Since its inception, Bitcoin has (almost) ever been the poster kid for volatility. Yet, the Bitcoin terms is hardly moving successful immoderate absorption astatine the moment. But the latest information suggests a astonishing twist successful the tale.

As per a caller report by on-chain information supplier Glassnode, “Bitcoin markets are experiencing an incredibly quiescent patch, with respective measures of volatility collapsing towards all-time lows.” This raises the question: Are we entering a caller epoch of Bitcoin terms stability, oregon is the marketplace misreading the signs?

Historical Context For The Volatility Of Bitcoin

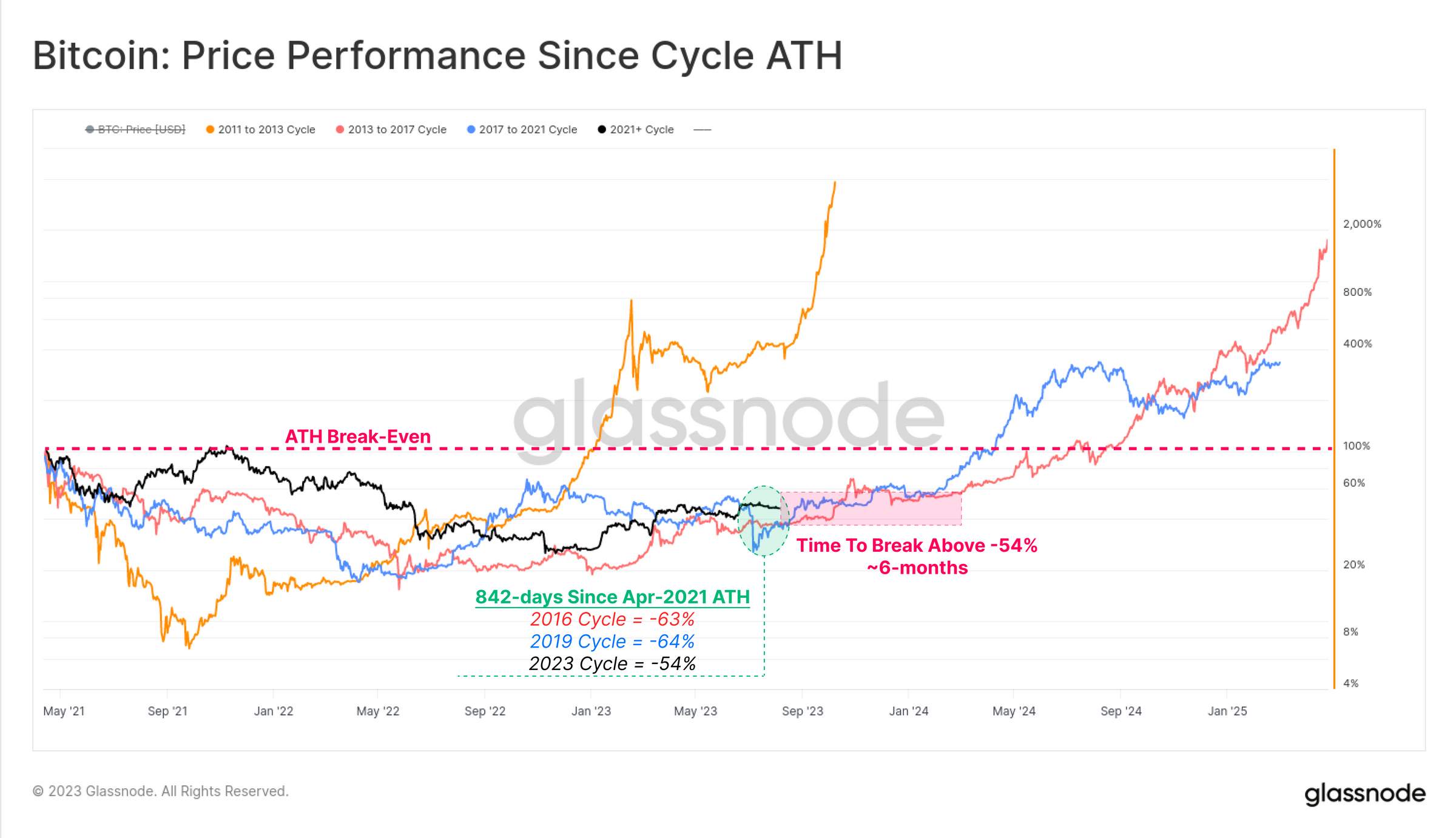

To genuinely recognize the existent authorities of the market, it’s indispensable to delve into the humanities context. The Glassnode study notes, “It has been 842-days since the bull marketplace highest was acceptable successful April 2021.” During this period, Bitcoin’s betterment has been much robust than successful erstwhile cycles, trading astatine -54% beneath its all-time precocious (ATH), compared to a humanities mean of -64%.

Drawing parallels with past cycles, the study highlights that some the 2015-16 and 2019-20 cycles underwent a “6-month play of sideways boredom earlier the marketplace accelerated supra the -54% drawdown level.” This could beryllium indicative of a akin “boredom” signifier successful the existent cycle.

Bitcoin terms show since rhythm ATH | Source: Glassnode

Bitcoin terms show since rhythm ATH | Source: GlassnodeOne of the astir striking revelations from the Glassnode study is the utmost volatility compression Bitcoin is presently undergoing. “Bitcoin realized volatility ranging from 1-month to 1-year reflection windows has fallen dramatically successful 2023, reaching multi-year lows.” This is reminiscent of 4 chiseled periods successful Bitcoin’s history, including the precocious signifier of the 2015 carnivore marketplace and the post-March 2020 consolidation pursuing the outbreak of COVID-19.

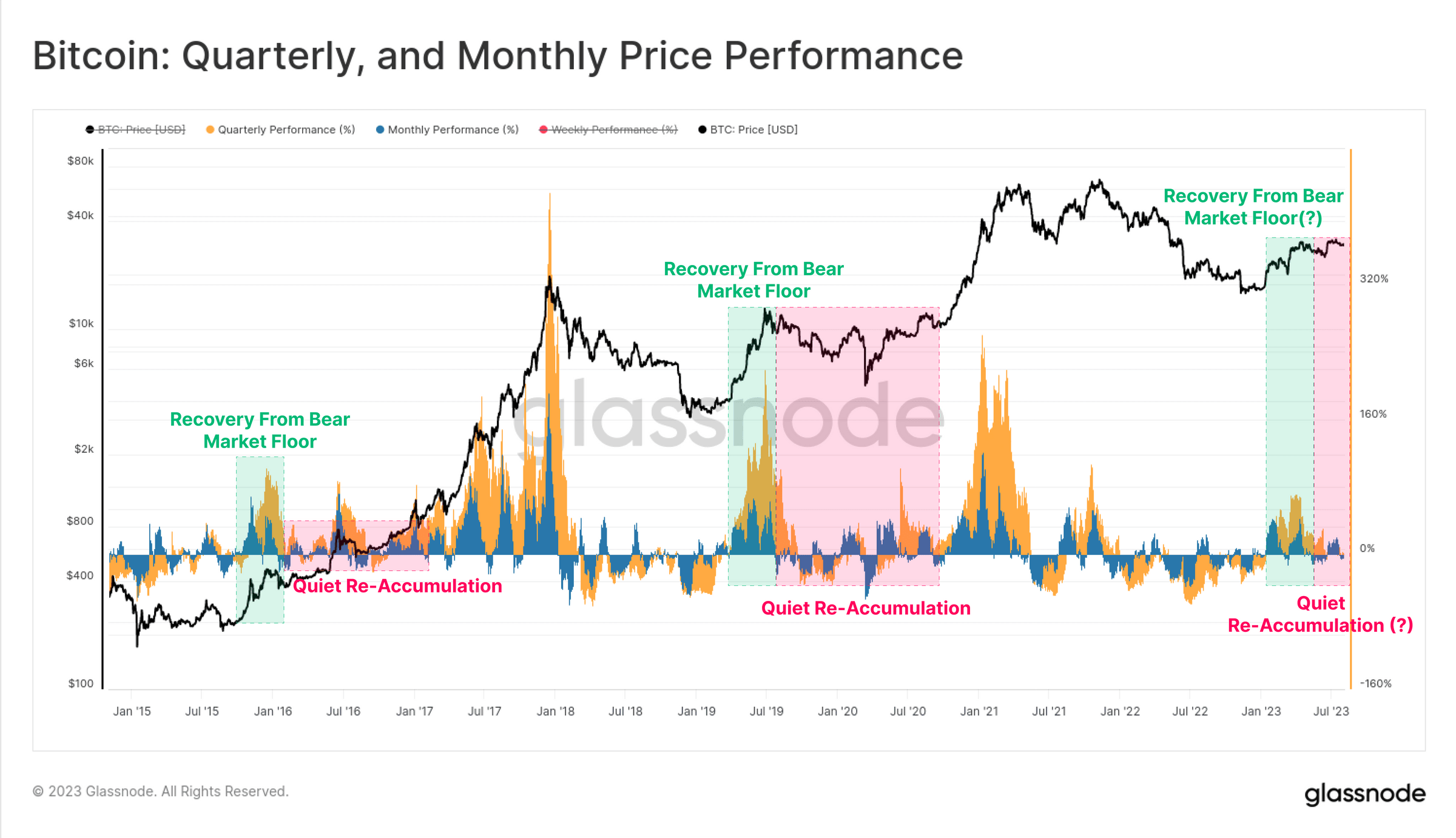

Following the furious rally astatine the opening to 2023, the terms show connected some a quarterly and monthly ground has moderated. This mirrors Bitcoin’s erstwhile cycles wherever the archetypal surge from the debased is robust, but past transitions into a prolonged signifier of uneven consolidation, a signifier of re-accumulation.

Bitcoin accumulation periods | Source: Glassnode

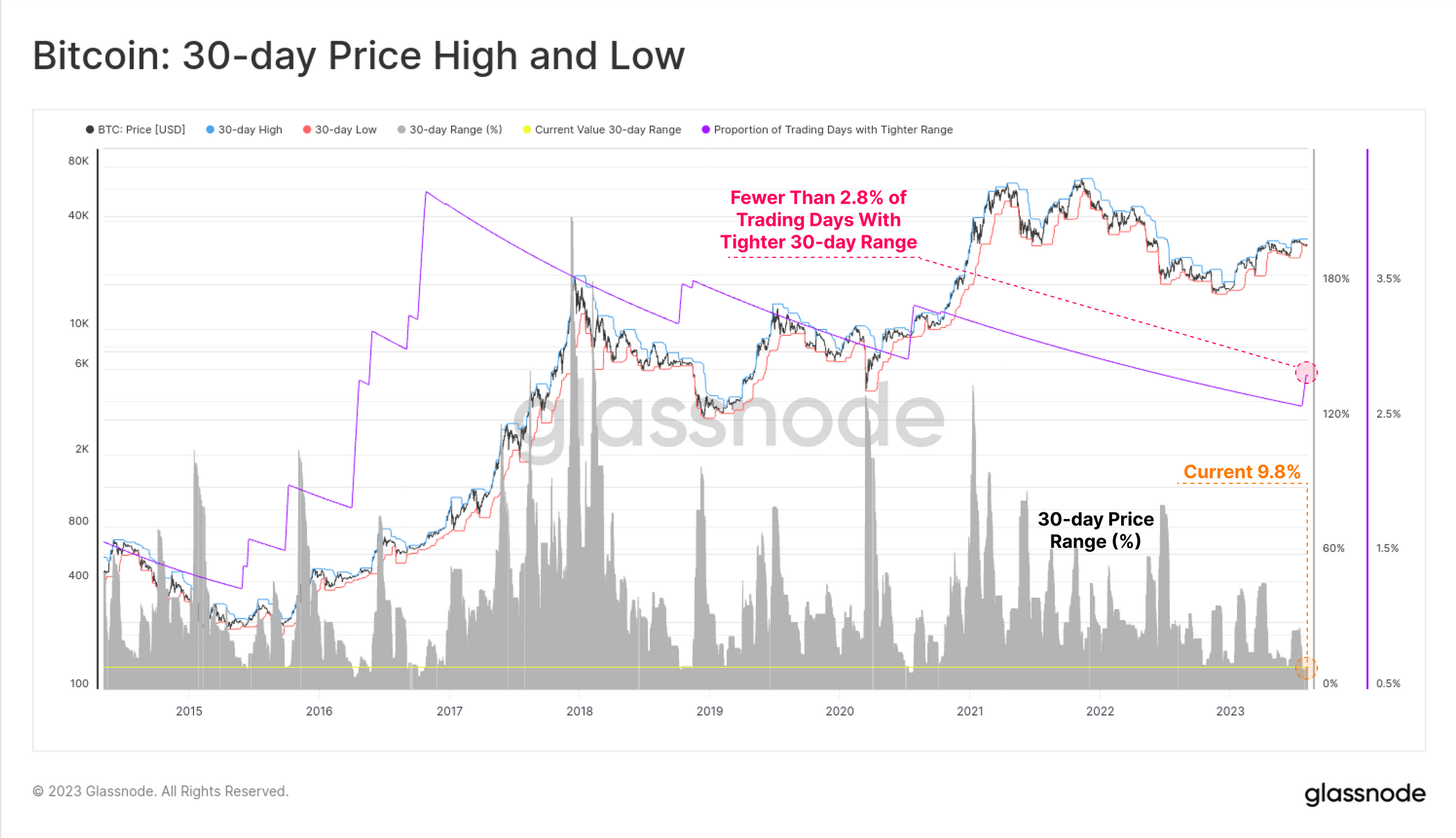

Bitcoin accumulation periods | Source: GlassnodeFurthermore, the study states, “The terms scope which separates the 7-day precocious and debased is conscionable 3.6%. Just 4.8% of each trading days person ever experienced a tighter play commercialized range.” The 30-day terms scope is adjacent much extreme, constricting terms to conscionable a 9.8%, and with lone 2.8% of each months successful BTC’s past being tighter. Such levels of terms compression are uncommon for Bitcoin, suggesting an anomaly oregon a imaginable precursor to a important marketplace move.

Bitcoin 30-day scope | Source: Glassnode

Bitcoin 30-day scope | Source: GlassnodeDerivatives Market Insights

The derivatives market, often seen arsenic a barometer for underlying plus sentiment, is besides echoing this quiescent spell. “The combined Futures and Options commercialized measurement for [BTC and ETH] are at, oregon approaching all-time-lows,” the study notes. This is further emphasized by the information that “BTC is presently seeing $19.0B successful aggregate derivatives commercialized volume, whilst ETH markets person conscionable $9.2B/day.”

Interestingly, the options marketplace is showing signs of a important “volatility crush.” As per Glassnode, “Options are pricing successful the smallest volatility premium successful history, with IV betwixt 24% and 52%, little than fractional of the semipermanent baseline.” This is further corroborated by the historically debased Put/Call Ratio and the 25-delta skew metric, suggesting a nett bullish sentiment successful the market.

The crux of the substance lies successful interpreting these signs. The study aptly questions, “Given the discourse of Bitcoin’s infamous volatility, is simply a caller epoch of BTC terms stableness upon us, oregon is volatility mispriced?” Historically, periods of debased volatility successful Bitcoin person often been followed by important terms movements. Whether this is simply a calm earlier a tempest oregon a genuine displacement towards a much unchangeable Bitcoin remains to beryllium seen.

But arsenic Tony “The Bull”, the main illustration technician astatine NewsBTC, has pointed retired yesterday, the method indicators are besides pointing to a prolonged play of re-accumulation, meaning that the signifier of debased volatility is apt to proceed for immoderate clip to come.

At property time, the BTC terms was astatine $29,277.

BTC rises slightly, 4-hour illustration | Source BTCUSD connected TradingView.com

BTC rises slightly, 4-hour illustration | Source BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)