On Saturday, Bitcoin experienced a robust rally, climbing supra $58,250. Despite this upward movement, it was incapable to prolong the momentum and adjacent supra the 200-day Exponential Moving Average (EMA). This led to the enactment of a bearish engulfing candlestick signifier connected Sunday, signaling imaginable downside momentum. Currently, Bitcoin is trading beneath $56,000, positioning it astatine a captious juncture successful presumption of method investigation and marketplace sentiment.

Sina G, the COO and co-founder of 21st Capital, provided a breakdown of the factors influencing Bitcoin’s terms trajectory today, peculiarly highlighting caller declines and evaluating its undervalued authorities done blase metrics. Starting with a humanities overview, Sina pointed retired that Bitcoin had seen a drastic 26% diminution from a March highest of $73,000, settling astir $56,000 successful caller weeks.

This crisp alteration has been attributed to respective macroeconomic and sector-specific factors. According to him, Bitcoin’s autumn from the $73,000 highest successful March to $56,000 aligns with historical bull marketplace corrections, which often spot important yet impermanent retracements.

The power of Bitcoin ETFs has been pivotal. Initially, these ETFs contributed importantly to the terms surge from $16,000 to $73,000, arsenic investors engaged heavy successful a buy-the-rumor, buy-the-news strategy. “Up to mid-march ETF flows were precise beardown and the marketplace moved up. Since past ETFs slowed down and bankruptcy outflows took over, causing a anemic terms enactment each the mode down to $56K.

A notable caller interaction connected Bitcoin’s terms has been the selling enactment of the German government, which disposed of Bitcoin seized successful 2013 from the pirated contented level Movie2k.to. “The government’s determination to liquidate astir 10,000 coins crossed 3 transactions coincided straight with important terms drops connected circumstantial dates successful June and July,” helium noted. This selloff contributed to a steep 24% clang successful June and July, exacerbated by the ample measurement of Bitcoin introduced into the market.

Is Bitcoin Undervalued?

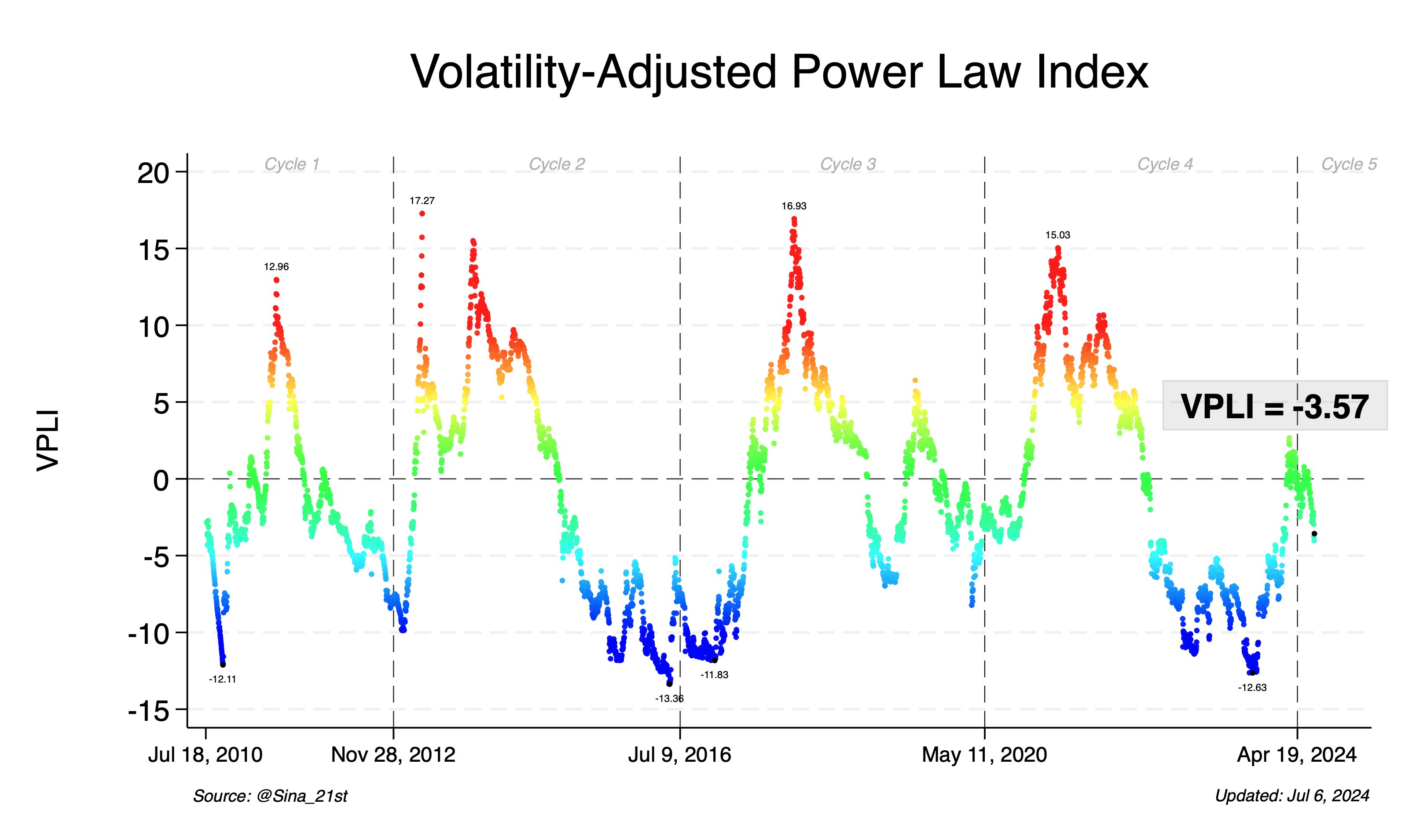

To code whether Bitcoin is presently undervalued, Sina turned to the Volatility-Adjusted Price Level Index (VPLI), a proprietary metric developed by 21st Capital. “Currently, our VPLI is astatine -3.57, which indicates that Bitcoin is importantly beneath its just price,” Sina stated. He further clarified that historically, a VPLI people of -10 corresponds with carnivore marketplace bottoms, placing the existent speechmaking successful a discourse that suggests Bitcoin is perchance undervalued.

Volatility-adjusted powerfulness instrumentality scale | Source: X @Sina_21st

Volatility-adjusted powerfulness instrumentality scale | Source: X @Sina_21st“This puts america successful the 41th percentile of values – i.e., Bitcoin has lone spent 41% of beneath this VPLI speechmaking (most of which during the carnivore markets). So the risk-reward equilibrium is favorable,” helium added.

Looking forward, Sina highlighted 2 captious short-term indicators that could dictate Bitcoin’s contiguous terms movements: the continuation of Bitcoin sales by the German government and the behaviour of the perpetual swaps backing rate. “Recently, the backing complaint has been negative, which is typically a bearish signal. This suggests that galore traders are taking abbreviated positions, anticipating further declines, which paradoxically mightiness bespeak that the marketplace is adjacent to reaching a bottom,” helium concluded.

At property time, BTC traded astatine $55,835.

BTC drops beneath $56,000 again, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC drops beneath $56,000 again, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

11 months ago

11 months ago

English (US)

English (US)