It has been a rollercoaster period successful the satellite of Ethereum. On April 11, the archetypal palmy shadiness fork of the Ethereum mainnet spurred optimism astir a coming Merge, but expectations were tempered a fewer days aboriginal erstwhile halfway developer Tim Beiko speculated that the displacement to proof-of-stake (PoS) is no longer likely to travel successful June arsenic galore had hoped.

Much has already been written astir the delay, wherefore it happened and whether proof-of-stake is inactive connected the skyline for 2022 (Beiko says it is). But each of this speculation astir timelines is simply a spot of a sideshow (in which I, admittedly, person indulged).

So connected to what really matters.

This nonfiction primitively appeared successful Valid Points, CoinDesk’s play newsletter breaking down Ethereum’s improvement and its interaction connected crypto markets. Subscribe to get it successful your inbox each Wednesday.

New security, caller problems

I wrote successful last week’s newsletter that astir Ethereum users won’t announcement overmuch of a alteration aft the Merge. The network’s underwhelming web speeds (around 16 transactions per second, compared to Solana’s implicit 2,000 transactions per second) and precocious state fees volition stay mostly unchanged.

The Merge will, however, present an wholly caller strategy for keeping the web secure, and with this caller strategy travel caller threats of web centralization.

Enter, Lido, the liquid staking pool that mightiness beryllium connected way to predominate the full Ethereum staking ecosystem. If immoderate skeptics are to beryllium believed, the solution which makes it casual for anyone to involvement connected Ethereum mightiness beryllium the largest menace to the network’s information yet.

Centralization connected Ethereum

Centralization tin beryllium interpreted successful a assortment of ways, but successful this context, we’ll usage it to notation to the quality for a tiny radical of actors to sway a blockchain web successful 1 absorption oregon different – controlling thing from however the web is upgraded, to determining what transactions are oregon aren’t processed.

Blockchain centralization should beryllium considered on a spectrum. It would beryllium unfair to telephone Ethereum “centralized” conscionable due to the fact that determination are less nodes operating the web (about 6,000) successful examination to Bitcoin (about 15,000). But astatine the aforesaid time, it’s hard to telephone Ethereum wholly “decentralized” erstwhile 20% of the archetypal supply of ether – 12 cardinal ETH, oregon 10% of today’s proviso – went to the Ethereum Foundation and a tiny radical of aboriginal contributors.

There are galore vectors by which a web similar Ethereum mightiness beryllium considered “centralized,” but centralization is astir pressing successful the discourse of web security.

In today’s proof-of-work system, miners unafraid the web by devoting machine powerfulness to validating transactions. In return, miners get immoderate of the fees generated whenever transactions are processed. They besides person a tiny magnitude of ETH that gets minted with each caller block.

Cheating – e.g., sneaking successful a fake transaction that moves tokens from 1 wallet to different – would necessitate 51% of each of the network’s “hash power.”

Over time, Bitcoin and Ethereum person turned crypto mining into a multibillion-dollar industry, starring to the improvement of specialized machine hardware for the circumstantial intent of mining cryptocurrency (known arsenic ASICs).

With truthful galore expensive, highly specialized machines competing for web rewards, it is nary longer profitable for astir radical to excavation ether (or BTC) connected their ain computers.

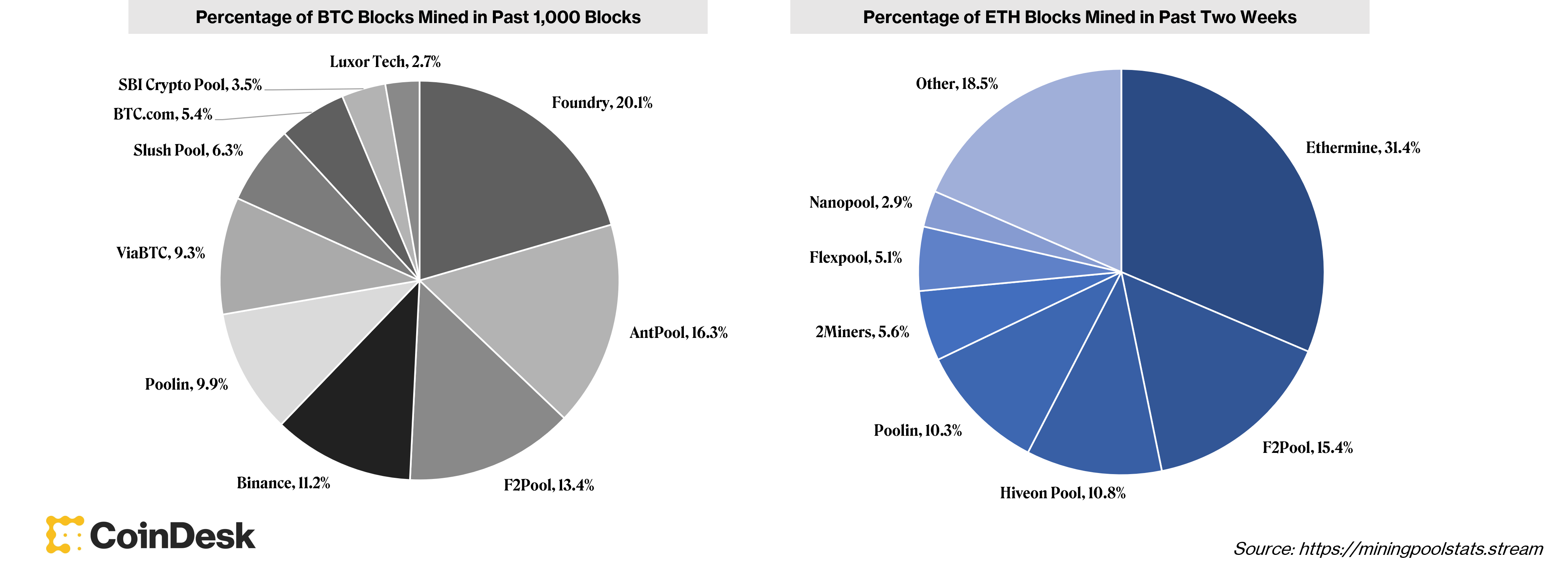

Instead, a bulk of mining enactment has fallen into the hands of a tiny fig of pools – groups of miners who enactment unneurotic to excavation blocks successful speech for a stock of each the group’s aggregate rewards.

Just a fewer mining pools are liable for mining a bulk of blocks connected Bitcoin connected Ethereum.

While unlikely, conscionable 3 pools connected Ethereum could theoretically enactment unneurotic to sabotage the web by amassing much than 51% of its hash rate.

Proof-of-stake and centralization

In summation to dramatically decreasing the biology toll of Ethereum, proof-of-stake has been framed arsenic a mode to amended decentralization.

Rewards volition nary longer travel to those with the astir compute power. Instead, anyone who “stakes” 32 ETH is eligible to beryllium randomly selected to verify each artifact and person rewards. If a staker tries to sabotage the network, her involvement tin get slashed, meaning she loses immoderate of her invaluable ether.

Sabotaging the web via a 51% onslaught requires amassing much than fractional of each staked ether – a sum which, successful today’s market, would magnitude to tens of billions of dollars. By the clip a staker has managed to get that overmuch ether, sabotaging the web wouldn’t marque consciousness since it would (in theory) devalue that staker’s holdings. Even if an attacker's information is not financial, the upfront costs successful Ethereum's PoS strategy are designed to render attacks infeasible.

PoS systems are not inherently little centralized than PoW. I wrote successful this newsletter a mates of weeks agone astir however the delegated proof-of-stake (DPoS) Ronin blockchain, which was exploited for implicit $600 cardinal past month, was near susceptible erstwhile a tiny radical of stakers were near securing the full system.

In Ronin’s system, 5 compromised passwords were fundamentally each it took to drain much than fractional a cardinal dollars into the hands of an attacker (controlled by North Korea, apparently).

But this is not an apples-to-apples examination with Ethereum. Anyone volition theoretically beryllium allowed to involvement connected Ethereum’s PoS system, whereas Ronin’s tiny acceptable of DPoS validators were handpicked by the chain’s creators.

Less centralized variations connected the DPoS taxable person been employed by different blockchains similar Solana (DPoS holds a batch of advantages implicit PoS erstwhile securing a smaller network), but Ethereum’s developers accidental they are trying to marque Ethereum arsenic decentralized arsenic imaginable by opening staking up to anyone.

Despite these ambitions, Ethereum’s PoS Beacon Chain – which is presently moving successful parallel with the PoW mainnet and volition yet merge with it – has shown that adjacent much integrated forms of centralization stay a threat.

In the aboriginal days of the Beacon Chain astatine the commencement of 2021, it seemed arsenic if centralized exchanges similar Coinbase and Kraken mightiness beryllium poised to predominate Ethereum staking by making it casual for their monolithic idiosyncratic bases to excavation their ether and gain staking rewards.

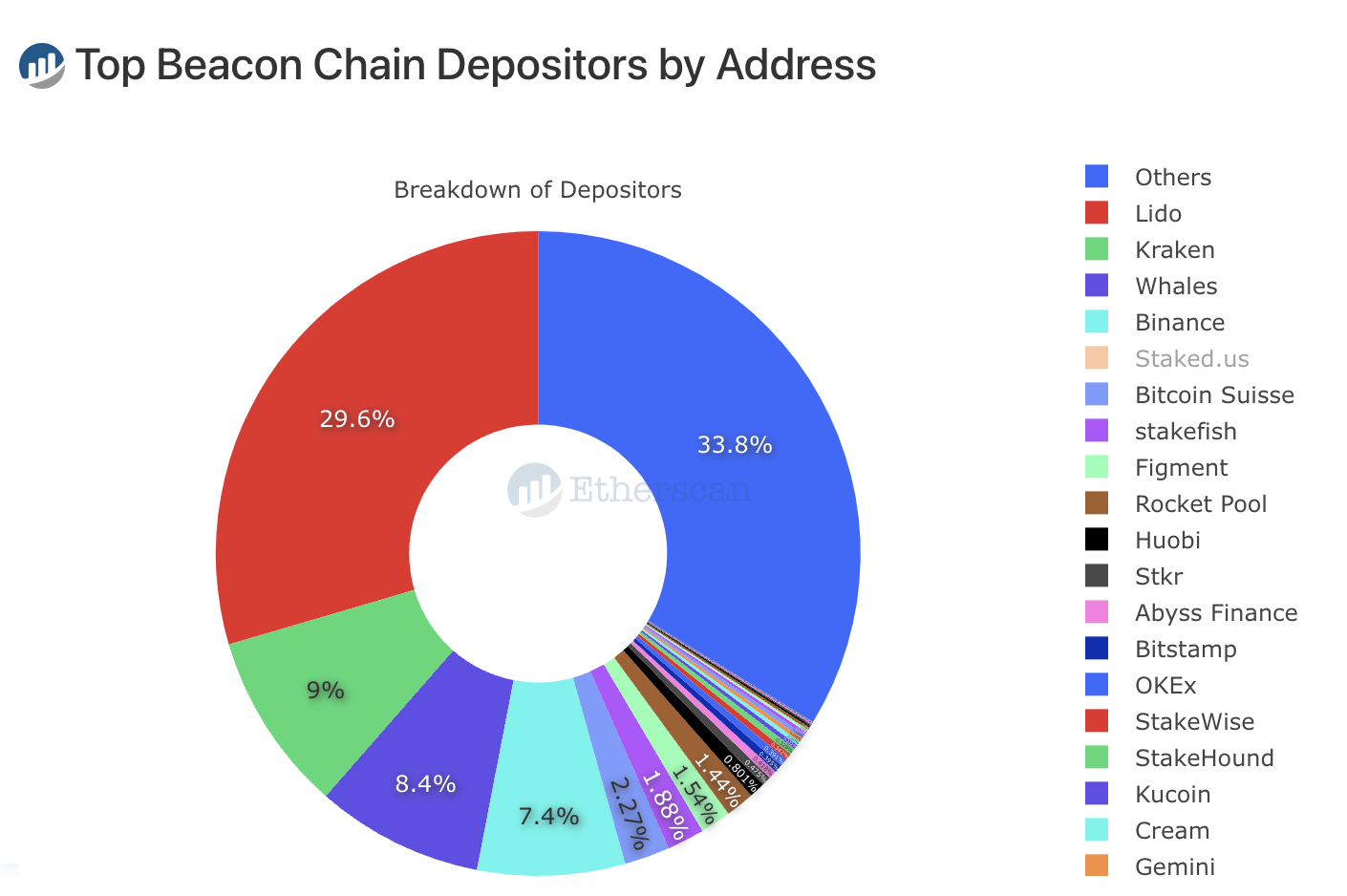

While centralized exchanges are so playing a ample relation successful the ETH staking game, the largest staker connected Ethereum’s PoS Beacon Chain by acold is Lido, a alleged liquid staking excavation that has amassed a monolithic 30% stock of each staking enactment connected Ethereum, according to Etherscan.

Lido is the largest depositor successful the Beacon Chain staking declaration (Etherscan)

With implicit $35 cardinal staked connected the Beacon Chain, however has Lido – a azygous staking solution – amassed $10 cardinal successful ether?

Staking connected Ethereum is costly and confusing for astir users. Most radical don’t person 32 ether (about $90,000) lying astir to involvement and mounting up a node incorrectly (or adjacent with shoddy Wi-Fi) tin incur slashing, oregon the nonaccomplishment of one’s funds.

Staked ether is besides illiquid. Until the Merge, ether staked connected the Beacon Chain volition beryllium intolerable to unstake, meaning it can’t beryllium sold oregon utilized to gain involvement via decentralized concern (DeFi).

Lido launched successful December 2020 to marque it easier for anyone to gain rewards for staking. If you springiness immoderate magnitude of ether to Lido, the level volition bundle it up with ether belonging to others and manus the afloat sum (at slightest 32 ETH) implicit to 1 of Lido’s trusted node providers – a work that specializes successful mounting up validators. This enables you to gain immoderate rewards (around 4% annually) for securing the web without the request for 32 ETH oregon immoderate peculiar expertise.

Lido is called a “liquid” staking solution due to the fact that it gives retired staked ether (stETH) – a 1:1 derivative of ether – to users who involvement with the platform. This stETH accrues involvement to lucifer staking rewards, and though users volition beryllium incapable to unstake ether until the Merge, they tin merchantability their stETH backmost to the marketplace if they’d similar to currency out.

On apical of earning staking rewards, it has go highly communal to usage stETH to enactment successful DeFi activities similar lending and borrowing to gain adjacent greater yield.

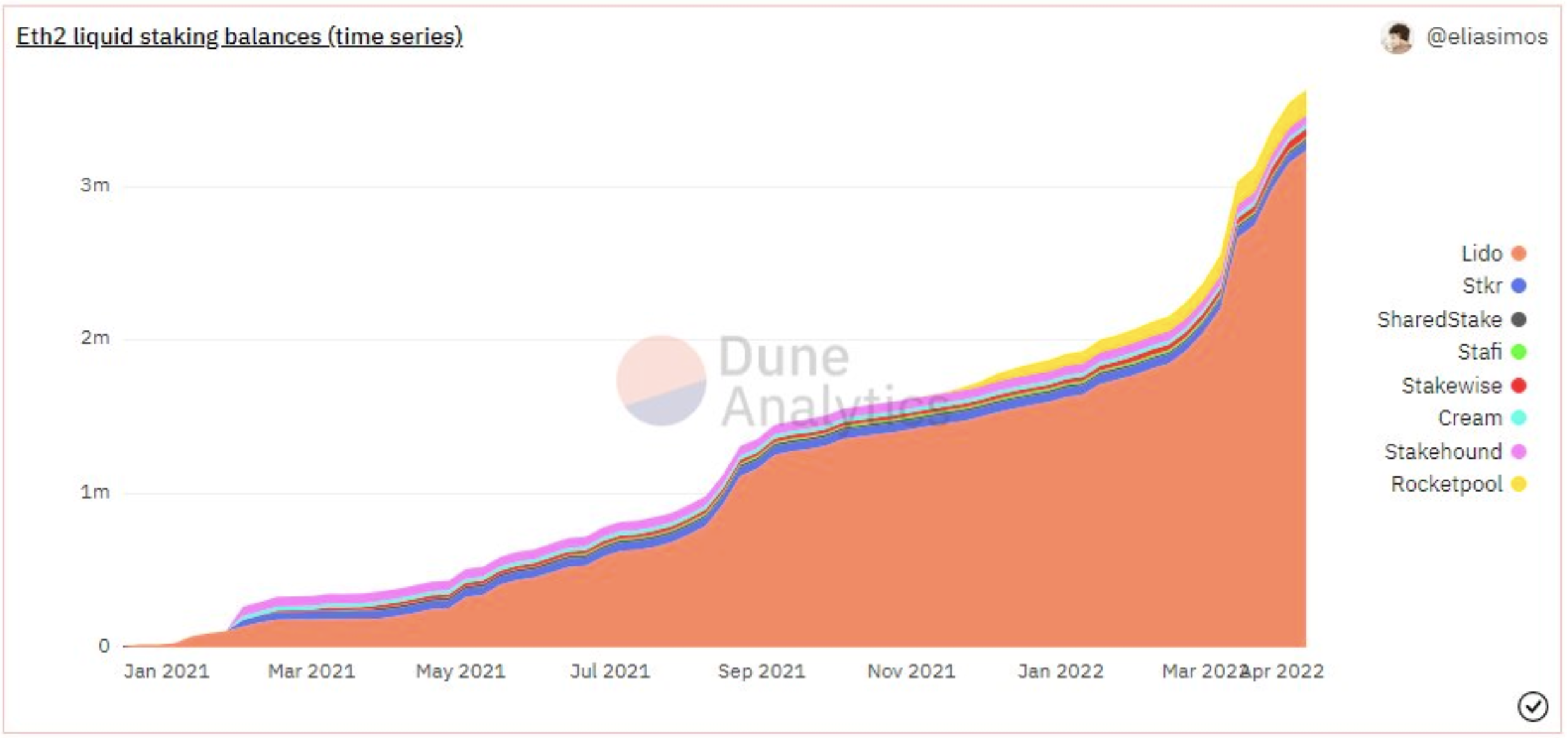

As stETH has grown into a hugely fashionable DeFi primitive, oregon gathering block, much users person flocked to Lido. Although Lido started to spot contention soon aft it launched, it has dominated competitors, specified arsenic Rocketpool and Stkr, and present controls astir 90% of the fast-growing liquid staking market.

Lido has amassed astir 90% of the liquid staking marketplace (Dune Analytics/@eliasimos)

A bid for decentralization

Over time, Lido has raised alarm bells among those who deliberation it risks centralizing Ethereum’s PoS chain. By the looks of it, Lido mightiness beryllium connected way to power implicit 50% of each staked ether, meaning the platform, which is governed by a assemblage of LDO token holders, could person a stranglehold implicit the full network.

By Lido’s ain account, “75% of caller stakers who joined successful the past 30 days have done truthful via Lido.”

“While this validates our ngo to democratize staking successful Ethereum,” Lido said past week successful a blog post, “some radical person expressed interest that this level of occurrence tin marque Lido a centralizing force.”

In the station and an accompanying Twitter thread, Lido explained however it is moving to progressively decentralize its platform.

Most of Lido’s proposals halfway astir reforming however the platform’s assemblage delegates staking powerfulness to validator operators.

Although Lido doesn’t deploy validator nodes itself, it has dispersed staking responsibilities among astir 20 handpicked node operators. Lido’s assemblage could, theoretically, alteration this fig should it truthful choose, though the assemblage presently caps the max magnitude of ether a fixed spouse is allowed to stake.

One of Lido’s projected steps toward decentralization involves adopting “Distributed Validator Technology” (DVT) to radical validators into autarkic committees that suggest and attest to blocks together. According to Lido, this volition “greatly trim the hazard of an idiosyncratic validator underperforming oregon misbehaving.”

Lido besides plans to present a scoring strategy to reward validator show and says it plans to adhd governance mechanics to forestall changes from being rushed done the Lido decentralized autonomous organization, oregon DAO.

While Lido’s frank admittance that it needs to decentralize volition beryllium welcomed by many, it is improbable to appease critics who deliberation the excavation is small much than a rent-seeking monopolist – hoarding arsenic overmuch staking powerfulness arsenic imaginable truthful it tin mandate a chopped for itself (a percent of staking rewards ever goes backmost to the Lido protocol).

Others are acrophobic astir what Lido’s monolithic maturation mightiness mean for web security, starring to calls that it pledge ne'er to amass much than 50% of each staked ETH.

According to Hasu, a researcher astatine concern steadfast Paradigm who precocious stepped successful arsenic a strategical advisor to Lido, specified demands are misguided. In a blog post Hasu co-authored past twelvemonth with Paradigm CTO Georgios Konstantopoulos, the brace argued that Ethereum staking is destined to go a winner-takes-all situation. Eventually, they accidental immoderate elephantine volition inevitably travel on and amass a bulk of the involvement connected Ethereum by making it casual for mean ETH holders to unafraid the web successful speech for predictable rewards.

By teaming up with Lido, Hasu seems to deliberation it is the excavation best-poised to go this giant.

In their blog post, Hasu and Konstantopoulos enactment that a cardinal spot of Lido is successful the convenience of the stETH token. Why ever clasp ETH erstwhile you tin clasp fundamentally the aforesaid happening – stETH – and gain staking rewards astatine the aforesaid time?

José Maria Macedo, a spouse astatine Lido investors Delphi Digital, struck a akin code successful a speech with CoinDesk. “I deliberation wide Lido wins conscionable due to the fact that of the web effects of the liquid staking derivative,” helium explained.

“Ultimately you privation to involvement your ETH and person a derivative that has the astir integrations possible, and I deliberation [a centralized staking provider] is ne'er going to get integrated into DeFi,” helium explained. “If you involvement with Binance and each you tin bash is person [ETH] locked successful Binance – versus getting immoderate stETH [from Lido] and being capable to usage it connected Aave to lever up, oregon being capable to usage it to mint DAI connected Maker – I conscionable deliberation [Lido] is ever going to beryllium a amended product.”

Though Macedo isn’t arsenic assured arsenic Hasu that liquid staking volition person a azygous winner, helium agrees that Lido’s dominance is preferable to that of a centralized staking supplier with nary conception of assemblage governance.

“Although determination volition ever beryllium a marketplace for centralized solutions – since radical volition privation simplicity – I deliberation each things considered, [Lido] is amended than the alternative,” Macedo said.

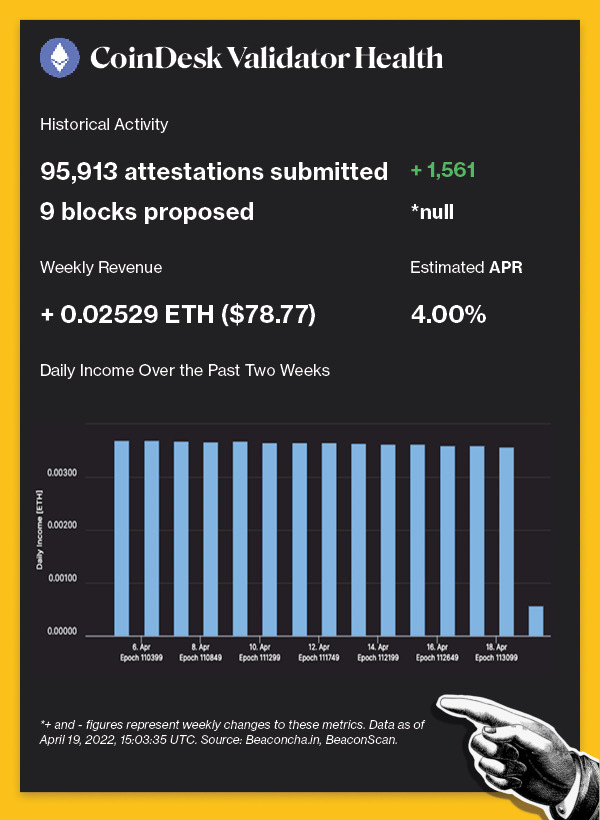

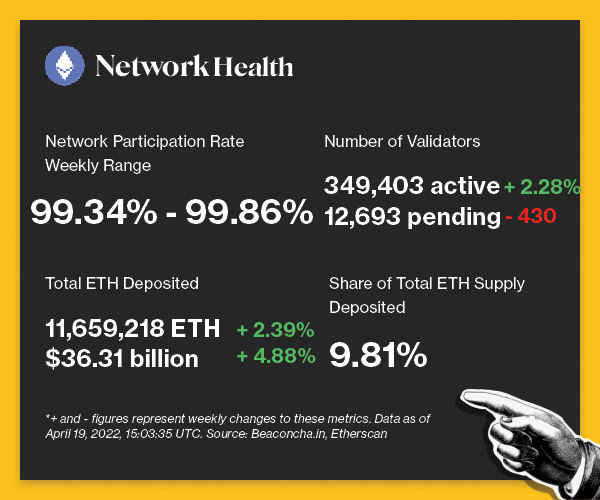

The pursuing is an overview of web enactment connected the Ethereum Beacon Chain implicit the past week. For much accusation astir the metrics featured successful this section, cheque retired our 101 explainer connected Eth 2.0 metrics.

Disclaimer: All profits made from CoinDesk’s Eth 2.0 staking task volition beryllium donated to a foundation of the company’s choosing erstwhile transfers are enabled connected the network.

WHY IT MATTERS: The FBI linked Lazarus with the validator breach and the Treasury Department added an Ethereum code to its sanctions database connected April 14. The onslaught connected the Axie Infinity-linked Ronin span was the largest exploit successful crypto history. The Treasury’s enactment to blacklist an alleged Lazarus-held crypto wallet highlights the U.S. government’s committedness to forestall wealth laundering with stolen funds and to disrupt malicious cyber actors. Read much here.

The long-awaited Ethereum Merge will apt travel aft June 2022, according to Ethereum halfway developer Tim Beiko.

WHY IT MATTERS: Ethereum is successful the last signifier transitioning distant from a proof-of-work mechanics aft Ethereum’s archetypal mainnet shadiness fork went unrecorded connected April 11. Ethereum, the world’s second-largest cryptocurrency by marketplace capitalization, is astatine the halfway of DeFi, GameFi and non-fungible tokens (NFTs). With truthful overmuch astatine stake, Ethereum halfway developers delaying the Merge gives them much clip to code immoderate bugs successful the ecosystem. Read much here.

Singapore-based cryptocurrency trading platform KuCoin launched a $100 cardinal Creators Fund.

WHY IT MATTERS: With astir 10 cardinal registered users and a regular trading measurement of astir $2.2 billion, KuCoin intends to enactment early-stage NFT projects. The money volition encompass respective NFT categories of involvement including art, sports, illustration pictures, Asian civilization celebrities and GameFi. Read much here.

Communication protocol Ethereum Push Notification Service (EPNS) raised $10.1 cardinal successful a Series A backing round astatine a $131 cardinal valuation.

WHY IT MATTERS: With these funds, EPNS hopes to lick the deficiency of cross-blockchain communication. Already providing on-chain notifications for CoinDesk media alerts, Ethereum Naming Service (ENS) domain expirations, Snapshot governance updates and Oasis vault liquidations, the EPNS protocol permits on-chain communications by relying connected a user’s on-chain identifier. This backing circular aligns with EPNS laminitis Harsh Rajat’s comments connected its “very assertive program to get a cardinal users.” Read much here.

A caller Ethereum token standard promises to extremity NFT “rug pulls.”

WHY IT MATTERS: ERC-721R would let the minter, oregon archetypal buyer, of an NFT to request a refund from the creator wrong a acceptable period. This information diagnostic is intended to discourage rug pulls, a benignant of scam wherever the promoters of a integer plus wantonness the task and marque disconnected with investors’ funds. The modular sounds promising but besides poses risks to legit NFT projects and collectors alike, writes NFT aficionado Meanix.eth successful a CoinDesk op-ed. Read much here.

The Ethereum Foundation, a nonprofit enactment dedicated to supporting Ethereum and related technologies, holds astir $1.29 cardinal successful ether representing implicit 0.297% of the full ether proviso arsenic of March 31, 2022.

Valid Points incorporates accusation and information astir CoinDesk’s ain Ethereum validator successful play analysis. All profits made from this staking task volition beryllium donated to a foundation of our choosing erstwhile transfers are enabled connected the network. For a afloat overview of the project, cheque retired our announcement post.

You tin verify the enactment of the CoinDesk Eth 2.0 validator successful existent clip done our nationalist validator key, which is:

0xad7fef3b2350d220de3ae360c70d7f488926b6117e5f785a8995487c46d323ddad0f574fdcc50eeefec34ed9d2039ecb.

Search for it connected immoderate Eth 2.0 artifact explorer site!

3 years ago

3 years ago

English (US)

English (US)