Last week saw 1 of the largest losses of worth successful the past of cryptocurrency. Bitcoin and the wide crypto marketplace situation was deed by the Terra ecosystem’s collapse. Bitcoin plummeted to nether $30,000. Obviously, organization players took vantage of the circumstance.

Investors Flood Bitcoin

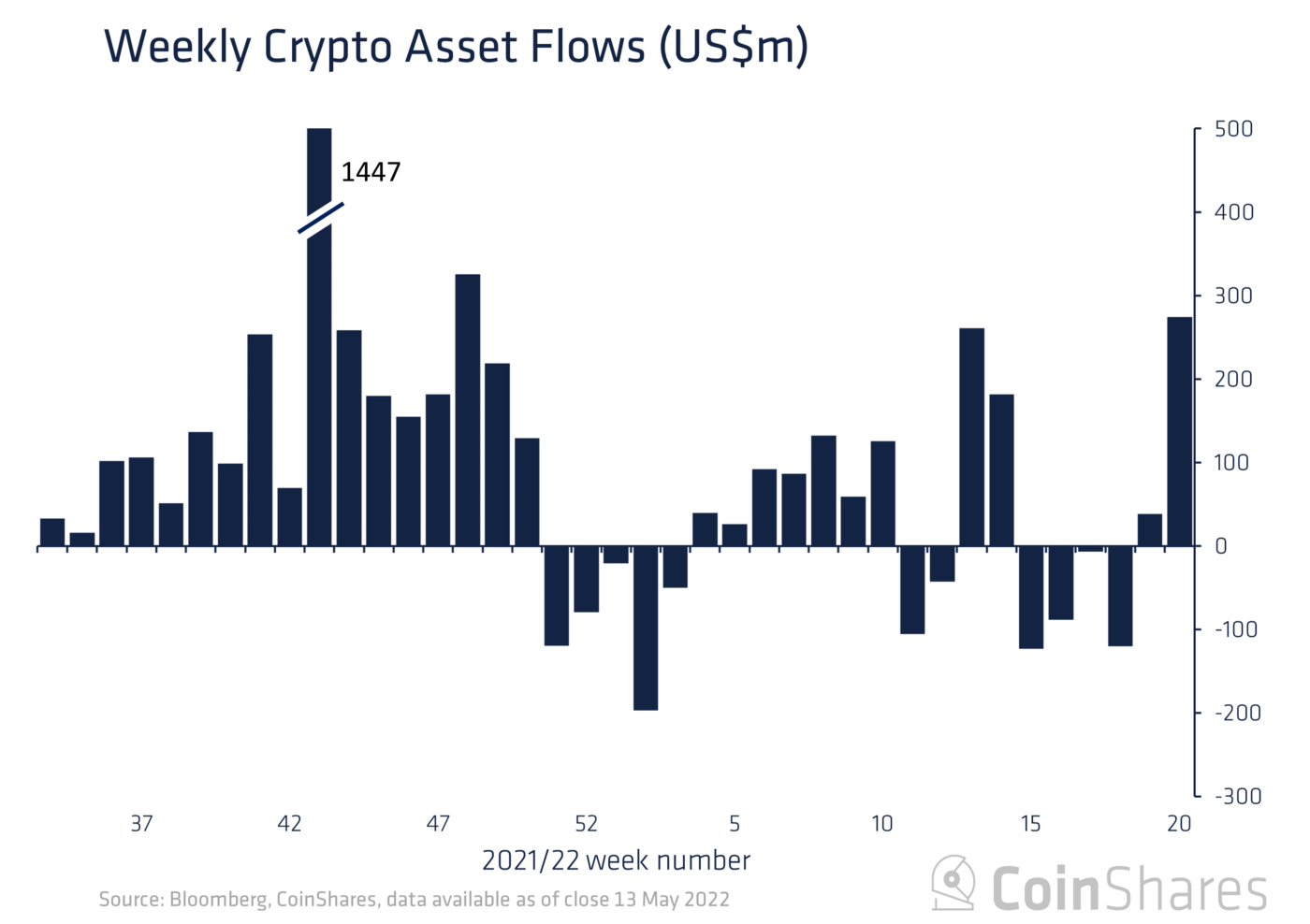

Institutions reportedly invested $300 Million into exchange-traded Bitcoin funds past week, according to reports. According to CoinShares, the erstwhile week recorded grounds play crypto inflows for the twelvemonth 2022. The nett play inflows were $274 cardinal successful the erstwhile week.

While North American investors pumped $312 cardinal into cryptocurrency past week, European investors saw a $38 cardinal nett outflow. According to the CoinShares report:

Investors saw the caller UST unchangeable coin de-peg and its associated wide sell-off arsenic a buying opportunity. Bitcoin was the superior benefactor, with inflows totalling US$299m past week, suggesting investors were flocking to the comparative information of the largest integer asset.

CoinShares’ caput of research, James Butterfill, expressed amazement astatine the unprecedented measurement of bullish investments successful Bitcoin funds contempt accrued marketplace volatility. “It’s the highest play full since October 2021, and the 19th highest since records began successful 2015,” helium said.

Bitcoin’s terms peaked astatine $69,000 successful November of past year, and it has since been connected a dependable decline, losing much than 50% of its value. The Bitcoin terms has dropped by much than 20% since the opening of May 2022.

Related speechmaking | Grayscale Met With The SEC, Tried To Convince Them To Turn The GBTC Into An ETF

Would Price Surge?

Bitcoin plummeted against the US dollar and deed the $29,000 enactment level. BTC indispensable settee supra the $30,500 absorption to statesman a coagulated rise. Bitcoin dipped beneath $30,000 aft failing to summation traction supra $31,000.

The terms is presently trading supra some the $30,000 and the 100 hourly elemental moving averages. A interruption implicit a connecting antagonistic inclination enactment with absorption adjacent $29,600 was seen connected the hourly illustration of the BTC/USD pair. The brace could get bullish momentum if it closes supra the $30,500 resistance.

Although the terms dipped beneath $29,500, bulls were progressive adjacent $29,000. The terms has recovered losses aft forming a debased adjacent $29,060. Above the $29,500 barrier, determination was a wide upward movement. The terms surpassed the 23.6 percent Fib retracement level of the latest driblet from the plaything precocious of $31,390 to the debased of $29,060.

There is contiguous absorption adjacent the $30,300 mark. It’s approaching the 50% Fib retracement level of the latest driblet from the plaything precocious of $31,390 to the debased of $29,060. A coagulated adjacent supra $30,300 mightiness pave the way for a ample gain.

Around $31,400 is the adjacent large absorption level. In the adjacent sessions, a wide interruption implicit the $30,300 and $31,400 absorption levels could kick-start a caller upswing. Near $32,500 could beryllium the adjacent large absorption level, aft which the terms could emergence to $34,000.

If bitcoin fails to interruption past the $31,400 obstruction mark, it could autumn further. On the downside, $29,600 provides contiguous support.

Around $29,000 is the archetypal important support. If the terms breaks and closes beneath the $29,000 enactment level, it mightiness herald the commencement of a important fall.

Related speechmaking | TA: Bitcoin Holds Key Support, Why BTC Must Clear This Resistance

Featured representation from iStockPhoto, Charts from TradingView.com

3 years ago

3 years ago

English (US)

English (US)