Invictus Capital, a crypto concern steadfast based successful South Africa, moved crypto from funds designated for investments with “no anticipated downside risk” into Terra USD and held the tokens done the UST de-peg lawsuit citing “pretty astonishing interest” arsenic justification for hholding done the crash.

Highlights

- Invictus Capital invested millions of dollars of capitalist funds into the Terra ecosystem to leverage outsized gains wrong “regulated” funds.

- Fund managers refused capitalist calls to merchantability UST earlier the peg broke beneath $0.93.

- Investors’ crypto assets were expected to beryllium successful acold storage, but Invictus invested them successful Celsius instead.

- The institution laminitis was forced retired aft making a atrocious commercialized costing the institution $4 million.

- Invictus Capital employees threatened to study the laminitis for fraud arsenic leverage successful the merchantability of 1 of the funds.

- Employees unopen down each societal media channels and suspended withdrawals.

- Invictus directors allegedly threatened the laminitis and chased him to his parent’s home.

- Invictus allegedly created a smear run against laminitis and ex-CEO Daniel Schwartzkopff.

- Invictus Capital is presently undergoing voluntary liquidation successful the Cayman Islands done its holding institution New World Holdings.

- The restructuring CEO attempted to usage power to forestall the communicative from being published.

Invictus Capital

Invictus Capital had astir $135 cardinal successful assets nether absorption astatine the clip of the illness of Terra Luna. A percent of these funds were held successful UST, which could beryllium viewed arsenic acting against the presumption of the archetypal whitepaper that referenced “USD equivalents with small anticipated drawdown risk.”

Around the aforesaid time, 50% of its assets nominated for acold retention were revealed to beryllium held successful Celsius. The funds are present locked, and Invictus Capital is teetering connected the brink of bankruptcy and has filed for voluntary liquidation.

The steadfast suspended withdrawals and unopen down each of its societal media channels amid interior struggle and an outcry from investors demanding accusation connected their holdings.

Communication from Invictus has been constricted since aboriginal June, and a restructuring CEO, Haydn Hammond, has been appointed pursuing the departure of laminitis and ex-CEO Daniel Schwartzkopff.

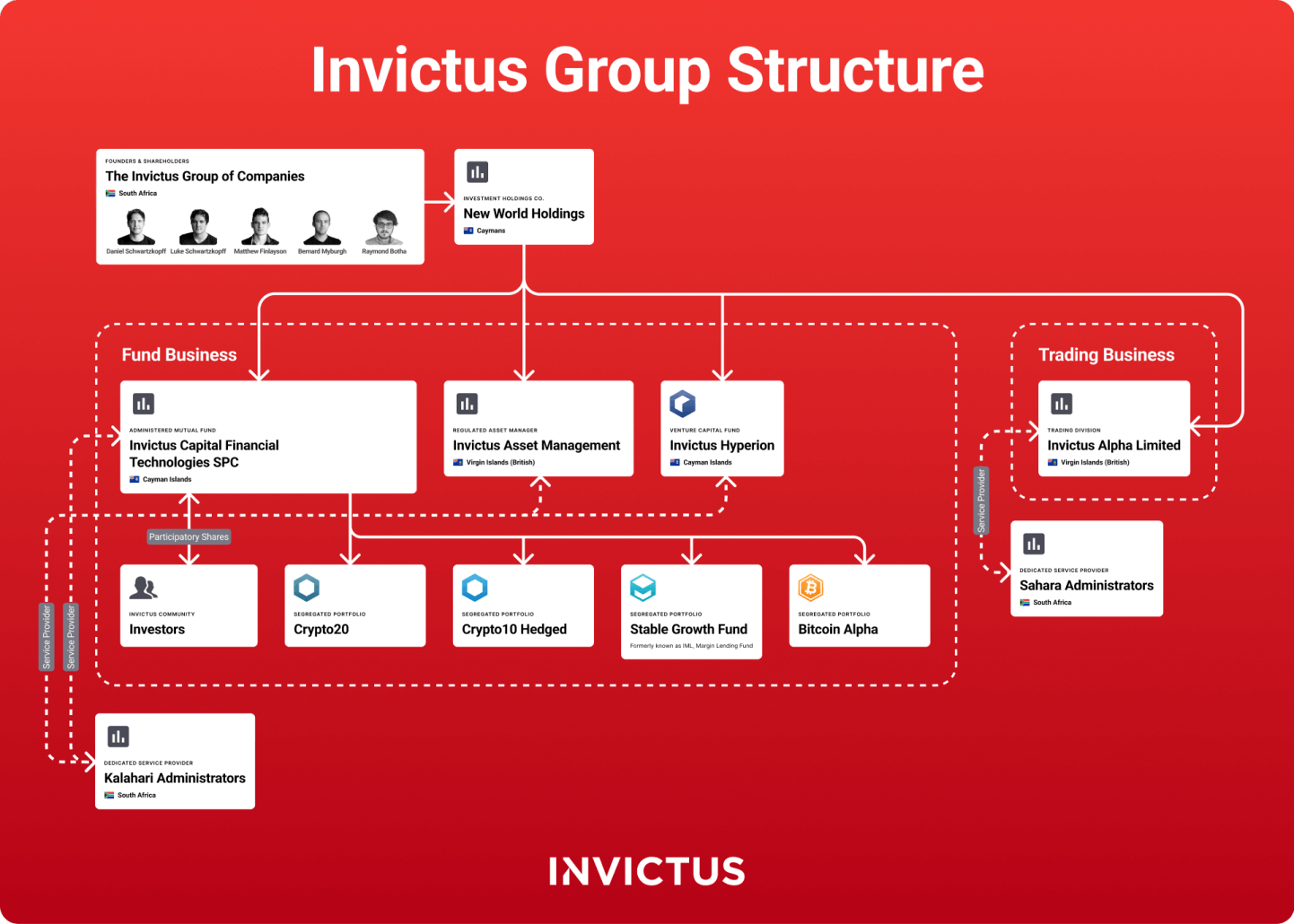

Invictus Capital is simply a public-facing entity representing respective segregated portfolio companies successful the Cayman Islands. Its offering is designed to let investors a elemental mode to put successful cryptocurrencies portion minimizing the downside risks.

One product, Invictus Margin Lending (IML), really offers “the quality to instrumentality vantage of the cryptocurrency market’s volatility to gain involvement with no anticipated downside risk.“

Removal of the CEO

Things started to autumn isolated for Invictus successful April 2022 aft in-fighting betwixt Schwartzkopff and members of 1 of its work providers Kalahari. Kalahari and different company, Sahara, provided each worker services for the Invictus Capital Group of companies, according to filings by Kalahari and Sahara Director Steven Williams.

CryptoSlate reached retired to respective Invictus employees but each requests for remark were refused. The lone disposable remark comes from a letter to Invictus unit pursuing the removal of Schwartzkopff stating, ” it is sufficiently superior that it is apt to origin the concern to beryllium discontinued oregon materially restructured.”

However, we were capable to talk to Schwartzkopff and respective investors, including Lev Mazur.

Mazur, the laminitis of Quantfury, a blockchain trading platform, became progressive with Invictus done its concern product, the Hyperion Investment Fund. Investors gained vulnerability to a handbasket of imaginable blockchain unicorns by buying the IHF token.

Quantfury was launched done an IHF investment, yet Mazur affirms that the institution has nary nonstop narration with Invictus Capital arsenic a business. The acquisition did, however, springiness him penetration into the workings of the institution done interactions with its employees.

Mazur and Schwartzkopff became adjacent pursuing Quantfury’s funding, with Mazur stating that the motorboat was “all him” successful notation to Schwartzkopff’s assistance successful securing the investment. Mazur speaks highly of Schwartzkopff, saying, “he’s benignant of a genius type… akin to SBF.”

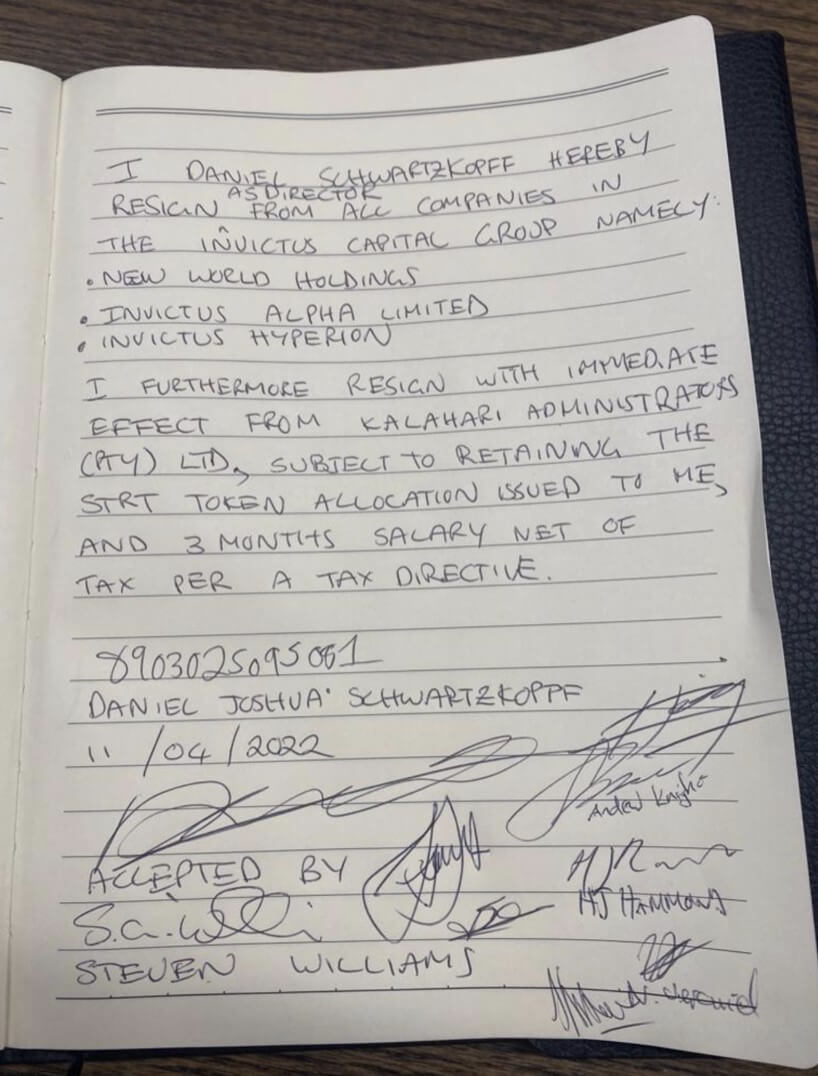

In mid-April, Schwartzkopff was ousted from Invictus and made to tender his resignation during a committee meeting.

The beneath representation is simply a leaked transcript of the resignation missive signed by Schwartzkopff and the committee members written connected a notepad.

It is highly antithetic for a institution with implicit a 100 cardinal dollars successful assets nether absorption to usage a notepad for specified an important document. People acquainted with the substance told CryptoSlate that Schwartzkopff was “literally pushed and mentally abused, extruded to motion it.”

Schwartzkopff founded Invictus Capital and is well-known to beryllium the brains down the operation. While galore members of the assemblage person present turned against him, fewer asseverate that helium was not highly talented.

Schwartzkopff created respective ETF-like products that utilized astute contracts to hedge crypto investments and dispersed them crossed crypto assets. His creations made the institution precise profitable, but the statement was that helium was not acceptable to beryllium the CEO.

Reports authorities that Schwartzkopff seldom came into the bureau and was much funny successful the codification than moving the company. He was perpetually coming up with caller ideas for concern strategies, and during 1 of these strategies, helium mislaid $4 cardinal of Invictus Capital funds.

Schwartzkopff told CryptoSlate that the wealth helium mislaid was from institution profits. Many assemblage members, however, allege that Schwartzkopff utilized lawsuit funds lent from the Invictus Alpha Fund. No grounds has been recovered to corroborate these claims.

Schwartzkopff believes the allegations were created by Invictus Capital employees “posting nether troll pseudonyms connected the Discord.”

He further claimed they threatened him, chased him to his parent’s home, and

“[Did] immoderate beauteous unscrupulous things similar logging into my backstage Whatsapp and Telegram connected my institution laptop that I handed in. They besides refused to springiness maine my emails oregon Slack messages truthful that I could support myself against immoderate allegations.”

After Schwartzkopff was ousted from the company, Invictus Capital sent a missive to its assemblage refusing to springiness circumstantial details astir the circumstances surrounding Schwartzkopff’s removal. It did, however, relay that the “boards accordingly authorized absorption to petition Daniel’s resignation, which helium tendered.”

UST de-peg event

With Schwartzkopff retired of the picture, Invictus Capital accrued the vulnerability to UST of the Invictus Margin Lending fund, arsenic displayed successful an email sent to immoderate investors. The update was leaked to CryptoSlate by an ex-employee, and it explained that

“Regrettably, anterior to the de-pegging, the bulk of the ISG Funds (98%), a ample portion of the IBA Fund (48%), and a information of the C10 currency hedge (40%) were exposed to the UST stablecoin.”

The percentages bespeak that Invictus Capital had astir $22.5 cardinal tied up straight successful UST.

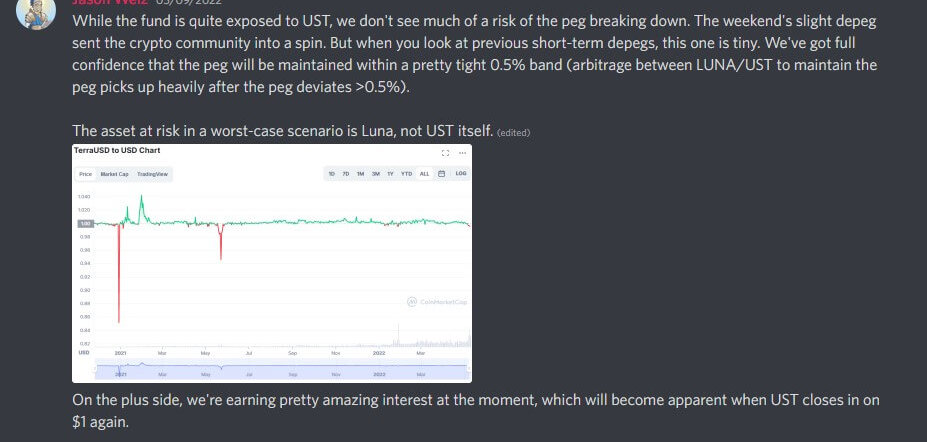

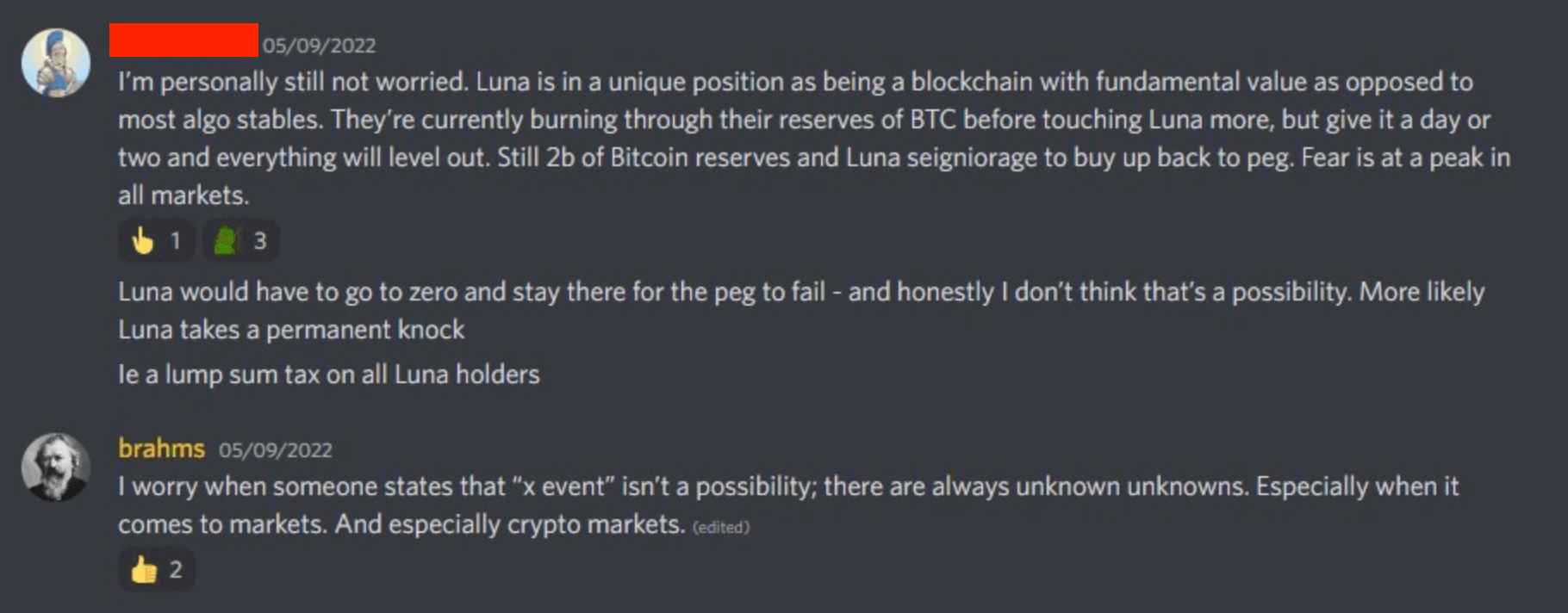

Before this accusation became public, investors reached retired to Invictus via the authoritative Discord server, telling them to exit the position. However, Invictus representatives played down fears that the de-peg would person semipermanent repercussions.

During the week of Terra’s collapse, a verified Invictus Fund Analyst told investors successful Discord that “we don’t spot overmuch of a hazard of the peg breaking down,” citing the past show of UST arsenic his rationale. He further stated that helium had “full assurance that the peg volition beryllium maintained.”

Welz aboriginal added that “we’re earning beauteous astonishing interest… 30+%,” and helium was “still not worried.” He additionally declared that helium didn’t deliberation it was a anticipation that LUNA could spell to zero “and enactment there.”

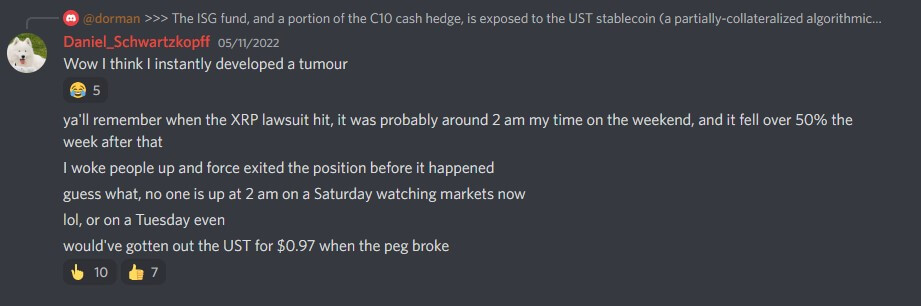

In respective conversations regarding the event, Schwartzkopff claimed that helium would person gotten retired of the presumption astir $0.97, citing his late-night determination to merchantability XRP erstwhile the “lawsuit hit.” Schwartzkopff was nary longer progressive with the institution during this period. However, helium told america that helium tried to telephone Invictus erstwhile the peg yet broke, but cipher picked up.

Due to Invictus’ condemnation that UST would re-peg, investors asked for impervious of a hazard absorption strategy. None was provided, but 1 capitalist who reached retired via Invictus’ website received a effect connected May 11 saying, “we should spot a dilatory betterment backmost to the dollar parity.”

At this point, UST had fallen beneath $0.65 and recovered to astir $0.86. Invictus remained bullish, stating, “the ISF money volition beryllium maintaining its UST position.” The email to investors that “regrettably” informed them that implicit $22.5 cardinal of UST was held crossed respective funds was sent the adjacent day, May 12.

Celsius implicit acold storage

Two of the halfway products offered by Invictus were cryptos scale funds called C20 and C10. C20 was marketed arsenic a mode to put successful “regulated and tokenized funds” and allowed investors vulnerability to “the apical 20 crypto assets” done 1 azygous token. Meanwhile, C10 was a hedged “smart scale fund” designed to bounds the nonaccomplishment of superior utilizing a “dynamic currency hedging mechanism.”

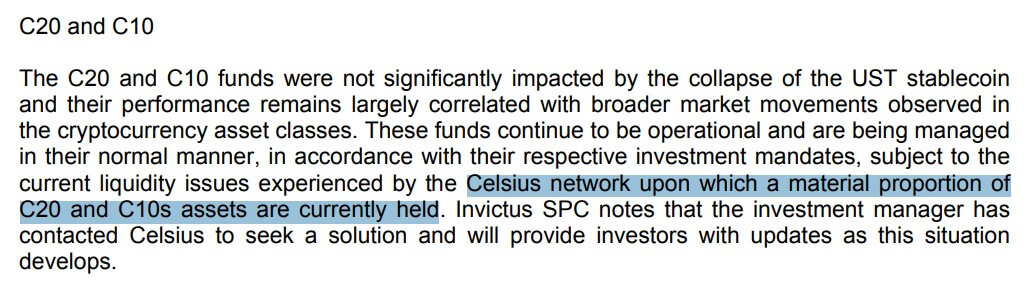

The crypto wrong the C20 Fund was expected to beryllium held successful acold storage, according to the portfolio’s whitepaper. However, Invictus aboriginal revealed that 50% of the C20 money and the bulk of C10 were, instead, held connected Celsius.

“Both C20 and C10 person important vulnerability to the Celsius network, which has precocious suspended withdrawals. Most of C10’s assets are held connected the Celsius network, and astir 50% of C20’s assets are besides held there.”

Another missive to investors confirmed the vulnerability to Celsius but interestingly contradicted an aboriginal connection regarding the C10 vulnerability to UST:

The full worth of reserves held successful Celsius is estimated to beryllium successful the portion of $49 cardinal earlier the illness of Terra and $23 cardinal after. The funds were astir 55% of the full assets nether management. At the clip of Celsius’ bankruptcy filing, successful which Invictus Capital was listed arsenic 1 of the largest creditors, the worth of assets amounted to $17.7 million.

The interaction connected investors

Of the $135 cardinal managed by Invictus, astir $80 cardinal was invested successful either Terra oregon Celsius. These investments were either mislaid to the illness of Terra oregon are inactive locked wrong Celsius. Investors person had nary entree to retreat funds for implicit a month, with each means of connection disabled by Invictus.

Investors person grouped unneurotic to make a backstage Discord assemblage with hundreds of members and thousands of messages. The server, named “Independent Invictus Tokenholders,” has been instrumental successful aiding CryptoSlate successful sourcing archetypal documentation from Invictus to validate claims.

Several progressive members spoke to CryptoSlate straight to facilitate this investigation, revealing that galore retail investors progressive with Invictus person mislaid their full nett worthy successful the disaster.

Alvarez & Marsal, the aforesaid steadfast representing Celsius, represents Invictus. It told Celsius that “it indispensable not pass with customers due to the fact that they whitethorn beryllium seen to beryllium prejudiced successful the lawsuit of a bankruptcy.” Invictus Capital has been arsenic soundless connected the substance pursuing its voluntary liquidation filing.

CryptoSlate reached retired to respective members of Invictus Capital and Kalahari, including Restructuring CEO Haydn Hammond, but nary 1 was consenting to comment. Hammond did, however, interaction CryptoSlate successful June, asking journalists to halt looking into the story.

CryptoSlate volition people follow-up stories arsenic our probe into Invictus moves guardant and arsenic we uncover much information.

Blocklight is the investigative part of CryptoSlate. If you person mislaid wealth done Invictus Capital, clasp further information, oregon person immoderate different tips regarding atrocious actors wrong crypto, you tin interaction america via email.

Initial Research: Oluwapelumi Adejumo

The station Investors mislaid implicit $100M aft Invictus Capital moved funds into UST, Celsius against their wishes appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)