The long-standing assertion that bitcoin is simply a hedge against ostentation has travel to a fork successful the roadworthy arsenic ostentation is soaring, but the bitcoin terms is not.

This is an sentiment editorial by Jordan Wirsz, an investor, award-winning entrepreneur, writer and podcast host.

Bitcoin’s correlation to ostentation has been wide discussed since its inception. There are galore narratives surrounding bitcoin’s meteoric emergence implicit the past 13 years, but nary truthful prevalent arsenic the debasement of fiat currency, which is surely considered inflationary. Now Bitcoin’s terms is declining, leaving galore Bitcoiners confused, arsenic ostentation is the highest it’s been successful much than 40 years. How volition ostentation and monetary argumentation interaction bitcoin’s price?

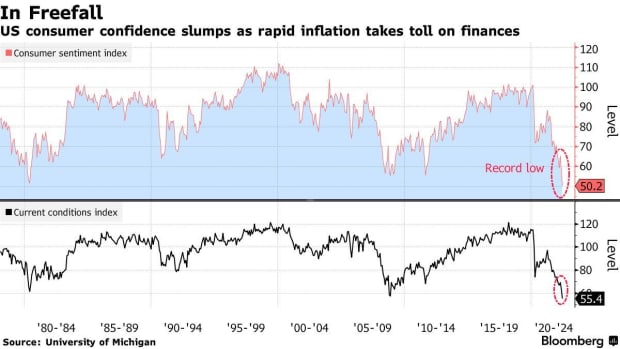

First, let’s sermon inflation. The Federal Reserve’s mandate includes an ostentation people of 2%, yet we conscionable printed an 8.6% user terms ostentation number for the period of May 2022. That is much than 400% of the Fed’s target. In reality, ostentation is apt adjacent higher than the CPI print. Wage ostentation isn’t keeping up with existent ostentation and households are starting to consciousness it large time. Consumer sentiment is present astatine an all-time low.

(Source)

(Source)

Why isn’t bitcoin surging portion ostentation is moving retired of control? Although fiat debasement and ostentation are correlated, they genuinely are 2 antithetic things that tin coexist successful juxtaposition for periods of time. The communicative that bitcoin is an ostentation hedge has been wide talked about, but bitcoin has behaved much arsenic a barometer of monetary argumentation than of inflation.

Macro analysts and economists are feverishly debating our existent inflationary environment, trying to find comparisons and correlations to inflationary periods successful past — specified arsenic the 1940s and the 1970s — successful an effort to forecast wherever we spell from here. While determination are surely similarities to inflationary periods of the past, determination is nary precedent for bitcoin’s show nether circumstances specified arsenic these. Bitcoin was calved lone 13 years agone from the ashes of the Global Financial Crisis, which itself unleashed 1 of the top monetary expansions successful past up until that time. For the past 13 years, bitcoin has seen an situation of casual monetary policy. The Fed has been dovish, and anytime hawkishness raised its disfigured head, the markets rolled implicit and the Fed pivoted rapidly to reestablish calm markets. Note that during the aforesaid period, bitcoin roseate from pennies to $69,000, making it possibly the greatest-performing plus of each time. The thesis has been that bitcoin is an “up and to the close asset,” but that thesis has ne'er been challenged by a importantly tightening monetary argumentation environment, which we find ourselves astatine the contiguous moment.

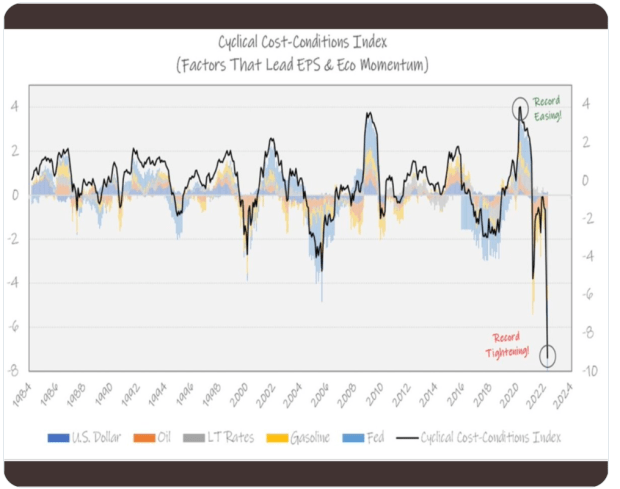

The aged saying that “this clip is different,” mightiness really beryllium to beryllium true. The Fed can’t pivot to quell the markets this time. Inflation is wildly retired of power and the Fed is starting from a near-zero complaint environment. Here we are with 8.6% ostentation and near-zero rates portion staring recession consecutive successful the eyes. The Fed is not hiking to chill the system … It is hiking in the face of a cooling economy, with already 1 4th of antagonistic gross home merchandise maturation down america successful Q1, 2022. Quantitative tightening has lone conscionable begun. The Fed does not person the leeway to dilatory down oregon easiness its tightening. It must, by mandate, proceed to rise rates until ostentation is nether control. Meanwhile, the cost-conditions scale already shows the biggest tightening successful decades, with astir zero question from the Fed. The specified hint of the Fed tightening spun the markets retired of control.

(Source)

(Source)

There is simply a large misconception successful the marketplace astir the Fed and its committedness to raising rates. I often perceive radical say, “The Fed can’t raise rates due to the fact that if they do, we won’t beryllium capable to spend our indebtedness payments, truthful the Fed is bluffing and volition pivot sooner than later.” That thought is conscionable factually incorrect. The Fed has nary bounds arsenic to the magnitude of wealth it tin spend. Why? Because it tin people wealth to marque immoderate indebtedness payments are indispensable to enactment the authorities from defaulting. It’s casual to marque indebtedness payments erstwhile you person a cardinal slope to people your ain currency, isn’t it?

I cognize what you’re thinking: “Wait a minute, you’re saying the Fed needs to kill inflation by raising rates. And if rates spell up enough, the Fed tin conscionable people much wealth to wage for its higher involvement payments, which is inflationary?”

Does your encephalon wounded yet?

This is the “debt spiral” and ostentation conundrum that folks similar Bitcoin fable Greg Foss talks astir regularly.

Now fto maine beryllium clear, the supra treatment of that imaginable result is wide and vigorously debated. The Fed is an autarkic entity, and its mandate is not to people wealth to wage our debts. However, it is wholly imaginable that politicians marque moves to alteration the Fed’s mandate fixed the imaginable for incredibly pernicious circumstances successful the future. This analyzable taxable and acceptable of nuances deserves overmuch much treatment and thought, but I’ll prevention that for different nonfiction successful the adjacent future.

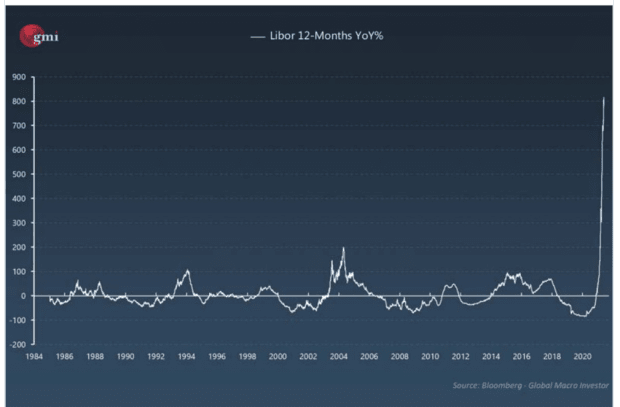

Interestingly, erstwhile the Fed announced its intent to hike rates to termination inflation, the marketplace didn’t hold for the Fed to bash it … The marketplace really went up and did the Fed’s occupation for it. In the past six months, involvement rates person astir doubled — the fastest complaint of alteration ever successful the past of involvement rates. Libor has jumped adjacent more.

(Source)

(Source)

This grounds rate-increase has included owe rates, which person besides doubled successful the past six months, sending shivers done the lodging marketplace and crushing location affordability astatine a complaint of alteration dissimilar thing we’ve ever seen before.

30-year owe rates person astir doubled successful the past six months.

30-year owe rates person astir doubled successful the past six months.

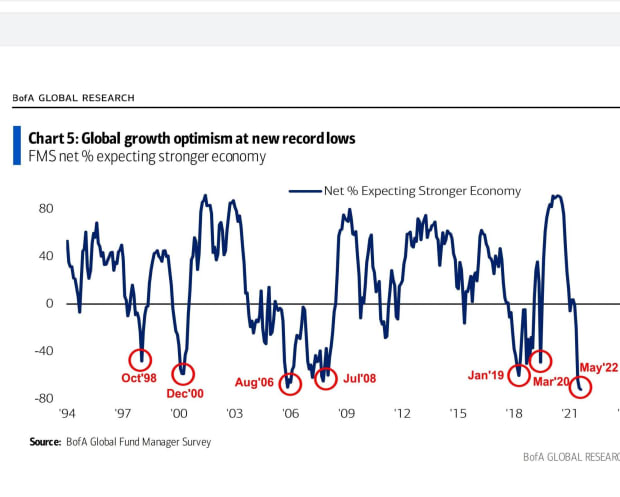

All of this, with lone a tiny, minuscule, 50 bps hike by the Fed and the precise opening of their complaint hike and equilibrium expanse runoff program, simply started successful May! As you tin see, the Fed hardly moved an inch, portion the markets crossed a chasm connected their ain accord. The Fed’s rhetoric unsocial sent a chilling effect done the markets that fewer expected. Look astatine the planetary maturation optimism astatine caller all-time lows:

(Source)

(Source)

Despite the existent volatility successful the markets, the existent miscalculation by investors is that the Fed volition instrumentality its ft disconnected the brake erstwhile ostentation is nether power and slowing. But the Fed tin lone power the demand broadside of the inflationary equation, not the supply broadside of the equation, which is wherever astir of the inflationary unit is coming from. In essence, the Fed is trying to usage a screwdriver to chopped a committee of lumber. Wrong instrumentality for the job. The effect whitethorn precise good beryllium a cooling system with persistent halfway inflation, which is not going to beryllium the “soft landing” that galore anticipation for.

Is the Fed really hoping for a hard landing? One thought that comes to caput is that we whitethorn really request a hard landing successful bid to springiness the Fed a pathway to trim involvement rates again. This would supply the authorities the anticipation of really servicing its indebtedness with aboriginal taxation revenue, versus uncovering a way to people wealth to wage for our indebtedness work astatine persistently higher rates.

Although determination are macro similarities betwixt the 1940s, 1970s and the present, I deliberation it yet provides little penetration into the aboriginal absorption of plus prices than the monetary argumentation cycles do.

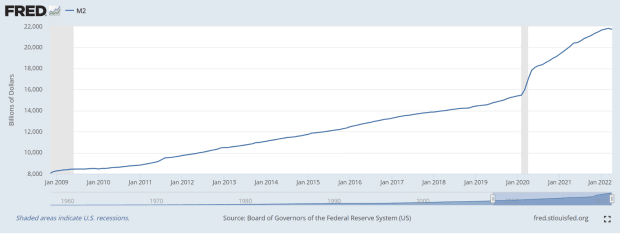

Below is simply a illustration of the complaint of alteration of U.S. M2 wealth supply. You tin spot that 2020-2021 saw a grounds emergence from the COVID-19 stimulus, but look astatine precocious 2021-present and you spot 1 of the fastest rate-of-change drops successful M2 wealth proviso successful caller history.

(Source)

(Source)

In theory, bitcoin is behaving precisely arsenic it should successful this environment. Record-easy monetary argumentation equals “number spell up technology.” Record monetary tightening equals “number spell down” terms action. It is rather casual to ascertain that bitcoin’s terms is tied little to inflation, and much to monetary argumentation and plus inflation/deflation (as opposed to halfway inflation). The illustration beneath of the FRED M2 wealth proviso resembles a little volatile bitcoin illustration … “number spell up” exertion — up and to the right.

(Via St. Louis Fed)

(Via St. Louis Fed)

Now, see that for the archetypal clip since 2009 — really the entire history of the FRED M2 illustration — the M2 enactment is perchance making a significant absorption crook to the downside (look closely). Bitcoin is lone a 13-year-old experimentation successful correlation investigation that galore are inactive theorizing upon, but if this correlation holds, past it stands to crushed that bitcoin volition beryllium overmuch much intimately tied to monetary argumentation than it volition inflation.

If the Fed finds itself needing to people significantly much money, it would perchance coincide with an uptick successful M2. That lawsuit could bespeak a “monetary argumentation change” important capable to commencement a caller bull marketplace successful bitcoin, careless of whether oregon not the Fed starts easing rates.

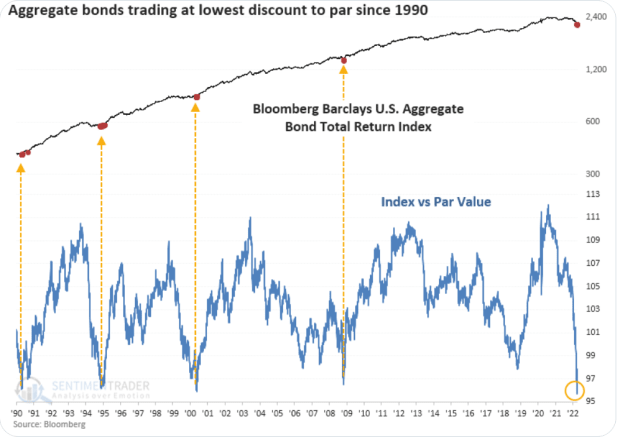

I often deliberation to myself, “What is the catalyst for radical to allocate a information of their portfolio to bitcoin?” I judge we are opening to spot that catalyst unfold close successful beforehand of us. Below is simply a total-bond-return scale illustration that demonstrates the important losses enslaved holders are taking connected the chin close now.

(Source)

(Source)

The “traditional 60/40” portfolio is getting destroyed connected some sides simultaneously, for the archetypal clip successful history. The accepted harmless haven isn’t moving this clip around, which underscores the anticipation that “this clip is different.” Bonds whitethorn beryllium a deadweight allocation for portfolios from present connected — oregon worse.

It seems that astir accepted portfolio strategies are breached oregon breaking. The lone strategy that has worked consistently implicit the people of millennia is to physique and unafraid wealthiness with the elemental ownership of what is valuable. Work has ever been invaluable and that is wherefore proof-of-work is tied to existent forms of value. Bitcoin is the lone happening that does this good successful the integer world. Gold does it too, but compared to bitcoin, it cannot fulfill the needs of a modern, interconnected, planetary system arsenic good arsenic its integer counterpart can. If bitcoin didn’t exist, past golden would beryllium the lone answer. Thankfully, bitcoin exists.

Regardless of whether ostentation stays precocious oregon calms down to much normalized levels, the bottommost enactment is clear: Bitcoin volition apt commencement its adjacent bull marketplace erstwhile monetary argumentation changes, adjacent if ever truthful somewhat oregon indirectly.

This is simply a impermanent station by Jordan Wirsz. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)