides of a woody with the Movement Foundation — erstwhile arsenic an cause of the Movement Foundation and erstwhile arsenic a Web3Port subsidiary — a setup that could theoretically let the middleman to dictate presumption and nett from its presumption successful the middle.

Movement’s woody with Rentech yet enabled wallets tied to Web3Port — a Chinese fiscal steadfast that claims to person worked with projects including MyShell, GoPlus Security, and the Donald Trump-affiliated World Liberty Financial — to instantly liquidate $38 cardinal successful MOVE tokens the time aft the token debuted connected exchanges.

Binance, the crypto exchange, aboriginal banned the market-making account for “misconduct,” and Movement announced a token buyback plan.

Like banal options astatine startups, token allocations successful crypto projects are typically taxable to lock-up periods intended to forestall insiders from selling ample stakes during a project’s aboriginal trading.

The Binance prohibition created the content — which Movement denied — that task insiders mightiness person entered into an improper statement with Web3Port to merchantability tokens up of schedule.

Pointing fingers

Movement, a caller Layer 2 blockchain designed to standard Ethereum utilizing Facebook's Move programming language, is 1 of the astir talked-about crypto projects of caller years.

Founded by 22-year-old Vanderbilt University dropouts Rushi Manche and Cooper Scanlon, the institution raised $38 cardinal from investors, nabbed a spot successful the World Liberty Financial crypto portfolio, and has been the taxable of aggravated societal media attention.

Reuters reported successful January that Movement Labs was adjacent to wrapping a $100 cardinal backing circular that would person valued the institution astatine $3 billion.

In interviews with much than a twelve radical acquainted with Movement’s interior operations, astir of whom requested anonymity to debar reprisal, CoinDesk heard a scope of conflicting allegations implicit who architected the Rentech arrangement, which manufacture experts called highly unusual.

Galen Law-Kun, the proprietor of Rentech, rejects the proposition that the Foundation was deceived into signing a market-making agreement, asserting that the entity operation was crafted with afloat collaboration from the Movement Foundation's wide counsel, YK Pek.

Pek disputes having immoderate engagement successful creating Rentech and was, astatine slightest astatine first, profoundly captious of the woody internally, according to a memo and different communications reviewed by CoinDesk.

In his connection to employees, Scanlon, the co-founder of Movement Labs, states that Movement is “a unfortunate successful this situation.”

According to 4 sources acquainted with the probe who spoke to CoinDesk connected information of anonymity, Movement is besides examining the engagement of its co-founder Rushi Manche, who initially forwarded a woody with Rentech to the Movement squad and promoted it internally, and Sam Thapaliya, an informal advisor to Movement and concern spouse to Law-Kun.

Web3Port did not respond to aggregate requests for comment.

"Possibly the worst statement I person ever seen"

Despite initially rejecting a risky market-making woody with Rentech, Movement yet signed a revised statement with akin features, relying connected assurances from a middleman without immoderate identifiable way record.

In the lightly regulated cryptocurrency industry, projects typically divided their operations betwixt a nonprofit instauration and a for-profit improvement firm. The developer — Movement Labs, successful this lawsuit — builds the technology, portion the instauration stewards the token and manages assemblage resources.

The 2 entities are expected to run independently: a operation designed to shield the token from securities regulations. In Movement’s case, however, interior correspondence reviewed by CoinDesk suggests that Manche — an worker of the improvement firm, Movement Labs — besides played an progressive relation successful the non-profit Movement Foundation.

On March 28, Manche sent a market-making contract to the Movement Foundation successful a Telegram connection — it needed a signature.

The draught statement projected loaning a monolithic 5% allocation of MOVE tokens to Rentech, a institution with zero integer footprint.

Pek, the foundation’s lawyer, flagged the papers successful an email arsenic “[p]ossibly the worst agreement” helium had ever seen. In a abstracted memo reviewed by CoinDesk, helium warned that it would manus power of MOVE’s marketplace to a azygous chartless entity. Marc Piano, manager of the foundation’s British Virgin Islands entity, besides refused to sign.

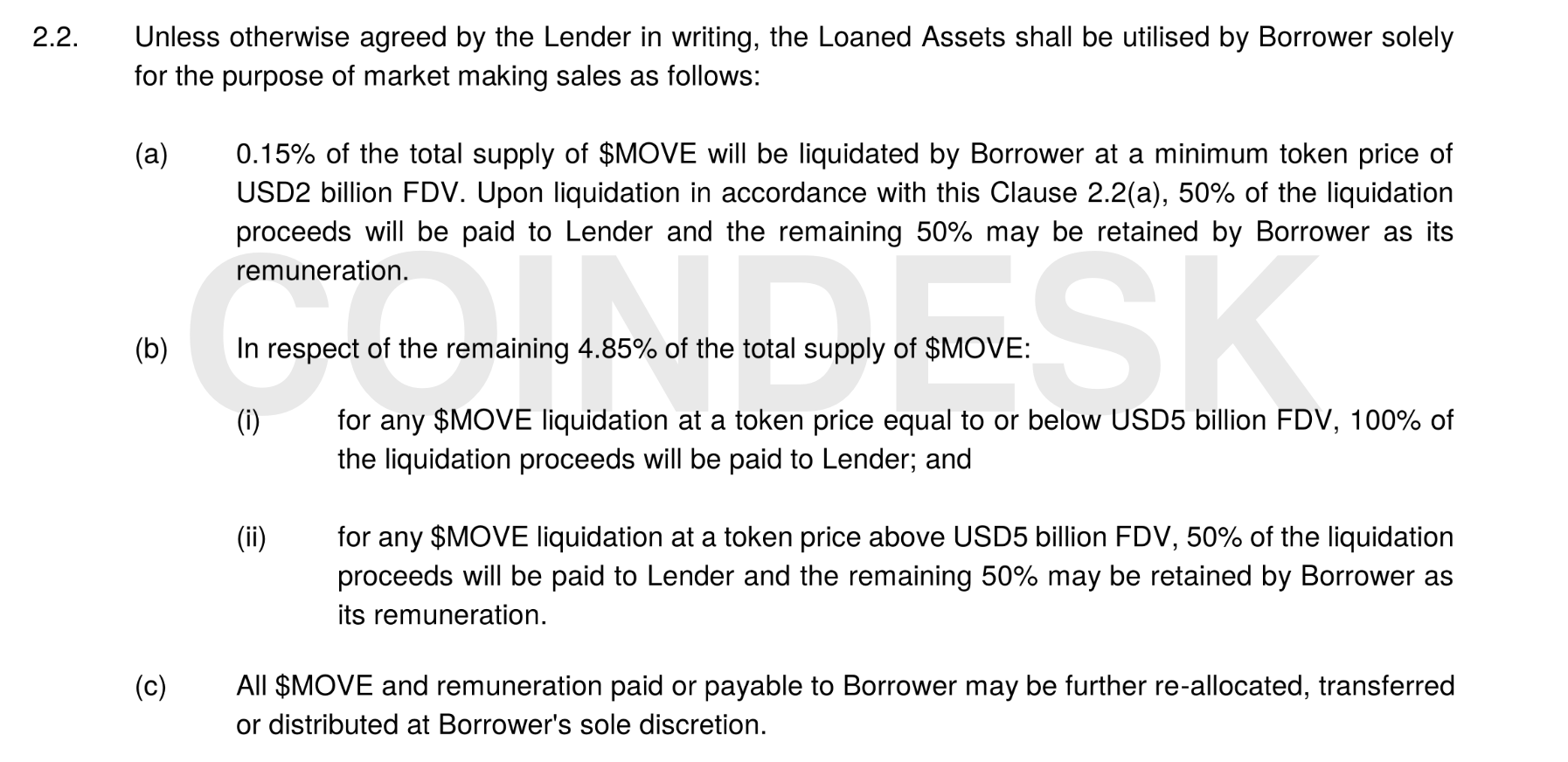

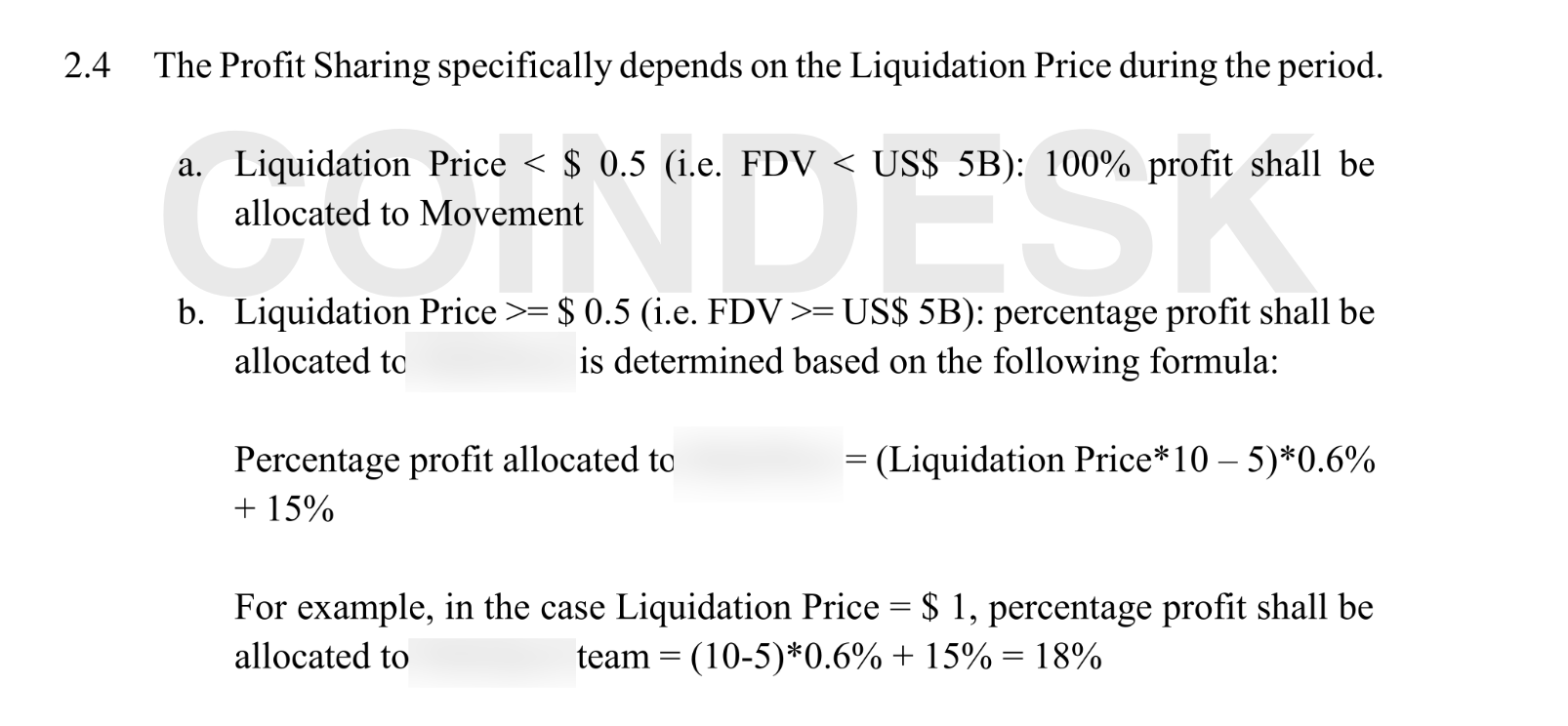

Among the contract’s much antithetic provisions was a clause allowing Rentech to liquidate its MOVE tokens if the cryptocurrency’s afloat diluted worth exceeded $5 cardinal — a benchmark that, if reached, would person allowed Rentech to divided profits 50-50 with the foundation.

According to Manian, this created a perverse inducement for the marketplace shaper to artificially summation the terms of MOVE truthful that it could merchantability its monolithic proviso of tokens for a profit.

Movement Foundation declined to motion the deal, but they continued discussions with Rentech.

According to 3 radical acquainted with the discussions and ineligible documents reviewed by CoinDesk, Rentech yet told Movement Foundation it was operating arsenic a subsidiary of Web3Port, the Chinese market-making firm. According to these sources, Rentech besides offered to beforehand $60 cardinal of its ain collateral, a item that helped sweeten the statement for the foundation.

On December 8, the Movement Foundation agreed to a modified mentation of the market-making declaration that removed immoderate of the provisions astir troubling to the foundation. Among the changes: the caller woody eliminated a clause that would person allowed Web3Port to writer Movement Foundation for damages if the MOVE token failed to database connected a circumstantial crypto exchange.

The revised agreement, which was chiefly crafted by Pek, who primitively pushed back, inactive contained galore of the aforesaid features arsenic the original: It inactive allowed Web3Port to get 5% of MOVE’s proviso and merchantability tokens for a profit, albeit nether a antithetic disbursement structure.

The caller declaration listed Web3Port arsenic the borrower, and a manager of Rentech signed connected its behalf.

DNS records amusement that the domain sanction attached to the Rentech director’s email address, web3portrentech.io, was registered connected the aforesaid time the declaration was signed.

A pre-existing agreement

According to 3 radical adjacent to the situation, Movement Foundation officials did not recognize that Web3Port had already entered into an agreement with “Movement” weeks earlier the December 8 woody was signed.

A declaration dated November 25 and obtained by CoinDesk shows that Web3Port had signed a deal, seemingly with Movement, that intimately resembled the archetypal connection Movement Foundation had rejected. In this deal, Rentech was listed arsenic a typical of Movement.

The woody was structured likewise to the Nov. 27 contract, explicitly allowing the marketplace shaper to liquidate tokens if MOVE’s terms deed definite targets — a cardinal proviso from the older statement that stood retired to experts similar Manian.

"Shadow co-founder"

Sources adjacent to Movement person presented respective theories astir who yet architected the narration with Rentech, which led to December's token-dumping incidental and a question of antagonistic property attraction for Movement.

The statement was initially circulated internally by Manche, who was concisely placed connected administrative permission past week, arsenic Blockworks archetypal reported.

“Throughout the marketplace shaper enactment process, the MVMT Labs squad trusted assorted advisors and members connected the instauration squad to supply input and assistance decently operation those deals,” Manche told CoinDesk. “Apparently, astatine slightest 1 subordinate of the Foundation squad represented interests connected some sides of the marketplace shaper deal, which we are present successful the process of investigating.”

Among those adjacent to Movement, scrutiny implicit the woody has besides spurred questions astir whether Sam Thapaliya — the laminitis of crypto protocol Zebec and an advisor to Manche and Scanlon — whitethorn person played a behind-the-scenes role.

Thapaliya was CC'd alongside Rentech and Manche successful an email from Web3Port to "Movement Team" and different communications regarding the market-making statement reviewed by CoinDesk.

“My knowing is that Sam is simply a adjacent advisor to Rushi and possibly benignant of a shadiness 3rd co-founder,” said 1 employee. “Rushi kept the narration beauteous hidden; we often conscionable heard his name.”

“A batch of times we’d determine connected something, and astatine the past infinitesimal determination would beryllium this change,” said another. “In those cases, we knew it was astir apt coming from Sam.”

Thapaliya was contiguous astatine Movement's San Francisco bureau connected the time that the MOVE token launched to the public, according to 3 radical who were present.

Telegram screenshots reviewed by CoinDesk besides amusement that Scanlon commissioned Thapaliya to assistance curate MOVE’s airdrop whitelist — the cautiously controlled database of wallet addresses eligible to person tokens successful Movement's (long-delayed) assemblage token giveaway.

The statement reinforced a cognition among immoderate Movement employees that Thapaliya’s power wrong the institution was much extended than acknowledged.

Thapaliya, according to a connection helium shared with CoinDesk, met Manche and Scanlon portion they were assemblage students and has served arsenic an extracurricular advisor to Movement implicit the years. Thapaliya told CoinDesk helium has "no equity successful Movement Labs," "no token from Movement Foundation" and "no decision-making power" wrong either organization.

Who is Rentech?

Rentech, the entity astatine the halfway of the token dispute, was created by Galen Law-Kun, Thapaliya’s concern partner. Law-Kun told CoinDesk helium established Rentech arsenic a subsidiary of Autonomy, his Singapore-based fiscal services firm, to link crypto projects with household offices successful Asia.

In a connection to CoinDesk, Law-Kun said YK Pek “helped acceptable up and was wide counsel of Autonomy SG, which is the genitor oregon affiliate institution of Rentech.” He besides claimed that Pek, contempt pushing backmost against the archetypal Rentech woody internally, “advised to acceptable up the Rentech operation for the launch” and “advised connected the archetypal mentation of the contract, which is astir identical to the declaration helium aboriginal drafted and approved for the foundation.”

CoinDesk's probe has not uncovered immoderate grounds confirming that Pek acceptable up Rentech oregon authored the archetypal mentation of the declaration portion acting connected behalf of Autonomy.

“I americium not and person ne'er been Galen oregon immoderate of his entities' wide counsel,” stated Pek. “A firm medication steadfast that I co-founded, and which provides firm secretarial services to implicit 150 entities successful the Web3 abstraction has provided firm secretarial services to 2 of his companies, some of which filed 'no assets' arsenic portion of their yearly renewals successful 2025. Neither of these companies are Rentech.”

Pek states that helium erstwhile spent “two hours” reviewing an advisory statement that Law-Kun had with a task successful 2024. Additionally, "[h]e reached retired to maine regarding the FTX filing deadline," and successful August, "he forwarded maine an NDA Docusign which I formed my oculus implicit without charging him."

“I person nary thought wherefore Galen would assertion I americium his wide counsel and I americium frankly confused and disturbed by that claim,” Pek continued. “He was represented successful email correspondence with my firm services spouse by his idiosyncratic lawyer from 1 'Hillington Group'."

According to Pek, “[b]oth the wide counsels of Movement Foundation (myself) and Movement Labs were introduced to GS Legal arsenic counsel for Rentech by Rushi Manche.”

In Law-Kun's telling, Pek was "introduced to 10 projects arsenic my Autonomy lawyer" and "never hesitated to accidental different oregon close the statement." According to Law-Kun, "The GS instauration was conscionable done arsenic a formality requested by Movement."

In his Slack connection to employees, Scanlon said Movement had retained Groom Lake, an extracurricular auditing firm, to “conduct the third-party reappraisal into caller marketplace shaper abnormalities.”

“Movement is simply a unfortunate successful this situation,” helium wrote.

7 months ago

7 months ago

English (US)

English (US)