After falling beneath a important enactment level, Bitcoin (BTC) is attempting to retrieve immoderate of its mislaid ground. An expert suggested that this week’s show volition beryllium decisive for the cryptocurrency’s adjacent trend.

Bitcoin Loses Bull Flag Formation

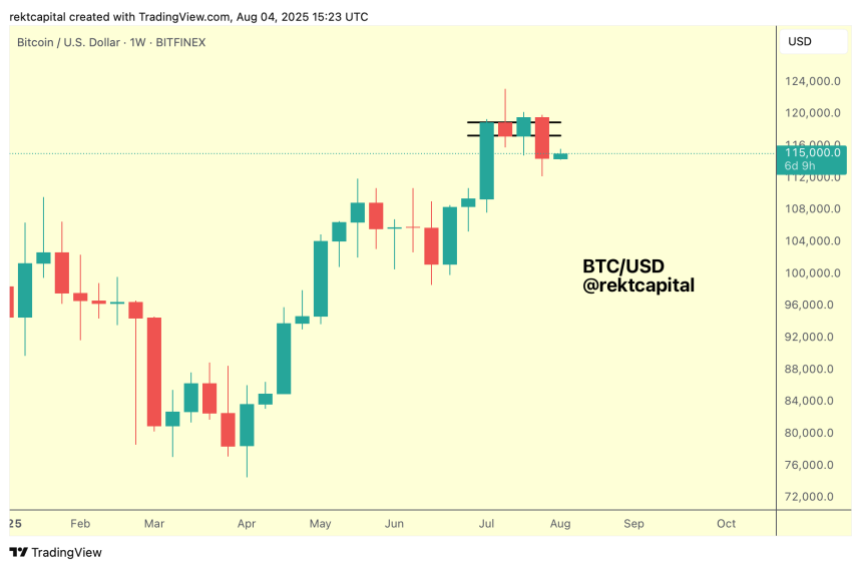

Over the weekend, Bitcoin mislaid its post-breakout scope for the archetypal clip successful 3 weeks, falling to a section debased of $112,296 connected August 3. The flagship crypto had been trading betwixt the $114,000-$120,000 scope since the aboriginal July breakout, hitting its all-time precocious (ATH) of $122,838 amid the rally.

As July neared its end, BTC experienced immoderate volatility, retesting the scope lows doubly implicit its past week. However, the cryptocurrency was incapable to repetition its terms betterment from the erstwhile weekend, losing the important country connected August 1.

Rekt Capital noted that Bitcoin’s rally could beryllium astatine risk, explaining that BTC has formed a bull emblem successful the play illustration and held the pattern’s lows arsenic enactment until the latest Weekly Close.

BTC loses its three-week bull flag. Source: Rekt Capital

BTC loses its three-week bull flag. Source: Rekt CapitalFollowing its caller terms action, the expert considers that this week’s show volition beryllium pivotal to spot whether the pattern’s bottom, astir the $117,200 area, volition go a caller absorption and corroborate the breakdown, oregon if the flagship crypto’s terms volition retrieve the structure.

According to the analysis, if the terms tin reclaim the structure, the correction would beryllium considered a fake downside deviation earlier resynchronizing with the pattern.

Meanwhile, turning the pattern’s bottommost into absorption would beryllium a bearish retest, confirming the breakdown, and perchance starring to a caller retest of the $112,000 country arsenic support.

BTC’s Weekly Close To Determine Next Trend

Rekt Capital besides elaborate that this week’s show volition find the aboriginal of BTC’s 2nd Price Discovery uptrend, which has technically started its 5th week.

Depending connected what happens to the Bull Flag (reclaim oregon a confirmation of the breakdown), we volition cognize whether the Price Discovery Uptrend 2 volition proceed oregon whether BTC has experienced a precise abbreviated PDU2 instead.

Last week, the expert retesting that the continuation of the Price Discovery inclination could neglect arsenic BTC transitioned into weeks 5-7 of this phase. Historically, the 2nd uptrend has started to dilatory down astir Weeks 5-6, hitting its highest during this “Danger Zone.”

If Bitcoin reclaims the Bull Flag and challenges caller highs, past its 2nd Price Discovery uptrend volition advancement according to its humanities tendencies.

However, if it fails to Weekly Close supra the pattern’s bottommost and confirms further downside, the 2nd Price Discovery uptrend would person ended successful Week 2, overmuch quicker than has historically been the case.

Moreover, it would uncover that BTC has been successful its 2nd Price Discovery Correction, which “would beryllium going wholly against the atom of history.”

The expert suggested that macro-wise, Bitcoin inactive has plentifulness of clip for a 3rd Price Discovery uptrend. If the 2nd signifier has already ended, a last uptrend could overcompensate for the existent uptrend’s underperformance.

Previously, Rekt Capital asserted that what comes aft the 2nd uptrend would beryllium connected however agelong the corrective signifier takes, arsenic a changeable correction could let for a 3rd uptrend earlier the carnivore market.

Bitcoin trades astatine $114,993 successful the one-week chart. Source: BTCUSDT connected TradingView

Bitcoin trades astatine $114,993 successful the one-week chart. Source: BTCUSDT connected TradingViewFeatured Image from Unsplash.com, Chart from TradingView.com

3 months ago

3 months ago

English (US)

English (US)