Bitcoin’s terms retracement from its caller all-time precocious of $108,353 connected Tuesday to astir $96,000 (a -11.5% pullback) has ignited aggravated speculation astir whether the existent bull rhythm is nearing its peak. To code increasing uncertainty, Rafael Schultze-Kraft, co-founder of on-chain analytics supplier Glassnode, released a thread connected X detailing 18 on-chain metrics and models. “Where is the Bitcoin TOP?” Schultze-Kraft asked, earlier laying retired his elaborate analysis.

Has Bitcoin Reached Its Cycle Top?

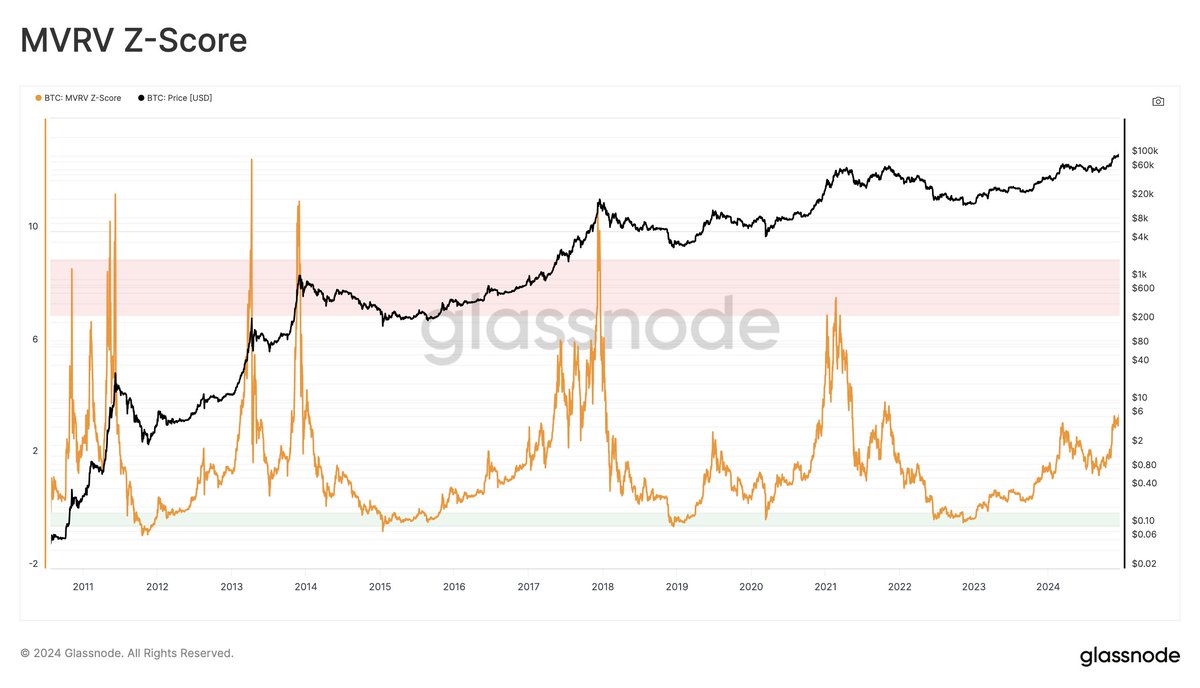

1/ MVRV Ratio: A longstanding measurement of unrealized profitability, the MVRV ratio compares marketplace worth to realized value. Historically, readings supra 7 signaled overheated conditions. “Currently hovering astir 3 – country to grow,” Schultze-Kraft noted. This suggests that, successful presumption of aggregate unrealized profit, the marketplace is not yet astatine levels that person antecedently coincided with macro tops.

MVRV Z-Score | Source: X @n3ocortex

MVRV Z-Score | Source: X @n3ocortex2/ MVRV Pricing Bands: These bands are derived from the fig of days MVRV has spent astatine utmost levels. The apical set (3.2) has been exceeded for lone astir 6% of trading days historically. Today, this apical set corresponds to a terms of $127,000. Given that Bitcoin sits astatine astir $98,000, the marketplace has not yet reached a portion that historically marked apical formations.

3/ Long-Term Holder Profitability (Relative Unrealized Profit & LTH-NUPL): Long-term holders (LTHs) are considered much unchangeable marketplace participants. Their Net Unrealized Profit/Loss (NUPL) metric is presently astatine 0.75, entering what Schultze-Kraft presumption the “euphoria zone.” He remarked that successful the 2021 cycle, Bitcoin ran different ~3x aft hitting akin levels (though helium clarified helium is not needfully expecting a repetition). Historical apical formations often saw LTH-NUPL readings supra 0.9. Thus, portion the metric is elevated, it has not yet reached erstwhile rhythm extremes.

Notably, Schultze-Kraft admitted his observations whitethorn beryllium blimpish due to the fact that the 2021 rhythm peaked astatine somewhat little profitability values than anterior cycles. “I would’ve expected these profitability metrics to scope somewhat higher levels,” helium explained. This whitethorn awesome diminishing peaks implicit successive cycles. Investors should beryllium alert that humanities extremes whitethorn go little pronounced implicit time.

4/ Yearly Realized Profit/Loss Ratio: This metric measures the full realized profits comparative to realized losses implicit the past year. Previous rhythm tops person seen values supra 700%. Currently astatine astir 580%, it inactive shows “room to grow” earlier reaching levels historically associated with marketplace tops.

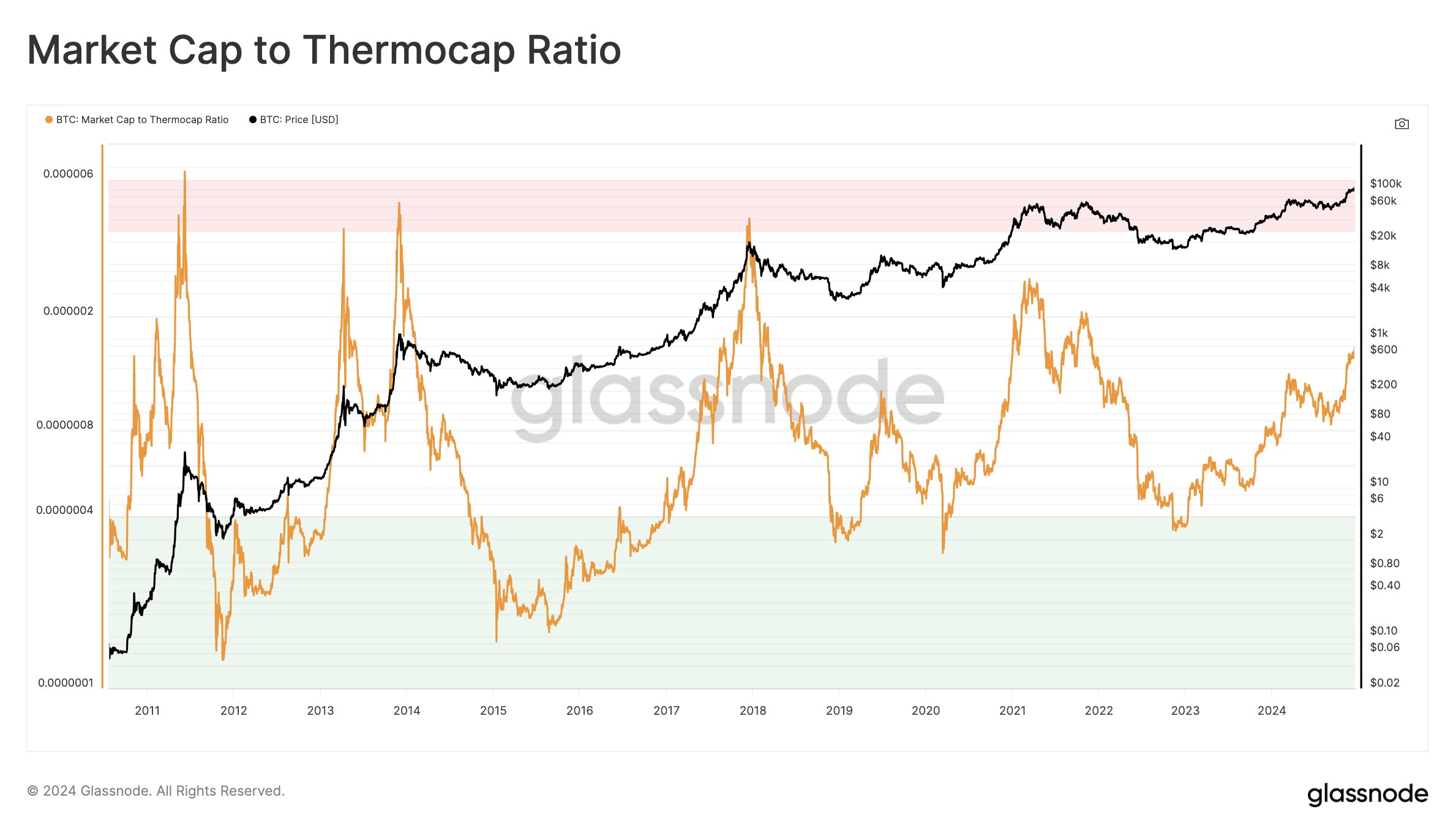

5/ Market Cap To Thermocap Ratio: An aboriginal on-chain metric, it compares Bitcoin’s full marketplace capitalization to the cumulative mining outgo (Thermocap). In anterior bull runs, the ratio’s extremes aligned with marketplace tops. Schultze-Kraft advises caution with circumstantial people ranges but notes that existent levels are not adjacent to erstwhile extremes. The marketplace remains beneath humanities thermocap multiples that indicated overheated conditions successful the past.

Market Cap To Thermo Cap Ratio | Source: X @n3ocortex

Market Cap To Thermo Cap Ratio | Source: X @n3ocortex6/ Thermocap Multiples (32-64x): Historically, Bitcoin has topped astatine astir 32-64 times the Thermocap. “We’re astatine the bottommost of this range,” said Schultze-Kraft. Hitting the apical set successful today’s situation would connote a Bitcoin marketplace headdress conscionable supra $4 trillion. Given that existent marketplace capitalization ($1.924 trillion) is importantly lower, this suggests the anticipation of important upside if humanities patterns were to hold.

7/ The Investor Tool (2-Year SMA x5): The Investor Tool applies a 2-year Simple Moving Average (SMA) of terms and a 5x aggregate of that SMA to awesome imaginable apical zones. “Which presently denotes $230,000,” Schultze-Kraft noted. Since Bitcoin’s existent terms is good beneath this level, the indicator has not yet flashed an unequivocal apical signal.

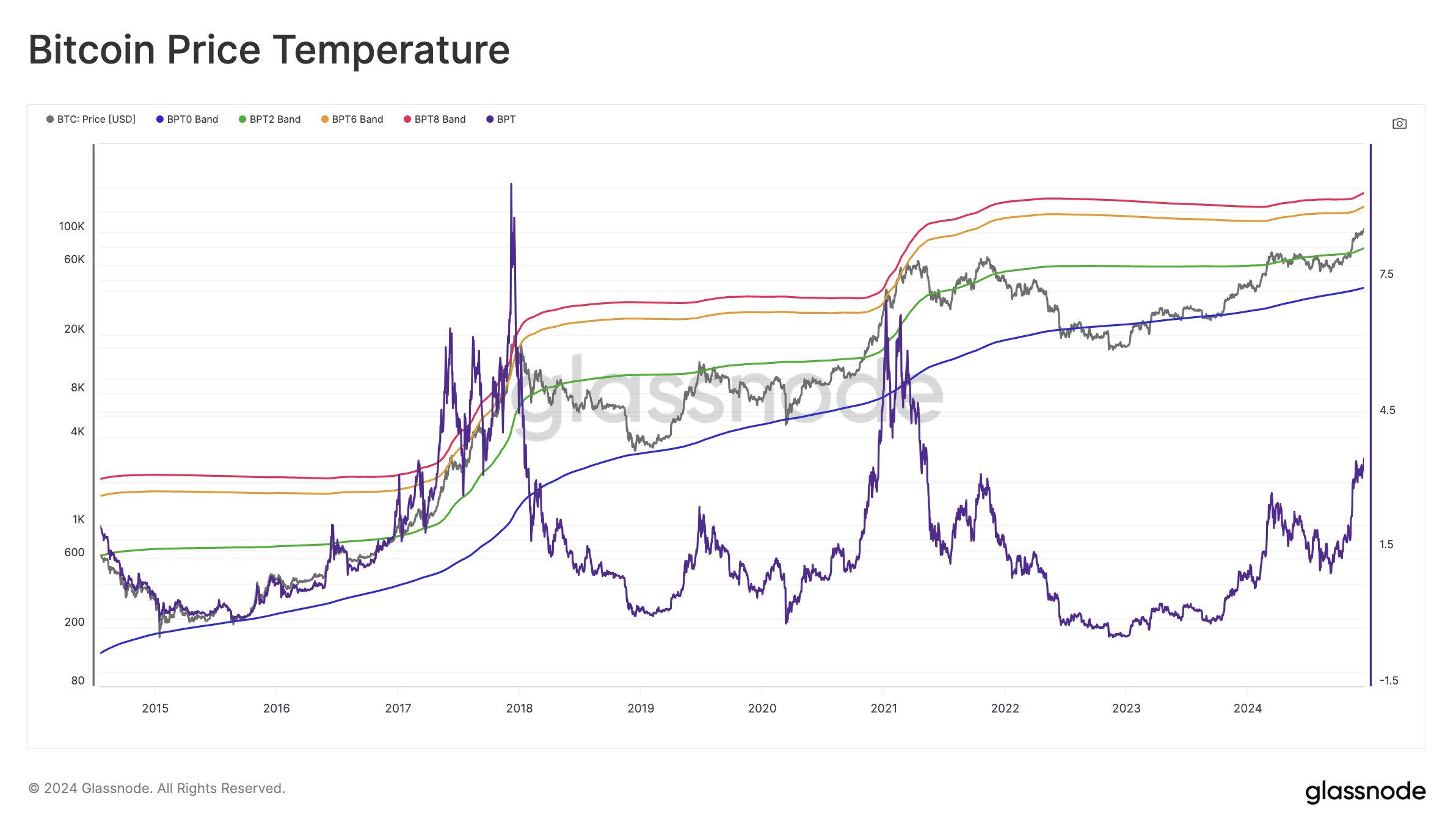

8/ Bitcoin Price Temperature (BPT6): This exemplary uses deviations from a 4-year moving mean to seizure cyclical terms extremes. Historically, BPT6 was reached successful erstwhile bull markets, and that set present sits astatine $151,000. With Bitcoin astatine $98,000, the marketplace is inactive abbreviated of levels antecedently associated with highest overheating.

Bitcoin Price Temperature | Source: X @n3ocortex

Bitcoin Price Temperature | Source: X @n3ocortex9/ The True Market Mean & AVIV: The True Market Mean is an alternate outgo ground model. Its MVRV-equivalent, known arsenic AVIV, measures however acold the marketplace strays from this mean. Historically, tops person seen much than 3 modular deviations. Today’s equivalent “amounts to values supra ~2.3,” portion the existent speechmaking is 1.7. “Room to grow,” Schultze-Kraft said, implying that by this metric, the marketplace is not yet stretched to its humanities extremes.

10/ Low/Mid/Top Cap Models (Delta Cap Derivatives): These models, based connected the Delta Cap metric, historically showed diminished values during the 2021 cycle, ne'er reaching the ‘Top Cap.’ Schultze-Kraft urges caution successful interpreting these owed to evolving marketplace structures. Currently, the mid headdress level sits astatine astir $4 trillion, astir a 2x from existent levels. If the marketplace followed erstwhile patterns, this would let for sizeable maturation earlier hitting levels diagnostic of earlier tops.

11/ Value Days Destroyed Multiple (VDDM): This metric gauges the spending behaviour of long-held coins comparative to the yearly average. Historically, utmost values supra 2.9 indicated that older coins were heavy hitting the market, often during late-stage bull markets. Presently, it’s astatine 2.2, not yet astatine utmost levels. “Room to grow,” Schultze-Kraft noted, suggesting not each semipermanent holders person afloat capitulated to profit-taking.

12/ The Mayer Multiple: The Mayer Multiple compares terms to the 200-day SMA. Overbought conditions successful erstwhile cycles aligned with values supra 2.4. Currently, a Mayer Multiple supra 2.4 would correspond to a terms of astir $167,000. With Bitcoin nether $100,000, this threshold remains distant.

Mayer Multiple | Source: X @n3ocortex

Mayer Multiple | Source: X @n3ocortex13/ The Cycle Extremes Oscillator Chart: This composite uses aggregate binary indicators (MVRV, aSOPR, Puell Multiple, Reserve Risk) to awesome rhythm extremes. “Currently 2/4 are on,” meaning lone fractional of the tracked conditions for an overheated marketplace are met. Previous tops aligned with a afloat suite of triggered signals. As such, the illustration suggests the rhythm has not yet reached the strength of a full-blown peak.

14/ Pi Cycle Top Indicator: A price-based awesome that has historically identified rhythm peaks by comparing the short-term and semipermanent moving averages. “Currently the abbreviated moving mean sits good beneath the larger ($74k vs. $129k),” Schultze-Kraft said, indicating nary crossover and frankincense nary classical apical signal.

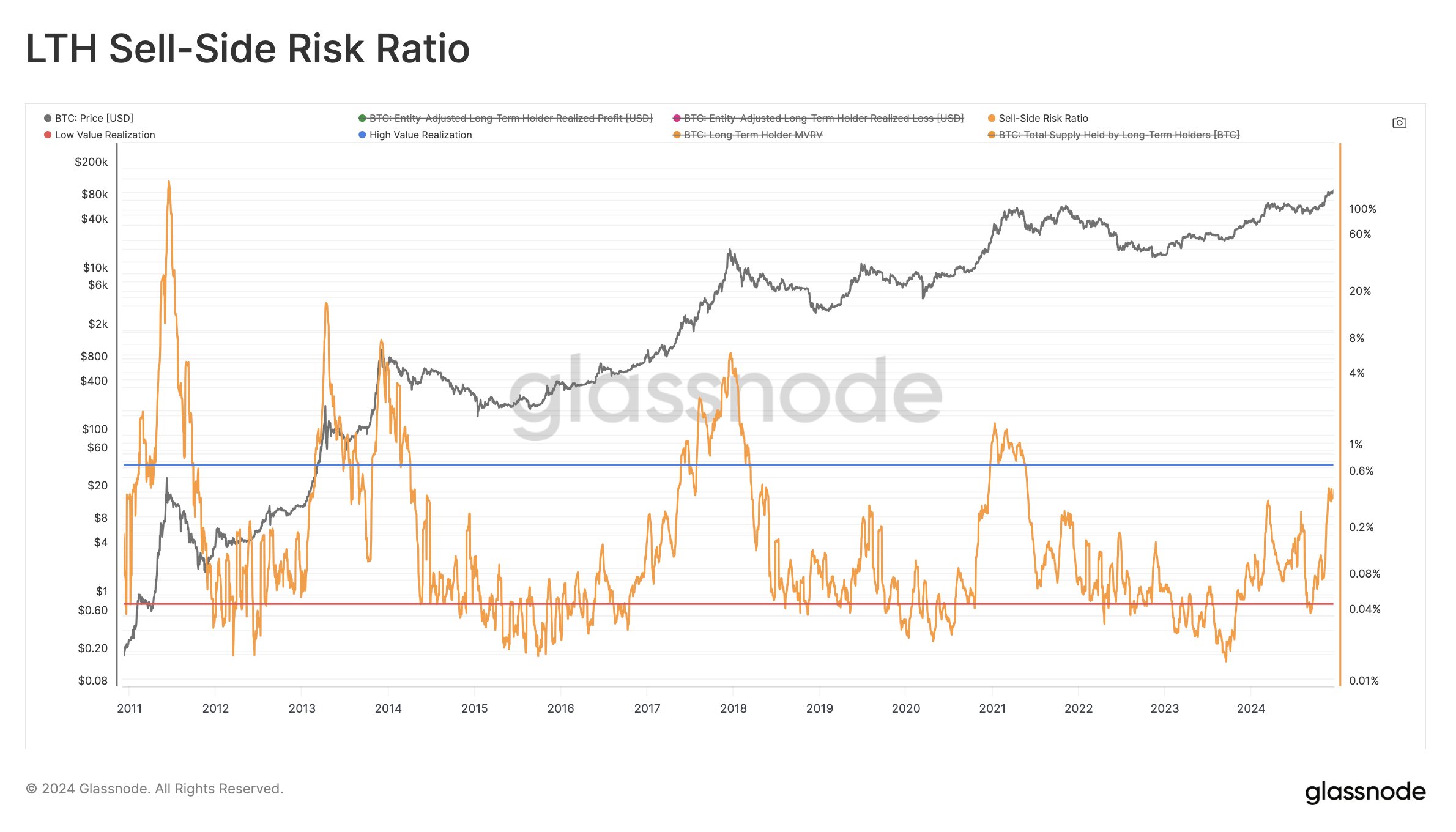

15/ Sell-Side Risk Ratio (LTH Version): This ratio compares full realized profits and losses to the realized marketplace capitalization. High values correlate with volatile, late-stage bull markets. “The absorbing portion is astatine 0.8% and above, portion we’re presently astatine 0.46% – country to grow,” Schultze-Kraft explained. This implies that, contempt caller profit-taking, the marketplace has not yet entered the aggravated merchantability unit portion often seen adjacent tops.

Sell-Side Risk Ratio | Source: X @n3ocortex

Sell-Side Risk Ratio | Source: X @n3ocortex16/ LTH Inflation Rate: Schultze-Kraft highlighted the Long-Term Holder Inflation Rate arsenic “the astir bearish illustration I’ve travel crossed truthful far.” While helium did not supply circumstantial people values oregon thresholds successful this excerpt, helium stated it “screams caution.” Investors should show this intimately arsenic it whitethorn awesome expanding organisation from semipermanent holders oregon different structural headwinds.

17/ STH-SOPR (Short-Term Holder Spent Output Profit Ratio): This metric measures the profit-taking behaviour of short-term holders. “Currently elevated, but not sustained,” Schultze-Kraft noted. In different words, portion short-term participants are taking profits, the information does not yet amusement the benignant of persistent, assertive profit-taking emblematic of a marketplace top.

18/ SLRV Ribbons: These ribbons way trends successful short- and semipermanent realized value. Historically, erstwhile some moving averages apical retired and transverse over, it indicates a marketplace turning point. “Both moving averages inactive trending up, lone becomes bearish astatine rounded tops and crossover. No denotation of a apical astatine this time,” Schultze-Kraft stated.

Overall, Schultze-Kraft emphasized that these metrics should not beryllium utilized successful isolation. “Never trust connected azygous information points – confluence is your friend,” helium advised. He acknowledged that this is simply a non-comprehensive database and that Bitcoin’s evolving ecosystem—now with ETFs, regulatory clarity, organization adoption, and geopolitical factors—may render humanities comparisons little reliable. “This rhythm tin look vastly different, yet (historical) information is each we have,” helium concluded.

While galore metrics amusement that Bitcoin’s marketplace is moving into much euphoric and profitable territory, fewer person reached the humanities extremes that marked erstwhile rhythm tops. Indicators similar MVRV, profitability ratios, thermal metrics, and assorted price-based models mostly suggest “room to grow,” though astatine slightest one—LTH Inflation Rate—raises a enactment of caution. Some composites are lone partially triggered, portion classical apical signals specified arsenic Pi Cycle Top stay inactive.

At property time, BTC traded astatine $96,037.

Bitcoin price, 1-day illustration | Source: BTCUSDT connected TradingView.com

Bitcoin price, 1-day illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

9 months ago

9 months ago

English (US)

English (US)