Major U.S. concern banks are urging caution and flexibility arsenic the situation sparked by a astonishment Hamas onslaught connected Israel earlier this period continues to evolve. Analyst notes from JPMorgan and Morgan Stanley supply penetration into however Wall Street is interpreting events connected the crushed and imaginable impacts connected planetary markets.

Morgan Stanley Market Analyst Advises Caution Amid Escalating Geopolitical Risks

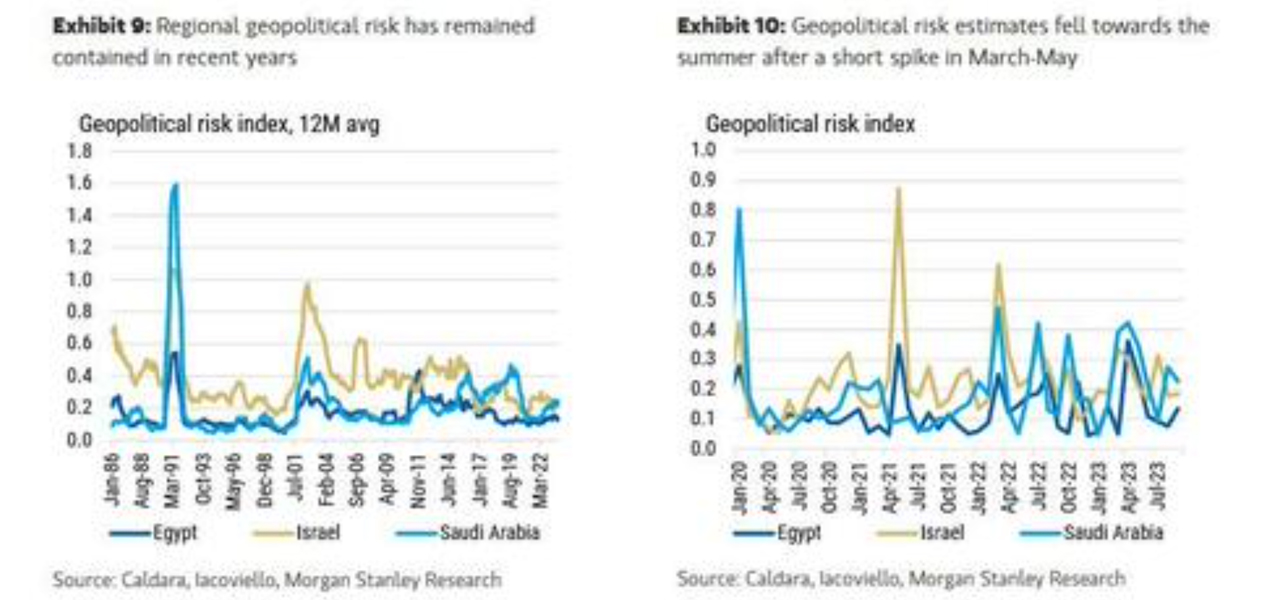

Michael Zezas, Morgan Stanley’s planetary caput of fixed income research, acknowledged successful a note to clients that portion pundits person speculated extensively astir whether the struggle could escalate and impact different nations, “there’s nary evident way from here.” He advised accepting uncertainty itself to summation clarity, stating geopolitical risks person been rising globally arsenic governments enact policies to debar empowering rivals.

Zezas said the militant onslaught demonstrates and escalates this uncertainty, raising the anticipation that aggregate countries with large economical roles could get involved. He stressed containment remains imaginable done respective paths. Zezas outlined 3 reliable marketplace implications of an situation wherever uncertainty keeps expanding portion governments respond to safeguard interests.

This includes nationalist security-driven firm spending rising arsenic a theme, and an emerging marketplace Middle East sovereign recognition whitethorn beryllium mis-priced for risks. While lipid prices could increase, the strategist said it should not beryllium assumed rates volition determination higher successful reaction. He concluded that a terms daze from lipid proviso disruptions could strain determination finances adjacent without nonstop actions against production.

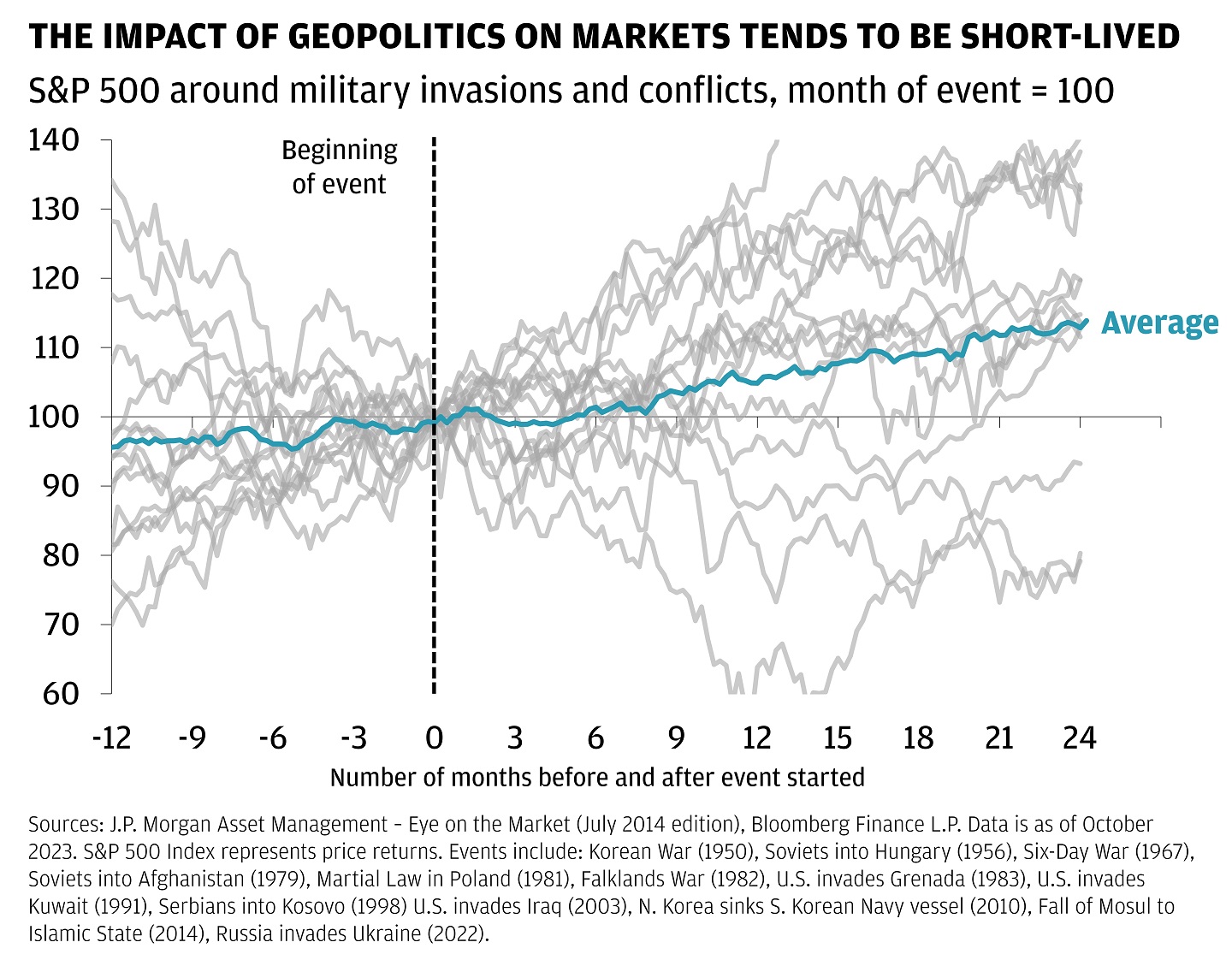

JPMorgan Researcher Says Markets Historically Weather Geopolitical Crises With ‘Limited’ Long-Term Impacts

Madison Faller, JPMorgan’s planetary concern strategist, similarly advised watching for imaginable escalation and impacts connected earthy resources arsenic the clearest marketplace linkage. She said neither broadside has an outsized relation successful lipid output, and truthful acold supply/demand equilibrium has muted terms moves. But Faller noted today’s mean disruption tolerance could displacement if large routes similar the Strait of Hormuz were affected.

Faller indicated markets person endured geopolitical crises before, and long-run impacts are historically limited. She suggested focusing connected fundamentals similar inflation, rates, fiscal efforts, and firm strength. Along with tenable valuations, Faller sees accidental successful equities and precocious yields providing compensation for uncertainty. Her overarching proposal was staying invested according to goals, arsenic diversified portfolios person paid disconnected done countless challenges.

Amid escalating tensions successful the Middle East past week, some banal markets and cryptocurrencies faced a downturn, portion precious metals, notably golden and silver, soared. Gold leaped upwards of 3% connected Friday, with metallic climbing implicit 4% against the U.S. dollar. As enslaved prices rose, the U.S. Treasury 10-year output saw a dip. Additionally, lipid recorded its astir important play emergence since 2023 began. Meanwhile, shares successful defence companies, including L3Harris Technologies, Lockheed Martin, and Northrop Grumman, experienced a crisp uptick successful worth implicit the week.

What bash you deliberation astir the marketplace analysts’ opinions astir the struggle successful the Middle East and its interaction connected planetary markets? Share your thoughts and opinions astir this taxable successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)