With the crypto manufacture struggling done a grounds carnivore marketplace situation, 1 plus that has polarized analysts is Coinbase banal which has fallen to caller lows.

Bitwise Invest Chief concern serviceman Matt Hougan thinks Coinbase banal is undervalued contempt falling importantly successful 2022.

According to Hougan, Coinbase raised wealth astatine a valuation of $8 cardinal successful 2018. At the time, it had 22 cardinal users, generated $520 cardinal successful revenue, and had $11 cardinal successful assets connected the platform.

Fast guardant to 2022, the gross is $3.3 billion, it has 101 cardinal users, and the platform’s assets are present $101 billion. Despite these wide indications of growth, the institution is trading astatine a valuation of $9 billion.

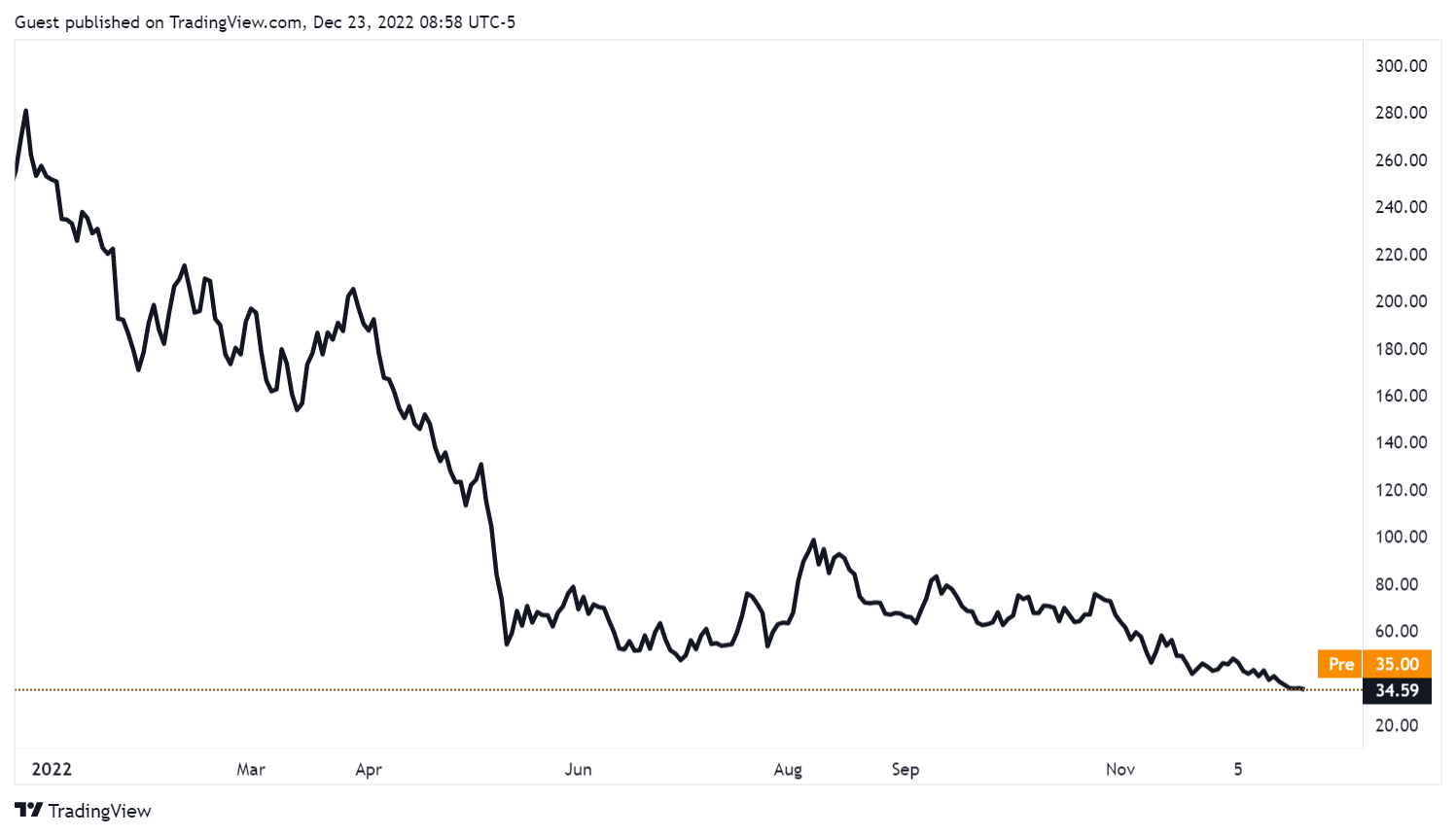

Coinbase banal is astatine an all-time low

Coinbase stocks person fallen since the commencement of the year, trading astir $35 arsenic of property time. This represents a much than 86% driblet successful the year-to-date metric.

Following its banal worth decline, the exchange’s marketplace headdress dropped to astir $8 billion, portion adjacent Dogecoin’s marketplace headdress surpassed it astatine $10 billion. While this does not bespeak the exchange’s intrinsic value, it shows however the existent marketplace conditions person affected it.

Analysts person tied its banal diminution to respective factors, which included the existent crypto wintertime and the information that the speech has been burning done currency astatine a grounds pace. During the archetypal 3 quarters of 2022, the speech recorded implicit $2 cardinal successful losses.

Coinbase’s superior gross root is from trading fees, and the existent marketplace has impacted that. While it has much customers, trading fees are little due to the fact that crypto plus values are down. Rivals similar Binance.US person besides tried to entice traders with caller features similar zero-trading fees for assets similar Bitcoin (BTC).

CEO Brian Armstrong told Bloomberg that helium expects the exchange’s gross to driblet by arsenic overmuch arsenic 50% successful the existent year.

Industry perspectives

Some deliberation Coinbase is overvalued, pointing to its currency burn, deficiency of important improvements implicit the years, and worker banal compensation. Several marketplace analysts person downgraded the stock. Mizuho precocious downgraded the banal to underperform, mounting a $30 terms target.

Before then, the Bank of America had downgraded the banal from Buy to Neutral, mounting a $50 terms target. It noted that portion the speech is thing similar FTX, the worldly diminution successful the worth of Bitcoin volition impact its stocks.

Many successful the crypto assemblage besides stock this view, noting that Coinbase was overvalued successful 2018. Lazar Wolf tweeted that E*Trade sold for 2.5% of its assets nether management, portion JP Morgan is valued astatine astir 10% of its AUM.

Wolf added that helium was a bid C capitalist successful the speech and dumped each his stocks past twelvemonth astatine $340.

Bullish views remain

Meanwhile, contempt the pessimism shared by immoderate analysts, others stock Hougan views.

21.co CEO Hany Rashwan expressed the content that Coinbase stocks are undervalued. According to him, though Coinbase has mislaid a batch of wealth this year, it has doubled its stock of the fiat speech marketplace since September.

Rashwan said that anyone who believes successful crypto’s semipermanent imaginable and values Coinbase’s caller maturation rates and marketplace stock would spot the 1 oregon 2 years of mediocre marketplace conditions arsenic an aberration. He added:

“They’re losing a batch of money, yes. They should evidently trim these losses, but I inactive spot a fundamentally bully concern underneath.”

Meanwhile, Coinbase CEO Brian Armstrong insists that the institution volition inactive beryllium successful the adjacent 2 decades and believes investors should bargain COIN banal conscionable arsenic they bargain crypto assets. Armstrong said:

“We’ll besides beryllium a beneficiary of accrued regularisation and diversifying our gross watercourse distant from trading fees.”

The station Is Coinbase banal undervalued? Analysts divided appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)