Ethereum (ETH) options for June amusement a marked involvement successful higher onslaught prices, focusing connected levels exceeding $3,600.

Data from Deribit reveals a concentrated stake among traders connected calls surpassing this price, indicating a bullish sentiment toward Ethereum’s near-term trajectory. The astir favored onslaught terms among these optimistic bets is an ambitious $6,500.

Options Market Bullish On Ethereum

Notably, options are contracts that springiness traders the right, but not the obligation, to bargain (in the lawsuit of calls) oregon merchantability (in the lawsuit of puts) the underlying plus astatine a specified onslaught terms by the expiry date.

A telephone enactment is typically purchased by traders who judge the plus volition increase successful price, allowing them to bargain astatine a little complaint and perchance merchantability astatine a higher marketplace price. Conversely, enactment options are favored by those anticipating a diminution successful the asset’s price, aiming to merchantability astatine the existent complaint and repurchase astatine a little value.

Currently, the Ethereum options marketplace is tilting heavy towards calls, with the aggregate unfastened interest—representing the full fig of outstanding declaration options—showing a penchant for higher onslaught prices.

This attraction of calls, chiefly supra the $3,600 mark, suggests that a important marketplace conception is positioning for Ethereum to ascend to higher levels by the extremity of June.

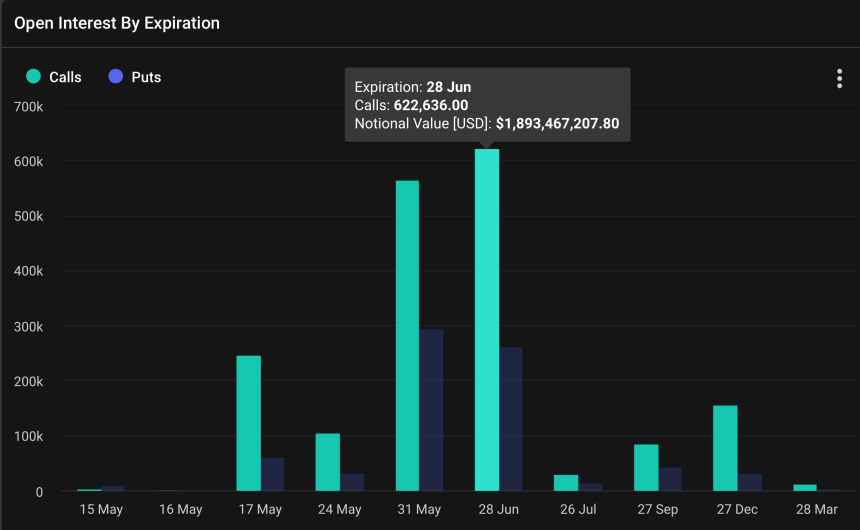

Ethereum Open Interest By Expiration. | Source: Deribit

Ethereum Open Interest By Expiration. | Source: DeribitAccording to Deribit data, astir 622,636 Ethereum telephone contracts are acceptable to expire by June’s end, encapsulating a notional worth supra $1.8 billion. Such important positioning underscores the market’s assurance successful Ethereum’s imaginable uplift.

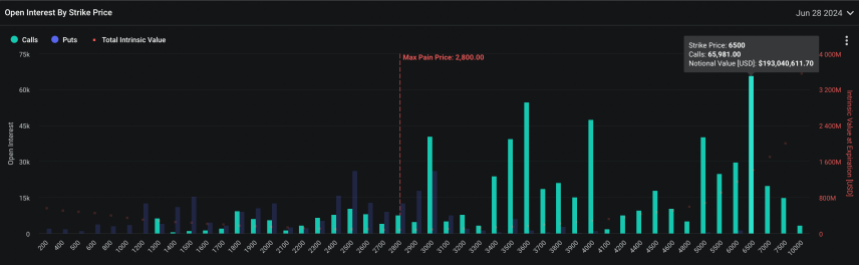

Data further shows that the astir important unfastened involvement is clustered astir the $6,500 onslaught price, with a notional worth of $193 million.

Ethereum Open Interest By Strike Price. | Source: Deribit

Ethereum Open Interest By Strike Price. | Source: DeribitThis attraction reflects trader optimism and supports Ethereum’s marketplace price, particularly if these options are exercised arsenic the plus terms approaches oregon surpasses these onslaught levels.

Despite the optimism embedded successful these options, Ethereum is presently navigating a flimsy downturn. It has dropped 5.4% implicit the past week and 2.2% successful the past 24 hours, positioning it beneath $2,900. This diminution places adjacent much absorption connected upcoming marketplace catalysts that could importantly sway ETH’s price.

Regulatory Decisions And Technical Indicators: A Dual Influence connected ETH’s Path

One important upcoming lawsuit is the US Securities and Exchange Commission’s (SEC) decision connected respective applications for Ethereum-based Exchange-Traded Funds (ETFs), which is owed by May 25th.

This determination is pivotal arsenic support could usher successful a question of organization investments into Ethereum, perchance catapulting its price. Conversely, rejection could dampen the bullish sentiment and pb to further pullbacks.

From a method investigation standpoint, signs are pointing to a imaginable rebound. The “Bullish Cypher Pattern,” identified by the expert Titan Of Crypto, suggests that Ethereum could beryllium astatine a turning point. Currently, Ethereum is astatine the 38.2% Fibonacci retracement level, a key enactment zone successful galore bull markets.

This level has historically acted arsenic a launchpad for upward terms movements, hinting that Ethereum could beryllium gearing up for a important rise.

#Altcoins #Ethereum Bounce incoming.

The Bullish Cypher Pattern played retired perfectly and each the targets got reached 🎯.#ETH is presently astatine the 38.2% Fibonacci retrace level besides called “1st stop”. In a bull marketplace this level holds.

I expect a bounce from this level. 🚀 pic.twitter.com/o9e6VLEREz

— Titan of Crypto (@Washigorira) May 12, 2024

Featured representation from Unsplash, Chart from TradingView

1 year ago

1 year ago

English (US)

English (US)