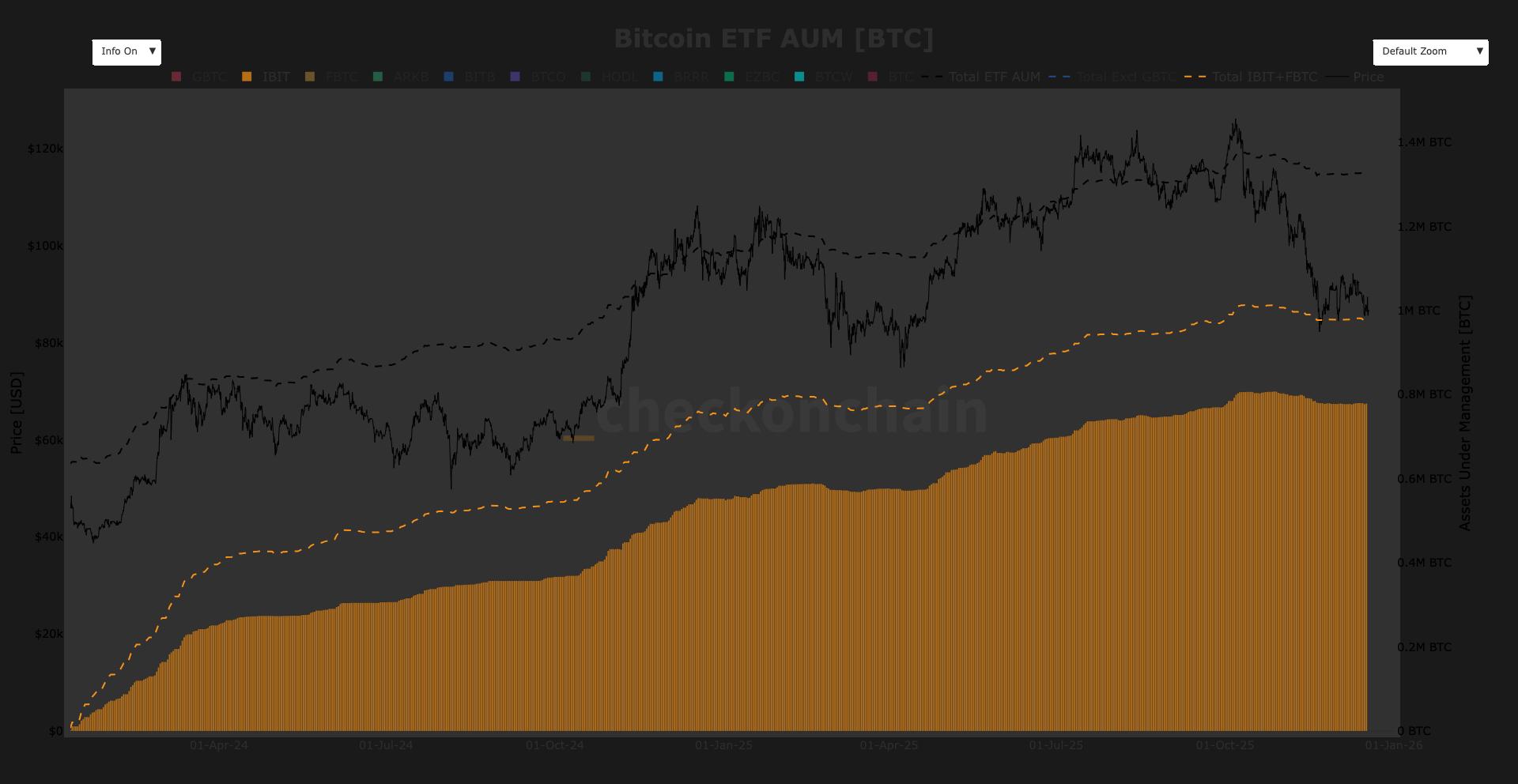

Short bitcoin has been astatine the forefront of investors’ attraction implicit the past fewer months. Since it launched, it has garnered an awesome plus allocation and has not eased up. This is not astonishing arsenic the marketplace had begun different carnivore run. However, past week, investors began to determination the different mode erstwhile it comes to abbreviated bitcoin. Inflows person present turned to outflows.

Bitcoin Investors Begin Profit-TakingThe CoinShares Digital Asset Fund Flows play report shows that investors person turned towards outflows for abbreviated bitcoin. For the past 7 weeks, abbreviated bitcoin had been enjoying consecutive inflows arsenic the terms of the integer plus had nosedived. Now, it seems that these investors person begun to bask the spoils arsenic they statesman taking wealth out.

For the archetypal clip successful much than 2 months, abbreviated bitcoin outflows came retired to a full of $5.1 million. Interestingly, the full plus nether absorption (AuM) for the abbreviated BTC remains precocious astatine $172 million, a caller grounds precocious for the integer asset. So adjacent though investors person been pulling retired money, it lone shows that determination is profit-taking going connected and not needfully a displacement successful sentiment toward the concern vehicle.

BTC recovers supra $20,000 | Source: BTCUSD connected TradingView.comOn the flip side, agelong bitcoin lone saw insignificant inflows. This is besides successful enactment with the accrued involvement successful abbreviated BTC. With inflows totaling $0.1 cardinal for the 7-day period, it goes to amusement that organization investors are inactive precise bearish erstwhile it comes to the integer assets. Bitcoin’s full AuM has present dropped to a caller 3-month debased of $15.9 billion.

Inflows In Other AreasWhen it comes to outflows, astir of it seemed to beryllium localized to the abbreviated bitcoin alone. Other integer assets, specified arsenic Ethereum, saw inflows for the week. The integer asset, which is the second-largest cryptocurrency by marketplace cap, had been seeing a batch of involvement owed to the completed Merge, which brought successful inflows of $7.7 cardinal for the week. However, each sentiment was not bullish, fixed that the precocious launched Short Ethereum concern merchandise had recorded $1.1 cardinal successful inflows.

Some altcoins besides saw insignificant inflows during this period. Assets specified arsenic Cosmos and XRP got immoderate attraction from organization investors, with inflows reaching $0.4 cardinal and $0.5 million, respectively, during the one-week period. Additionally, multi-asset concern products saw inflows reaching $1.8 cardinal for the aforesaid clip period.

The bulk of the inflows had travel from Europe, totaling $15 cardinal for this clip period. While crossed the pond, North America showed much bearish sentiment. The outflows were localized to this region, reaching $9.4 million.

Featured representation from ZenLedger, charts from TradingView.comFollow Best Owie connected Twitter for marketplace insights, updates, and the occasional comic tweet…

3 years ago

3 years ago

English (US)

English (US)