Cover art/illustration via CryptoSlate

New protocols are perpetually coming online successful DeFi, with protocols utilizing stablecoins being the astir common. There are presently implicit 70 stablecoins successful circulation, but nary protocol supports each stablecoins.

Because anchoring the aforesaid plus successful antithetic protocols tin look arsenic antithetic tokens, users often request to swap betwixt these tokens. mStable is built to lick this problem.

What is mStable?

mStable is an Ethereum-based stablecoin aggregation protocol, minting a handbasket of underlying assets, bAsset (Basket Asset, e.g. USDT, DAI), into mAsset (e.g. mUSD, mBTC) with definite weighting done astute contracts. Currently the meta-assets that tin beryllium minted are mUSD anchored by USD and mBTC anchored by BTC.

mStable is designed to lick the pursuing 3 problems.

- Significant fragmentation erstwhile anchoring the aforesaid plus and mediocre idiosyncratic experience. mStable wants to lick the occupation of utilizing the same-peg assets successful antithetic protocols but perpetually swapping betwixt them.

- Lack of output for assets. Increase idiosyncratic gross done the Save diagnostic and involvement for further MTA rewards oregon different level token rewards.

- Lack of extortion against imperishable nonaccomplishment of pegged assets. In examination to a azygous stablecoin, mUSD is made up of aggregate stablecoins, which spreads retired the losses caused by utmost risks successful a azygous stablecoin. mTA besides activates a extortion mechanics to re-anchor the USD successful the lawsuit of a de-anchoring.

mStable provides a one-stop solution to the supra problems done 3 sections: Save, Pools and Swap.

- Save

Users tin gain involvement erstwhile depositing mUSD oregon mBTC. The APY connected stablecoins successful the past 90 days has been arsenic precocious arsenic 44% down to 4%.

The root of involvement is earned done lending protocols specified arsenic Compound oregon Aave, arsenic good arsenic fees for users to redeem and swap connected the platform.

Users tin prevention mUSD with 10 antithetic tokens (including nonstop deposit to mUSD, oregon to USDC, DAI, FEI, ETH, etc.), and likewise for mBTC with 7 tokens.

Users tin deposit non-mAsset assets past the protocol tin straight mint them oregon swap them for mUSD/mBTC. Upon deposit the idiosyncratic volition person imUSD/imBTC, oregon the idiosyncratic tin deposit assets straight into the Vault to person the protocol’s token reward MTA.

- Pools

Users supply liquidity to the excavation of mStable to gain swap fees. Direct deposits into the Vault besides gain MTA rewards, with one-third of the MTA disposable instantly and the remaining two-thirds are streamed linearly aft 26 weeks.

Liquidity providers tin boost net up to 3x by staking MTA. Current reward APY is up to 41.3%, but astir pools person little than $3 cardinal successful liquidity.

Since some assets of the mStable pool’s pairs are anchored to USD stablecoins oregon BTC, making the excavation is fundamentally immune to the hazard of impermanent loss.

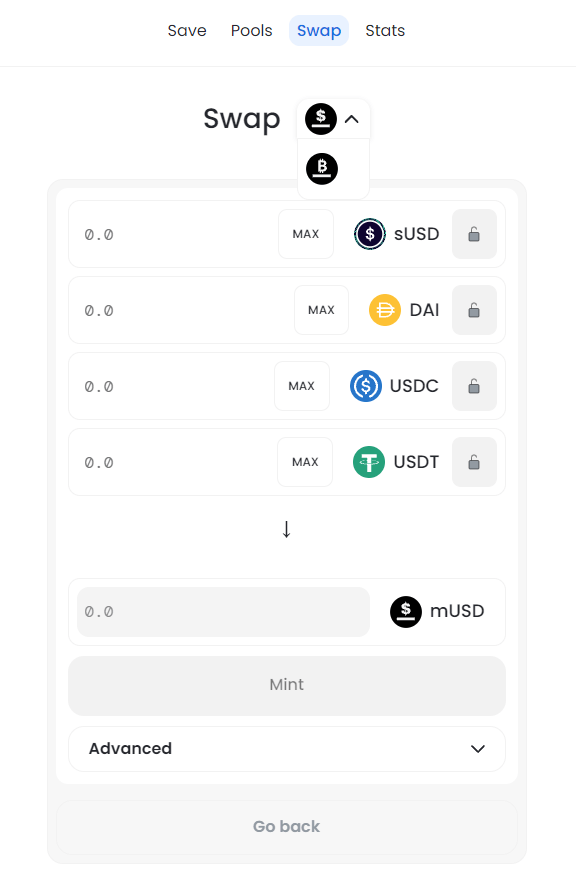

- Swap

In Swap, users tin rapidly swap, mint oregon redeem mAssets straight betwixt tokens anchored to the aforesaid asset.

mStable supports nonstop minting to mUSD for 4 assets (sUSD, DAI, USDC and USDT), and to mBTC for 3 assets (WBTC, renBTC, sBTC), with minting and redemption prices predetermined by a formula. The terms takes into relationship the value of the plus successful the basket, the little the value the much mAssets are minted, this mounting gives the idiosyncratic the accidental to arbitrage.

(Source – mStable)

(Source – mStable)Tokenomics

- mUSD

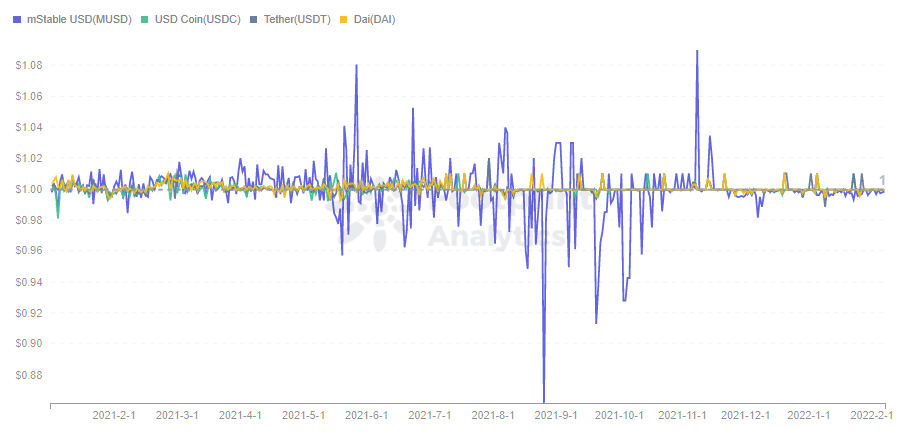

According to Footprint Analytics, mUSD’s terms experienced respective flimsy de-anchors successful the 2nd fractional of 2021, portion its underlying bAsset’s terms volatility was mostly stable. It is wide that mUSD is little unchangeable than different fashionable stablecoins, and its terms gradually stabilized aft December.

Footprint Analytics – mUSD Token Price

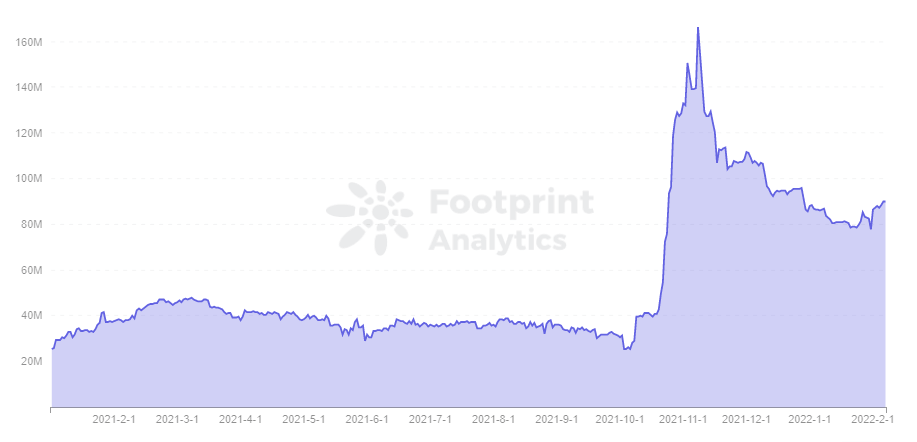

Footprint Analytics – mUSD Token PricemUSD’s marketplace headdress is successful enactment with the ascent of mStable TVL successful October, presently minted astatine $90 million. However, TVL and mUSD’s marketplace headdress person fallen backmost arsenic the platform’s APY has declined.

Footprint Analytics – mUSD Market Cap

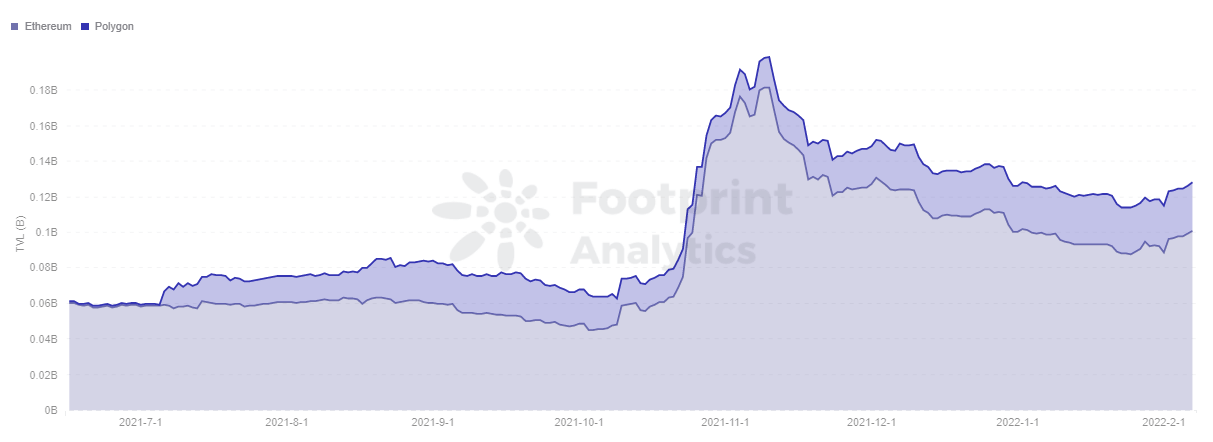

Footprint Analytics – mUSD Market Cap Footprint Analytics – mStable TVL

Footprint Analytics – mStable TVL- MTA

The MTA acts arsenic a governance token for mStable and has 3 functions.

- Incentivize mStable liquidity

In bid to thrust much users to mint the mAsset and supply liquidity, 20% of the MTA is utilized to reward contributors successful the aboriginal stages.

- Governance platform

Users who involvement MTA tin enactment successful the governance of the level and person the close to ballot astir the level including parameters specified arsenic redemption fees, reward distribution, bAsset creation and weighting.

- Source of protocol re-collateralization

Provides a extortion mechanics for the mAsset to support a unchangeable anchor. When a deviation from the anchor occurs that is under-collateralized, the level removes the de-anchored asset. mStable volition merchantability the MTA to acquisition the mAsset, past pain it to marque mAsset afloat collateralized. This is akin to the relation of MKR successful MakerDAO successful the lawsuit of a collateral shortfall.

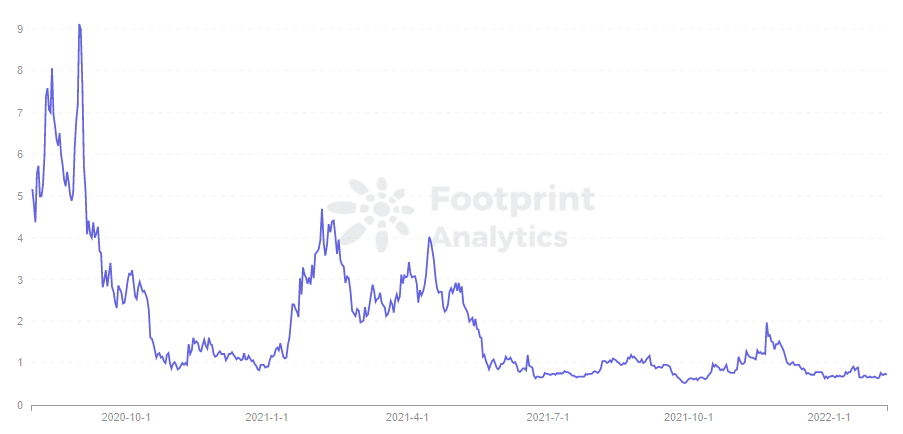

Footprint Analytics – MTA Token Price

Footprint Analytics – MTA Token PriceIs minting mAssets redundant?

Users purpose to get higher yields successful a elemental way. Is it redundant to mint a caller stablecoin successful mStable by spending state fees for a stablecoin already held, oregon is it a advancement of stablecoin application?

There are 3 aspects for mStable to consider:

- In presumption of information and stability, mUSD prices are intelligibly much volatile than its bAssets. mUSD is inactive exposed to the centralization issues arsenic the underlying bAsset are mostly centralized stablecoins. Since the stableness of algorithmic stablecoins is overmuch little than centralized and over-collateralized stablecoins, the hazard of de-anchoring whitethorn beryllium greater if algorithmic stablecoins are added.

- In presumption of convenience, mUSD is inactive missing from galore fashionable protocols and is not yet achieving its archetypal intent successful utility.

- In presumption of extent of pools, mStable has created 2 pools connected Balancer, USDC/mUSD and WETH/mUSD, which became the archetypal and 5th largest pools successful 2020 done treble token rewards. But with decreasing rewards, the extent of mStable’s excavation is shrinking.

With the improvement of DeFi, it is believed that the concern of stablecoins volition beryllium dominated by a almighty 1 oregon aggregated stablecoins. mStable has discovered the symptom points of users successful advance, though it inactive seems to beryllium a agelong mode to go, the aboriginal volition beryllium promising if it keeps going.

What is Footprint Analytics

Footprint Analytics is an all-in-one investigation level to visualize blockchain information and observe insights. It cleans and integrates on-chain information truthful users of immoderate acquisition level tin rapidly commencement researching tokens, projects and protocols. With implicit a 1000 dashboard templates positive a drag-and-drop interface, anyone tin physique their ain customized charts successful minutes. Uncover blockchain information and put smarter with Footprint.

Footprint Website: https://www.footprint.network

Discord: https://discord.gg/3HYaR6USM7

Twitter: https://twitter.com/Footprint_DeFi

Telegram: https://t.me/joinchat/4-ocuURAr2thODFh

Youtube: https://www.youtube.com/channel/UCKwZbKyuhWveetGhZcNtSTg

CryptoSlate Newsletter

Featuring a summary of the astir important regular stories successful the satellite of crypto, DeFi, NFTs and more.

Get an edge connected the cryptoasset market

Access much crypto insights and discourse successful each nonfiction arsenic a paid subordinate of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

3 years ago

3 years ago

English (US)

English (US)