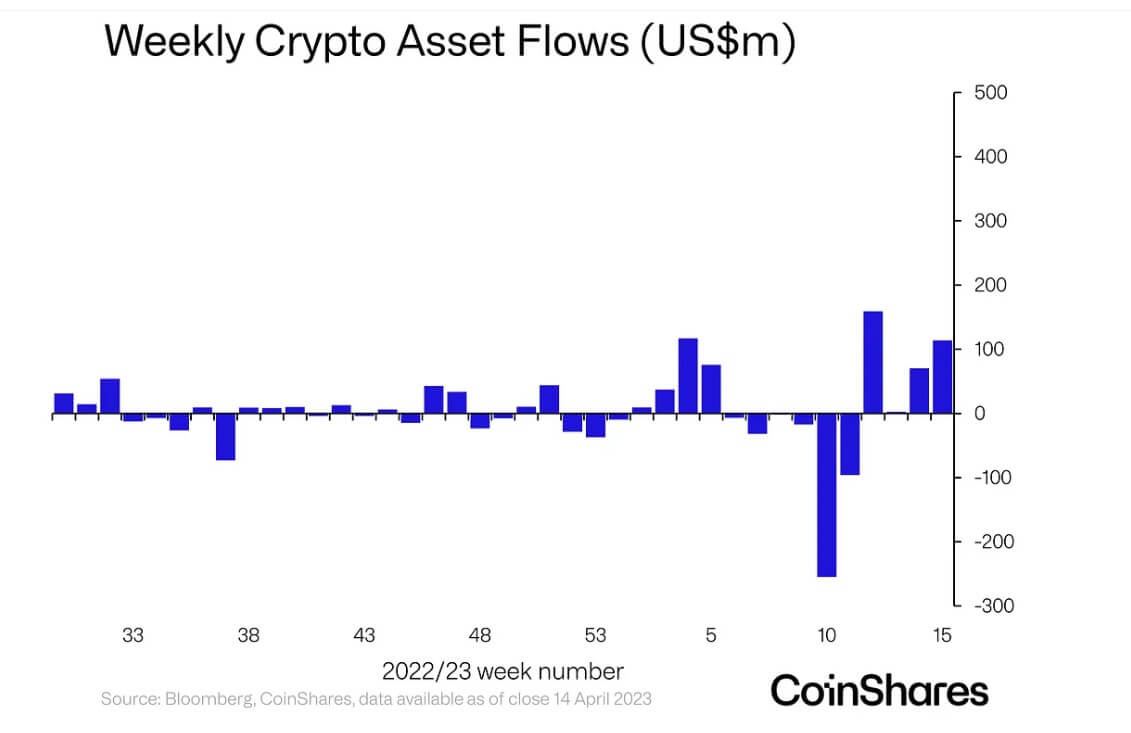

Digital assets concern products saw $114 cardinal successful inflows during the week of April 11 arsenic investors pumped wealth into Bitcoin (BTC), according to CoinShares’ report.

The past week’s inflow marks the 4th consecutive week for crypto products. According to CoinShares, inflows during this play present full $345 million.

Source: CoinShares

Source: CoinSharesBitcoin inflow tops $100 million

BTC dominated inflows to crypto concern products, seeing 91% — $104 cardinal — of each the investments for the week.

The flagship integer plus traded supra $30,000 for the archetypal clip successful astir a year. Its adoption besides roseate to a new all-time precocious arsenic much addresses were holding astatine slightest 0.1 BTC than ever before.

Meanwhile, CoinShares concern strategist James Butterfill wrote that the BTC i”flows bespeak a “flight to information by investors fearful of the ongoing accepted f”nance challenges.”

Butterfill added:

“This improving sentiment comes astatine a clip of precise debased volumes successful the Bitcoin market, averaging conscionable $5.6 cardinal per time compared to $12 cardinal for the afloat year.”

Howev”r, helium noted that “opini”n remains divided” due to the fact that Short Bitcoin products besides saw inflows of $14.6 BTC’son.

BTC’s full inflow connected the year-to-date metric is astir $78 million.

Ethereum, others spot minimal inflow

Ethereum (ETH) saw an inflow of $300,000 during the past week contempt the completion of its Shapella upgrade. The Shappella upgrade is the archetypal large ETH web update since the Merge and would alteration validators to retreat their staked ETH.

The upgrade positiETH’sreflected connected ETH’s value, pushing it above $2100 for the archetypal clip since May 2022. As of property time, implicit 1 cardinal ETH person been withdrawn.

According to Coinshares, determination was small enactment successful altcoins but for Polygon (MATIC) and Solana, (SOL) which saw $2.1 cardinal successful outflows, respectively.

Meanwhile, blockchain equities returned to their pre-FTX levels arsenic they saw inflows of $5.8 cardinal during the week nether review. The full worth of assets nether absorption for this merchandise reached $1.9 cardinal — its highest since October 2022.

The station Investors flock Bitcoin aft Ethereum’s Shapella upgrade appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)