Investment advisers volition astir apt overtake hedge funds arsenic the biggest holders of U.S.-listed spot bitcoin (BTC) exchange-traded funds (ETFs) adjacent year, CF Benchmarks said Monday.

A full of 11 spot BTC ETFs debuted successful the U.S. connected Jan. 11, providing a mode for investors to summation vulnerability to the cryptocurrency without personally having to clasp and store it. Since their inception, they person accumulated implicit $36 cardinal successful capitalist funds.

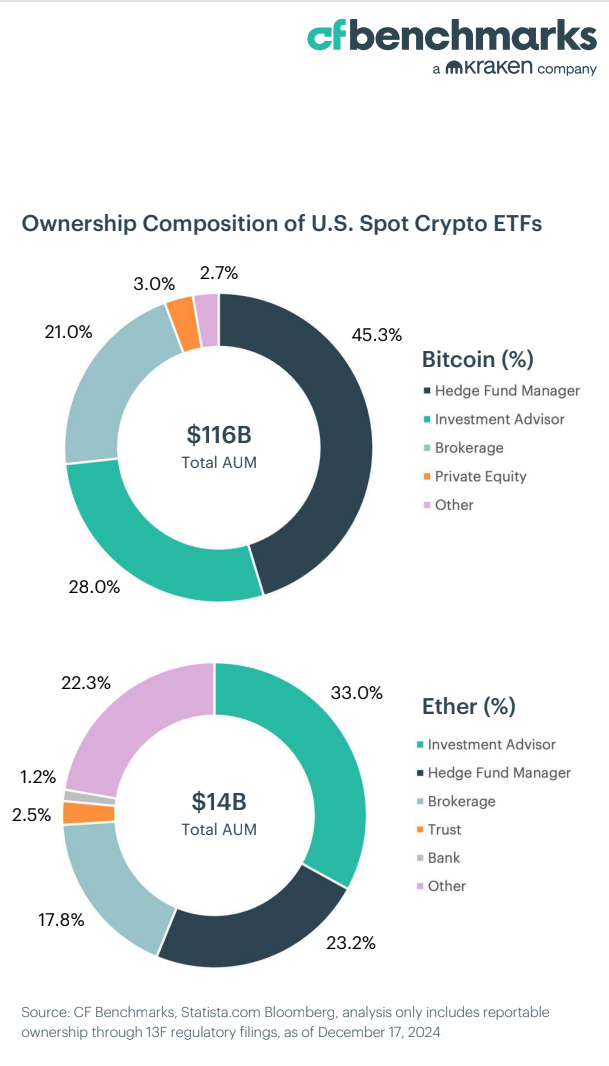

Demand has been dominated by hedge-fund managers, who ain 45.3% of the ETFs. Investment advisers, the gatekeepers to retail and high-net-worth capital, are a distant 2nd astatine 28%.

That's acceptable to alteration successful 2025, according to CF Benchmarks, which predicts concern advisers' stock volition emergence supra 50% successful some the BTC and ether (ETH) ETF markets. CF Benchmarks is simply a U.K.-regulated scale supplier down respective cardinal integer plus benchmarks, including the BRRNY, referred by galore ETFs.

"We expect Investment advisor allocations to emergence beyond 50% for some assets, arsenic the $88 trillion U.S. wealthiness absorption manufacture begins to clasp these vehicles, eclipsing 2024's combined record-breaking $40 cardinal successful nett flows," CF Benchmarks' said successful an yearly study shared with CoinDesk.

"This transformation, driven by increasing lawsuit demand, deeper knowing of integer assets, and merchandise maturation, volition apt reshape the existent ownership premix arsenic these products go staples successful exemplary portfolios," the scale supplier said.

Investment advisers are already successful rod presumption successful the ether ETF marketplace and are apt to widen their pb adjacent year.

Ether's genitor blockchain, Ethereum, is expected to payment from the increasing popularity of plus tokenization portion rival Solana could proceed to summation marketplace stock connected imaginable regulatory clarity successful the U.S.

"We expect the inclination towards plus tokenization to accelerate successful 2025, with tokenized RWAs topping $30B," the study said, referring to real-world assets.

In stablecoins, caller entrants similar Ripple's RLUSD and Paxos' USDG are expected to situation the dominance of tether's USDT, whose marketplace stock has accrued from 50% to 70%.

The scalability of blockchains volition besides beryllium tested, and the expected summation successful progressive idiosyncratic adoption owed to regulatory clarity nether President-elect Donald Trump's medication whitethorn necessitate on-chain capableness to treble to implicit 1600 TPS.

Last but not least, the Federal Reserve is seen turning dovish, employing unconventional measures similar output curve power oregon expanded plus purchases to code the toxic premix of higher indebtedness servicing costs and a anemic labour market.

"Deeper indebtedness monetization should elevate ostentation expectations, bolstering hard assets similar Bitcoin arsenic hedges against monetary debasement," the study said.

9 months ago

9 months ago

English (US)

English (US)