Ethereum is successful the midst of a paradox. Even arsenic ether deed grounds highs successful precocious August, decentralized concern (DeFi) enactment connected Ethereum’s layer-1 (L1) looks muted compared to its highest successful precocious 2021. Fees collected connected mainnet successful August were conscionable $44 million, a 44% driblet from the anterior month.

Meanwhile, layer-2 (L2) networks similar Arbitrum and Base are booming, with $20 cardinal and $15 cardinal in full worth locked (TVL) respectively.

This divergence raises a important question: are L2s cannibalizing Ethereum’s DeFi activity, oregon is the ecosystem evolving into a multi-layered fiscal architecture?

AJ Warner, the main strategy serviceman of Offchain Labs, the developer steadfast down layer-2 Arbitrum, argues that the metrics are much nuanced than conscionable layer-2 DeFi chipping astatine the furniture 1.

In an interrogation with CoinDesk, Warner said that focusing solely connected TVL misses the point, and that Ethereum is progressively functioning arsenic crypto’s “global colony layer,” a instauration for high-value issuance and organization activity. Products similar Franklin Templeton’s tokenized funds oregon BlackRock’s BUIDL merchandise motorboat straight connected Ethereum L1 — enactment that isn’t afloat captured successful DeFi metrics but underscores Ethereum’s relation arsenic the bedrock of crypto finance.

Ethereum arsenic a layer-1 blockchain is the unafraid but comparatively dilatory and costly basal network. Layer-2s are scaling networks built connected apical of it, designed to grip transactions faster and astatine a fraction of the outgo earlier yet settling backmost to Ethereum for security. That’s wherefore they’ve go truthful appealing to traders and builders alike. Metrics similar TVL, the magnitude of crypto deposited successful DeFi protocols, item this shift, arsenic enactment is moved to L2s wherever little fees and quicker confirmations marque mundane DeFi acold much practical.

Warner likens Ethereum’s spot successful the ecosystem to a ligament transportation successful accepted finance: trusted, unafraid and utilized for large-scale settlement. Everyday transactions, however, are migrating to L2s — the Venmos and PayPals of crypto.

“Ethereum was ne'er going to beryllium a monolithic blockchain with each the enactment happening connected it,” Warner told CoinDesk. Instead, it’s meant to anchor information portion enabling rollups to execute faster, cheaper and much divers applications.

Layer 2s, which person exploded implicit the past fewer years due to the fact that they are seen arsenic the faster and cheaper alternate to Ethereum, alteration full categories of DeFi that don’t relation arsenic good connected mainnet. Fast-paced trading strategies, similar arbitraging terms differences betwixt exchanges oregon moving perpetual futures, don’t enactment good connected Ethereum’s slower 12-second blocks. But connected Arbitrum, wherever transactions finalize successful nether a second, those aforesaid strategies go possible, Warner explained. This is apparent, arsenic Ethereum has had less than 50 cardinal transactions implicit the past month, compared to Base’s 328 cardinal transactions and Arbitrum’s 77 cardinal transactions, according to L2Beat.

Builders besides spot L2s arsenic an perfect investigating ground. Alice Hou, a probe expert astatine Messari, pointed to innovations similar Uniswap V4’s hooks, customizable features that tin beryllium iterated acold much cheaply connected L2s earlier going mainstream. For developers, quicker confirmations and little costs are much than a convenience: they grow what’s possible.

“L2s supply a earthy playground to trial these kinds of innovations, and erstwhile a hook achieves breakout popularity, it could pull caller types of users who prosecute with DeFi successful ways that weren’t feasible connected L1,” Hou said.

But the displacement isn’t conscionable astir technology. Liquidity providers are responding to incentives. Hou said that information shows smaller liquidity providers progressively similar L2s wherever output incentives and little slippage amplify returns. Larger liquidity providers, however, inactive clump connected Ethereum, prioritizing information and extent of liquidity implicit bigger yields.

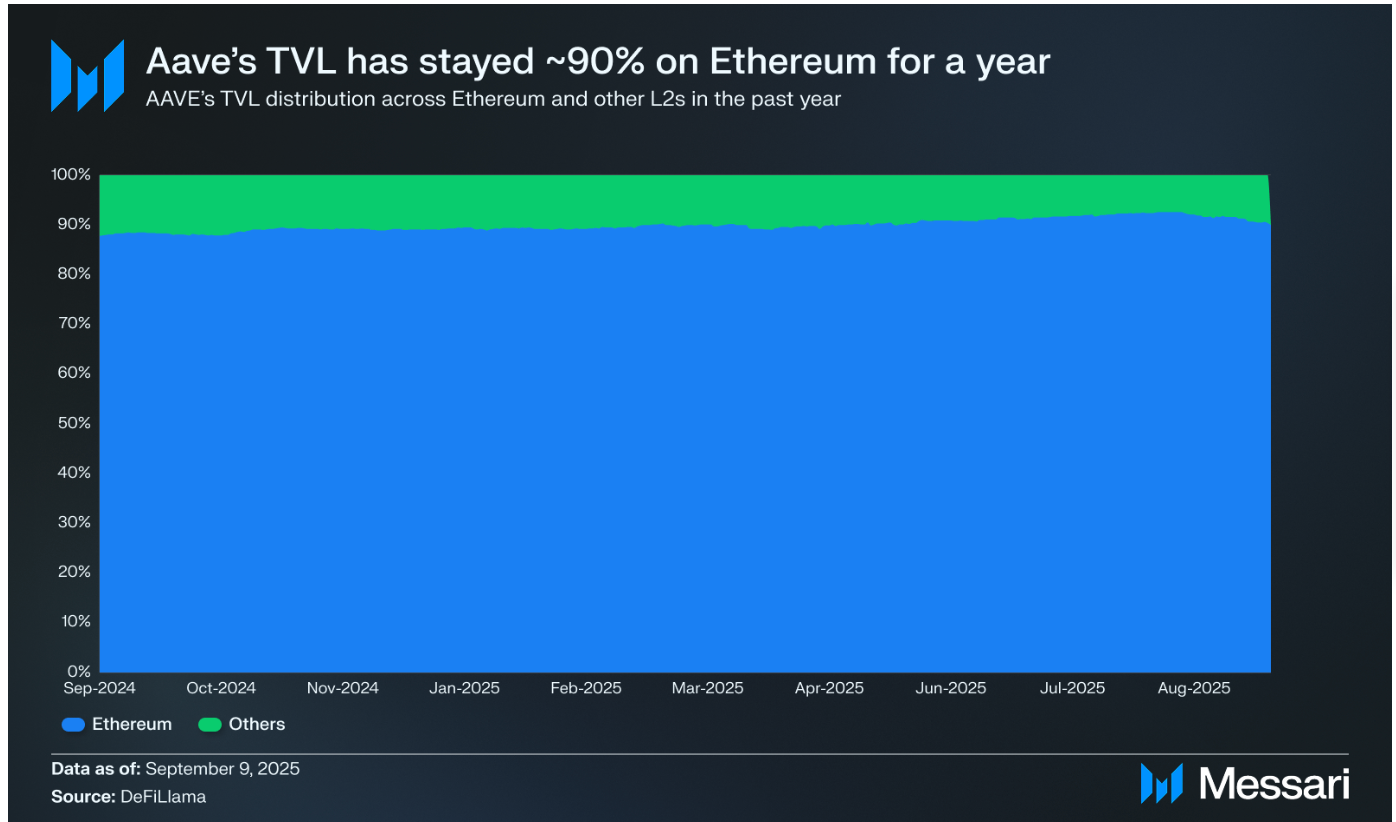

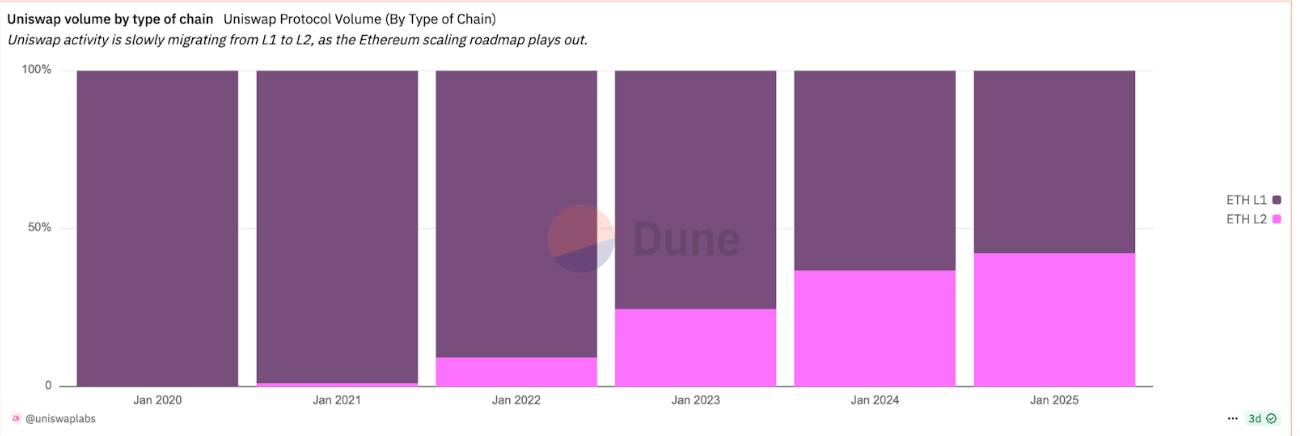

Interestingly, portion L2s are capturing much activity, flagship DeFi protocols similar Aave and Uniswap inactive thin heavy connected mainnet. Aave has consistently kept about 90% of its TVL connected Ethereum. With Uniswap however, there’s been an incremental displacement towards L2 activity.

Another origin accelerating L2 adoption is idiosyncratic experience. Wallets, bridges and fiat on-ramps progressively steer newcomers straight to L2s, Hou said. Ultimately, the information suggests the L1 vs. L2 statement isn’t zero-sum.

As of September 2025, astir a 3rd of L2 TVL inactive comes bridged from Ethereum, different 3rd is natively minted, and the remainder comes via outer bridges.

“This premix shows that portion Ethereum remains a cardinal root of liquidity, L2s are besides processing their ain autochthonal ecosystems and attracting cross-chain assets,” Hou said.

Ethereum frankincense arsenic a basal furniture appears to beryllium cementing itself arsenic the unafraid colony motor for planetary finance, portion rollups similar Arbitrum and Base are emerging arsenic execution layers for fast, inexpensive and originative DeFi applications.

“Most payments I marque usage thing similar Zelle oregon PayPal… but erstwhile I bought my home, I utilized a wire. That’s somewhat parallel to what’s happening betwixt Ethereum furniture 1 and furniture twos,” Warner of Offchain Labs said.

Read more: Ethereum DeFi Lags Behind, Even arsenic Ether Price Crossed Record Highs

2 months ago

2 months ago

English (US)

English (US)