The crypto marketplace is presently charged with tension, anticipating the U.S. Securities and Exchange Commission’s impending determination connected the archetypal spot Bitcoin ETF. Amidst divided opinions implicit whether the SEC volition approve the ETF successful the coming days oregon postpone the determination again, a adjacent investigation of Deribit’s Bitcoin options marketplace reveals traders bracing for sizeable terms movements successful January.

As of Jan. 5, the full unfastened involvement successful Bitcoin options connected Deribit is 228,646.70 BTC, representing a notional worth of $10.05 billion. This important fig indicates a precocious level of marketplace information and involvement successful Bitcoin’s aboriginal terms movements.

The dominance of telephone unfastened interest, comprising 162,694.50 BTC compared to enactment unfastened involvement astatine 65,952.20 BTC, suggests a bullish sentiment among investors. They look to beryllium anticipating oregon hedging against a imaginable summation successful Bitcoin’s price.

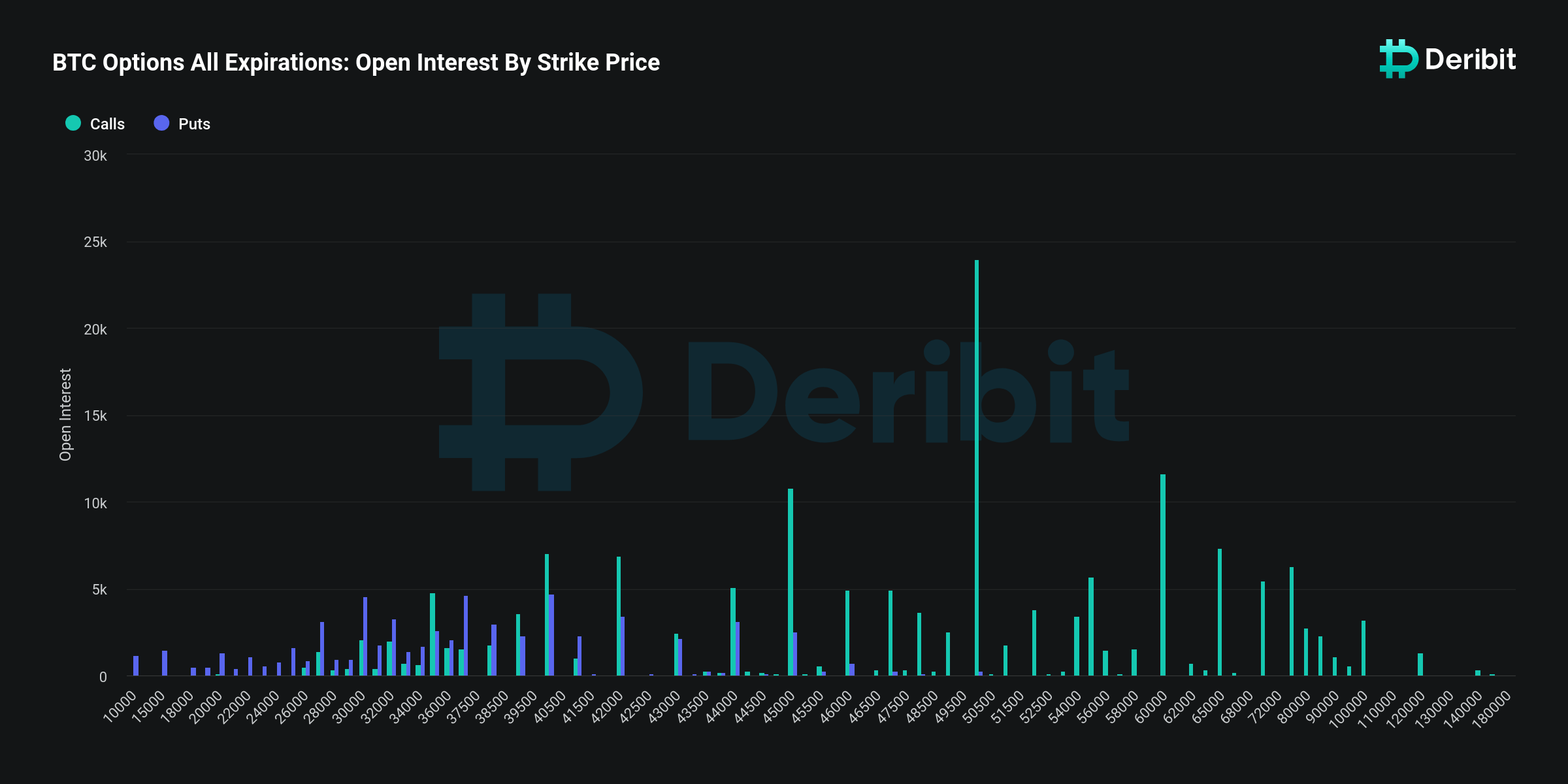

The breakdown of unfastened involvement by onslaught terms further reinforces this bullish sentiment. The highest attraction of telephone options is astatine the $50,000 onslaught price, with a worth of $1.05 billion. This level could beryllium viewed arsenic a important intelligence and fiscal threshold that galore investors are betting Bitcoin volition scope oregon surpass. The adjacent highest attraction is astatine the $45,000 and $60,000 onslaught prices, indicating optimism for adjacent higher prices, though with lesser condemnation than for the $50,000 mark.

Graph showing the unfastened involvement connected Bitcoin options of each expiration dates by onslaught terms connected Jan. 5 (Source: Deribit)

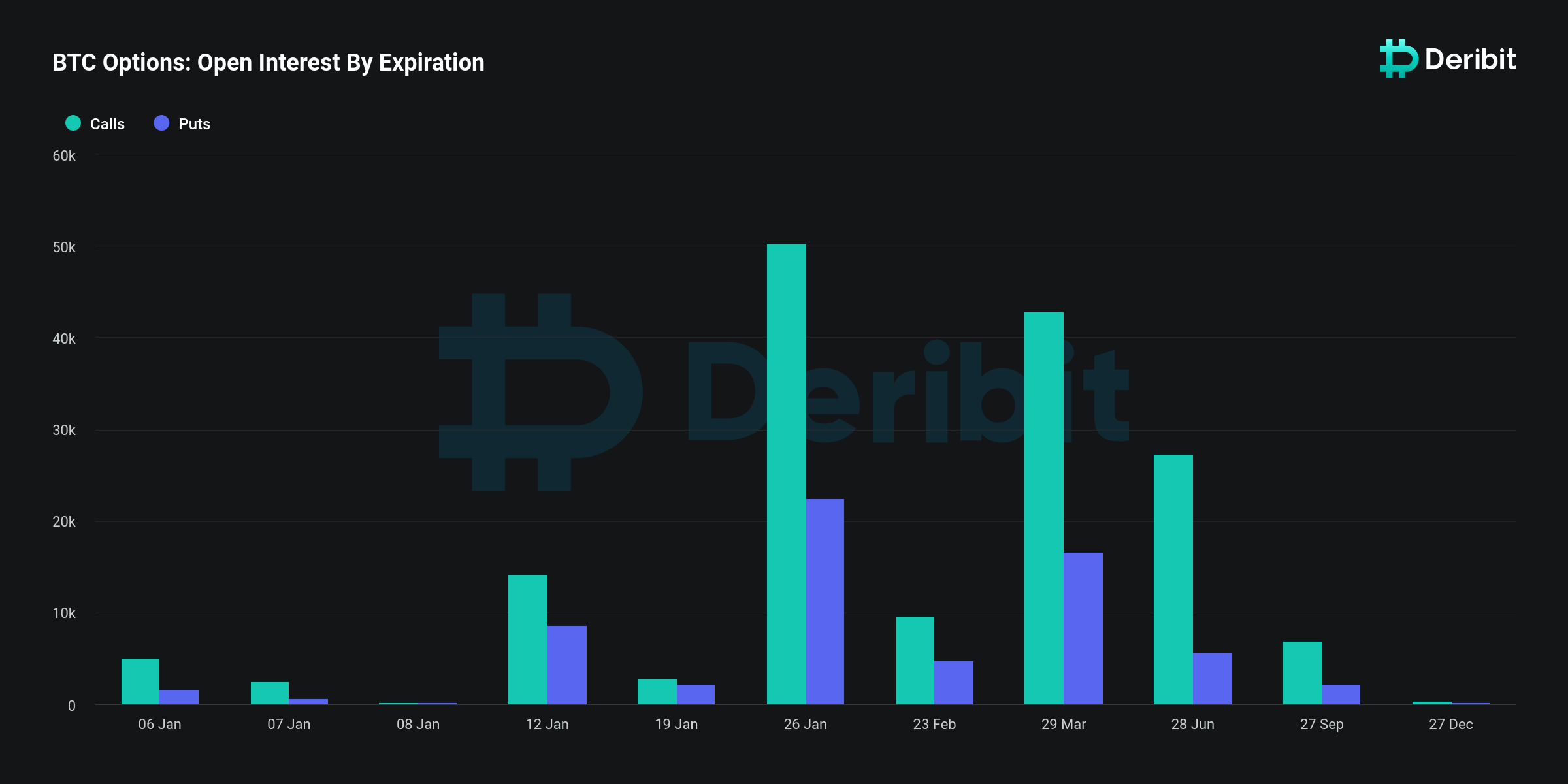

Graph showing the unfastened involvement connected Bitcoin options of each expiration dates by onslaught terms connected Jan. 5 (Source: Deribit)Regarding unfastened involvement by expiration, the information shows a dense attraction of telephone options for the Jan. 26 expiration, with $2.21 cardinal successful calls versus $988.49 cardinal successful puts. This suggests that the bullish sentiment is much pronounced for the mean term, with a ample portion of the marketplace anticipating important developments surrounding the Bitcoin ETF to hap earlier this date.

Graph showing the unfastened involvement connected Bitcoin options by expiration day connected Jan. 5 (Source: Deribit)

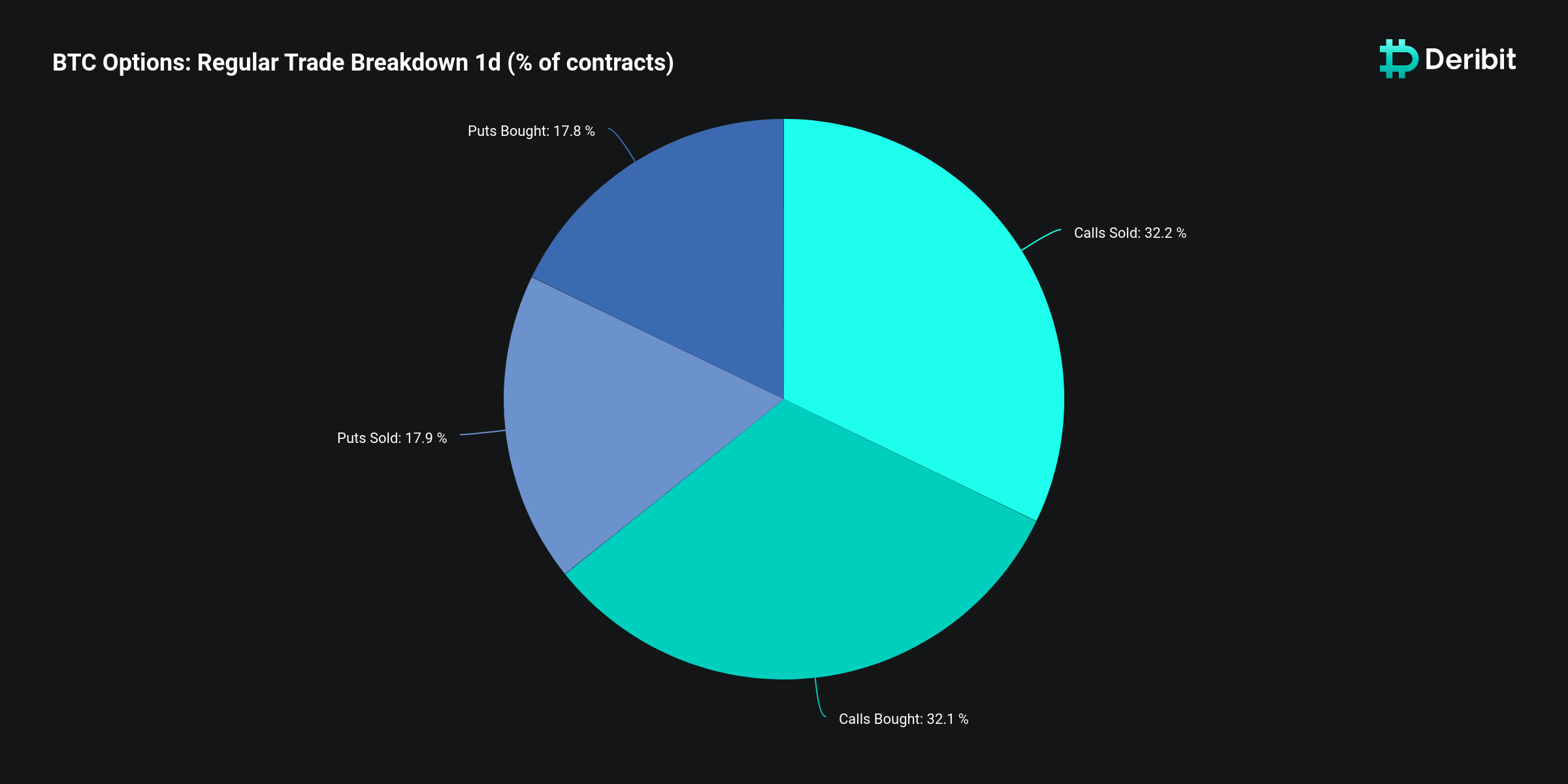

Graph showing the unfastened involvement connected Bitcoin options by expiration day connected Jan. 5 (Source: Deribit)The regular commercialized breakdown, showing astir adjacent percentages of puts and calls bought and sold —17.8% and 17.9% for puts, 32.1% and 32.2% for calls, respectively — indicates a balanced marketplace successful presumption of trading activities. The information shows that a higher percent of marketplace participants are engaged successful telephone enactment transactions compared to puts. This indicates a stronger involvement successful betting connected oregon hedging against an summation successful Bitcoin’s price. The equilibrium betwixt calls bought and sold is besides astir equal, suggesting that for each capitalist speculating connected a terms emergence (by buying calls), determination is astir an adjacent fig of investors (or possibly the aforesaid investors successful antithetic transactions) who are either much cautious oregon looking to nett from selling these options.

Graph showing the regular commercialized breakdown for Deribit options connected Jan. 5 (Source: Deribit)

Graph showing the regular commercialized breakdown for Deribit options connected Jan. 5 (Source: Deribit)Data from Deribit reflects a predominantly bullish sentiment, with investors showing a beardown content successful the imaginable for Bitcoin’s terms to increase, peculiarly towards the $50,000 level successful the abbreviated to mean term. However, a important magnitude of enactment options and balanced commercialized activities bespeak a cautious attack among traders, with galore preparing for further volatility.

The station Investors hedge bets connected Bitcoin with $50K telephone options earlier ETF decision appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)