Bitcoin surged past $100,000 connected May 8 arsenic organization investors ramped up ETF inflows, with ARK 21Shares, Fidelity and BlackRock starring the charge.

Bitcoin crossed the $100,000 people again connected May arsenic organization investors proceed stacking sats.

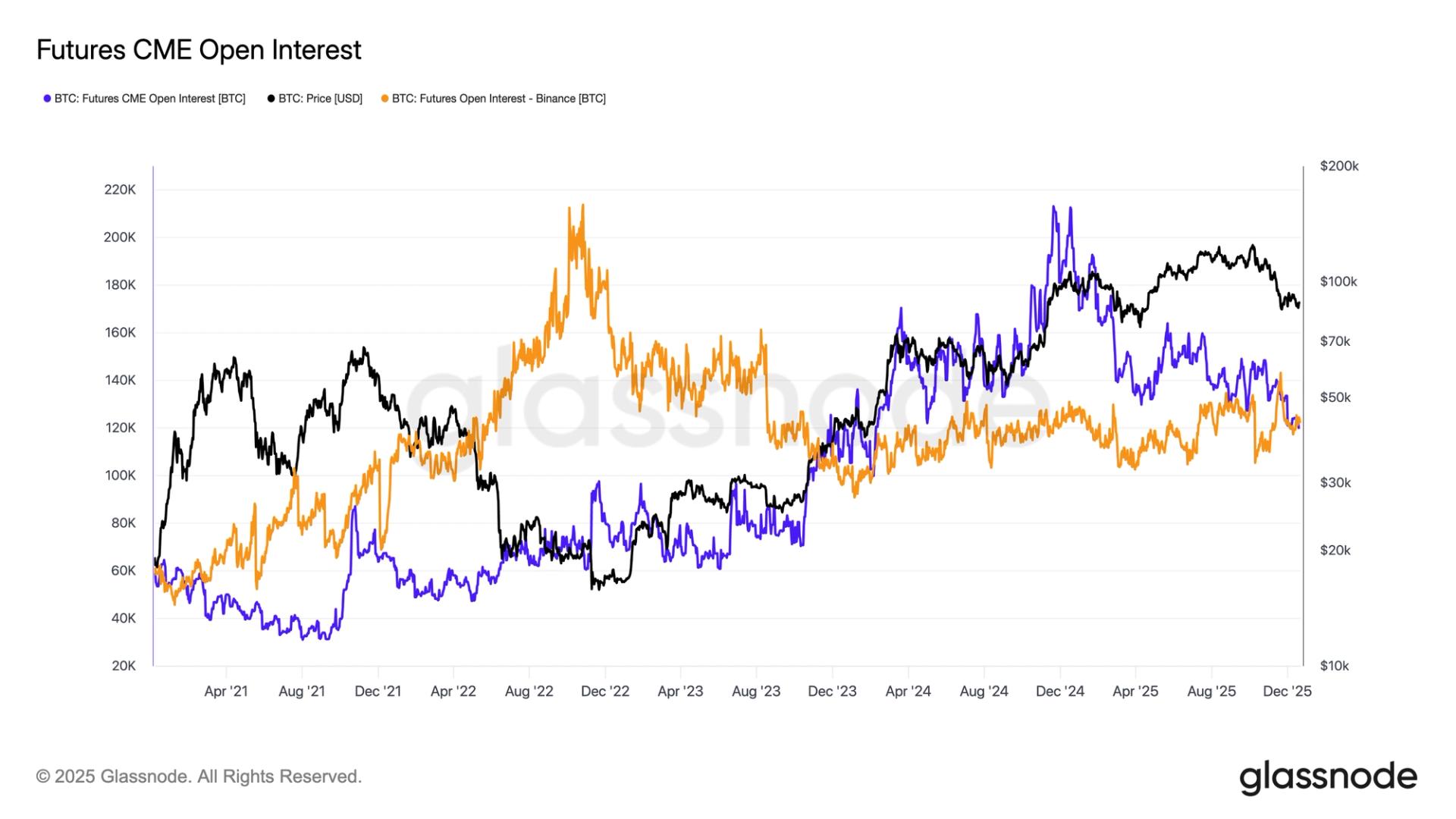

Farside Investors’ data shows that spot Bitcoin (BTC) exchange-traded funds (ETFs) recorded cumulative nett inflows of $142.3 cardinal connected May 7, successful a motion of “sustained organization interest,” according to the laminitis of Obchakevich Research, Alex Obchakevich.

“These inflows bespeak the enactment of organization investors, including hedge funds and plus managers, who proceed to accumulate BTC done regulated instruments,“ helium said.

The ARK 21Shares Bitcoin ETF (ARKB) led with $54 cardinal successful inflows, followed by Fidelity’s Wise Origin Bitcoin Fund (FBTC) astatine $39 cardinal and BlackRock’s iShares Bitcoin Trust (IBIT) astatine $37 million. Data from Arkham Intelligence shows BlackRock acquired much than 86 Bitcoin worthy $8.4 cardinal successful a azygous transaction connected May 7.

Related: Bitcoin terms reclaims $100K for archetypal clip since January

ETF inflows amusement bullish momentum

On May 8, Bitcoin ETFs saw implicit $117 cardinal worthy of inflows, this clip led by IBIT with $69 million, followed by FBTC with $35 cardinal and ARKB with $13 million. Obchakevich besides pointed to the strengthening correlation betwixt Bitcoin and tech stocks. “BTC correlation with the Nasdaq was 0.75, indicating the power of sentiment successful the tech market,” helium said, adding:

“The affirmative question of the Nasdaq connected May 8–9 supported BTC, which led to maturation supra $100,000.“Obchakevich said the affirmative inclination goes arsenic acold backmost arsenic May 2, erstwhile IBIT inflows were arsenic precocious arsenic $675 million. He said that the continuation of this inclination was the astir apt outcome:

“The inclination of organization buying was apt to proceed connected May 8-9, unless determination were crisp macroeconomic oregon geopolitical shocks.”Related: Bitcoin options could pave the way for caller BTC terms highs — Here is how

Grayscale Bitcoin Trust plays by antithetic rules

Obchakevich explained that “the lack of important outflows successful cardinal ETFs different than Grayscale Bitcoin Trust (GBTC) supports the proposal that the whales and funds stay bullish.” GBTC outflows, helium said, are justified by antithetic factors.

Obchakevich said GBTC outflows “are of peculiar value due to the fact that it is the largest Bitcoin ETF, and its precocious fees ~1.5% are driving investors to power to cheaper alternatives, which affects the terms of Bitcoin and marketplace dynamics.” According to the analyst, GBTC outflows are caused by “a operation of factors starting with tariffs, the governmental crisis, and the struggle betwixt Pakistan and India.” He added:

“The GBTC outflow is related to these factors arsenic investors are not assured successful the stableness of GBTC.“

7 months ago

7 months ago

English (US)

English (US)