In its caller monthly report titled “The Bitcoin Monthly: Bitcoin Battles Resistance Around Its On-Chain Mean”, Ark Invest has provided an exhaustive investigation of the existent marketplace landscape. The study categorizes its findings into bullish, neutral, and bearish perspectives, providing a holistic presumption of Bitcoin’s existent and imaginable aboriginal stance.

Bullish Arguments For Bitcoin

Grayscale Spot ETF and GBTC’s Discount To NAV: On August 29, a pivotal determination was made by a US Federal Appeals Court. They ruled that the U.S. Securities and Exchange Commission (SEC) indispensable revisit and reconsider its earlier rejection of the Grayscale Bitcoin Trust’s (GBTC) exertion to modulation into a spot ETF. This ineligible improvement saw GBTC’s discount to NAV displacement from -24% to -18% connected the aforesaid day, indicating heightened marketplace optimism. By the extremity of August, GBTC was astatine a discount-to-NAV of -20.6%.

Bitcoin’s General Cost Basis Recovery: Bitcoin’s realized capitalization, which encompasses some its superior (miners) and secondary (investors) markets, is simply a measurement of the aggregate outgo ground of BTC. Between Q4 2022 and Q1 2023, the realized headdress drawdown stood astatine -19%, marking its steepest since 2012. This drawdown serves arsenic a barometer for superior outflows from the network.

Ark’s investigation suggests that the deeper the drawdown, the higher the likelihood of Bitcoin holders exiting the market, perchance mounting the signifier for a much robust bull market. The realized headdress has improved from its all-time precocious successful 2021, moving from a 19% debased station the FTX illness successful November 2022 to 15.6%, indicating superior inflows implicit the past 8 months.

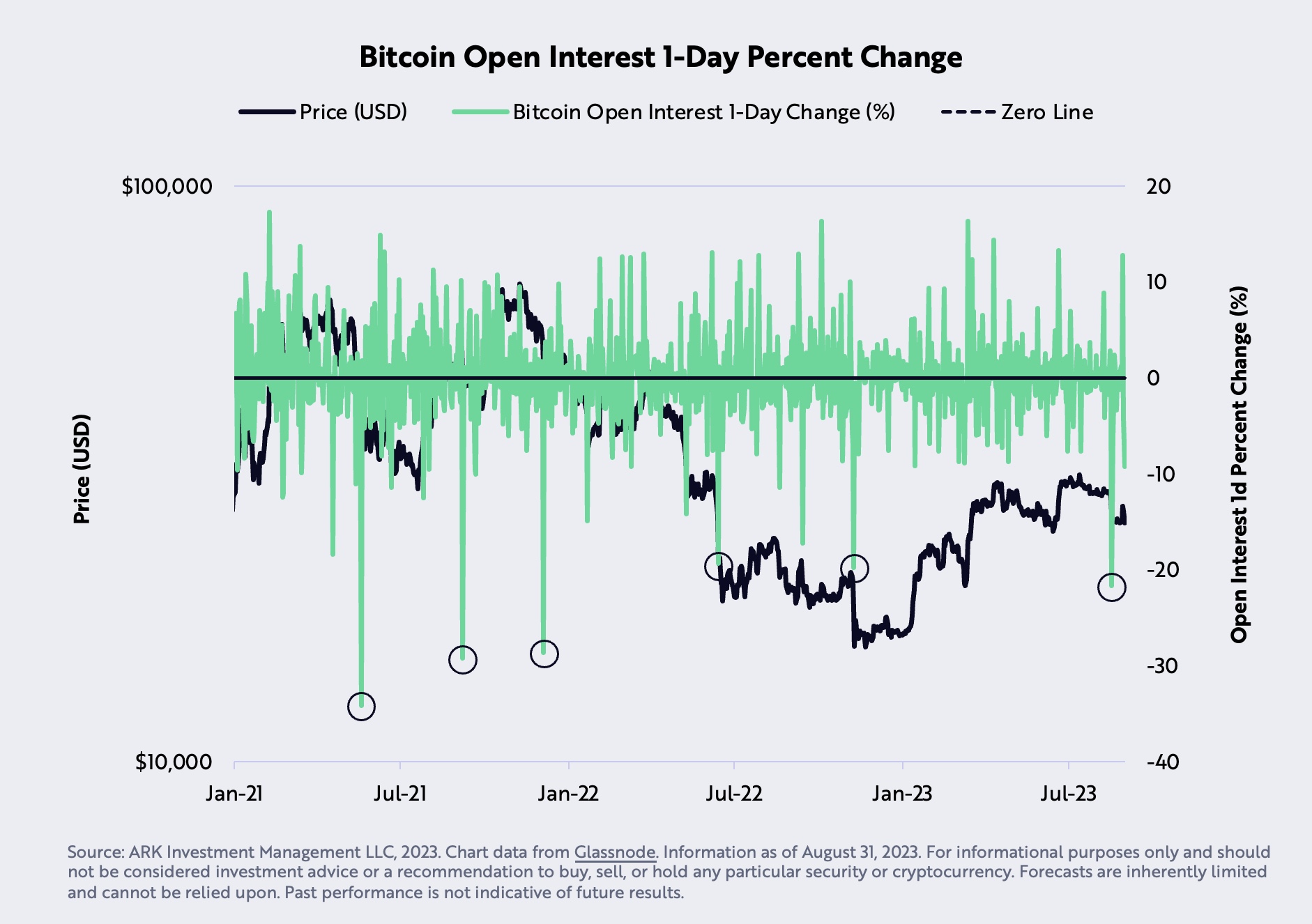

Futures Open Interest Collapse: August 17 witnessed a accelerated liquidation of Bitcoin futures by 21.7%, the swiftest since December 2021. Ark Invest interprets this terms correction arsenic a “cathartic sentiment correction.”

Bitcoin OI flush | Source: Ark Invest

Bitcoin OI flush | Source: Ark InvestNeutral Arguments

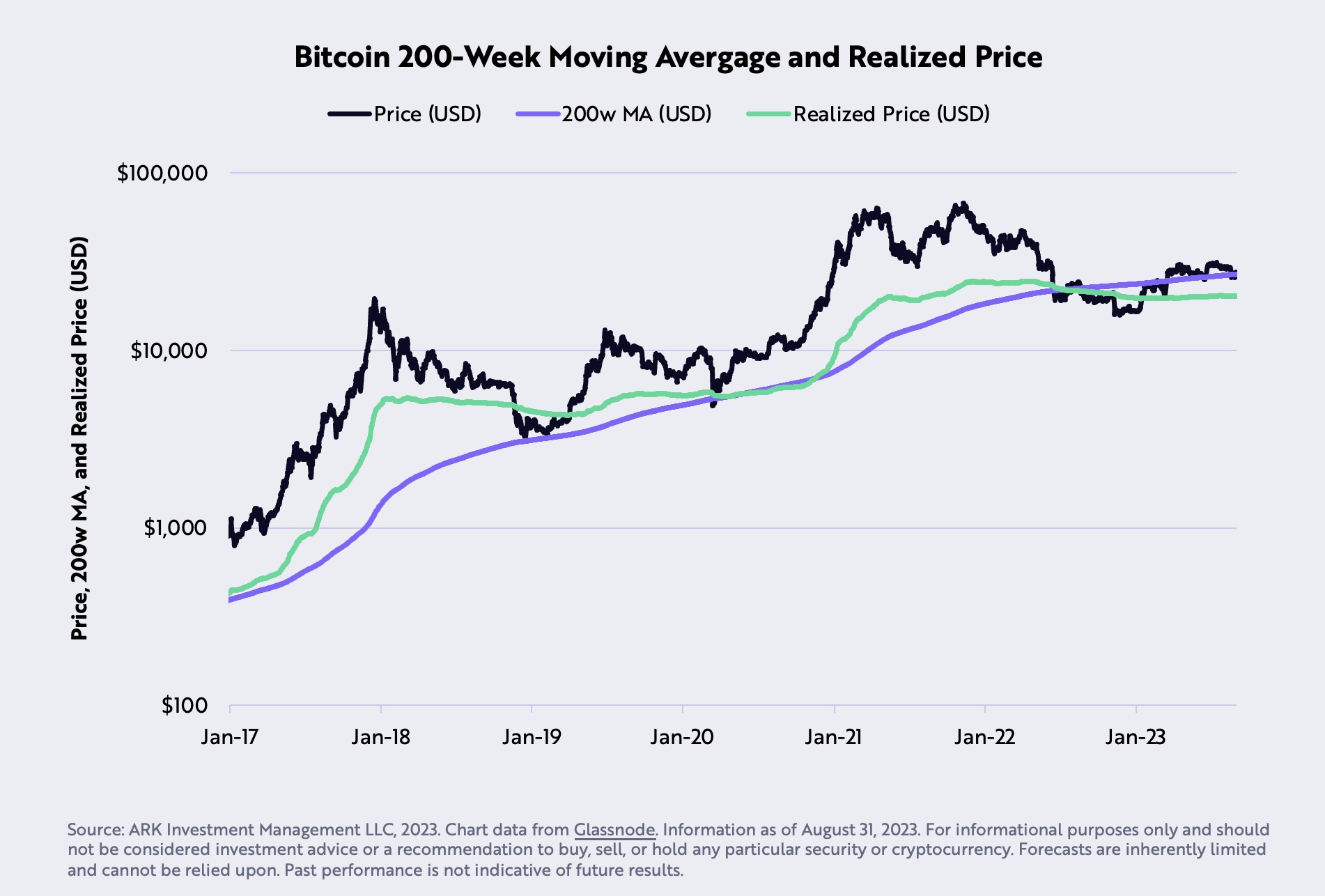

Bitcoin Price and the 200-Week Moving Average: August was a challenging period for Bitcoin arsenic its terms dipped by 5.4%, settling beneath its 200-week moving mean astatine $27,580. This was the archetypal lawsuit since June 2023. However, Ark Invest posits that Bitcoin should find important downside enactment astatine its realized terms of $20,300.

Bitcoin 200-Week Moving Average and Realized Price | Source: Ark Invest

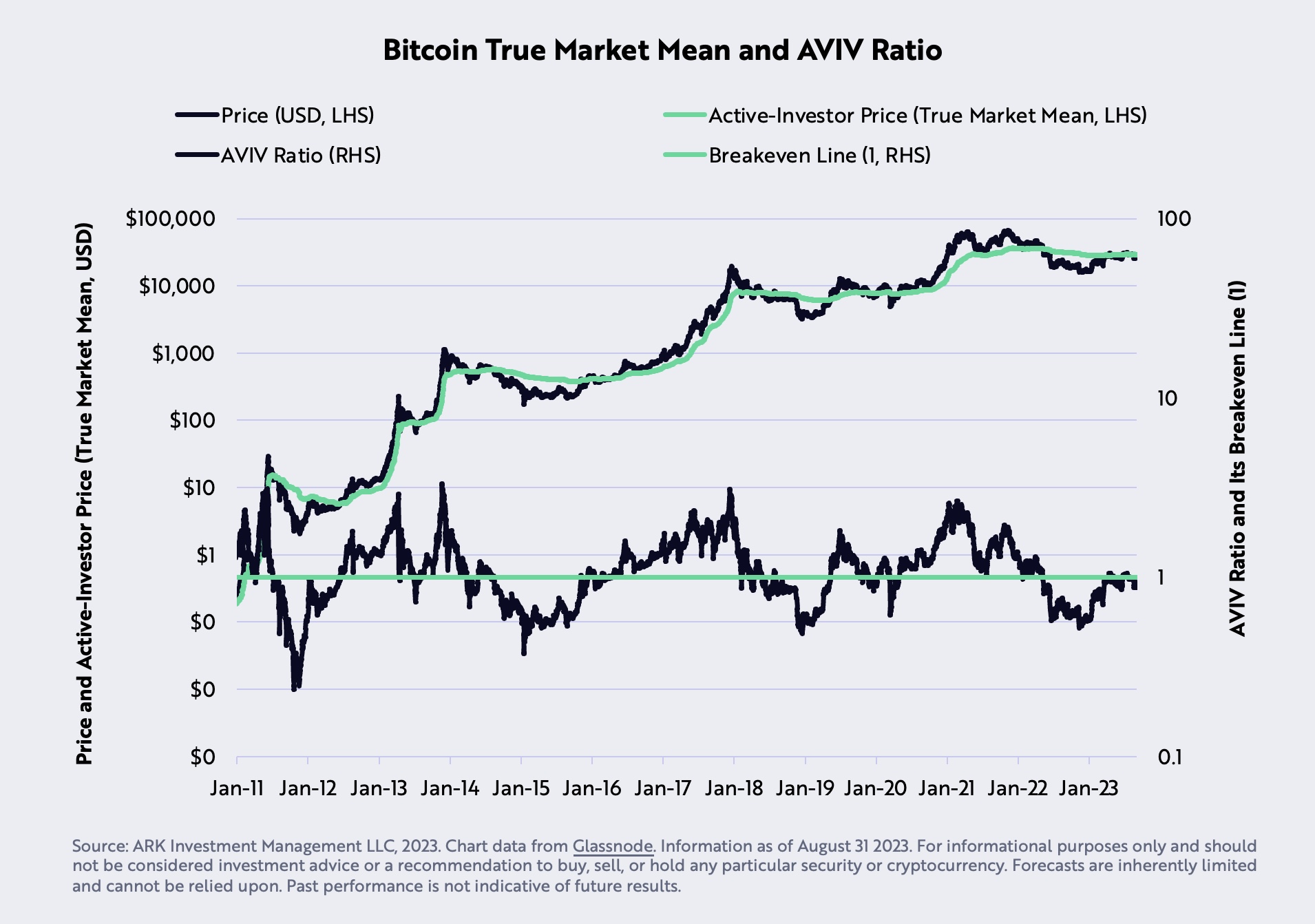

Bitcoin 200-Week Moving Average and Realized Price | Source: Ark InvestBitcoin’s On-Chain Mean Resistance: The “on-chain mean,” besides termed arsenic the “active-investor price” oregon “true marketplace mean,” reached $29,608 successful August, establishing a imaginable important absorption for BTC. This metric, a collaborative effort betwixt ARK Invest and Glassnode, calculated by dividing investors’ outgo ground by the fig of progressive coins. These coins are determined based connected the aggregate clip they’ve remained dormant comparative to the full supply.

Bitcoin True Market Mean | Source: Ark Invest

Bitcoin True Market Mean | Source: Ark InvestStablecoins Market Cap and Liquidity: Stablecoins, often viewed arsenic a liquidity barometer for the market, person seen their 90-day proviso driblet implicit 20% from $162 cardinal successful March 2022 to $120 cardinal currently, signaling a diminution successful onchain liquidity. However, nett inflows during the aforesaid timeframe hint astatine a gathering bullish marketplace momentum.

Bearish Arguments For BTC (All Macro)

Real GDP vs. Real GDI Growth Rates: A grounds divergence has been observed betwixt the YoY percent changes successful existent Gross Domestic Product (GDP) and existent Gross Domestic Income (GDI). Historically, GDP and GDI should beryllium connected par, arsenic income earned should equate to the worth of goods and services produced. Former Federal Reserve economist, Jeremy Nalewaik, has posited that GDI mightiness beryllium a much close indicator than GDP.

Real Federal Funds Policy Rate vs. Natural Rate of Interest: For the archetypal clip since 2009, the Real Federal Funds Policy Rate has surpassed the Natural Rate of Interest, indicating a displacement towards restrictive monetary policy. This theoretical rate, arsenic conceptualized by New York Federal Reserve President, John Williams, is the complaint wherever the system neither expands nor contracts. With monetary policy’s interaction connected the system being agelong and variable, lending and borrowing are expected to look accrued downward pressure.

Government’s Employment Revision: Employment, a lagging indicator, has been pivotal successful the Federal Reserve’s complaint decisions. Despite the labour disruptions caused by the COVID-19 pandemic expected to person been resolved by now, the authorities has revised nonfarm payroll statistic downward for six consecutive months. This suggests a weaker labour marketplace than initially reported. The past lawsuit of specified a trend, extracurricular of a recession, was successful 2007, close earlier the Great Financial Crisis.

In summary, Ark Invest’s study presents 3 bullish, 4 neutral, and 3 bearish arguments connected Bitcoin and the broader market, emphasizing that the marketplace could beryllium astatine a important turning point. At property time, BTC traded astatine $25,789.

BTC remains beneath $26,000, 4-hour illustration | Source: BTCUSD connected TradingView.com

BTC remains beneath $26,000, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)