Bitcoin Lightning Network liquidity supplier LQWD Technologies has partnered with Amboss Technologies to found further organization liquidity connected Lightning. The collaboration positions LQWD to lend liquidity to Amboss’s marketplace, enabling the fulfillment of marketplace request for Lightning Network liquidity portion generating a output connected LQWD’s Bitcoin holdings.

Amboss, a supplier of information analytics solutions and payments operations connected Lightning, offers specialized products specified arsenic Magma, a liquidity marketplace, and Hydro, an precocious liquidity automation tool. These products purpose to make an orderly marketplace and facilitate payments connected the Lightning Network. As a liquidity provider, LQWD volition motorboat an archetypal tranche of Bitcoin to Amboss, with plans to deploy further Bitcoin passim the partnership.

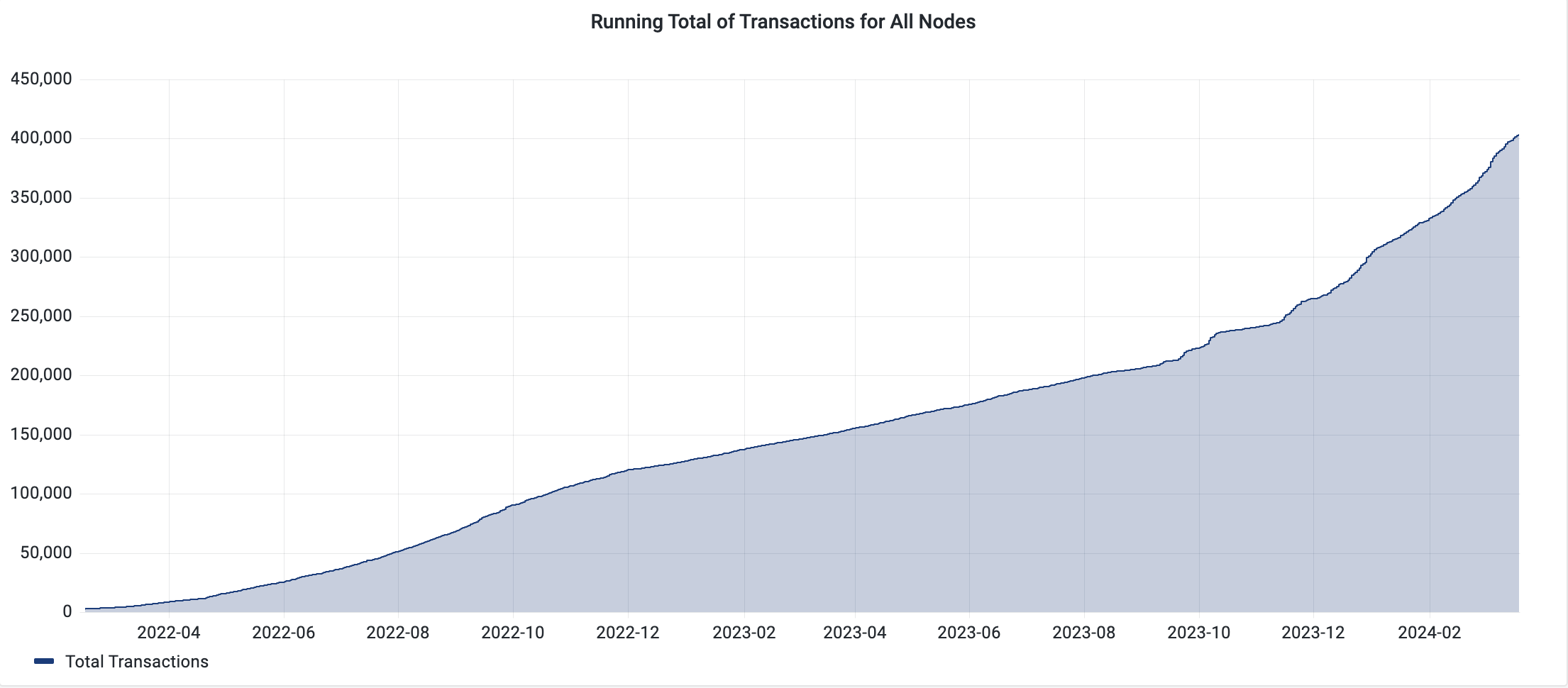

LQWD has seen consistent growth successful its Lightning Network transactions since 2022, precocious surpassing 400,000, according to self-reported data.

LQWD Lightning transactions

LQWD Lightning transactionsAmboss clients volition get liquidity from LQWD, allowing the second to gain archetypal and routing fees for transactions implicit the Lightning Network. Shone Anstey, CEO of LQWD, emphasized the value of the partnership, stating, “This strategical confederation signifies a important measurement guardant for some LQWD and Amboss arsenic we enactment unneurotic to heighten liquidity and ratio wrong the Bitcoin Lightning Network ecosystem.”

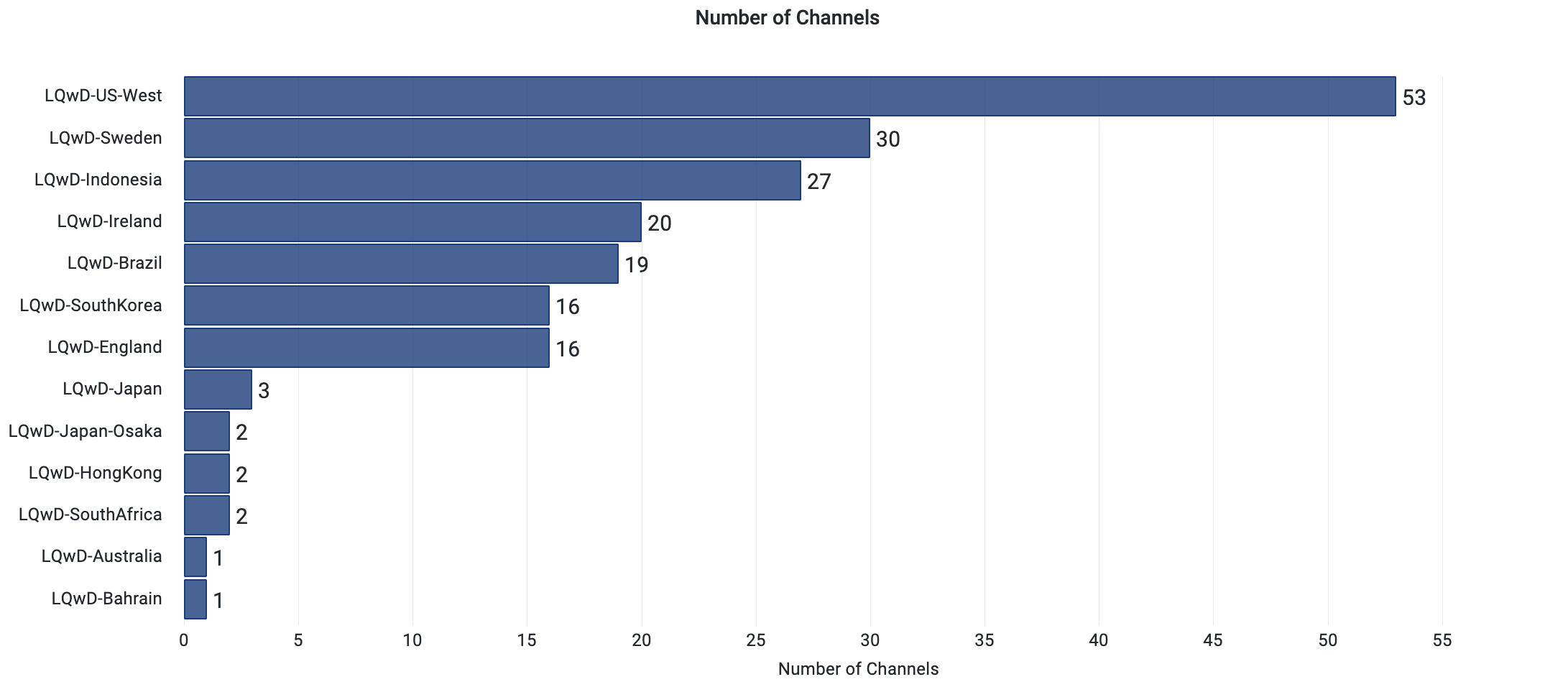

LQWD besides offers Lightning channels successful respective geographies, with the bulk being connected the West Coast of the US. Interestingly, aft the US, Sweden, Indonesia, Ireland, and Brazil person the astir progressive channels.

LQWD Bitcoin Lightning Channels

LQWD Bitcoin Lightning ChannelsThe concern enables LQWD to deploy its company-owned Bitcoin portion perchance capturing important transaction measurement and generating output connected its holdings. Importantly, LQWD maintains afloat sovereignty and custody passim the process, aligning with its absorption connected processing outgo infrastructure and solutions accelerating Bitcoin adoption done the Lightning Network.

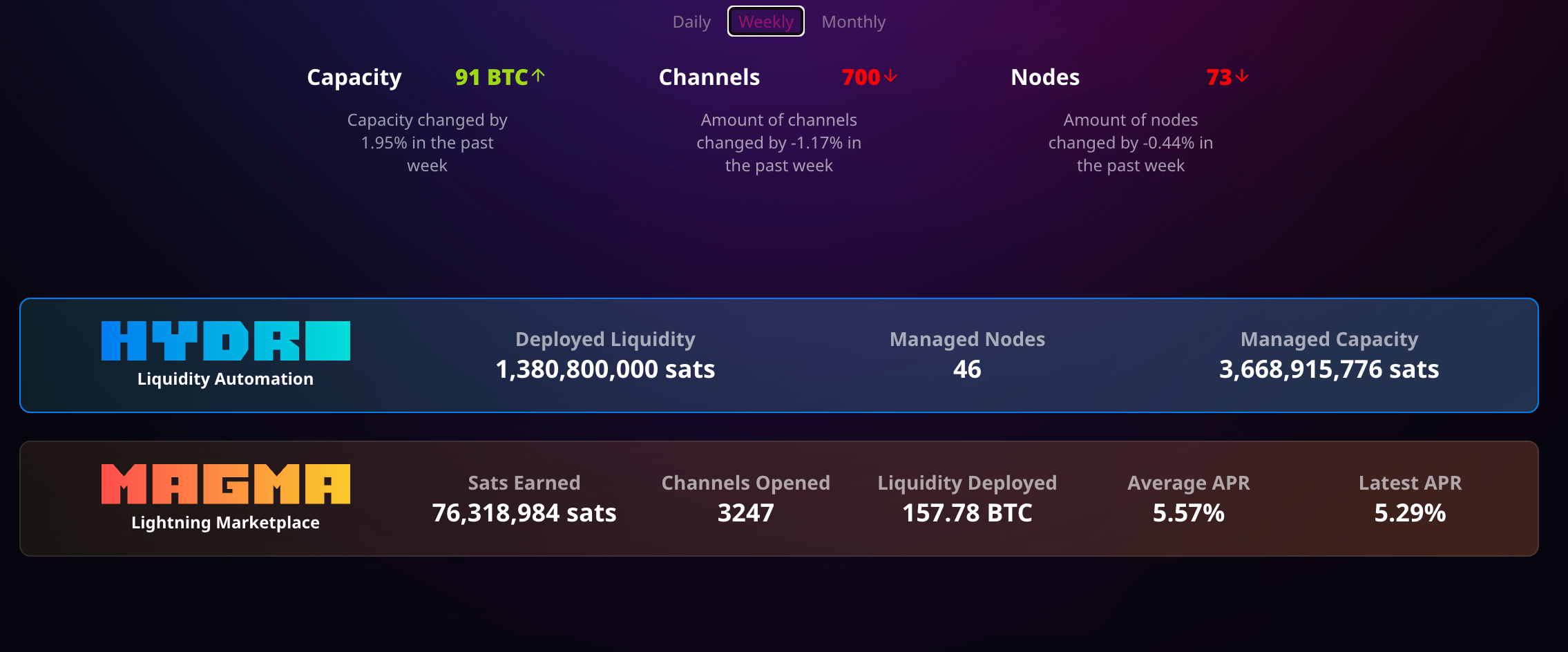

Amboss’ marketplace presently offers a 5.57% APR connected Bitcoin deployed done Lightning Channels with full liquidity of 157 BTC, astir $10 cardinal arsenic of property time.

Amboss Bitcoin Lightning marketplace

Amboss Bitcoin Lightning marketplaceJesse Shrader, Co-Founder and CEO of Amboss, highlighted the benefits of the collaboration, stating,

“Partnering with LQWD ensures that Amboss’s planetary customers person nonstop entree to institutional-grade liquidity for Bitcoin payments, allowing LQWD to make further output done their nodes connected the Lightning Network. Additionally, this concern increases the proviso broadside of Amboss’s liquidity marketplace.”

LQWD besides uses its ain Bitcoin arsenic an operating plus to found nodes and outgo channels connected the network. With the concern betwixt LQWD and Amboss, some companies are looking to lend to the maturation and ratio of the Bitcoin Lightning Network ecosystem, providing enhanced liquidity solutions for businesses and consumers alike.

The station Institutions looks to deploy Bitcoin arsenic liquidity to Lightning Network to gain yield appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)