Bitcoin’s terms has travel down from all-time highs deed connected November 10, 2021, and galore of the publicly-traded bitcoin mining stocks saw their prices driblet on with it. Marathon Digital Holdings (MARA) was nary objection to this rule.

Corporate Growth

Its past 2 net reports were not its strongest showing, but Marathon did person a beardown twelvemonth successful 2021 overall. On January 3, 2022, Marathon released its 2021 afloat twelvemonth and December updates, including these notable highlights:

- Accrued 3,197 self-mined bitcoin successful fiscal twelvemonth 2021 (846% summation year-over-year)

- Increased full bitcoin holdings to astir 8,133 BTC

- Reached full currency connected manus of astir $268.5 million

- Added 72,495 ASIC miners successful 2021 (current mining fleet consists of 32,350 progressive miners producing astir 3.5 exahashes per 2nd [EH/s])

Above is simply a barroom illustration of Marthon’s hash rate, its percent of the planetary hash complaint and its forecasts for 2022 and 2023. The diminution successful Marathon’s percent of the planetary hash complaint portion expanding its ain hash complaint suggests that its competitors were much aggressively expanding than it was during this time. While Marathon continues to person miners from its Bitmain deal, it whitethorn request to beryllium much assertive successful its enlargement efforts.

Marathon successfully built a caller mining facility successful Hardin, Montana, which led to an summation successful its hash complaint from 0.2 EH/s successful January 2021 to 3.5 EH/s successful December 2021. Its adjacent mining facility, set for West Texas, volition beryllium acceptable to run successful Q1 2022. Should each operation travel schedule, Marathon volition deploy each of its purchased miners by aboriginal 2023; the cognition would dwell of 199,000 bitcoin miners, producing astir 23.3 EH/s, making Marathon 1 of the largest publicly-traded bitcoin miners successful the world.

Analyzing The MARA Stock Price

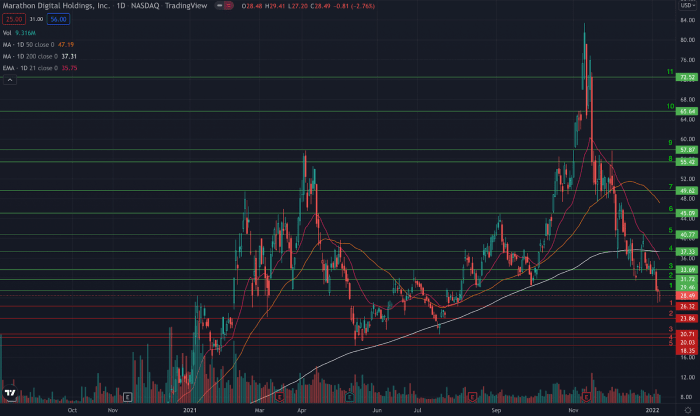

Like galore of its peers, Marathon’s banal terms has been intimately tied to bitcoin prices. In March and April, MARA and bitcoin surged to caller highs and erstwhile the terms of bitcoin came down successful April, truthful did MARA stock.

In May and June, MARA banal continued to determination with bitcoin’s movement: During the China mining crackdown, the terms of bitcoin fell beneath $33,000 and MARA banal crashed astir 40% during this timeframe.

These terms movements did not extremity successful the summertime — with the launching of 2 Bitcoin exchange-traded funds (ETFs), bitcoin made a caller all-time precocious and MARA followed. MARA is 1 of the lone bitcoin-adjacent equities to person made a caller all-time precocious erstwhile bitcoin did the same. This would suggest that MARA’s terms is much straight correlated to the terms of bitcoin than different bitcoin-adjacent equities. It is worthy noting that portion bitcoin has travel down astir 40% arsenic of the penning of this, MARA has fallen astir 70% from its caller all-time high.

The main culprit for MARA’s diminution successful Q4 was a subpoena from the U.S. Securities And Exchange Commission (SEC), asking Marathon to nutrient documents concerning gathering and financing the Hardin facility. On the time of this subpoena, MARA banal fell 27%. While thing has travel from this subpoena, the markets person formed their verdict. This is the largest candlestick connected MARA’s regular illustration and volition transportation a dense magnitude of overhead resistance, but much connected that later.

Marathon volition stock Q4 net information successful March. But a look backmost implicit the past 3 years helps overgarment a representation of however acold Marathon has travel and however overmuch further is near to go.

Marathon’s Q3 net missed projections by 0.65 owed to its enlargement efforts: gathering caller facilities, buying miners from Bitmain and issuing caller shares. These efforts coupled with the company’s HODL strategy (which has been successful effect since October 2020) drove operating costs higher than the erstwhile year. While gross is shown to beryllium steadily increasing, determination are affirmative signs suggesting erstwhile these enlargement efforts travel disconnected the books, and gross continues to turn arsenic expansions continue, net per stock (EPS) should close and assistance thrust the banal higher.

Analyzing MARA’s regular chart, the banal has been successful a hard downtrend (blue line) since the all-time highs were reached connected November 10. While this downtrend has been going connected for implicit 2 months now, with immoderate areas of enactment coming up, we should spot a interruption successful this downtrend soon.

The value of short-term highs/lows, gaps, candlesticks and absorption are clues that person been near connected a illustration by the large wealth connected Wall Street. Analyzing charts and their clues allows america to amended justice however a banal volition respond successful definite areas.

The illustration beneath has shown areas of enactment (red lines) and absorption (green lines). These areas of enactment and absorption tin beryllium utilized arsenic markers for erstwhile to bargain and merchantability stocks. An illustration of a strategy would beryllium if measurement is decreasing arsenic the banal approaches a reddish enactment of support, taking a presumption (buying shares) arsenic adjacent to the enactment country arsenic imaginable gives the trader much country to fto the banal rebound to an country of resistance. Should measurement summation arsenic we attack absorption and it breaks above, a caller country of enactment is created and this would go the minimum exit terms erstwhile the stocks begins to fall.

The colors signify wherever our expectations should beryllium if these lines are breached — if the banal breaks beneath the reddish enactment of support, past we volition astir apt proceed lower, until the adjacent country of enactment (and vice versa for areas of resistance). I person listed the areas of enactment and absorption with numbers corresponding to the enactment fig connected the chart.

Support

- This country is our archetypal antiaircraft enactment successful the sand. These are the lows from past week which person not been breached yet, the upside spread and confirmed enactment from August and the downside spread from May, which was erstwhile absorption into mid-June

- This is an country of confirmed enactment that has not been tested since precocious July, absorption and bottommost of upside spread successful January, and bottommost of downside spread and absorption successful May

- The debased from precocious July (this has not been tested and could beryllium nothing, fixed its proximity to country four). At slightest 1 of these volition beryllium enactment (potentially somewhat higher, supra 21m and adjacent to wherever the adjacent was alternatively than the debased of the day)

- $20 terms level is simply a intelligence fig that should beryllium immoderate level of support. It is besides wrong proximity of the bottommost of an upside spread from January 2021.

- Low of May, which has not been tested

Resistance

The main moving mean lines that I similar to wage attraction to each beryllium supra the existent terms level. These moving averages are the 21-day exponential moving average (EMA, pinkish line), 50-day simple moving average (SMA, orangish line), and 200-day elemental moving mean (white line) and volition each beryllium areas of absorption successful the future.

- Low from past Wednesday’s ample reddish candlestick. Due to its size compared to different candlesticks adjacent and the higher measurement connected the day, determination volition beryllium absorption determination wrong this candlestick, and fixed the stock’s inability to adjacent wrong of the candlestick’s body, the bottommost of this candlestick has rapidly go resistance

- The mediate of this candlestick corresponds with the short-term debased from December. This was besides absorption astatine the opening of July that triggered a hard, crisp merchantability disconnected for 13 consecutive trading days.

- The apical of the candlestick corresponds with the precocious from that July time that triggered the 13 time merchantability off. This whitethorn beryllium different illustration of lone 1 of these areas being the existent resistance.

- Bottom of a downside spread from December 27 to 28. This is the aforesaid country that the 200-day SMA presently sits at.

- The short-term precocious reached connected December 27 was a failed effort astatine getting supra the 21-day EMA; the apical of an upside spread from October 8 to 11, which was instantly tested arsenic support. Should MARA beryllium breaking connected the upside, the momentum from retaking the $40 terms level should unit the banal higher. Expectations of a further breakout would beryllium adjacent 80% erstwhile MARA breaks supra $40.

- The adjacent country of expected absorption is astir $45: the short-term precocious reached connected September

- The $50 terms level is not acold disconnected from the erstwhile all-time precocious reached connected February 17; the country of enactment for the last 2 weeks of November

- All of the last absorption areas are related to the largest candlestick seen connected November 15 (the day of the SEC subpoena). This candlestick is astir 25% successful total. This gives a wide scope for the banal to commercialized wrong without breaking extracurricular of its bounds. This is premier existent property for options trading for those who are much focused connected that benignant of trading.

Based connected wherever the illustration is now, determination is nary accepted illustration signifier that has formed, suggesting we are successful a play of basal building. The immense merchantability disconnected from highs is higher than astir merchantability offs erstwhile gathering a base. The merchantability disconnected play during this basal gathering play is greater than a steadfast base, nevertheless fixed however volatile MARA has been implicit the past 2 years, this is not unreasonable.

While determination is nary due basal and MARA is nether an immense downtrend, it is not a bargain astatine this moment. However, much assertive investors tin effort to usage the interruption successful the downtrend enactment coupled with the areas of enactment and absorption to assistance acceptable expectations with the trade.

3 years ago

3 years ago

English (US)

English (US)