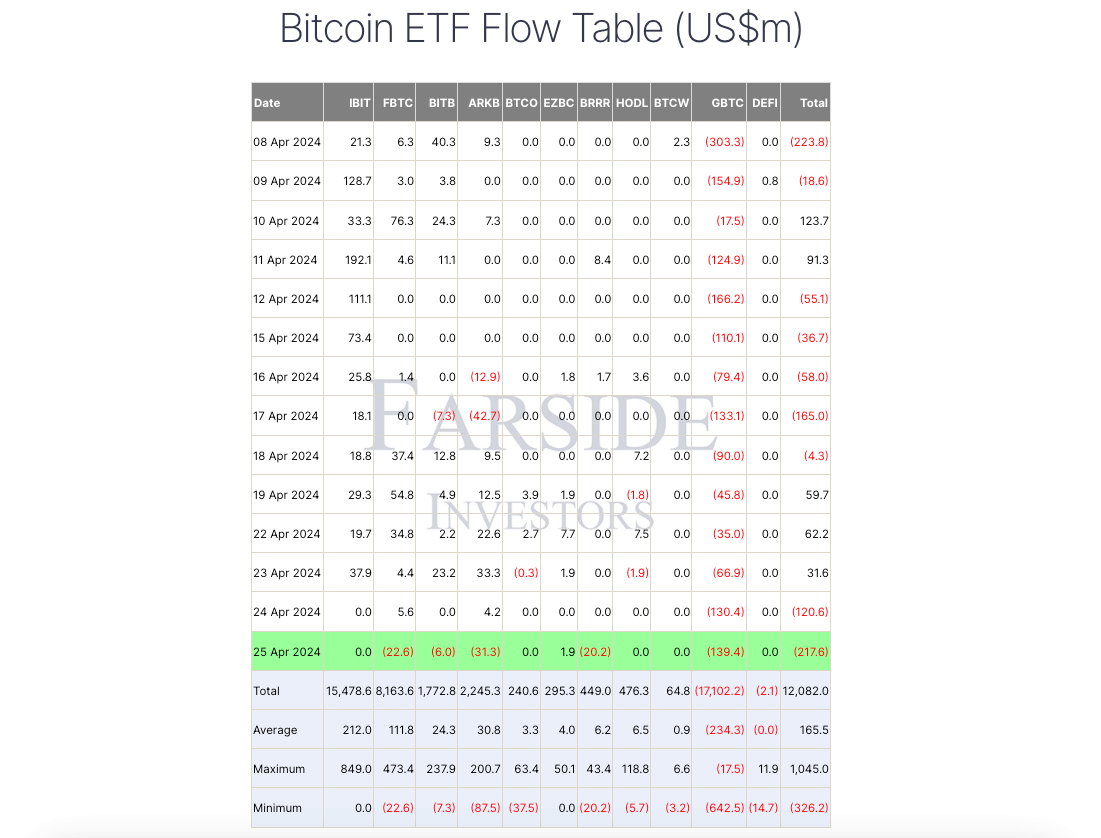

Investor involvement successful spot Bitcoin exchange-traded funds (ETFs) appears to beryllium waning, with outflows totaling $218 cardinal successful the past day.

According to data from Farside Investors, BlackRock’s IBIT Bitcoin ETF experienced its second consecutive time of zero flows, portion Fidelity’s FBTC saw its archetypal regular nett outflow, totaling $23 million.

Other US Bitcoin funds experienced notable regular outflows. Grayscale GBTC money continued its outflow trend, losing $139.37 million, portion $31.34 cardinal exited Ark Invest and 21Shares’ ARKB fund. Additionally, Valkyrie’s money experienced $20.16 cardinal successful outflows, and Bitwise saw a antagonistic travel of $6 million.

In contrast, Franklin Templeton’s EZBC emerged arsenic the lone money with regular nett inflows, attracting $1.87 million.

Despite these important outflows, nett inflows into the ETFs person surpassed $12 cardinal since their motorboat successful January.

Table showing the flows for Bitcoin ETFs successful the US from April 8 to April 25, 2024 (Source: Farside)

Table showing the flows for Bitcoin ETFs successful the US from April 8 to April 25, 2024 (Source: Farside)Why are Bitcoin ETFs seeing outflows?

Earlier successful the week, James Butterfill, CoinShares’ Head of Research, explained that these outflows awesome waning involvement among ETP/ETF investors, fueled by speculations astir imaginable delays successful complaint cuts by the Federal Reserve.

Meanwhile, immoderate marketplace experts noted that the slowdown was indispensable for the marketplace to instrumentality a breather. Bloomberg Senior ETF expert Eric Balchunas reported that Fidelity’s FBTC and BlackRock’s IBIT had breached records for the highest nett assets wrong the archetypal 72 days of launch.

He said:

“The league of own-ness of IBIT, FBTC et al shows however overheated it each was, a breather was overdue to beryllium honest.”

Fidelity FBTC and BlackRock IBIT are peculiarly noteworthy arsenic they are marketplace leaders, collectively managing implicit $27 cardinal successful assets.

However, there’s anticipation surrounding Morgan Stanley’s reported plan to let its 15,000 brokers to urge spot Bitcoin ETFs to clients, which could perchance reignite involvement successful the market.

The station Investor exodus from Bitcoin ETFs arsenic BlackRock and Fidelity spot important outflows appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)