Bitcoin is undergoing a structural transformation, and organization investors are steadily tightening their grip connected the cryptocurrency. As of mid-2025, organization investors are becoming a ascendant unit in Bitcoin ownership and are steadily capturing a ample information of its circulating supply.

Institutional Bitcoin Holdings Barrel Toward 20% Of Supply

Recent information shows that institutions, ranging from ETFs to nationalist companies, present power an unprecedented stock of Bitcoin, worthy hundreds of billions of dollars. Estimates spot organization ownership anyplace betwixt 17 and astir 31 percent of full proviso erstwhile besides factoring the magnitude controlled by governments.

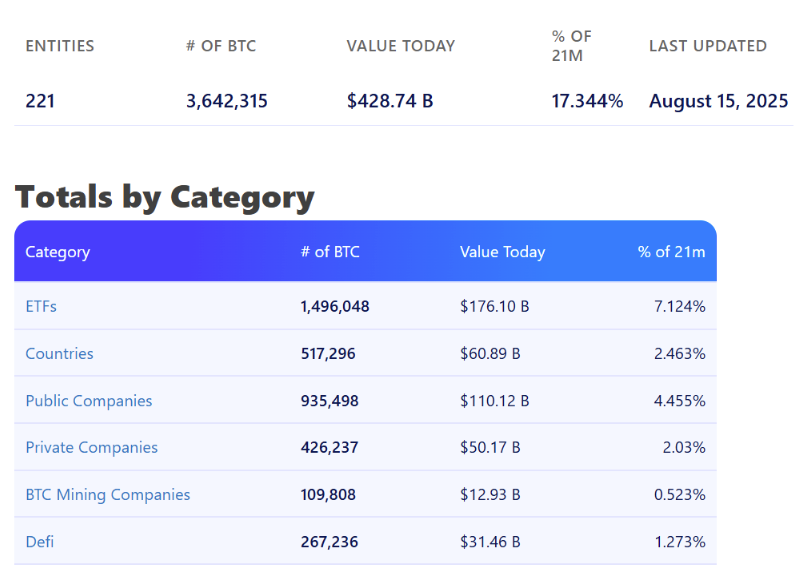

According to data from Bitbo, entities specified arsenic ETFs, nationalist and backstage companies, governments, and DeFi protocols collectively clasp much than 3.642 cardinal BTC, adjacent to astir 17.344% of the full supply. At today’s prices, that represents astir $428 cardinal worthy of Bitcoin locked distant successful organization treasuries.

ETFs are the largest contributors, with implicit 1.49 cardinal BTC, portion nationalist companies specified arsenic Strategy, Tesla, and others relationship for 935,498 BTC. Strategy’s relation is particularly noteworthy, arsenic the firm’s relentless accumulation strategy successful caller years has seen it amass 628,946 BTC, oregon astir 3 percent of the full circulating supply.

Bitbo information shows backstage companies clasp 426,237, worthy $50.17 billion, and astir 2.03% of the full circulating supply. BTC mining companies ain 109,808 BTC (0.523% of the full circulating supply), portion DeFi protocols ain 267,236 BTC (1.273% of the full circulating supply).

Bitcoin holdings by category. Source: Bitbo

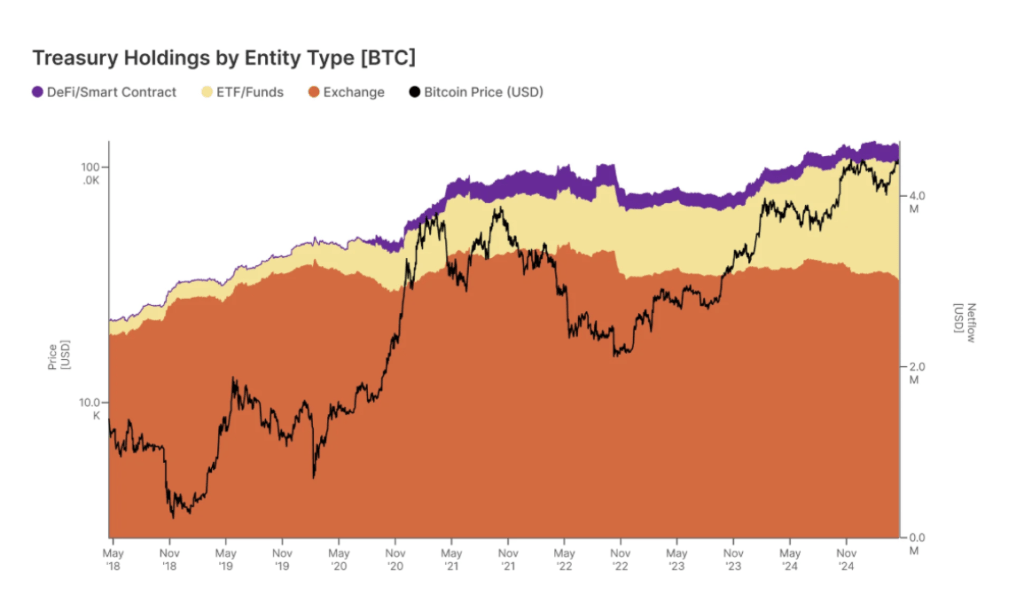

Other reports, including a associated survey by Gemini and Glassnode, suggest the numbers could beryllium adjacent higher. Their findings constituent to centralized treasuries composed of governments, ETFs, corporations, and exchanges controlling up to 30.9% of circulating Bitcoin, which equates to implicit 6.1 cardinal BTC. This summation represents a 924% surge successful organization power of Bitcoin compared to a decennary ago.

Chart Image From Gemini: Bitcoin treasury holdings by entity type

Is Bitcoin The New Wall Street Playground?

Bitcoin’s emergence successful its aboriginal years was based connected a premix of enthusiasm from retail investors and semipermanent condemnation from aboriginal adopters, but the market’s equilibrium of powerfulness is shifting. According to the holding data, Bitcoin is progressively becoming overmuch little affordable for retail traders and is present becoming a playground for ample Wall Street institutions.

Institutional request for Bitcoin has not been confined to corporations and ETFs alone. Governments are opening to marque their beingness felt, and the United States took the astir notable measurement earlier this year. In March 2025, the US authorities established a Strategic Bitcoin Reserve filled with seized and forfeited integer assets. Other governments similar El Salvador and Bhutan are besides accumulating Bitcoin done intentional, ongoing purchases, further tightening the proviso successful circulation

Some analysts judge this could trim Bitcoin’s terms volatility and support its terms maturation over the agelong term. On the different hand, the attraction of Bitcoin among a comparatively tiny fig of entities could undermine its decentralization and the earthy maturation of its price. Either way, the information shows that Bitcoin is present becoming Wall Street’s newest playground.

At the clip of writing, Bitcoin was trading astatine $117,460.

Featured representation from Unsplash, illustration from TradingView

3 months ago

3 months ago

English (US)

English (US)