In caller days, Bitcoin has shown signs of a imaginable reversal, with the cryptocurrency charting 3 consecutive greenish regular candles. The past clip specified a signifier was observed was aboriginal July and betwixt mid and precocious June, erstwhile Bitcoin rallied from conscionable nether $25,000 to implicit $31,000. This displacement successful terms dynamics has led to a alteration successful marketplace sentiment, with the bearish outlook dilatory giving mode to a much bullish perspective.

While Bitcoin has successfully averted the confirmation of a treble apical connected the 1-week illustration fo the moment, this terms enactment has fueled discussions among analysts astir the anticipation of Bitcoin forming a treble bottommost pattern, a important method indicator.

Bitcoin Double Bottom In The Making?

A treble bottommost is simply a classical method investigation signifier that signifies a imaginable inclination reversal from bearish to bullish successful markets. It is characterized by 2 chiseled troughs oregon lows successful the terms chart, separated by a highest oregon a insignificant precocious successful between. The signifier resembles the missive “W,” with the archetypal trough indicating a important low, followed by a impermanent rebound, and past a 2nd trough, usually adjacent the aforesaid terms level arsenic the first. A valid treble bottommost is confirmed erstwhile the terms breaks supra the highest oregon absorption level betwixt the 2 troughs, signaling a imaginable upward inclination reversal.

Rekt Capital, a renowned crypto analyst, precocious shared his insights suggesting that Bitcoin’s existent terms signifier successful the play illustration resembles a treble top, which typically indicates a bearish reversal. This signifier is characterized by an ‘M’ shape. However, for this to beryllium confirmed, the terms would request to interruption down from the $26,000 support. At property time, Bitcoin was trading astatine $26,618, successfully fending disconnected the treble apical validation astatine the moment.

On the flip side, a treble bottom, which forms a ‘W’ shape, would necessitate Bitcoin to rebound from the $26,000 people and tweeted today, “Could this BTC Double Top really beryllium a Double Bottom? And the elemental reply is – technically, yes. […] But for BTC to signifier a Double Bottom, it would request to rebound from $26k and rally to $30.6k (which is its validation point).”

Bitcoin Double Bottom? | Source: X @rektcapital

Bitcoin Double Bottom? | Source: X @rektcapitalHe further highlighted the challenges Bitcoin faces, noting the uncertainty surrounding the $26k enactment level and the galore confluent resistances ahead, which mightiness hinder the completion of the treble bottommost formation. Rekt Capital elaborated connected the value of the $26,000 level, tweeting, “It looks similar BTC whitethorn beryllium choosing the ‘relief rally’ way archetypal successful an effort to perchance crook aged enactment into caller resistance. The achromatic Monthly level (~$27,200) is astir confluent with the Bull Market enactment set arsenic well.”

He besides pointed to Bitcoin’s caller bearish monthly candle adjacent for August, emphasizing that Bitcoin closed beneath astir $27,150, thereby confirming it arsenic a mislaid support. Therefore helium warns that the existent terms determination by Bitcoin could lone beryllium a alleviation rally to corroborate $27,150 arsenic caller absorption earlier dropping into the $23,000 region.

“It’s imaginable BTC could rebound into ~$27,150, possibly adjacent upside wick beyond it this September. […] $23,000 is the adjacent large Monthly enactment present that ~$27150 has been lost,” helium remarked.

More Resistance Levels For BTC Price

So it’s wide that BTC has a large absorption level of $27,150 to interruption earlier the bulls tin adjacent imagination of confirming a treble bottommost pattern. But determination are besides different cardinal resistances to flooded earlier $30,600 tin beryllium breached and the treble bottommost confirmed.

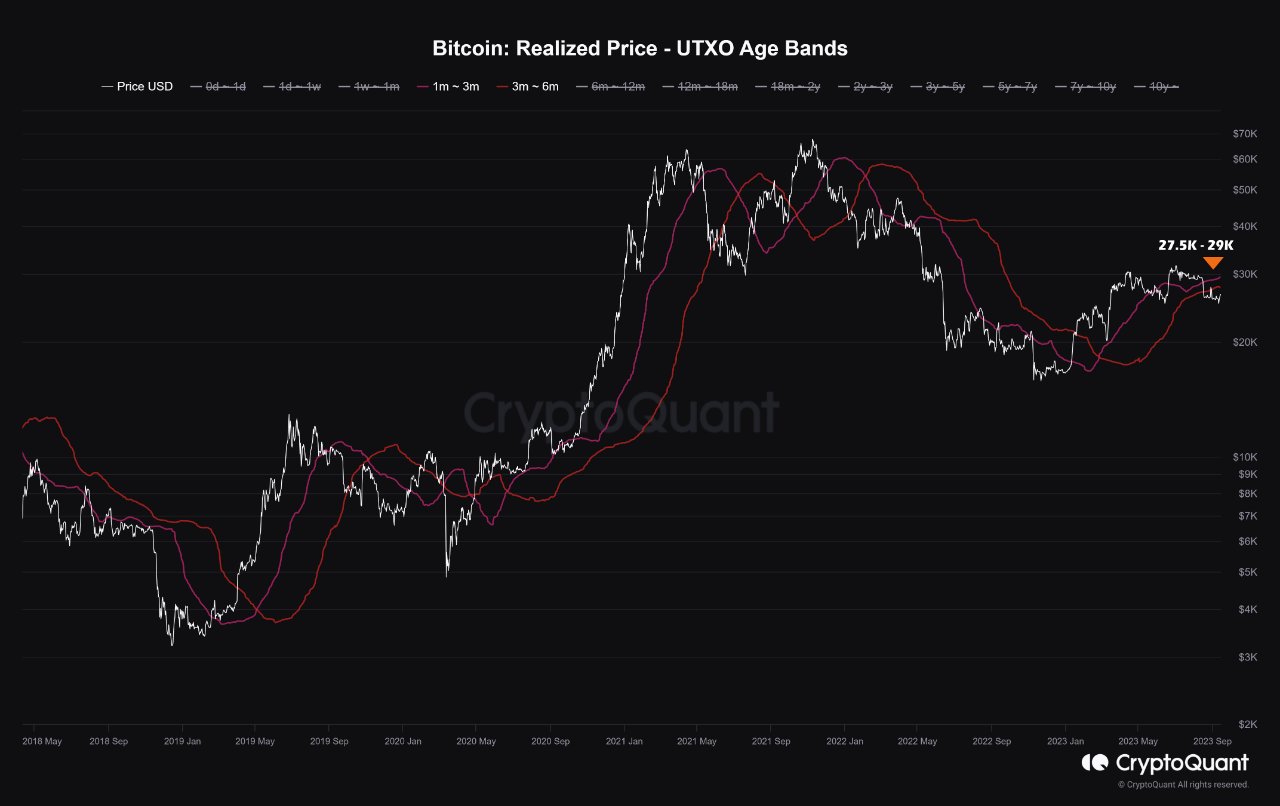

On-chain investigation steadfast CryptoQuant emphasized the relation of short-term Bitcoin holders, who often supply the liquidity for important terms movements. According to their data, the break-even terms for these holders lies betwixt $27,500 and $29,000. If Bitcoin remains beneath these levels for an extended period, these holders mightiness beryllium incentivized to sell, perchance exerting downward unit connected the price:

The much clip we walk beneath these terms levels, the much inducement determination volition beryllium to exit liquidity from the market, and the ground information for the instrumentality of the upward inclination of Bitcoin depends connected the terms leap supra the short-term realized prices.

Bitcoin Realized Price UTXO Age Bands | Source: X @cryptoquant_com

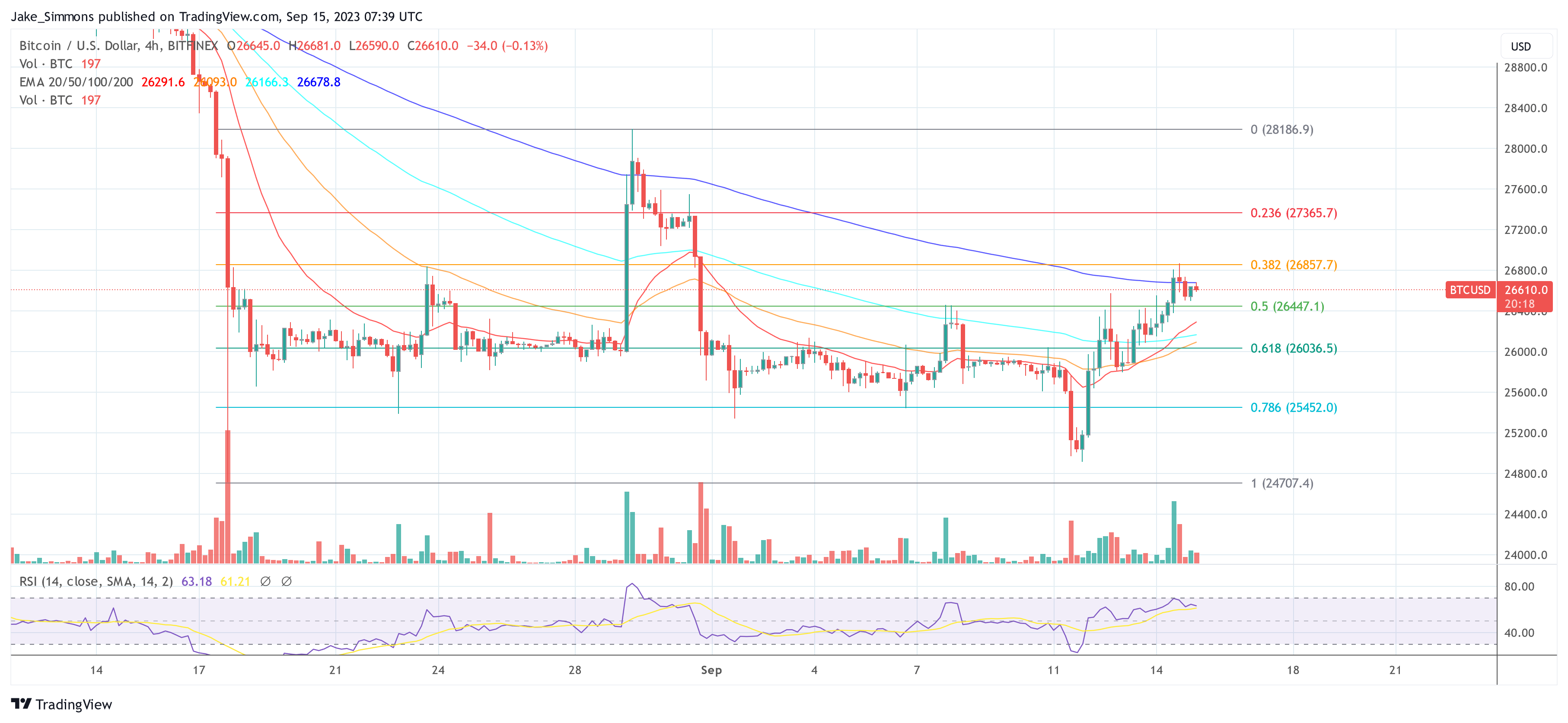

Bitcoin Realized Price UTXO Age Bands | Source: X @cryptoquant_comOn the 4-hour clip frame, BTC needs to flooded 3 large resistances: $26,857 (38.2% Fibonacci retracement level), $27,365 (23.6% Fibonacci retracement level) and $28,186 (post-Grayscale precocious from August 29th).

Key terms level for the BTC price, 4-hour illustration | Source: BTCUSD connected TradingView.com

Key terms level for the BTC price, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)