Bitcoin has nary lender of past edifice for those who instrumentality undue risks. Bitcoin’s caller leverage cleansing is par for the people for a genuinely scarce asset.

The beneath is simply a nonstop excerpt of Marty's Bent Issue #1228: “Deleveraging bitcoin earlier the satellite de-levers.” Sign up for the newsletter here.

The bitcoin marketplace is successful the process of going done a large deleveraging event. The process started past period erstwhile the Luna-Terra ponzi blew up spectacularly and was forced to liquidate astir 80,000 bitcoin. The process accelerated past week erstwhile Celsius, Three Arrows Capital, and Babel Finance proved to beryllium overextended successful exotic high-yield token projects that crashed hard and, successful the lawsuit of Babel, lending to those overextending successful these projects.

Each entity's nonaccomplishment brought with it a question of bitcoin merchantability orders that drove the terms beneath $18,000 implicit the weekend. As of close now, the terms of bitcoin has recovered, presently sitting supra $20,000, nevertheless rumors are swirling that determination are galore much companies struggling down the scenes that volition bring with them much monolithic merchantability orders arsenic these entities question liquidity to screen their obligations. We shall spot if these rumors materialize into truth.

Whether they bash oregon don't, this wide deleveraging is steadfast for a fewer reasons. First, it reduces the magnitude of interconnected hazard passim the bitcoin market. Second, the epic stroke ups — particularly Celsius, which lured radical into their trap of a institution by promising yields connected bitcoin that were attained by taking insane risks crossed DeFi protocols, lending and bitcoin mining — are providing a caller question of aboriginal adopters with the hard acquisition of trusting your precious sats with centralized 3rd parties who instrumentality undue hazard with your bitcoin. This acquisition has been taught galore times passim the years: Mt. Gox, Mintpal, QuadrigaCX, BitConnect, OneCoin. Celsius tin present beryllium added to this list. Lastly, the accelerated and convulsive deleveraging is showing that bitcoin is simply a genuinely escaped market. If you instrumentality undue risks and those risks travel backmost to wound you successful the ass, determination is nary lender of past resort.

Due to the normalization of playing acold retired connected the hazard curve that the fiat strategy has brought with it, galore felt comfy playing fiat games with their bitcoin. They are coming to find that bitcoin is simply a cruel mistress and if you don't dainty her close by holding and securing your ain keys, you volition beryllium wiped retired with the tide erstwhile the seas get turbulent. Over time, arsenic much radical larn this lesson, the marketplace should self-correct and individuals should opt for products that let them to person power of a cardinal oregon keys wrong a quorum erstwhile interacting with 3rd parties if they determine to prosecute with them successful the archetypal place. Bitcoin is simply a perfectly scarce plus that should summation successful purchasing powerfulness implicit longer timeframes, truthful picking up pennies to perchance suffer fortunes volition go much evidently anserine arsenic clip moves forward.

The terms driblet is decidedly a spot jarring, but it's thing new. Simply par for the people of a perfectly scarce plus going done its aboriginal monetization signifier during which we humans effort to recognize the dynamics of the web and however we volition interact with it.

Now here's wherever things get interesting. Bitcoin is having a monolithic cleansing lawsuit astatine a clip erstwhile it is becoming abundantly wide that the fiat monetary strategy is astir to beryllium perfectly steamrolled by the compounding errors that person been made by argumentation makers implicit the people of decades. It genuinely does consciousness similar “this is the large one.” Central bankers crossed the satellite look progressively disquieted and, much importantly, their caller argumentation changes are seeming to beryllium wholly ineffective. The Federal Reserve's complaint hikes whitethorn really beryllium making ostentation prospects worse arsenic a rapidly expanding national funds complaint leads to important increases successful the outgo of capital, which is lone making it harder for vigor companies to put successful the infrastructure needed to statesman quelling the supply-side contented that is causing prices to skyrocket.

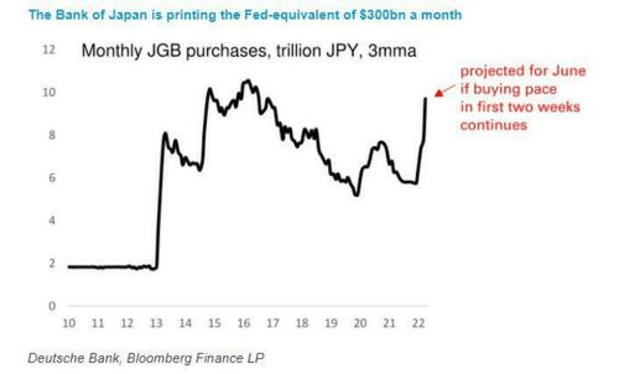

As we said past week, the Fed failing to tame ostentation aft making immoderate of the astir assertive complaint increases successful the past 30 years could pb to a illness successful assurance that could merchandise the hyperinflation hounds. Last week, we warned astir the Bank of Japan losing power of its output curve power efforts. As the calendar has turned and terms increases astir the satellite look little apt to dilatory down immoderate clip soon, the concern successful Japan is becoming much dire arsenic the Japanese 10-year authorities enslaved fails to clasp the 0.25% complaint the Bank of Japan has been targeting. Japan’s debt-to-GDP ratio is truthful precocious that it is virtually intolerable for them to rise rates successful conjunction with Western economies. If they did, they would bankrupt the state successful the process. So alternatively of overt default, it seems that Japan is choosing the way of hyperinflation arsenic they volition beryllium forced to people unimaginable amounts of yen to effort to power rates.

via DB via ZeroHedge

via DB via ZeroHedge

Like we said past week, if the Bank of Japan loses power and hyperinflation breaks retired crossed the country, it volition beryllium crippled implicit for the remainder of the world's developed economies who person pursued akin policies, which includes the Fed, the European Central Bank, the Bank of Canada, the Bank of England and galore others. A Japan-like stroke up is the extremity authorities of each azygous cardinal slope who embarked connected QE4eva.

With this successful mind, your Uncle Marty is envisioning a script that could perchance play retired implicit the people of this summertime and into the aboriginal autumn that whitethorn supply a way to “decoupling” for bitcoin.

There's nary mode to archer if a importantly de-levered and comparatively inexpensive bitcoin would beryllium the plus that individuals and larger superior allocators crook to arsenic the satellite goes to shit, yet bringing to fruition the “safe haven” narrative. It's hard to contradict that the conditions for a decoupling to really hap volition beryllium riper than they ever person been. Keep an oculus retired connected this arsenic we get person to October and November 2022.

3 years ago

3 years ago

English (US)

English (US)