The pursuing nonfiction is an sentiment portion and is not intended to beryllium fiscal advice.

“Ask yourself: Is bitcoin going up much than 3% each year? Then it is simply a mistake not to maximize your vulnerability astatine the existent complaint of inflation. Any indebtedness you tin rotation guardant for a tenable magnitude of clip is good. A indebtedness with a 10- to 15-year owe against your spot is simply a no-brainer.” — Michael Saylor

Bitcoin is the champion security against inflation. The continuous issuance of wealth by cardinal banks has debased fiat currencies, destroying their purchasing power. More than one successful 5 dollars was created successful 2020 and 2021.

Data from the Federal Reserve shows that a wide measurement of the banal of dollars, known arsenic M2, rose from $15.4 trillion astatine the commencement of 2020 to $21.18 trillion successful December 2021. M2 is simply a measurement of the wealth proviso that includes cash, checking and redeeming deposits and easy convertible adjacent wealth similar treasury bills and wealth marketplace funds. The summation of $5.78 trillion equates to 37.53% of the full proviso of dollars.

Bitcoin, which is constricted successful supply, increases successful terms arsenic marketplace participants are looking for a bully store of worth to support their wealth against ostentation and authorities confiscation. This was illustrated by the caller spike successful the ruble/bitcoin trading brace with measurement expanding arsenic Russians looked to circumvent sanctions imposed by the planetary assemblage due to the fact that of the Russian penetration of Ukraine connected Thursday, February 24, 2022.

Bitcoin has outperformed astir assets successful the bequest strategy implicit the past decennary and volition astir apt proceed to bash so. Bitcoin exhibits the qualities of dependable wealth — scarcity, durability, divisibility, portability and fungibility — similar nary different monetary plus successful history. The ultimate characteristics of bitcoin perpetually summation the likelihood that it volition proceed to outcompete golden and fiat currencies via the Lindy effect, a mentation that the longer immoderate nonperishable happening survives, the much apt it is to past successful the future. We whitethorn presume that bitcoin’s terms increases 60% to 70% per twelvemonth going guardant for the medium term.

Every minute, hour, time and twelvemonth that bitcoin survives increases its chances of continuing into the aboriginal arsenic it garners much spot and survives much shocks. It is besides worthy noting this goes hand-in-hand with the spot of antifragility, wherever thing becomes much robust oregon stronger with each onslaught oregon clip the strategy is nether immoderate signifier of stress. Due to the inherent properties of bitcoin, immoderate sensible marketplace subordinate volition (and should) maximize their exposure to bitcoin implicit time.

The astir evident happening to bash is to bargain bitcoin. However, this strategy is constricted to the disposable liquidity. In addition, the existing liquidity tin beryllium tied up successful responsibilities. For example, a existent property capitalist needs to beryllium liquid successful fiat to person capable currency connected manus to conscionable fiscal obligations, specified arsenic spot attraction oregon slope liabilities. Consequently, the task is to summation the superior disposable to bargain bitcoin without putting yourself successful a susceptible position. If you person accumulated wealthiness successful the existing bequest system, you tin usage your assets arsenic collateral to incur fiat-denominated debt. Buy bitcoin and wage disconnected the indebtedness with currency travel from your assets oregon bitcoin’s terms appreciation.

For some, astir apt many, it seems risky to instrumentality connected indebtedness to bargain bitcoin erstwhile the other is true. Borrowing fiat-denominated indebtedness to bargain bitcoin is 1 of the top concern opportunities of our lives. Debt denominated successful fiat that you instrumentality connected contiguous volition suffer worth successful the aboriginal portion the terms of bitcoin rises. In addition, involvement rates are presently low.

Bitcoin’s entreaty comes from the information that its monetary argumentation is incorruptible and unalterable. There volition ne'er beryllium much than 21,000,000 bitcoin. This means that those radical that voluntarily take to instrumentality connected indebtedness successful an inflating currency successful favour of a disinflationary and dependable currency volition beryllium capable to accumulate semipermanent oriented capital astatine a disproportionate complaint to those who bash not.

USD/SAT Historical Performance. A sat (satoshi) is the smallest denomination of bitcoin, equivalent to 100 millionth of a bitcoin (Source).

Michael Saylor, CEO of bundle quality steadfast MicroStrategy, has brilliantly laid retired a blueprint of techniques for utilizing fiat indebtedness to bargain bitcoin.

In August 2020, Saylor famously announced MicroStrategy’s archetypal bitcoin purchase, stating that the institution had converted $250 cardinal from its currency holdings to much than 21,000 bitcoin. By precocious September the aforesaid year, Saylor converted an additional $175 cardinal dollars into bitcoin, efficaciously converting 100% of MicroStrategy’s currency presumption into bitcoin.

MicroStrategy announced the closing of its “bond offering” of elder secured notes owed 2028 with the volition of utilizing the proceeds to bargain bitcoin connected June 14, 2021. The aggregate main magnitude of the notes sold successful the offering was $500 cardinal and the notes carnivore involvement astatine an yearly complaint of 6.125%. The notes were sold successful a backstage offering to qualified organization buyers.

The notes are afloat and unconditionally guaranteed connected a elder secured basis, jointly and severally, by MicroStrategy Services Corporation. The notes and the related guarantees are secured, connected a elder secured ground with MicroStrategy’s existing and aboriginal elder indebtedness, by information interests connected substantially each of MicroStrategy’s and the guarantors’ assets. This includes immoderate bitcoin oregon different integer assets acquired connected oregon aft the closing of the offering, but excluding MicroStrategy’s existing bitcoin arsenic good arsenic bitcoin and integer assets acquired with the proceeds from existing bitcoin.

In parallel, MicroStrategy announced a $1 cardinal banal offering. The institution utilized the proceeds from the merchantability of its Class A communal banal to get adjacent much bitcoin. In total, MicroStrategy completed 17 bitcoin purchases. At the clip of writing, the institution holds 125,051 bitcoin for which it has paid a full of $3.78 billion, with an mean acquisition terms per bitcoin of astir $30,200. MicroStrategy’s existing bitcoin is being held by a recently formed subsidiary, MacroStrategy LLC.

Although Michael Saylor bought bitcoin late, helium understands the worth of bitcoin precise well. It is integer golden for the integer age. It is simply a intent built wealth for the integer property — permissionless, open-source, dependable and global. Bitcoin is casual to buy, store and sell. High successful liquidity and tradable 24/7.

Bitcoin has a unsocial worth proposition. Bitcoin arsenic a protocol for exchanging worth allows you to straight ain portion of it. The Bitcoin web is simply a transaction processing system. From transaction processing comes the quality to speech money, which is bitcoin the asset, the currency that represents the worth of the underlying system. It is some a outgo web and an asset, backed by the astir resilient machine web successful the world. If you could ain portion of the internet, would you accidental no?

The volatility successful bitcoin is earthy to commodities. We observe akin terms patterns successful golden and oil. Bitcoin's volatility is much utmost arsenic it is the archetypal globally traded asset, but arsenic its marketplace headdress increases, its volatility decreases.

The volatility is beardown day-to-day, but implicit 5 years, nary 1 who has held for the full play has ever mislaid money, adjacent the radical that bought astatine marketplace tops. Anyway, the volatility allows for large introduction points. More important is the liquidity and accessibility of bitcoin. Saylor has said, “Try to merchantability $100 cardinal worthy of golden connected a Saturday connected your iPhone … I stake that won’t work.”

In addition, the volatility is to the upside. The volatility of a deflationary plus is preferable to the little volatility of an inflationary asset.

Leveraging Your Assets

If you recognize the worth proposition of bitcoin, you could bash what Saylor did. Look astatine your assets successful the bequest strategy and leverage the semipermanent worth of those assets into bitcoin. Do you ain a business? You tin get wealth with the institution and wage the involvement with net from the company. Do you ain existent estate? Use the existent property arsenic collateral to get wealth and wage backmost the indebtedness with the rental income. It's champion to talk straight to a Bitcoin-friendly slope due to the fact that you don't person to explicate bitcoin's worth proposition. However, a slope does not needfully privation to cognize the intent of a indebtedness if the collateral that secures it has a bully currency flow, for example, a spot with bully rental income. I inactive deliberation it's important to beryllium transparent erstwhile the slope asks for it. This should beryllium assessed connected a case-by-case basis.

Since bitcoin is precise volatile, you indispensable beryllium careful. Price declines of 40–60% hap regularly successful bitcoin. Don't marque yourself susceptible to terms fluctuations. You indispensable woody with volatility, truthful support the loan-to-value (LTV) low. I suggest a loan-to-value ratio of 10–25%. In addition, a indebtedness should lone beryllium taken retired if bitcoin experiences a important driblet successful price, arsenic the hazard of a further driblet successful bitcoin’s terms is importantly reduced. A indebtedness should person a minimum word of astatine slightest 5 years, ideally 10 oregon 15 arsenic bitcoin carnivore markets tin historically past up to 3 years. This strategy applies to some individuals and companies.

I volition amusement however effectual this strategy is utilizing the illustration of a spot owned by a medium-sized existent property improvement company:

Company A builds and owns a 68-unit flat building. The spot brings successful yearly rental income of $750,000. A slope volition mostly worth the spot based connected 20 times the yearly rental income multiplier, i.e., $15,000,000. Typically, the operation of specified a spot was financed by a bank. Company A could use for an further $2,000,000 indebtedness with a 10-year word and 5% interest, i.e., $100,000, with the spot arsenic collateral from the slope that financed the operation of the property. The indebtedness would correspond to astir 13.3% of the collateral.

Company A volition usage the rental income from the spot to work the yearly involvement charge.

This leaves much than capable rental income to work existing obligations, including the involvement complaint connected the archetypal operation indebtedness and the proviso for immoderate costs that whitethorn arise, without creating unnecessary further risks.

Rental income ($750,000) minus 5% yearly involvement complaint ($100,000) equals $650,000.

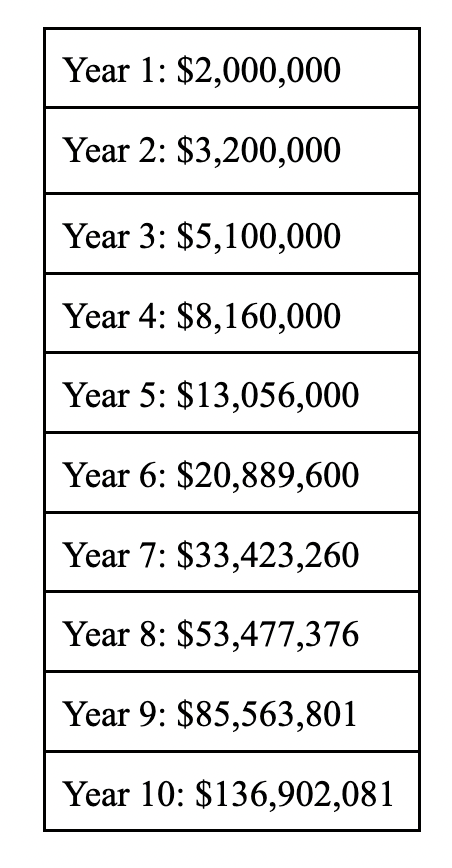

Assuming that bitcoin grows astatine a 60% yearly rate-of-return, aft 10 years, the bitcoin acquired with the indebtedness volition person the pursuing value:

The imaginable worth of a $2 cardinal dollar bitcoin bargain if the terms appreciates astatine a 60% yearly rate-of-return.

However, this would mean that the worth of bitcoin, presently astir $42,000, volition emergence to implicit $2,600,000 successful 10 years. For maine arsenic a Bitcoiner, this terms is likely, particularly considering that astir 10 years ago, the closing terms for bitcoin connected December 31, 2012, was $13.45. But I don't deliberation bitcoin volition make arsenic rapidly due to the fact that it's simply a substance of bigger sums present to spot specified growth, that would necessitate a fig of nation-states to follow bitcoin arsenic a reserve currency, which volition astir apt instrumentality much clip to play out.

We should, therefore, headdress the bitcoin terms astatine $1,000,000 by 2030. These assumptions are based connected a bitcoin terms prediction by ARK Invest.

Assuming a bitcoin terms of $38,000 from the clip this nonfiction was written, Company A tin bargain 52.63157894 bitcoin with $2,000,000 ($2,000,000 divided by $38,000). Assuming bitcoin grows to a terms of $1,000,000 by and aft 2030, the bitcoin purchased with the indebtedness volition beryllium worthy astir $52,631,579 aft 10 years.

No 1 tin foretell the future, but we tin safely presume that the adoption of bitcoin has reached the constituent of nary return. This has been confirmed by the acceptance of bitcoin arsenic ineligible tender successful El Salvador and its inclusion connected a fig of equilibrium sheets by Nasdaq-listed companies specified arsenic Tesla and MicroStrategy.

Its usage lawsuit arsenic a integer store of worth implies that continuous adoption is accompanied by a continuous summation successful price. There is simply nary amended exertion than Bitcoin that fulfills the relation of a integer store of value. Just arsenic humanity ne'er went backmost to horses aft the improvement of cars, we volition not halt utilizing bitcoin and instrumentality to an inferior currency similar the U.S. dollar, golden oregon U.S. Treasuries arsenic a store of value.

We can, therefore, reason that Company A, with a debased loan-to-value of astir 13.3% and an involvement load that does not impact unnecessary risk, tin marque an above-average concern by taking connected the fiat-denominated indebtedness and buying bitcoin.

In a aboriginal article, I volition amusement however Company A tin marque usage of the bitcoin they clasp arsenic a effect of acquiring the bitcoin arsenic illustrated above.

For further resources visit:

Pomp Podcast #385: “Michael Saylor On Buying Bitcoin With His Balance Sheet”

Bitcoin Strategy with Michael Saylor, CEO of MicroStrategy

This is simply a impermanent station by Leon A. Wankum. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)