Yields connected long-dated U.S. Treasuries person been erratic this twelvemonth and this week, the 10-year Treasury output crossed 3.5% for the archetypal clip successful a decade. Following the Fed’s 75bps (basis points) complaint hike, 10-year notes reached 3.642% and two-year Treasury notes jumped to a 15-year precocious astatine 4.090%. The curve betwixt the two- and 10-year notes indicates the chances of a heavy U.S. recession person grown stronger, and caller reports accidental enslaved traders person been “confronted with the wildest volatility of their careers.”

2 Quarters of Negative GDP, Red-Hot Inflation, and Extremely Volatile T-Notes

At the extremity of July, aft the 2nd consecutive 4th of antagonistic gross home merchandise (GDP), a fig of economists and marketplace strategists stressed that the U.S. is successful a recession. However, the Biden medication disagreed and the White House published an nonfiction which defines the commencement of a recession from the National Bureau of Economic Research’s perspective. Additionally, red-hot inflation has been wreaking havoc connected Americans, and marketplace analysts judge that rising user prices besides constituent to a recession successful the United States.

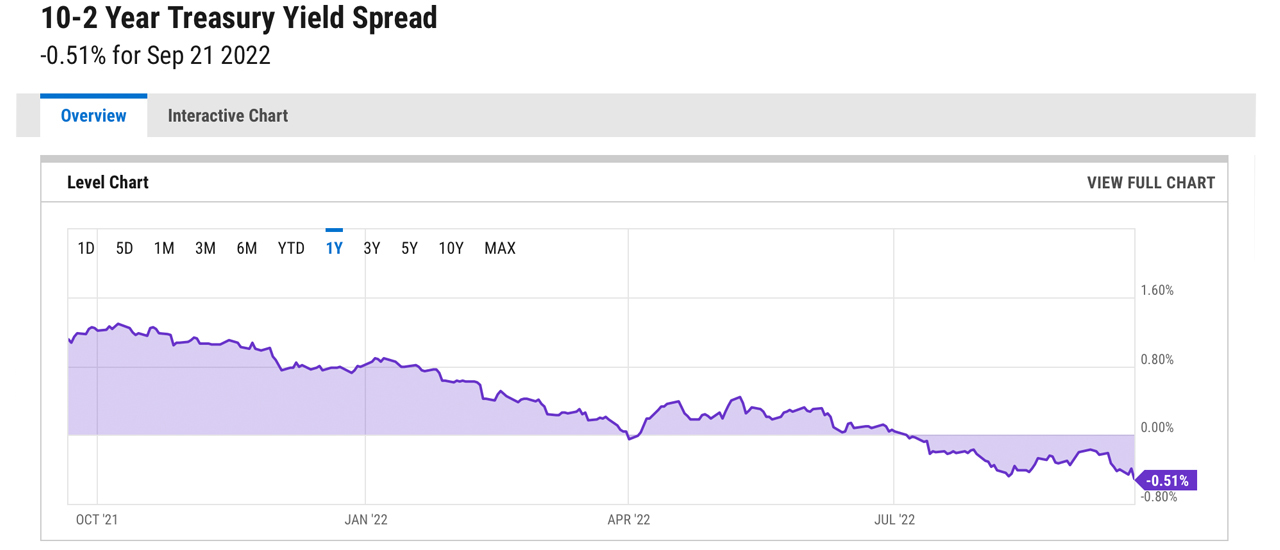

One of the biggest signals, however, is the output curve which measures semipermanent indebtedness with short-term indebtedness by monitoring two and 10-year Treasury enactment yields. Many analysts judge an inverted output curve is 1 of the strongest signals that points to a recession. The inverted output curve is antithetic but not successful 2022, arsenic enslaved traders person been dealing with a brainsick trading situation this year. This week, two- and 10-year Treasury enactment (T-note) yields broke records arsenic the 10-year T-note surpassed 3.5% connected September 19, for the archetypal clip since 2011. On the aforesaid day, the two-year T-note tapped a 15-year precocious reaching 3.97% for the archetypal clip since 2007.

Despite the information that specified enslaved marketplace volatility is usually a motion of a weakening system successful the U.S., nonrecreational traders claim enslaved markets person been breathtaking and “fun.” Bloomberg authors Michael MacKenzie and Liz Capo McCormick accidental enslaved markets are “characterized by abrupt and sweeping regular swings that are typically a favorable situation for traders and dealers.” Paul Hamill, the caput of planetary fixed income, currencies, and commodities organisation astatine Citadel Securities agrees with the Bloomberg reporters.

“We are close successful the saccharine spot of rates truly being an absorbing market, with clients being excited to trade,” Hamill explained connected Wednesday. “Everyone is spending each time talking to clients and talking to each other. It’s been fun.”

Sovereign Risk Rises, Yield Curve Between 2- and 10-Year T-Notes Slips to 58bps — BMO Capital Markets Analyst Says ‘Investors Are Running retired of Havens’

However, not everyone thinks the equity and enslaved marketplace volatility is each amusive and games. The main strategist astatine bubbatrading.com, Todd ‘Bubba’ Horwitz, recently said that helium expects to spot “a 50 to 60 percent haircut” successful equity markets. The caller U.S. Treasury output fluctuations person fixed marketplace strategists reasons to beryllium acrophobic astir looming economical issues. During the archetypal week of September, Lead-Lag Report steadfast and portfolio manager, Michael Gayed, warned that the erratic enslaved marketplace could spark a sovereign indebtedness situation and “several achromatic swans.”

Studies and empirical evidence amusement a volatile U.S. Treasury enactment marketplace is not bully for overseas countries holding U.S. T-notes and dealing with important indebtedness issues. That’s due to the fact that erstwhile U.S. T-notes are leveraged for restructuring purposes and a solution tool, “sudden and sweeping regular swings” tin punish countries trying to usage these fiscal vehicles for indebtedness restructuring. Additionally, since the Covid-19 pandemic, the monolithic U.S. stimulus programs, and the Ukraine-Russia war, sovereign hazard has elevated crossed the board, successful a myriad of countries worldwide.

On Wednesday, Bloomberg authors MacKenzie and McCormick besides quoted Ian Lyngen, the caput of U.S. rates strategy astatine BMO Capital Markets, and the expert noted that the beingness of alleged fiscal harmless havens is waning. “This volition beryllium a defining week for Fed complaint expectations betwixt present and the extremity of the year,” Lyngen said conscionable earlier the Fed raised the national funds complaint by 75 ground points. Lyngen remarked that there’s a “[sense of investors] not wanting to beryllium agelong the market. As we displacement to a genuinely assertive monetary argumentation stance, investors are moving retired of havens.”

On Thursday, the output curve betwixt the two- and 10-year T-notes slipped to 58bps, a debased not seen since the heavy lows successful August and past 40 years ago, backmost successful 1982. At the clip of writing, the output curve betwixt the two- and 10-year T-notes is down 0.51%. The crypto system is down 0.85% during the past 24 hours and is coasting on astatine $918.12 billion. Gold’s terms per ounce is down 0.14% and metallic is down 0.28%. Equity markets opened little connected Thursday greeting arsenic each 4 large indexes (Dow, S&P500, Nasdaq, NYSE) person printed losses.

What bash you deliberation astir the erratic enslaved markets successful 2022 and the signals that amusement the system and harmless havens are unreliable these days? Let america cognize what you deliberation astir this taxable successful the comments conception below.

3 years ago

3 years ago

English (US)

English (US)