After reaching an all-time precocious supra $100,000, the Bitcoin price has entered a multi-week downtrend. This correction has people raised questions astir whether Bitcoin is inactive aligned with the 2017 bull cycle. Here we’ll analyse the information to measure however intimately Bitcoin’s existent terms enactment correlates with erstwhile bull markets, and what we tin expect adjacent for BTC.

Bitcoin Price Trends successful 2025 vs. 2017 Bull Cycle

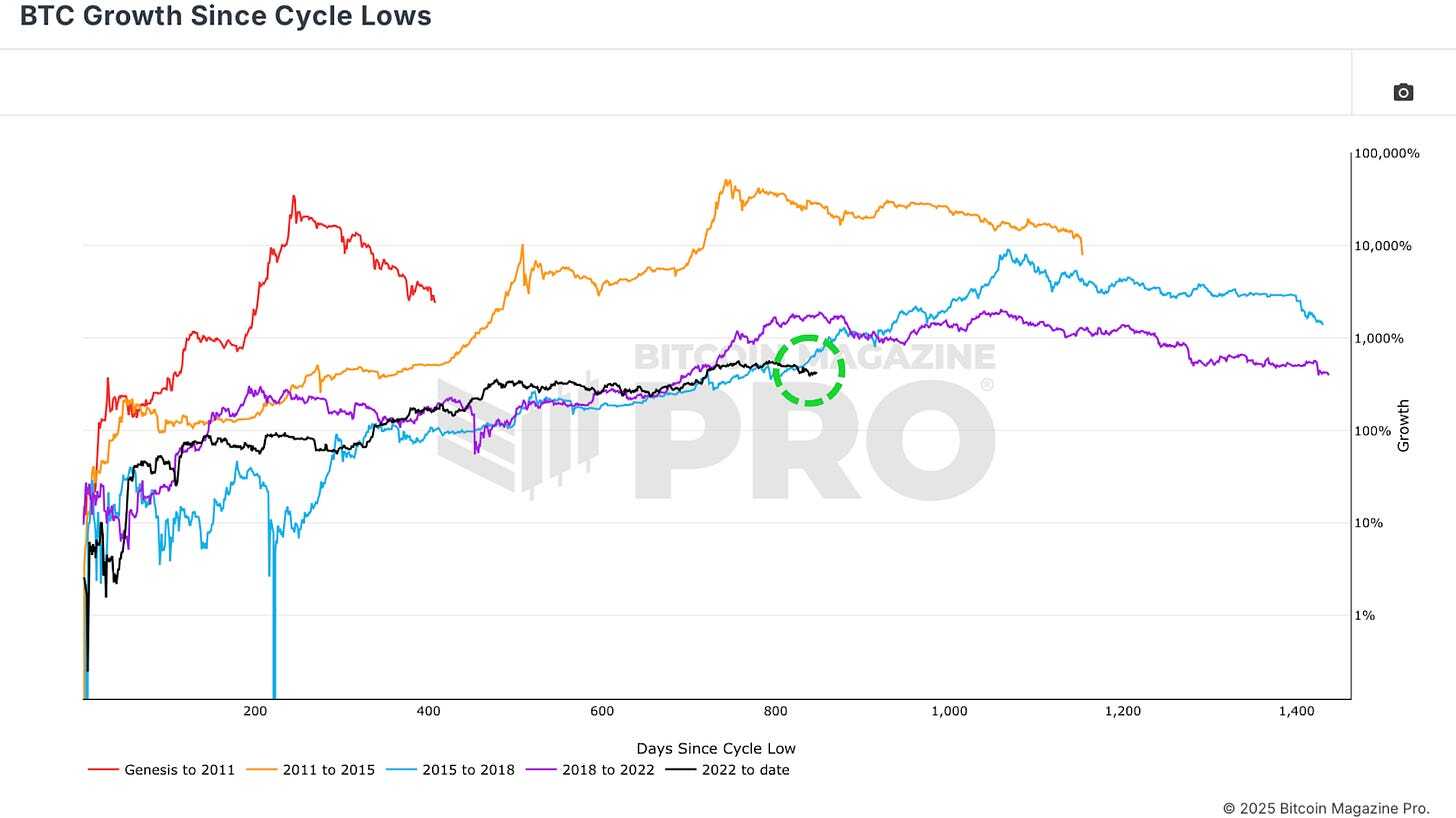

Bitcoin’s price trajectory since the rhythm lows acceptable during the 2022 carnivore marketplace has shown singular similarities to the 2015–2017 cycle, the bull marketplace that culminated successful Bitcoin reaching $20,000 successful December 2017. However, Bitcoin’s caller downtrend marks the archetypal large divergence from the 2017 pattern. If Bitcoin were inactive tracking the 2017 cycle, it should person been rallying to caller all-time highs implicit the past month, instead, Bitcoin has been moving sideways and declining, suggesting that the correlation whitethorn beryllium weakening.

Figure 1: The existent rhythm trajectory has precocious diverged from humanities patterns.

Figure 1: The existent rhythm trajectory has precocious diverged from humanities patterns.Despite the caller divergence, the humanities correlation betwixt Bitcoin’s existent rhythm and the 2017 rhythm remains amazingly high. The correlation betwixt the existent rhythm and the 2015–2017 rhythm was astir 92% earlier this year. The caller terms divergence has reduced the correlation somewhat to 91%, inactive an highly precocious fig for fiscal markets.

How Bitcoin Market Behavior Echoes 2017 Cycle Patterns

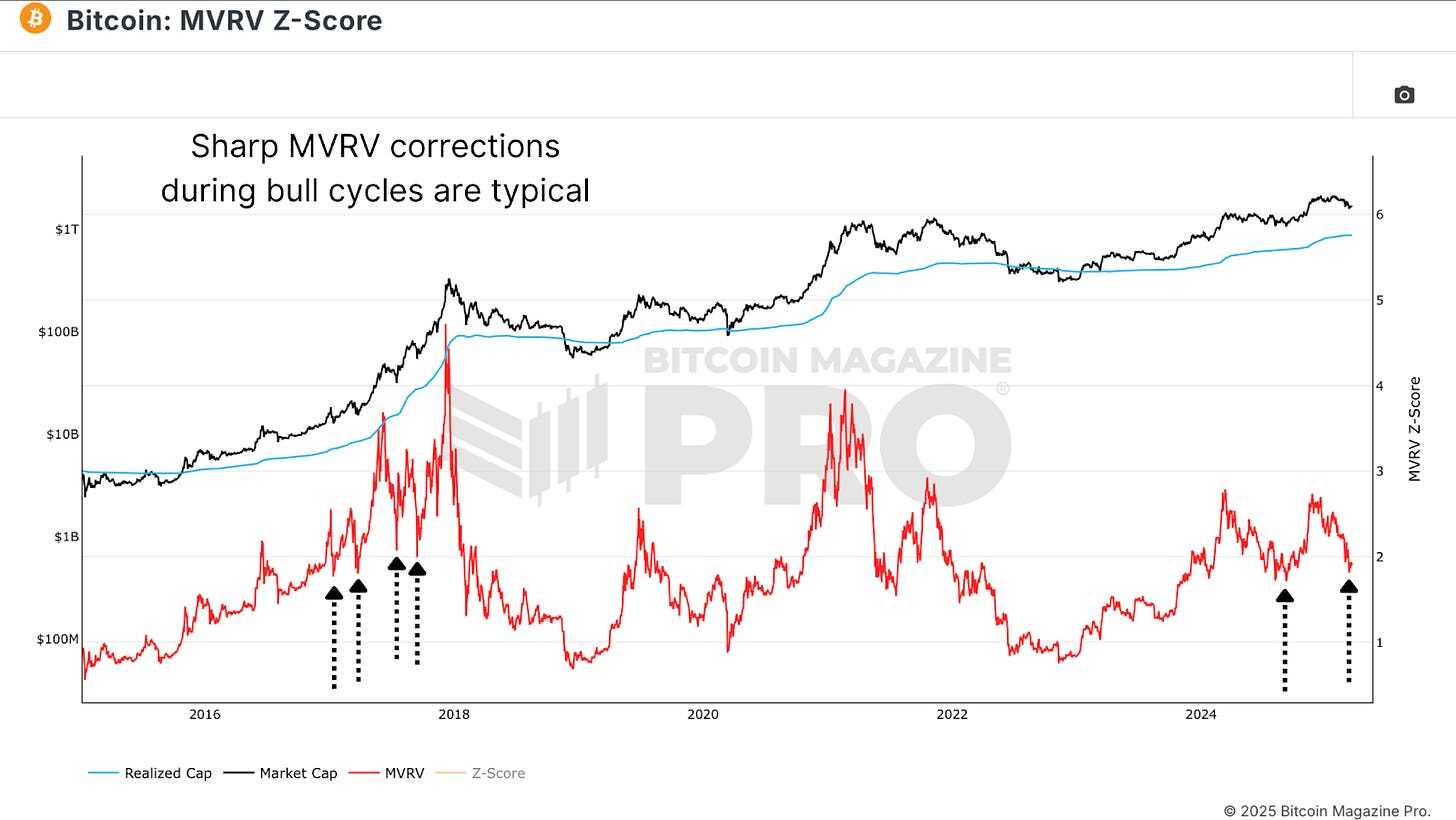

The MVRV Ratio is simply a cardinal indicator of capitalist behavior. It measures the narration betwixt Bitcoin’s existent marketplace terms and the mean outgo ground of each BTC held connected the network. When the MVRV ratio rises sharply, it indicates that investors are sitting connected important unrealized profits, a information that often precedes marketplace tops. When the ratio declines toward the realized price, it signals that Bitcoin is trading adjacent to the mean acquisition terms of investors, often marking a bottoming phase.

Figure 2: The MVRV Ratio is inactive moving likewise to the 2017 cycle.

Figure 2: The MVRV Ratio is inactive moving likewise to the 2017 cycle.The caller diminution successful the MVRV ratio reflects Bitcoin’s correction from all-time highs, however, the MVRV ratio remains structurally akin to the 2017 rhythm with an aboriginal bull marketplace rally, followed by aggregate crisp corrections, and arsenic such, the correlation remains astatine 80%.

Bitcoin Price Correlation with 2017 Bull Cycle Data

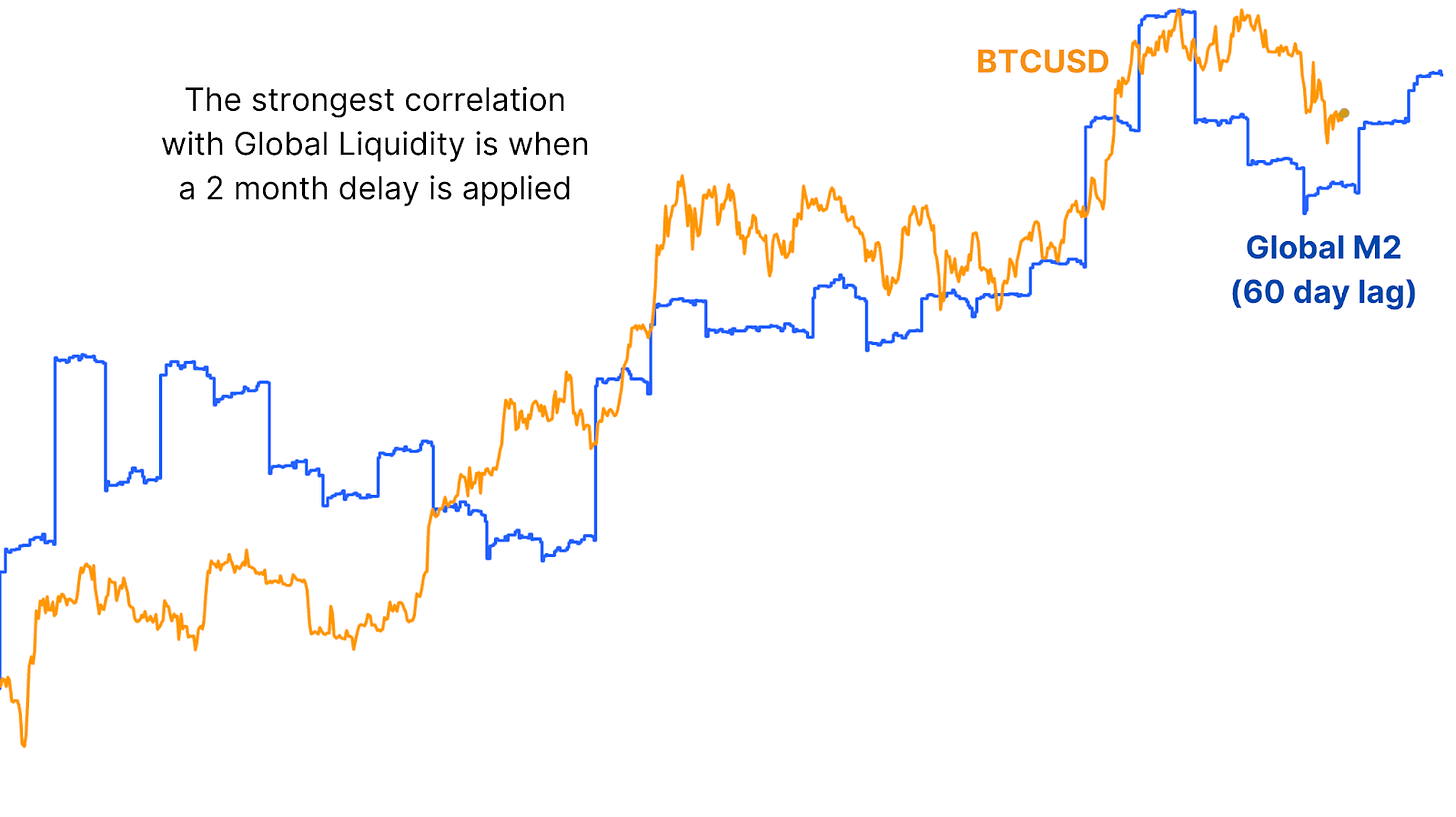

One imaginable mentation for the caller divergence is the power of information lag. For example, Bitcoin’s terms enactment has shown a beardown correlation with Global Liquidity, the full proviso of wealth successful large economies; however, humanities investigation shows that changes successful liquidity often instrumentality astir 2 months to bespeak successful Bitcoin’s terms action.

Figure 3: Global M2 has a delayed interaction connected BTC terms action.

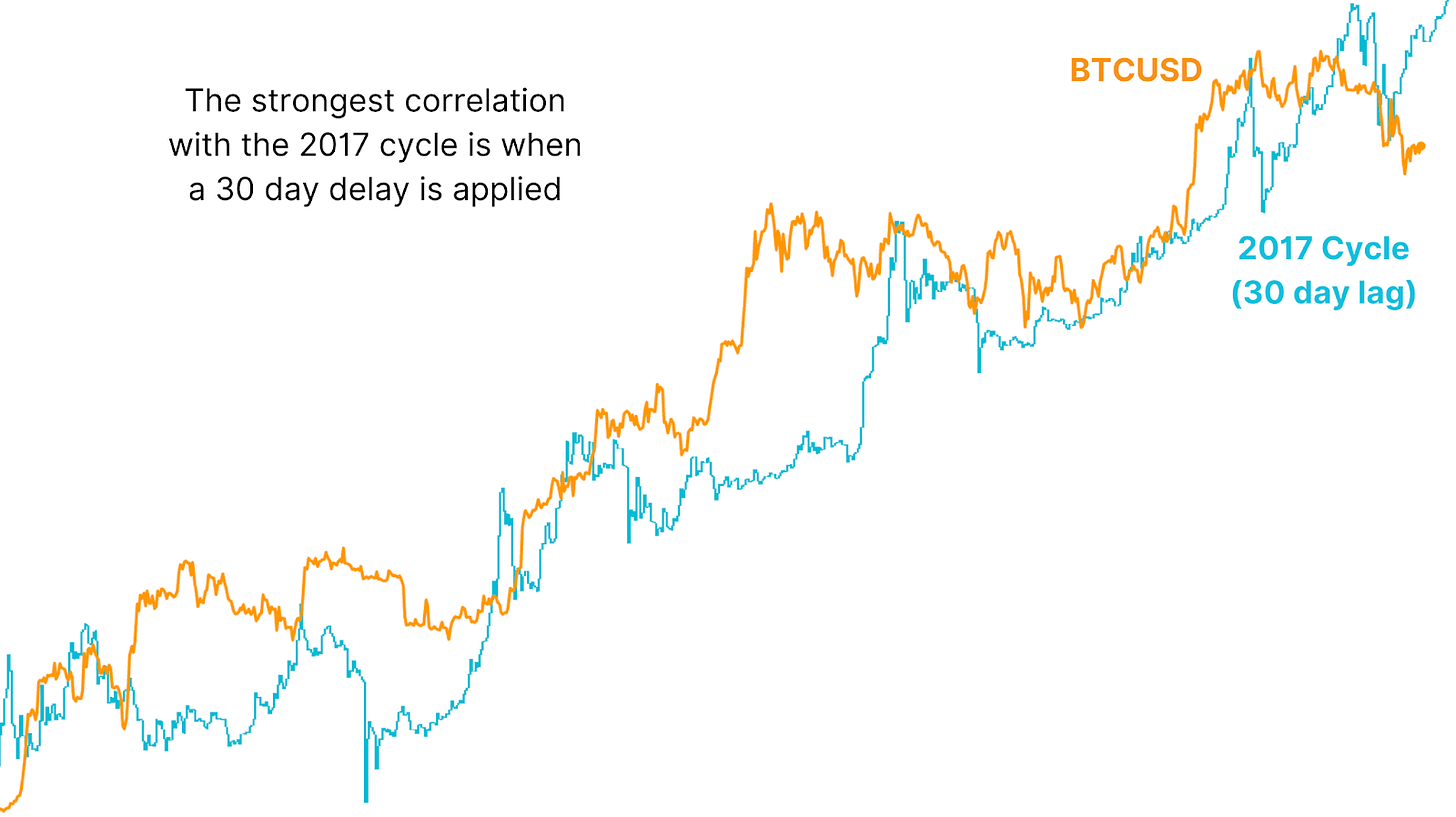

Figure 3: Global M2 has a delayed interaction connected BTC terms action.By applying a 30-day lag to Bitcoin’s terms enactment comparative to the 2017 cycle, the correlation increases to 93%, which would beryllium the highest recorded correlation betwixt the 2 cycles. The lag-adjusted signifier suggests that Bitcoin could soon resume the 2017 trajectory, implying that a large rally could beryllium connected the horizon.

Figure 4: Price is inactive precise intimately pursuing the 2017 information erstwhile delayed by 30 days.

Figure 4: Price is inactive precise intimately pursuing the 2017 information erstwhile delayed by 30 days.What 2017 Bull Cycle Signals Mean for Bitcoin Price Today

History whitethorn not repetition itself, but it often rhymes. Bitcoin’s existent rhythm whitethorn not present 2017-style exponential gains, but the underlying marketplace science remains strikingly similar. If Bitcoin resumes its correlation with the lagging 2017 cycle, the humanities precedent suggests that Bitcoin could soon retrieve from the existent correction, and a crisp upward determination could follow.

Explore unrecorded data, charts, indicators, and in-depth probe to enactment up of Bitcoin’s terms enactment at Bitcoin Magazine Pro.

Disclaimer: This nonfiction is for informational purposes lone and should not beryllium considered fiscal advice. Always bash your ain probe earlier making immoderate concern decisions.

5 months ago

5 months ago

English (US)

English (US)