The bitcoin terms tends to beryllium cyclical, and we’re each trying to clip the bottom. Can hash ribbons beryllium the metric that predicts it?

The question of whether the bitcoin terms bottommost is down america is connected the minds of galore investors who are poised with the challenge: bargain the dip oregon hold for a bigger one?

Financial predictions are seldom accurate, and that world echoes successful the bitcoin marketplace arsenic well. But since BTC trading typically follows four-year cycles of bull and carnivore markets, arsenic the peer-to-peer currency navigates its mode done its adoption cycle, galore inactive effort to clip bitcoin tops and bottoms erstwhile making allocation decisions.

With that successful mind, investors, traders and analysts person attempted to utilize antithetic techniques to spot the bottommost successful price, including method investigation (TA), sentiment, hash complaint and adjacent hunt popularity connected Google. And this nonfiction volition research a much caller terms indicator that relies connected Bitcoin’s hash complaint and its web of miners, known arsenic hash ribbons.

This indicator could beryllium invaluable due to the fact that it has proven reliable successful spotting opportunistic introduction points successful bitcoin successful the past from a risk/reward perspective, enabling investors to participate the marketplace and bargain low, earlier fearfulness of missing retired (FOMO) sets in. Though whether this accurately predicts the bitcoin terms oregon not is different question.

Miner Capitulation As A Bottom Indicator

Charles Edwards, laminitis of quantitative plus absorption steadfast Capriole Investments, told Bitcoin Magazine that, successful his view, the bitcoin terms and hash complaint are correlated successful a reflexive origin and effect relationship.

“Hash-rate drops and consequent recoveries person marked most, if not all, large bitcoin bottoms,” helium said.

The thought process is simple: When immoderate miners commencement being driven retired of the market, shown by a important driblet successful Bitcoin’s hash rate, further marketplace unit ensues arsenic miner nett margins are squeezed. Also, aggravated marketplace unit was needed to origin that capitulation successful the archetypal place, arsenic miners are seen arsenic precise resilient players successful the ecosystem.

“Given the magnitude of the proviso controlled by miners, and the wide level of precocious ratio successful their businesses, erstwhile miners are selling the worst has often occurred,” Edwards explained. “As a result, terms and hash complaint betterment retired of this miner capitulation has historically marked large terms bottoms.”

Edwards defines miner capitulation arsenic a measured diminution successful Bitcoin’s full hash rate, successful the bid of a 10% to 40% decline. To amended spot specified an event, the quant expert developed an indicator: hash ribbons.

Can Hash Ribbons Predict Bitcoin Price Bottoms?

Hash ribbons, publically disposable connected TradingView, is an indicator made up of 2 elemental moving averages (SMAs) of Bitcoin’s hash rate: the 30-day and the 60-day SMA. A downward transverse of the short-term MA connected the semipermanent MA marks the opening of a capitulation period, whereas an upward transverse spots its end.

Edwards argues that buying bitcoin astatine the extremity of a miner capitulation play produces outsized returns for investors arsenic the worst is believed to beryllium implicit and the marketplace is opening a recovery.

“To date, I judge it’s the champion publicly-available, semipermanent bargain signal, but the scholar should marque that assessment,” helium said.

In 2020, the hash ribbons indicator flashed a bargain awesome connected 3 occasions: April 24 ($7,505.53), July 12 ($9,306.17) and December 2 ($19,226.55). After 1 year, those buys generated returns of astir 567.76%, 255.73% and 194.11%, respectively.

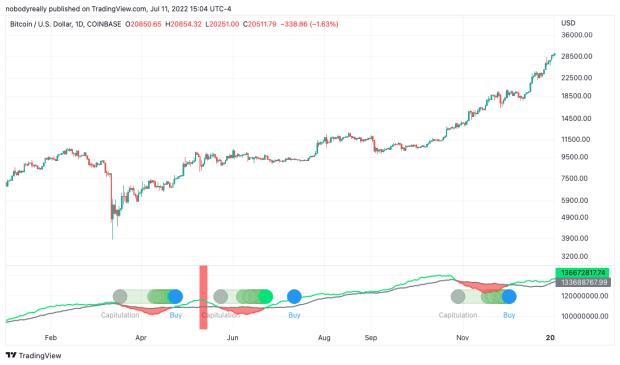

The hash ribbons indicator flagged 3 buying opportunities successful Bitcoin during 2020, each of which produced outsized returns successful conscionable 1 year. Image source: TradingView.

The hash ribbons indicator flagged 3 buying opportunities successful Bitcoin during 2020, each of which produced outsized returns successful conscionable 1 year. Image source: TradingView.

Last year, however, the indicator didn’t fare truthful well. An capitalist pursuing hash ribbons for bitcoin allocations would’ve bought BTC astatine astir $44,612.94 connected August 7, lone to spot that concern suffer implicit fractional its worth until the contiguous time arsenic the P2P currency trades beneath $20,000.

However, that’s aft bitcoin rallied to a caller all-time precocious terms of $69,000 successful November, astatine which constituent that capitalist would beryllium 54.66% successful the greenish successful lone 3 months. Still, it’s rather hard — if not intolerable — to accurately spot a top.

Buying erstwhile Hash ribbons past signaled an accidental would’ve yielded antagonistic results of 55.53% to date, aft being implicit 54% successful the greenish astatine the all-time precocious of $69,000. Image source: TradingView.

Buying erstwhile Hash ribbons past signaled an accidental would’ve yielded antagonistic results of 55.53% to date, aft being implicit 54% successful the greenish astatine the all-time precocious of $69,000. Image source: TradingView.

Edwards explained to Bitcoin Magazine that the hash ribbons strategy is acrophobic lone astir flagging charismatic introduction points, and the determination of erstwhile to merchantability and adjacent the presumption remains a load the capitalist themself indispensable endure.

In the 2018 to 2019 carnivore market, the hash ribbons indicator flashed a bargain awesome connected January 10, 2019. Bitcoin closed astatine $3,627.51 that time — lone 16% higher than that cycle’s debased of $3,122.28 seen connected December 15, 2018.

This year, miner capitulation helped spot different opportunistic diminution successful price.

“Recently we saw beardown grounds for a large miner capitulation successful June arsenic proven by the $30,000 to $20,000 terms driblet pursuing the hash ribbon capitulation signal, the consequent 30% drawdown successful miner treasuries and the $4 cardinal of miner indebtedness accent quality successful June 2022,” Edwards told Bitcoin Magazine.

Image source: TradingView.

Image source: TradingView.

Indeed, hash ribbons flagged the opening of a miner capitulation connected June 9, indicating that further accent could travel to the market. In the pursuing 9 days, bitcoin dropped beneath the 2017 high, nearing $17,500 connected June 18.

As it would beryllium discovered successful July’s nationalist filings and accumulation updates releases, many nationalist bitcoin miners sold thousands of bitcoin successful June. To date, lone Marathon Digital and HUT 8 person continued to deposit monthly mined BTC into custody.

Is The Relevancy Of Miner Capitulation Decreasing Each Year?

Fred Thiel, the CEO of Nasdaq-listed bitcoin miner Marathon Digital, told Bitcoin Magazine that strategies based connected miner capitulation periods presume what has been a bully regularisation of thumb successful wide markets: that those heavy wrong the manufacture person amended accusation than those connected the outside.

“Typically successful economical markets oregon fiscal markets, erstwhile the idiosyncratic with the champion accusation acts, it’s an indicator of the surest spot successful the market,” helium said.

Thiel continued to explicate that a miner knows circumstantial accusation specified arsenic what their operating outgo is, what the outgo to excavation 1 bitcoin is, and what the bitcoin terms is. They past leverage that accusation to determine a people of action, including to either liquidate their presumption and their bitcoin holdings, oregon adjacent cease operations if it reaches a constituent wherever it’s excessively unprofitable.

“So erstwhile a miner starts selling their bitcoin holdings, they’re astatine a constituent wherever that’s their champion alternative, and truthful you would presume that would bespeak a bottom,” Thiel said.

However, the main enforcement highlighted that the grade to which miner capitulation influences the marketplace volition diminish with time. Why? Whereas years agone miners were the biggest organization bitcoin holders, present their presumption sizes are being outgrown by those of companies specified arsenic MicroStrategy, Tesla and Block.

“So wherever earlier miners were a truly bully indicator of the bottom, I deliberation contiguous they’re a bully indicator of erstwhile the marketplace has deed a constituent wherever the symptom point’s existent high,” Thiel explained. “And if miners are selling bitcoin it’s due to the fact that either they don’t person an alternative, truthful they’re forced sellers, conscionable similar radical that get borderline calls, oregon they’re selling due to the fact that they’re getting desperate, if you would.”

Edwards acknowledges this constituent arsenic well, but doesn’t disregard the validity of looking astatine miners’ capitulation to spot charismatic bitcoin prices.

“I deliberation the powerfulness of hash ribbons diminishes with time, successful a step-change manner each 4 years with the Bitcoin halving cycle,” the expert told Bitcoin Magazine. “We person seen the introduction of institutions and banks into Bitcoin implicit the past 18 months.”

“The existent configuration of hash ribbons volition astir apt go noticeably little utile adjacent cycle, and possibly unusable successful the pursuing cycle,” Edwards added. “Nonetheless, hash ribbons has been large this rhythm truthful far, and the existent rhythm inactive has 2 years near to run. Capriole Investments is actively watching hash ribbons and utilizing it arsenic an input into our concern strategy.”

Is The Bitcoin Bottom In?

Even though hash ribbons is flagging a miner capitulation lawsuit has been underway for implicit a period now, it has not yet flagged a bargain awesome for bitcoin — which begs the question: Is the bitcoin bottommost down america oregon could determination beryllium much drawdowns?

Edwards told Bitcoin Magazine that, typically, miner capitulation periods past anyplace from 1 week to 2 months, indicating that either the bottommost already happened connected June 18 oregon that it could hap successful the adjacent future.

“We tally respective strategies internally astatine Capriole to assistance get a confluence of signals and approaches,” Edwards said. “Some strategies presently suggest we person bottomed, others suggest a bottommost is forming and others inactive accidental we are successful contraction and a bottommost is not yet confirmed.”

Given the hardship of spotting a bitcoin terms bottom, investors tin astatine a minimum leverage hash ribbons to spot miner capitulation periods — successful which dollar-cost averaging could crook into an effectual strategy implicit a agelong play of time. Alternatively, risk-averse investors that judge successful the reasoning down hash ribbons tin hold for the indicator’s bargain signal, arsenic it could spot the opening of a recovery.

In immoderate case, Edwards believes the clip is premier for allocating to bitcoin.

“My wide presumption is that the adjacent six to 12 months volition supply the champion accidental to get into bitcoin implicit the adjacent five-plus years,” Edwards predicted. “This is based connected the information we are quantitatively modeling, the existent rhythm downdraw, and timing wrong the existent four-year cycle, that is, bitcoin usually bottoms successful the nonstop six-to-12-month halving rhythm clip model we are presently in. Not fiscal proposal of course!”

3 years ago

3 years ago

English (US)

English (US)