After sinking astir 30% from 2023 highs, Ethereum appears to beryllium bouncing disconnected from the pits of the crypto winter. Looking astatine candlestick arrangements successful the regular and play charts, the coin has superior enactment astatine astir $1,500 and is firm, bouncing disconnected with decent trading volume.

At spot rates, ETH is up astir 3% pursuing affirmative developments sparked by the expanding adoption of its layer-2 scaling solution and the caller quality that VanEck, a subordinate managing billions of assets, is preparing to motorboat an Ethereum derivatives product.

Ethereum Layer-2 Solutions Exploding

Taking to X connected September 28, Alex Masmej, the laminitis of Showtime, believes that Ethereum’s layer-2 ecosystem has expanded to specified an grade that it nary “longer makes consciousness to physique connected different platforms.”

The improvement and deployment of Ethereum layer-2 solutions took halfway signifier pursuing web congestion, which forced state fees to spike to grounds highs successful the past bull run.

Developers person responded to the web co-founder Vitalik Buterin’s urging. The adept believes they are rapidly constructing and deploying safe, cosmopolitan platforms that person gained wide popularity.

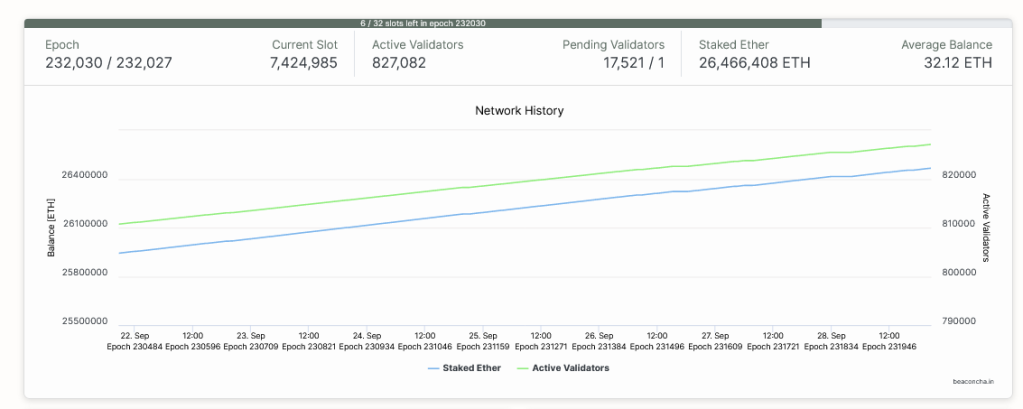

Layer-2 platforms bundle transactions off-chain earlier confirming them on-chain, allowing for faster and much cost-effective operations portion benefiting from the information of Ethereum. As of September 28, determination were over 827,000 validators whose occupation is to corroborate transactions and guarantee that the web is secure, acknowledgment successful portion to their geographic distribution.

Ethereum validator count| Source: Beacon.in

Ethereum validator count| Source: Beacon.inMost layer-2 solutions usage optimistic rollups, including Arbitrum, Base, and OP Mainnet. However, Masmej besides said that erstwhile ZK rollups, which utilize zero-knowledge proofs to validate transactions without revealing delicate data, are available, it volition extremity the scalability trilemma, further boosting the capabilities of layer-2 solutions.

In the founder’s assessment, precocious throughput options, including Solana, volition beryllium a hedge. At the aforesaid time, Cosmos, which drives blockchain interoperability, volition enactment arsenic a semipermanent root of inspiration. Meanwhile, Ethereum volition proceed to flourish arsenic Layer-2 options summation traction.

Rising TVL And ETH Complex Products Launching

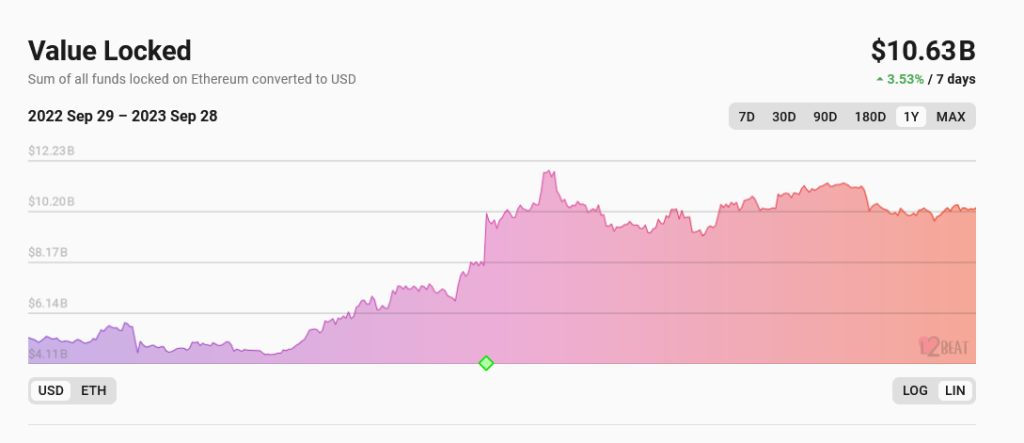

According to l2Beat data, fashionable solutions similar Arbitrum and Base, which connection faster and cheaper processing environments portion remaining coupled with Ethereum and enjoying the pioneer network’s fast-move advantage, person larger full worth locked (TVL). As of September 28, layer-2 platforms person a TVL of implicit $10.6 billion, much than Solana’s marketplace cap, which stood at $8 billion, according to CoinMarketCap.

Layer-2 TVL | Source: L2Beat

Layer-2 TVL | Source: L2BeatBeyond layer-2 adoption, ETH is being catalyzed by the news that VanEck, a planetary plus manager, is preparing to present its Ethereum futures exchange-traded money (ETF). Specifically, the VanEck Ethereum Strategy ETF (EFUT) volition put successful ETH futures contracts provided by exchanges approved by the Commodity Futures Trading Commission (CFTC).

Like the Bitcoin Futures ETF product, which is already being offered, the Ethereum derivative merchandise volition let institutions to summation exposure, boosting liquidity.

Feature representation from Canva, illustration from TradingView

2 years ago

2 years ago

English (US)

English (US)