Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum has experienced a much-needed surge supra the $2,000 level, a cardinal intelligence and method people that bulls person struggled to reclaim since March 10. This breakout sparked optimism successful the market, but the momentum was short-lived, arsenic ETH rapidly pulled backmost beneath the level and was incapable to corroborate a coagulated hold. Analysts wide hold that a beardown and sustained determination supra $2,000 is captious for Ethereum to initiate a broader betterment rally.

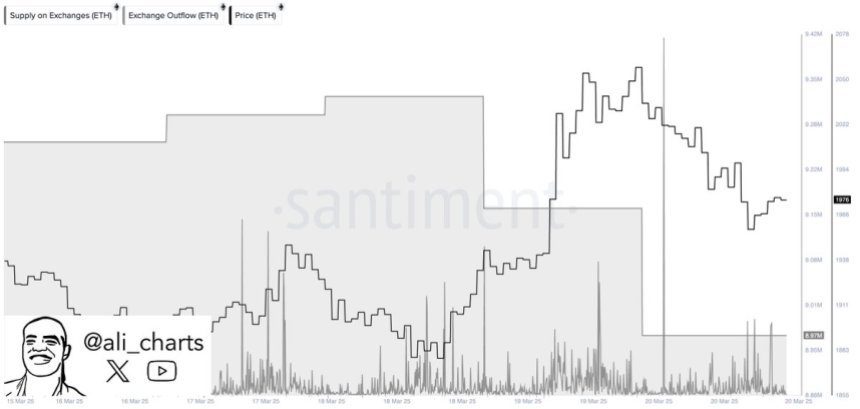

Despite the hesitation astatine resistance, on-chain information shows signs of increasing capitalist confidence. According to Santiment, investors person withdrawn implicit 360,000 ETH from centralized exchanges successful the past 48 hours. This displacement is often interpreted arsenic a bullish signal, suggesting that ample holders are moving their assets to backstage wallets, perchance successful anticipation of higher prices.

Meanwhile, the broader macroeconomic scenery continues to use pressure. Trade warfare tensions and unpredictable argumentation decisions from the U.S. authorities person weighed heavy connected some crypto and accepted markets, intensifying volatility and investor uncertainty. Still, Ethereum’s latest speech outflows hint astatine a imaginable inclination displacement — 1 that could favour accumulation and acceptable the signifier for the adjacent large move, provided bulls tin reclaim and clasp supra the $2K threshold.

Ethereum Faces Critical Test Amid Exchange Outflows

Ethereum has mislaid implicit 57% of its worth since mid-December, falling from a precocious of astir $4,100 to caller lows adjacent $1,750. This crisp correction has created a challenging situation for bulls, who person repeatedly failed to reclaim and clasp higher terms levels.

Now, the $2,000 people stands arsenic a intelligence and method battlefield. If Ethereum tin firmly found enactment supra this level, it could supply the instauration for a betterment rally. However, a nonaccomplishment to bash truthful would apt effect successful further downside and reenforce the bearish trend.

The existent marketplace scenery struggles with uncertainty. On 1 side, continued macroeconomic headwinds—rising commercialized tensions, ostentation concerns, and argumentation shifts from the U.S. government—have weakened capitalist assurance and driven volatility crossed hazard assets. On the different hand, determination are signs of imaginable betterment and accumulation.

Top crypto expert Ali Martinez shared data from Santiment, revealing that investors person withdrawn implicit 360,000 ETH from centralized exchanges successful the past 48 hours. Historically, large-scale withdrawals are considered a bullish signal, arsenic they suggest investors are moving assets into acold retention for semipermanent holding alternatively than preparing to sell.

360,000 Ethereum withdrawn from exchanges successful 48h | Source: Ali Martinez connected X

360,000 Ethereum withdrawn from exchanges successful 48h | Source: Ali Martinez connected XThis determination could bespeak increasing assurance among ample holders and awesome the aboriginal stages of a caller accumulation phase—provided Ethereum tin clasp supra $2,000.

Price Holds Steady Below $2,000

Ethereum is presently trading astatine $1,960 aft concisely attempting to reclaim the $2,000 people successful yesterday’s session. The intelligence and method absorption astatine $2,000 remains a important obstruction that bulls indispensable flooded to displacement marketplace momentum successful their favor. Despite a tiny bounce from caller lows, Ethereum has struggled to summation traction amid persistent marketplace uncertainty.

ETH trying to reclaim $2,000 | Source: ETHUSDT illustration connected TradingView

ETH trying to reclaim $2,000 | Source: ETHUSDT illustration connected TradingViewBulls request to propulsion ETH supra $2,000 and reclaim higher levels specified arsenic $2,150 and $2,300 to corroborate the opening of a betterment phase. A sustained determination supra these levels would not lone awesome a imaginable inclination reversal but could besides pull sidelined investors backmost into the market. Until that happens, Ethereum remains susceptible to continued downside pressure.

If bulls neglect to interruption supra the $2,000 absorption successful the coming sessions, Ethereum could suffer enactment astatine existent levels and revisit little request zones astir $1,850 oregon adjacent $1,750. With the broader crypto marketplace inactive nether the power of macroeconomic volatility and anemic sentiment, the coming days are apt to beryllium pivotal for ETH’s short-term direction. A decisive determination either supra oregon beneath this cardinal scope volition apt acceptable the code for the adjacent large terms action.

Featured representation from Dall-E, illustration from TradingView

6 months ago

6 months ago

English (US)

English (US)