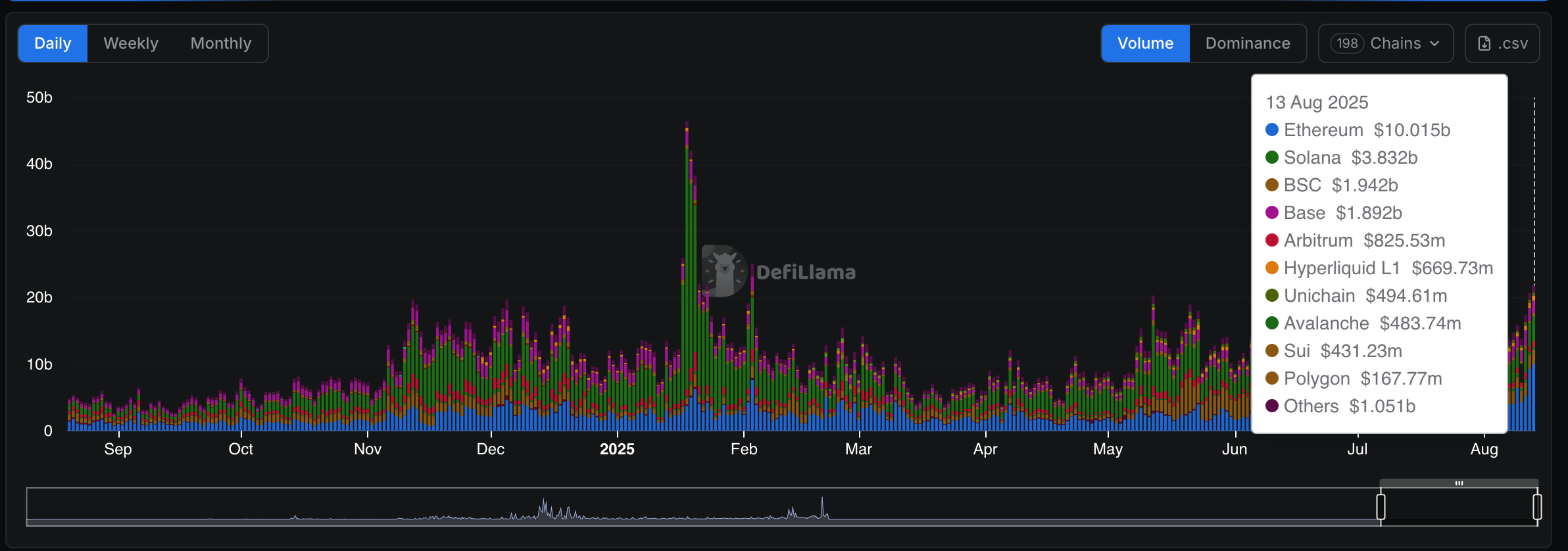

Decentralized speech (DEX) volumes connected Ethereum person leapfrogged Solana for the archetypal clip since April aft a swift displacement successful sentiment distant from Solana-based memecoins and towards ether ETH amid a question of organization activity.

Over the past 48 hours Ethereum-based DEXs person facilitated $24.5 cardinal successful trading measurement compared to Solana's tally of $10 billion, according to DefiLlama.

The 2 weeks anterior were besides dominated by Ethereum, with a full of $28 cardinal and $27 cardinal beating Solana's full of $20 cardinal and $24 billion.

This represents a opposition successful trader behaviour from earlier this year, which was dominated by Solana and BNB Chain successful a question of speculative memecoin trading.

However, organization flows into spot ether ETFs has buoyed the 2nd largest cryptocurrency, lifting it to $4,680 this period aft a 53% summation implicit the past 30 days.

Coinglass data shows that Monday's nett inflows to ETFs topped $1 cardinal for the archetypal clip ever, this was followed by much relentless buying connected Tuesday with different $523 cardinal inflow.

Solana, meanwhile, appears to person mislaid its magic successful the 2nd 4th of this year. In January, for example, DEX volumes topped $98 cardinal successful 1 week and $84 cardinal successful the next. That hype subsided aft U.S. President Donald Trump released the TRUMP memecoin, which yet mislaid much than 88% of its worth implicit the consequent 7 months, a infinitesimal that obliterated capitalist assurance successful memecoins.

Uniswap remains the most commonly utilized DEX connected Ethereum with $8.6 cardinal being traded implicit the past 24 hours, the adjacent champion being Fluid, which topped $1 billion during the aforesaid period.

The alteration successful behaviour could bode good for Ethereum-based staking tokens, which experienced a boost pursuing SEC clarification past week. Tokens similar LDO , the governance token of liquid staking protocol Lido are up by 65% implicit the past week.

4 months ago

4 months ago

English (US)

English (US)