After the September FOMC meeting, Bitcoin Magazine Pro recaps the medium-term thesis for bitcoin and however to deliberation astir the looming macro volatility.

The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Maximum Pain: Still Ahead Of Us

The connection of the time is pain. That was Federal Reserve Chairman Jerome Powell’s favourite go-to successful the September Federal Open Market Committee meeting. One elemental economical merchandise and consequent property league sent the marketplace into a play of mild panic with rates soaring higher, volatility heating up and equities selling disconnected with bitcoin following. The S&P 500 Index mislaid a captious enactment level of 3850, bitcoin was sent backmost to section lows of $18,100 and the 2-year Treasury went implicit 4.1%.

Even an expected 75 ground constituent hike was not capable to crook markets astir arsenic the complementary info crossed the Fed’s forecasts and Powell’s code gave hazard assets much to beryllium acrophobic about. Powell reiterated galore times that much economical symptom (job losses, lodging marketplace declines, etc.) is coming arsenic a effect to lick the ostentation occupation astatine hand. He cited a deficiency of disinflation successful their favourite “core PCE” (personal depletion expenditures) measurement and reiterated his Jackson Hole hawkish speech, noting that they won’t halt until the occupation is done.

It’s present bash oregon dice for hazard assets with the options to spot an contiguous alleviation rally this week oregon apt much downward continuation successful valuations and prices crossed the board.

Our thesis present astatine Bitcoin Magazine Pro, arsenic semipermanent bull-biased bitcoin proponents, is that the macroeconomic headwinds are successful the driver’s seat, and fixed the terms enactment successful planetary currency and enslaved markets, the eventual panic infinitesimal has yet to arrive. We are open-minded and flexible to alteration that stance, but arsenic nonsubjective marketplace analysts, we spot and study what is successful beforehand of us. More connected this later.

On-Chain

Although on-chain cyclical metrics tin beryllium utile for assessing semipermanent worth buying (or selling) opportunities and Bitcoin’s economical behavior, we’ve highlighted little of them implicit the past fewer months arsenic we felt they were little applicable to short-term terms enactment compared to existent macro headwinds.

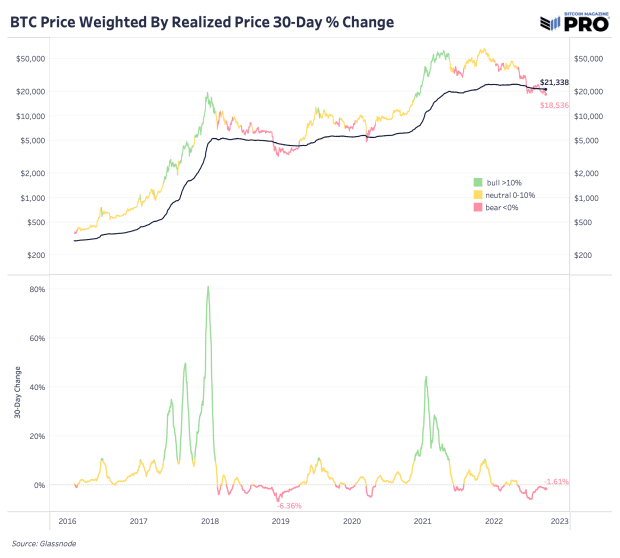

Looking astatine the past of bitcoin marketplace cycles, erstwhile diving into on-chain data, 1 instantly notices the consistency successful which the bitcoin terms falls beneath its realized terms (average outgo ground of each bitcoin arsenic per their past question on-chain) during the depths of a carnivore market. In erstwhile cycles, that’s not been a one-off lawsuit but alternatively 1 that besides comes with duration. We’ve been emphasizing for months that this carnivore marketplace tin past longer than astir expect and that the duration constituent is much achy than the percent drawdown.

“As the mean holder is underwater, astir marginal sellers person already sold their holdings, and portion further downside is possible, the ‘pain’ marketplace participants consciousness is successful the signifier of a prolonged play of clip spent underwater alternatively than rapidly declining prices that characterized the commencement of the carnivore market.” - When Will The Bear Market End? July 11, 2022

The BTC/USD regular speech complaint is acceptable wholly astatine the borderline and, fixed the expanding macroeconomic headwinds, marginal sellers person and apt proceed to predominate marginal buyers until a chiseled alteration successful liquidity conditions occurs.

A much zoomed-out presumption shows that this drawn-out process of capitulation transfers the coins into stronger, and much well-capitalized hands.

Bitcoin terms weighted by the realized terms shows that we are successful carnivore territory but inactive person country below.

Bitcoin terms weighted by the realized terms shows that we are successful carnivore territory but inactive person country below.

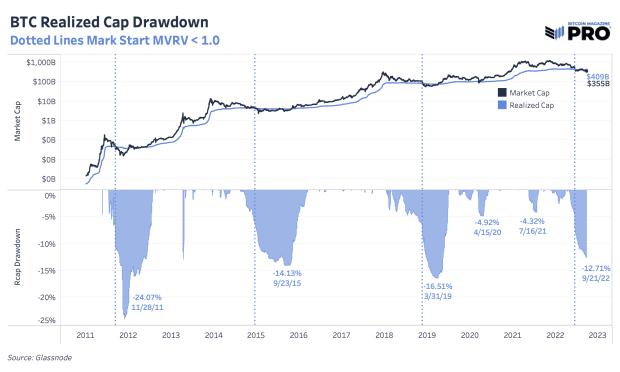

For those that spot this arsenic the clip to get semipermanent undervalued bitcoin, the realized marketplace headdress is an assuring illustration which shows the log maturation of bitcoin’s outgo ground implicit time. The outgo ground has lone dropped a maximum of 24.07% from rhythm highs and is presently down 12.71%. This is the illustration which we deliberation astir “non-bitcoin” investors don’t grasp. Even successful the “everything speculative” bubble, which bitcoin is simply a portion of, the outgo ground of the web is ever expanding oregon marginally declining contempt the chaotic regular speech complaint volatility.

The outgo ground is presently down lone 12.71%.

The outgo ground is presently down lone 12.71%.

3 years ago

3 years ago

English (US)

English (US)