The marketplace saw a melodramatic Bitcoin terms driblet implicit the past 2 days, plunging from a precocious of $64,500 connected Sunday to a debased of $58,474. Yesterday’s steep diminution followed an unexpected announcement from the trustee of the defunct Mt. Gox exchange, revealing plans to commence BTC and BCH payouts successful aboriginal July—a determination that has sent shockwaves done the market.

This quality raises urgent questions astir the contiguous aboriginal of Bitcoin’s terms trajectory. Amidst this marketplace turmoil, respective salient cryptocurrency analysts person weighed in, offering their insights connected whether Bitcoin could beryllium nearing a section bottom. Here is simply a deeper dive into their investigation and perspectives:

Bitcoin Technical Analysis

Tony “The Bull” Severino, Chief Analyst astatine NewsBTC, provided a method breakdown of the existent situation. Utilizing the Relative Strength Index (RSI), a momentum oscillator that measures the velocity and alteration of terms movements, Severino pointed retired that the RSI levels are present arsenic oversold arsenic they were during the collapse of FTX, suggesting a imaginable cyclical bottom.

“Bitcoin’s regular RSI is arsenic oversold arsenic during the FTX collapse, indicating a cyclical bottommost mightiness beryllium forming,” said Severino. This investigation implies that, historically, specified levels person often preceded a rebound oregon astatine slightest a stabilization successful price.

Bitcoin method investigation | Source: X @tonythebullBTC

Bitcoin method investigation | Source: X @tonythebullBTCVolume And Market Behavior

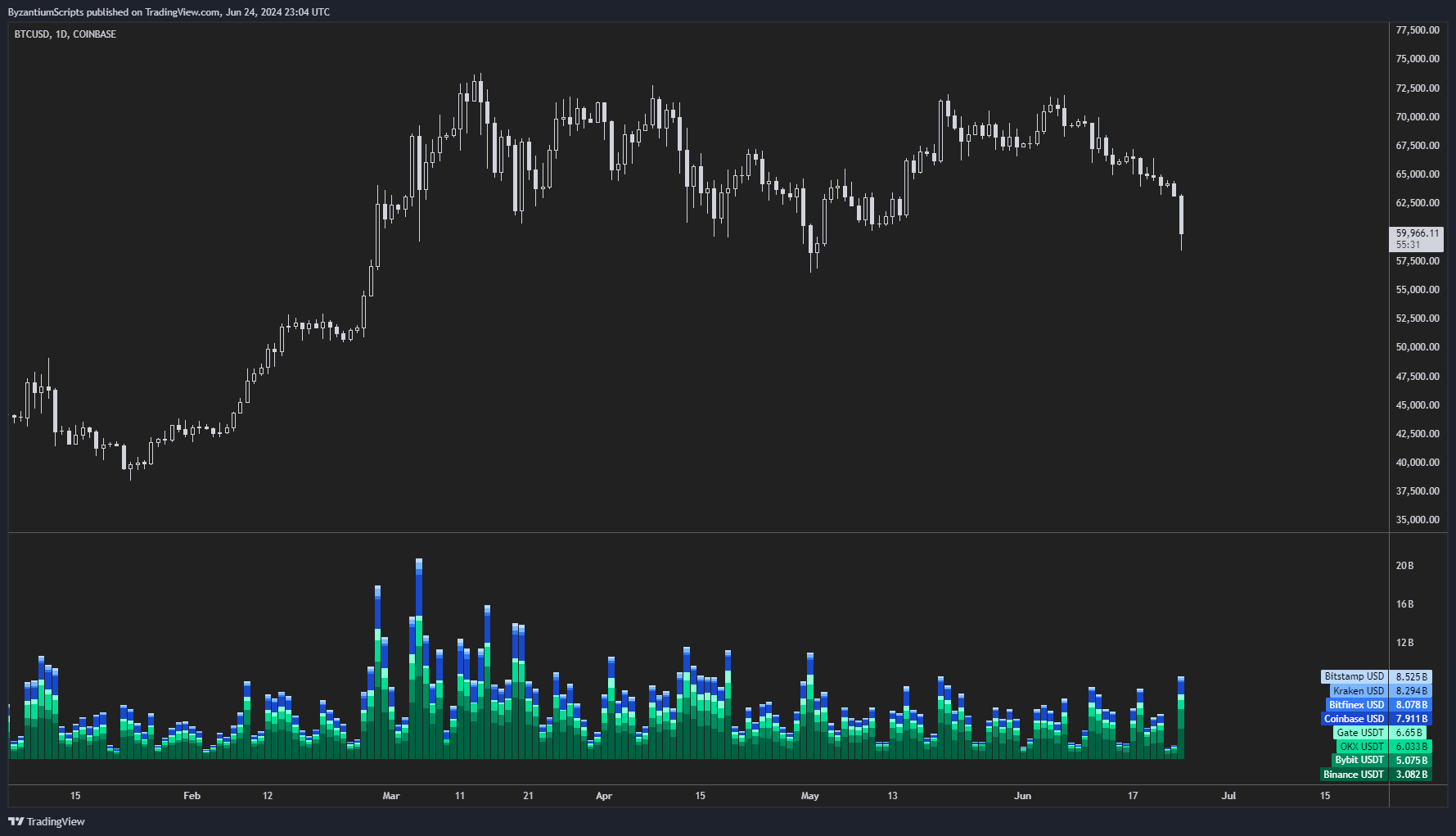

The Byzantine General, a trader and marketplace strategist, noted the unusually precocious spot measurement accompanying the terms drop. “We’re seeing importantly precocious spot volume, which historically tin awesome a local bottom,” helium remarked. High trading volumes during a terms driblet tin bespeak panic selling, which often exhausts itself starring to imaginable recovery.

Bitcoin measurement investigation | Source: X @ByzGeneral

Bitcoin measurement investigation | Source: X @ByzGeneralSocial Media Sentiment

Santiment, an analytics level focusing connected societal metrics, observed a spike successful discussions astir the word “bottom” crossed assorted societal media platforms. “This is 1 of the highest spikes successful societal measurement and dominance for the connection ‘bottom’ we’ve observed successful the past year,” they reported. Historically, specified spikes tin signify heightened marketplace attraction that whitethorn correlate with pivotal marketplace movements.

Bitcoin sentiment | Source: X @santimentfeed

Bitcoin sentiment | Source: X @santimentfeedHistorical Patterns And Technical Indicators

Teddy (@TeddyCleps), a cryptocurrency trader, emphasized the value of humanities patterns and circumstantial method indicators specified arsenic the 21-week Exponential Moving Average (EMA). “Historically, each correction successful the BTC bull tally has touched the 21-week EMA earlier rebounding. We’re approaching this indicator; if past is immoderate guide, $61k could correspond the bottom,” Teddy explained. The 21-week EMA is simply a cardinal method level watched by galore traders for signs of semipermanent inclination support.

On-Chain Data Analysis

James Check (@Checkmatey), an on-chain information analyst, shared his attack focused much connected worth acquisition alternatively than nonstop timing: “My strategy isn’t astir pinpointing the implicit bottommost but acquiring Bitcoin astatine important discounts, arsenic indicated by on-chain metrics similar STH-SOPR and STH-MVRV some being beneath 1.” These metrics suggest that short-term holders are selling astatine a loss, which tin beryllium an opportunistic introduction constituent for semipermanent investors.

I similar acquiring sats erstwhile some STH-SOPR and STH-MVRV are beneath 1.

I’m not looking for bottoms, I’m looking for meaningful discounts.

Love to spot it.#Bitcoin pic.twitter.com/Jou9TSH3A9

— _Checkmate 🟠🔑⚡☢️🛢️ (@_Checkmatey_) June 25, 2024

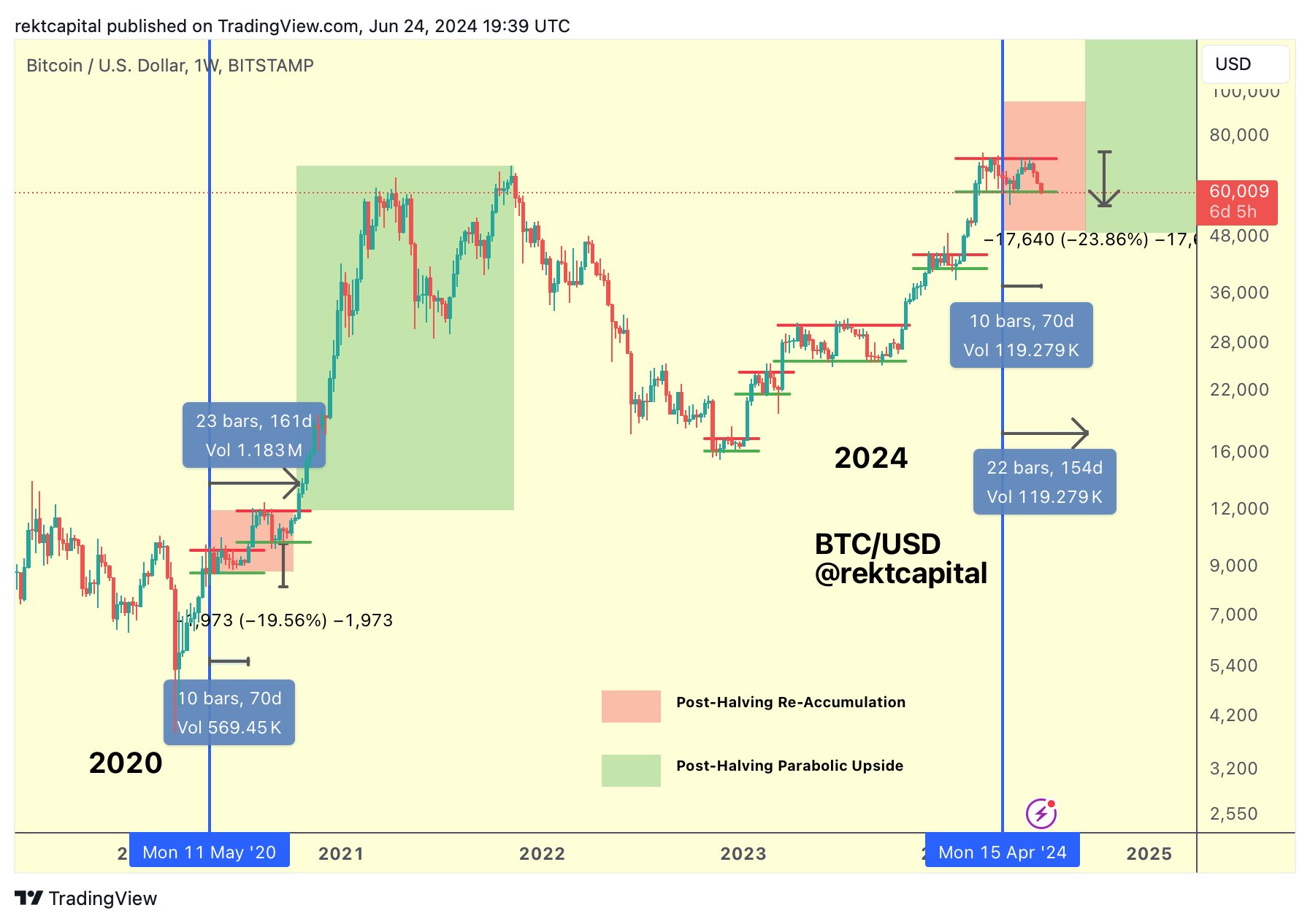

Historical Post-Halving Performance

Rekt Capital (@rektcapital) analyzed Bitcoin’s show successful post-halving periods, referring to the lawsuit wherever Bitcoin mining rewards are halved, theoretically expanding its scarcity. “BTC has not breached the precocious nor mislaid the debased of its ReAccumulation Range successful immoderate post-halving period. This humanities precedent suggests that Bitcoin should clasp these levels,” helium outlined.

Bitcoin Halving rhythm | Source: X @rektcapital

Bitcoin Halving rhythm | Source: X @rektcapitalMarket Psychology

Cred (@CryptoCred), different respected trader, offered different space and is not convinced the bottommost is already in: “If this is the BTC bottom, I americium apt to miss it. Often, a marketplace that fails to interruption down astatine a level, lone to instrumentality and adjacent beneath it later, indicates a much morganatic breakdown. I’m not shorting but americium besides not buying.”

At property time, BTC traded astatine $61,014.

BTC price, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC price, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)