Despite the caller rally successful equities, the enslaved marketplace has meaningfully reversed and resumed its sell-off portion treasury yields emergence with inflationary pressure.

The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Bear Market Rallies

In today’s issue, we volition revisit the ever-changing dynamics successful bequest markets, with a absorption connected the past of U.S. equity carnivore markets.

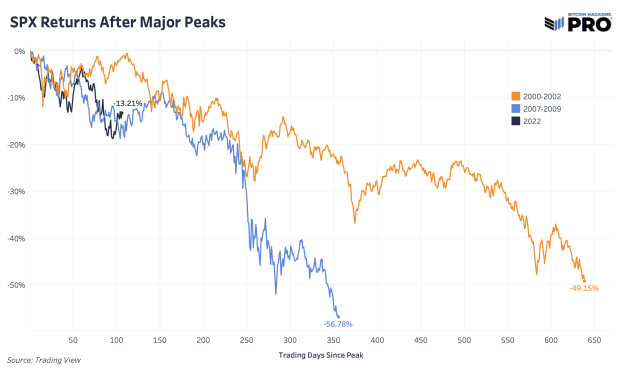

At the clip of writing, the S&P 500 equity scale is 8.5% disconnected the lows portion inactive being 13.2% beneath its all-time precocious peak. While thing is for certain, our basal lawsuit is that the equity marketplace is successful the midst of a carnivore marketplace alleviation rally. Shown beneath is today’s marketplace overlaid with erstwhile sustained carnivore markets of the past during the Great Recession and 2000s Dot-Com Bubble.

Significant, lengthy antagonistic SPX returns aft large peaks.

Significant, lengthy antagonistic SPX returns aft large peaks.

While this isn’t meant to spark fear, it is meant to springiness readers discourse arsenic to what is successful the realm of possibility. When referring to history, and fixed today’s environment, the Federal Reserve has publically stated it is attempting to reverse technologist a wealthiness effect to stomp retired user terms ostentation with monetary policy. With this successful mind, it's probable that the worst has yet to travel for the U.S. equity market.

In particular, 1 should recognize that humanities carnivore markets person witnessed aggregate rallies passim that convinced galore that the worst was over, lone earlier turning implicit for the adjacent limb lower.

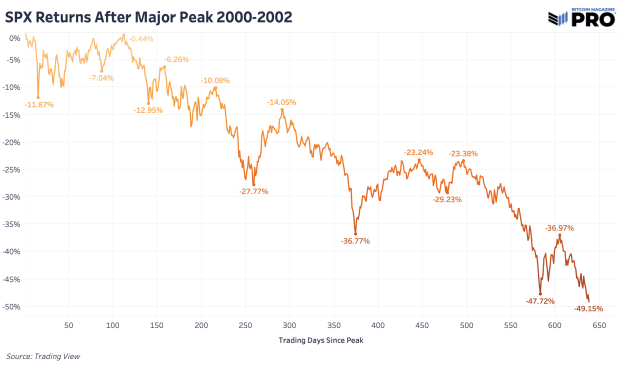

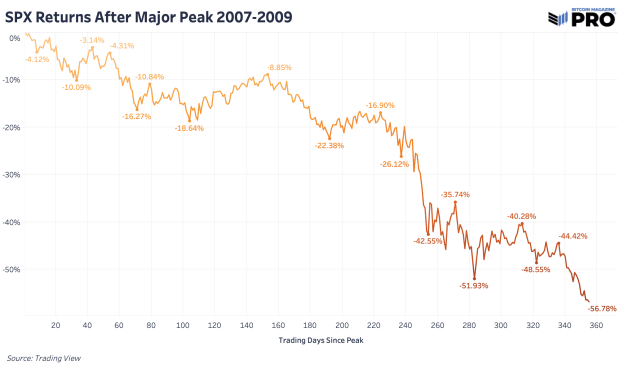

Displayed beneath are the carnivore markets successful the S&P 500 during the Dot-Com bust and the Global Financial Crisis.

Negative SPX returns aft the large highest from 2000-2002.

Negative SPX returns aft the large highest from 2000-2002.

Negative SPX returns aft the large highest from 2007-2009.

Negative SPX returns aft the large highest from 2007-2009.

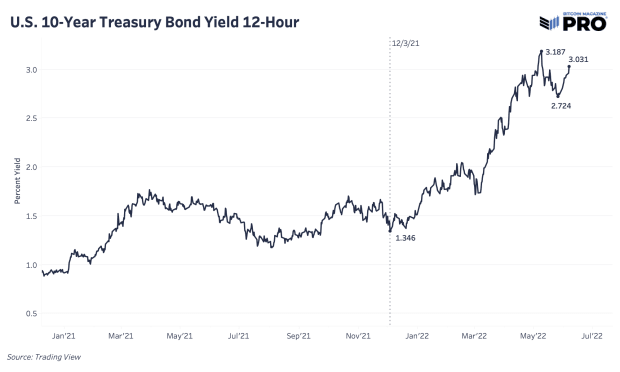

U.S. Treasuries Continue To Face Downside Pressure

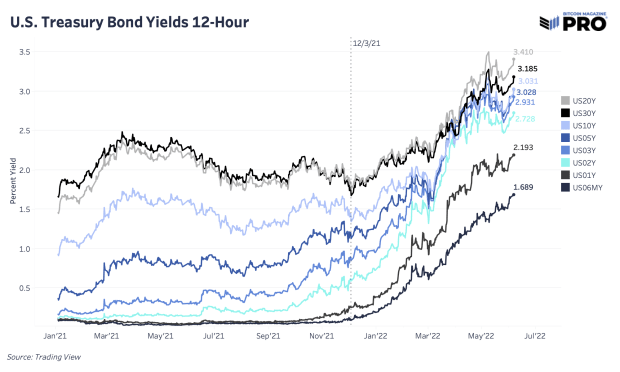

Despite the caller rally successful equities, the enslaved marketplace has meaningfully reversed and resumed its sell-off arsenic treasury yields crossed the duration curve proceed to emergence successful the look of inflationary pressures.

For investors, this is precise meaningful, arsenic it shows that investors judge that ostentation is stronger than galore expect astatine this signifier still, and bonds are falling arsenic a result. At the clip of writing, the 10-year treasury is trading with 3.03% yield, conscionable abbreviated of its 2022 precocious of 3.20%.

U.S. Treasury Bond yields are rising.

U.S. Treasury Bond yields are rising.

U.S. Treasury Bond yields are rising.

U.S. Treasury Bond yields are rising.

While bitcoin is inactive taxable to its ain autochthonal marketplace dynamics and forces, the beardown correlation betwixt bitcoin and U.S. equities is apt to stay elevated for the foreseeable future, with each planetary assets taxable to the ebbs and flows of the planetary liquidity tide, to some the upside and downside.

3 years ago

3 years ago

English (US)

English (US)