This is an sentiment editorial by Mike Ermolaev, caput of nationalist relations and contented astatine Kikimora Labs.

Setting The Context: Global Economy Fundamentals

The system is inactive recovering from the COVID-19 outbreak arsenic caller problems arise. We are present successful a clip of rampant ostentation with cardinal banks trying to remedy that by raising involvement rates.

The U.S. CPI data (consumer terms index), released connected October 13, came successful higher than expected (8.2% year-over-year), negatively impacting the bitcoin price. But ostentation is not the lone issue, the planetary system is besides struggling with the vigor crisis, affecting Europe much than the U.S., owed to its beardown dependency connected Russian earthy state and earthy material.

On the eastbound side, the warfare successful Ukraine with ensuing sanctions connected Russia, adhd further geopolitical instability and economical uncertainty. Also, China’s zero-COVID argumentation is disrupting the proviso concatenation worldwide, and the Evergrande default undermines 1 of the world’s biggest economies.

If we look astatine the main currencies, the dollar scale looks strong, compared to others. The Federal Reserve raised involvement rates by 75 ground points successful November, and the Bank of England raised involvement rates by the aforesaid amount. This argumentation of quantitative tightening aims to trim the wealth proviso and mitigate terms pressure. It is apt to proceed into adjacent twelvemonth and beyond. However, a planetary recession and hazard of stagflation is inactive precise strong, truthful nary state whitethorn consciousness harmless from cardinal slope monetary policy.

Bitcoin Correlation With The Economy

Bitcoin has shown not to beryllium immune from this planetary turmoil. Although the terms successful its aboriginal signifier was autarkic of accepted finance, correlation began to amusement successful 2016.

The thought of bitcoin arsenic a “digital gold” became fashionable due to the fact that some shared the scarcity and trouble of extraction (mining), arsenic good arsenic fulfilled the relation of being a store of value. Since galore presumption bitcoin arsenic a hazard asset, its correlation with the S&P 500 and Nasdaq-100 became disposable — nary antithetic than accepted stocks.

At the clip of writing, bitcoin’s 40-day terms correlation with golden reached 0.50 (after being astir zero successful August). According to Alkesh Shah and Andrew Moss, strategists from Bank of America:

“A decelerating affirmative correlation with SPX/QQQ and a rapidly rising correlation with XAU bespeak that investors whitethorn presumption bitcoin arsenic a comparative harmless haven arsenic macro uncertainty continues and a marketplace bottommost remains to beryllium seen.”

Negative Events

There are immoderate macroeconomic factors successful the larger cryptocurrency ecosystem that contributed to a bearish market: the Terra/LUNA collapse, forced liquidation of Three Arrows Capital and the bankruptcy of Celsius being the main ones.

The incoming bitcoin mining regulations by the EU and the existent profitability crisis of bitcoin mining indispensable beryllium besides taken into consideration.

Bitcoin: Present And Future

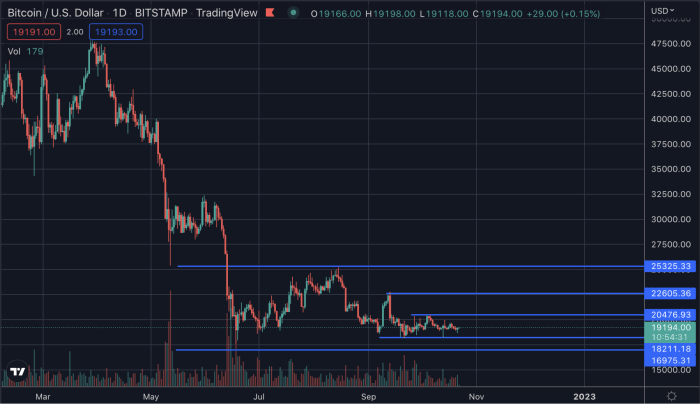

Despite each the supra adverse events, bitcoin was capable to someway support its terms successful the $19,000-$20,000 range, with record-low volatility. Currently, we are observing antithetic stableness successful the bitcoin price, precocious adjacent matching volatility of the British pound.

On the contrary, stocks person experienced precocious volatility and whipsaw terms action, besides pursuing speculations astir the Fed’s aboriginal decisions. According to Bloomberg’s Chief Commodity Strategist Mike McGlone, that’s wherefore bitcoin whitethorn emergence aft a steep discount and yet bushed the S&P 500. He believes that bitcoin’s finite proviso and deflationary attack whitethorn assistance it retrieve its erstwhile terms levels.

Since the past flash clang successful mid-June, the terms has been rather steady, but we cognize it seldom sits inactive for excessively long. This means that the probability of a abrupt (bullish oregon bearish) breakout increases implicit time. The longer the terms remains idle, the stronger the breakout is going to be.

Additionally, the BTC futures unfastened involvement is higher than ever, with liquidations reaching all-time low. A batch of liquidity is accumulating here, meaning that determination volition beryllium an adjacent stronger impulse erstwhile the terms starts to determination again.

According to the strategist Benjamin Cowen, bitcoin is expected to emergence to “fair value,” aft falling an further 15%. “Right now, the information would suggest that we’re astir 50% undervalued compared to wherever the just worth is.” Cowen thinks we whitethorn request to hold until aboriginal 2024 to spot this emergence happen.

Goldman Sachs strategist Kamakshya Trivedi has a different view, claiming that the U.S. dollar index, showing grounds values since 2002, whitethorn beryllium atrocious quality for the presently bearish bitcoin.

A Bearish Scenario: Could The 2018 Drop Happen Again?

Some analysts person been wondering if the 2018 script (low volatility, past large terms drop) whitethorn hap again contiguous due to the fact that the marketplace conditions look rather similar. We person the aforesaid 10% trading scope and we cognize thing is going to hap soon.

Comparison betwixt 2022 BTC terms (top) versus 2018 (bottom) utilizing eight-hour candles. (Source)

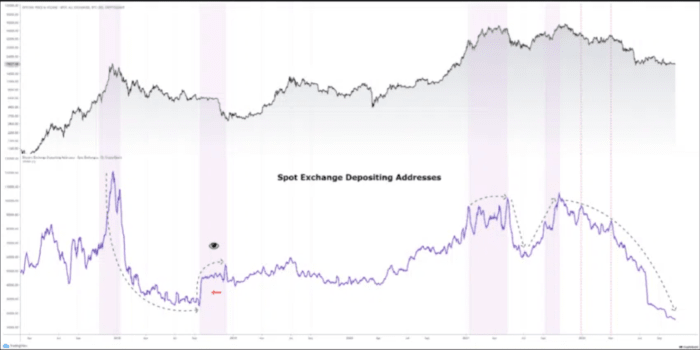

A singular quality betwixt the 2 cycles is that successful 2018 determination was an summation successful addresses sent to spot exchanges, portion successful our existent rhythm we are observing liquidity moving distant from exchanges and not galore caller addresses being created. According to a CryptoQuant analyst, this should mean that we won’t witnesser a akin script to 2018.

A 2018/2022 examination of spot speech depositing addresses. (Source)

What About Uptober and Moonvember?

Historically, Q4 is simply a large clip for bitcoin, with bullish trends starting successful October and expanding successful November. So the months of October and November were colloquially renamed “Uptober” and “Moonvember” — astatine least, this is what happened backmost successful 2021.

Can we inactive expect specified a bullish Q4 successful 2022? It’s hard to say, but the adverse macroeconomic concern and geopolitical issues marque it harder to ideate the aforesaid rally we saw past year. After all, the bitcoin marketplace has been down for 10 consecutive months and we don’t spot immoderate peculiar motion of betterment astatine the moment.

We indispensable besides support successful caput that, contempt the antagonistic planetary scenario, the “safe haven” relation of bitcoin whitethorn lend to giving the terms immoderate further strength, particularly successful these troubled times.

Exchange Data Analysis

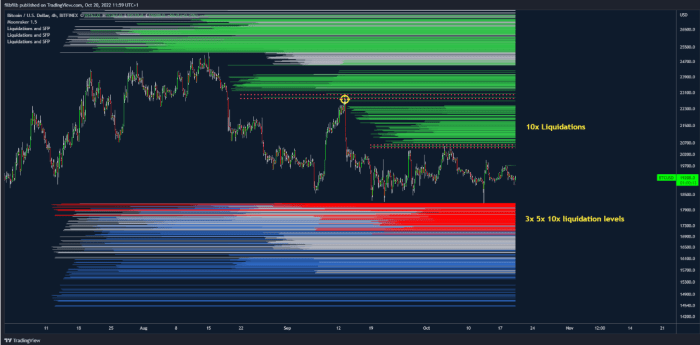

Liquidation information connected the Bitfinex speech was analyzed by filbfilb. He concluded that an upward breakout would person little momentum than a downward one. In fact, liquidity supra $20,500 is mostly 10x, portion liquidity beneath $18,000 is predominantly 10x, 5x and 3x, which means that a bullish breakout would beryllium “less brutal” than a bearish one.

Bitfinex liquidation chart. (Source)

Conclusions

We are presently witnessing a play of stasis successful the bitcoin market. The bitcoin terms needs to commencement moving again aft 2 months of consolidation. The wide economical script doesn’t look agleam astatine all, and bitcoin is correlated to events successful the existent world, but investors tin inactive admit the integer gold, safe-haven relation of the astir fashionable cryptocurrency. A beardown bitcoin terms breakout is expected, with caller volatility incoming.

The imaginable scenarios whitethorn be: a speedy dump and past a bullish betterment (V-shaped bounce) oregon a longer and deeper terms collapse, aft the interruption of the $19,000 absorption level.

Whatever happens, bitcoin volition support being the astir innovative exertion of the past decade, allowing fiscal state and nonstop power implicit one’s ain wealth. Bitcoin has historically witnessed galore beardown bearish times and has ever recovered from them.

This is simply a impermanent station by Mike Ermolaev. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)