In his latest method analysis, seasoned crypto expert Christopher Inks offers a elaborate look astatine the existent Bitcoin marketplace operation done a broad illustration analysis. The chart, precocious shared connected X, shows Bitcoin’s terms movements alongside respective cardinal method indicators and levels that could awesome a imaginable reversal from its bearish trend.

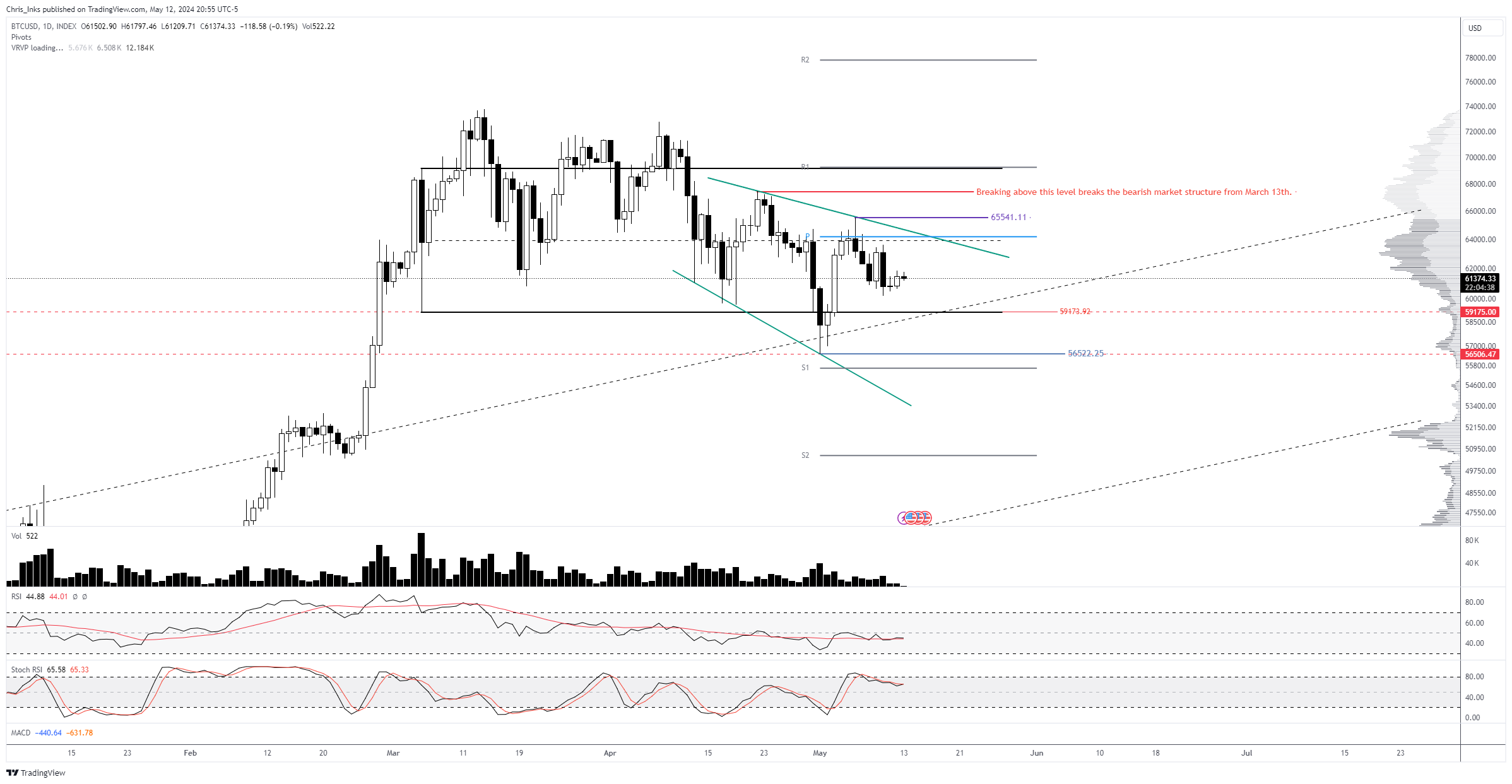

The expert illustrates Bitcoin’s terms enactment with regular candlesticks implicit the past fewer months, pinpointing important enactment (S1, S2) and absorption (R1, R2) levels. As of property time, Bitcoin traded astatine astir the $63,000 mark, encapsulated by 2 descending inclination lines which correspond a bearish marketplace structure.

Bitcoin terms investigation | Source: X @TXWestCapital

Bitcoin terms investigation | Source: X @TXWestCapitalThe Bottom Signal For Bitcoin

“We inactive privation to spot a breakout supra the noted level to awesome a interruption successful the bearish marketplace operation that began astatine the ATH,” Inks stated. This level is of paramount value due to the fact that it serves arsenic a junction of aggregate method elements: the regular pivot point, the precocious descending greenish absorption line, and the two-month scope equilibrium.

According to Inks, “an impulsive breakout and adjacent supra the regular pivot/descending greenish resistance/2-month scope EQ confluence country volition awesome that the debased is apt in.” This suggests that overcoming this obstruction could herald the extremity of the bearish marketplace operation that commenced from the all-time high.

If this absorption breaks, the adjacent large absorption is located astatine $65,541. Afterwards, $68,000 could beryllium connected the cards. “Breaking supra this level breaks the bearish marketplace structure from March 13th,” according to Inks. Then, R1 astatine $69,000 and R2 astatine astir $78,000 could beryllium the adjacent targets.

On the downside, the astir important enactment is astatine $56,522. It represents the little bound that Bitcoin needs to support to forestall a caller low, which would exacerbate the bearish sentiment.

Inks articulates the value of this support, noting, “If we tin people a higher debased now, which would necessitate a breakout supra the $65.541 level without printing a caller debased beneath $56,522, past that would truly adhd enactment for the thought that the bottommost is successful and a new ATH is incoming.”

This connection underlines the necessity for Bitcoin to clasp supra this enactment to debar further declines and stabilize wrong its existent range. If BTC breaks beneath the pivotal support, the terms could beryllium headed beneath $56,000 (S1) and $50,90 (S2).

Notably, the investigation is supported by a assortment of method indicators. The Relative Strength Index (RSI), hovering astir the neutral 50 mark, suggests a balancing enactment betwixt bullish and bearish forces. The RSI’s presumption indicates that the marketplace is neither overbought nor oversold, leaving country for imaginable upward question if bullish signals strengthen.

The Moving Average Convergence Divergence (MACD) presently shows that the MACD enactment is beneath the awesome line, a accepted bearish sign. However, the proximity of these lines besides hints astatine a imaginable upcoming bullish crossover, should the momentum shift.

The Stochastic RSI besides indicates imaginable for question successful either absorption but is peculiarly utile for identifying erstwhile Bitcoin mightiness beryllium entering overbought oregon oversold territories, which are captious for predicting short-term terms reversals.

Inks besides commented connected the market’s dynamics, stating, “The positives of the scope are that proviso has continued to alteration passim the bearish marketplace structure.” This reflection suggests that diminishing supply, paired with maintaining cardinal enactment levels, could assistance stabilize and perchance summation Bitcoin’s price.

At property time, BTC traded astatine $62,902.

BTC price, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC price, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)