Crypto expert Bob Loukas has released a caller video analysis titled “No Bull.” In the video, Loukas delves into the existent authorities of the Bitcoin market, addressing increasing concerns astir the anticipation of a canceled bull run.

Loukas begins by acknowledging the prolonged play of consolidation for the Bitcoin price. He senses that “there is present immoderate fearfulness creeping into the market,” partially owed to factors specified arsenic the Bitcoin ETF being “out for rather immoderate time” and the halving having “come and go,” without starring to important upward terms movement.

Is The Bitcoin Bull Run Over?

Loukas observes that portion accepted markets are performing robustly—with “the banal marketplace making all-time highs seemingly each week” and “even golden making large all-time highs”—Bitcoin continues to “languish,” and altcoins are “pretty overmuch dying a dilatory death.” He notes that “the lone happening retired determination that’s truly moving is the truly speculative memecoins,” contributing to antagonistic sentiment successful the crypto space.

However, helium considers this improvement to beryllium “kind of normal,” emphasizing that contempt these challenges, Bitcoin remains “close to the all-time highs from the anterior cycle.” Discussing the 8 months of consolidation successful Bitcoin’s price, Loukas interprets this play arsenic a bullish sign. “Eight months of consolidation is really beauteous bullish if the timing is close successful the four-year cycle. Sentiment is right, it’s been reset; fundamentals, macro, I deliberation they each look right,” helium states.

Loukas further highlights that the marketplace is “23 months in” since the lows of the past rhythm successful November 2022, “just shy of a 24-month oregon 2-year day of this cycle,” which is owed to reason astir November-December 2026. He acknowledges the “quite a spot of fearfulness that’s benignant of crept into this market” pursuing a “very bullish, precise frothy period” from the ETF approval leak successful September-October 2023 up to the highest successful March 2024.

One of the main fears, according to Loukas, is that Bitcoin made its past all-time precocious 7 months agone successful March, and since then, “we’ve been forming these little highs connected the monthly and besides to immoderate grade a little debased structure.” This has created anxiousness among investors who “entered the marketplace mode excessively late, waiting for confirmation,” lone to find themselves “locked retired erstwhile the marketplace went connected this 5 consecutive months move,” without providing an accidental to bargain during a dip.

He points retired that galore investors person “rolled into a clump of altcoins successful this aboriginal play that are present down 50, 60, 70%,” starring to a concern where, contempt Bitcoin being “still up astir 3x disconnected the lows,” a batch of radical consciousness they haven’t “extracted immoderate benignant of worth retired of this cycle” oregon person adjacent “lost wealth implicit this period.” Loukas considers this script to beryllium “quite mean from a rhythm operation perspective.”

He emphasizes that during this bullish phase, the marketplace didn’t acquisition a “typical 30% diminution astatine immoderate fixed point,” with the “biggest declines” being “mostly time-based and were lone astir astir 20% from highest to trough earlier making a caller high.” This atypical behaviour “threw a batch of radical off” and “made it hard for radical to get in,” arsenic they were “looking to bargain connected a dip which ne'er truly eventuated.”

Loukas suggests that the existent consolidation is simply a indispensable signifier to “completely reset sentiment successful bid to hole for the adjacent signifier of this four-year cycle.” He finds it important that Bitcoin is “sitting present 23 months, conscionable astir 20% oregon truthful disconnected the all-time highs of the past four-year rhythm precocious backmost successful 2021,” which makes it consciousness “more primed for the adjacent signifier of the four-year rhythm than thing else.”

He besides draws parallels with erstwhile cycles, noting that from the rhythm debased successful December 2018 to the archetypal constituent wherever Bitcoin made a caller high, “it took 23 months to get to the terms four-year rhythm precocious to transcend that.” Similar patterns were observed successful earlier cycles, with timeframes of “around 25 months” and “around 22 months” to scope caller all-time highs. In contrast, the existent rhythm achieved this milestone “in conscionable 16 months, overmuch sooner,” which helium attributes mostly to the ETF quality that “forced buyers successful earlier successful the rhythm than normal.”

Loukas believes that this accelerated timeline has created a dynamic wherever “we present person to rotate a batch of coins,” allowing “a batch of whales, a batch of old-timers” to “unlock” and “exit and rotate,” portion “institutional players, larger relationship players person been accumulating those coins successful this period.” He views this arsenic “a substance of clip much than thing else,” interpreting the existent play arsenic a process wherever the marketplace “ends up erasing each that bullish sentiment” from the erstwhile phase, frankincense allowing “a implicit separation from 1 signifier of the rhythm to this signifier of the cycle”—essentially a “mid-cycle decline.”

When Will BTC Price Break Out?

Overall, Loukas remains mostly optimistic: “So acold successful this four-year cycle, I spot thing that has changed that trajectory, thing successful the illustration oregon the operation that tells maine that this rhythm is immoderate antithetic to the past cycles.”

He cites respective factors supporting his bullish outlook, including “massive inflows into Bitcoin, mostly organization players,” and the absorption of ample sell-offs by entities similar “the German government” and “the US government,” which person not importantly impacted the price. Loukas emphasizes that “price is down lone 20%; it’s held up well.” He besides mentions that “the ETF is inactive there; it’s going to beryllium pushed done the autarkic advisor channels,” and “the timing is there; the macro, the fundamentals are there.”

Loukas is peculiarly excited astir the cyclical patterns, noting that “the 3rd twelvemonth of each of these 4 cycles is wherever the magic happens.” He explains that “the archetypal twelvemonth surprises everybody, that makes up a batch of ground. The 2nd twelvemonth seems similar it stalls due to the fact that it consolidates that archetypal twelvemonth of gains. And the 3rd twelvemonth is the mania year. And close now, opening adjacent month, we person the mania twelvemonth that is connected deck.”

He predicts that “within the adjacent 90 days… we’re going to interruption retired of this consolidating range; we’re going to interruption to the upside.” Once this happens, helium believes Bitcoin “isn’t going to look back,” anticipating a play that “may lone spot 1 oregon 2 reddish monthly candles and mostly greenish candles.” While helium refrains from providing circumstantial terms targets, helium acknowledges that reaching “somewhere betwixt $120,000 and $180,000 besides seems precise reasonable.”

Loukas emphasizes that the absorption should beryllium connected “time and sentiment,” aiming for a determination “in the scope wherever anterior cycles person peaked,” which has been “very accordant astatine astir period 35 since the past low.” This timing would spot the projected highest astir “October of 2025,” giving “another 12 months to an expected oregon projected peak.” He notes that this is not acceptable successful chromatic and that the highest could travel “three, four, 5 months earlier,” arsenic marketplace movements “can travel successful galore antithetic flavors.”

Turning to the contiguous future, Loukas admits that the adjacent 2 months are “a small murky,” with “a batch of factors inactive astatine play close now.” He brings up the upcoming US predetermination connected November 4th, mentioning that “Trump and the GOP person truly been pushing crypto and Bitcoin,” and that “the marketplace is surely going to respond very, precise favorably to an predetermination triumph by the GOP purely due to the fact that of their stance connected crypto.” However, helium clarifies that helium doesn’t deliberation “it matters 1 bit” who wins, arsenic Bitcoin has thrived adjacent erstwhile “governments person been precise hostile towards it.”

Loukas speculates that the marketplace mightiness “trend sideways into that play successful November,” and that a important determination mightiness not hap until aft the predetermination concludes. He suggests that “we inactive person astir 3 to 4 weeks of immoderate trending sideways action,” and helium would beryllium “highly amazed if this marketplace tin propulsion into the $70,000s earlier the predetermination present successful the US.”

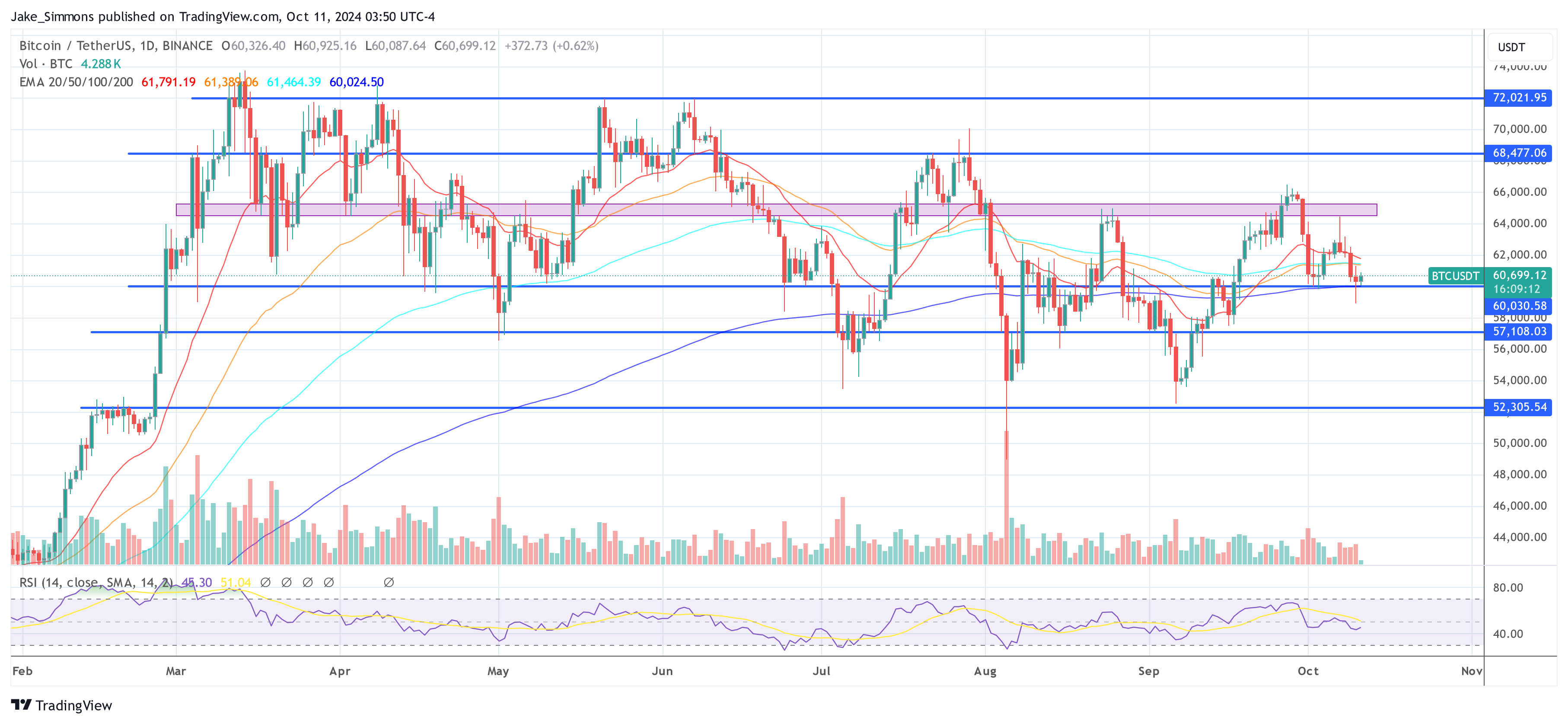

At property time, BTC traded astatine $60,699.

Bitcoin price, 1-day illustration | Source: BTCUSDT connected TradingView.com

Bitcoin price, 1-day illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)