The expansionary behaviour of the United States hasn’t stopped with different countries adopting bitcoin. The U.S. volition bash immoderate it takes to support the dollar.

This is an sentiment editorial by Pierre Corbin, the shaper and manager of “The Great Reset And The Rise of Bitcoin” documentary.

In the 18th century, the Dutch introduced the conception of communal funds, allowing investors to diversify betwixt antithetic planetary bonds. The aforesaid conception was embraced successful London successful the 19th century. This conception is what allowed companies similar F&C Investment Trust to beryllium founded successful 1868. F&C managed a portfolio of high-yielding planetary bonds, which pushed guardant the conception of portfolio diversification by putting unneurotic antithetic securities that lowered the hazard of the portfolio. This is existent successful fiscal theory, and anyone who has a higher acquisition successful concern surely worked connected gathering antithetic models astir that. At the time, they believed that adding immoderate benignant of further plus into a portfolio lowered its hazard — we present cognize this is not the case.

Of course, London was wherever the wealth was astatine the time. After beating France during the Napoleonic Wars, the U.K. established its presumption arsenic the world’s strongest empire and dispersed the British lb crossed the world. This diversification mentation was a large crushed to put successful the full world. Stock exchanges started sprouting astir the satellite and were a motion of a developed superior city. According to William Goetzmann of the National Bureau of Economic Research, “Between 1880 and 1910, much than fractional the world’s markets were launched.”

The British empire was far-reaching and majestic, but aft World War I, World War II and the aggregate bankruptcies wrong this period, it had to determination speech and fto different beardown powerfulness instrumentality over: the United States.

The U.S. has grown its power successful a akin fashion:

- This is wherever the wealth halfway was.

- By leveraging planetary markets and planetary investments.

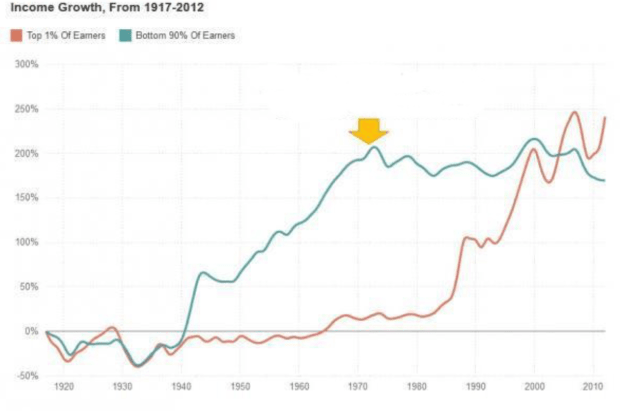

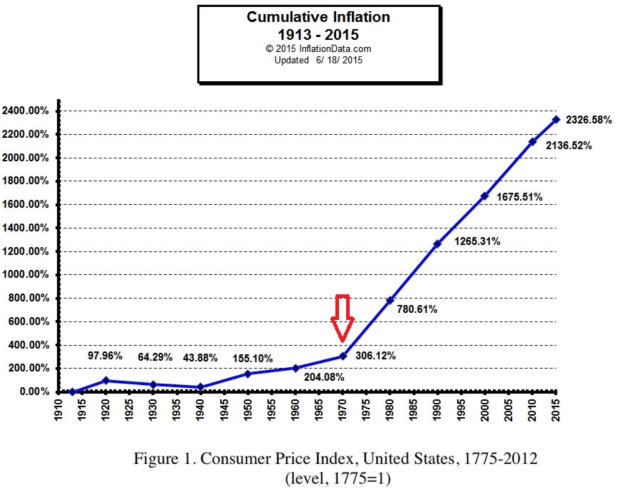

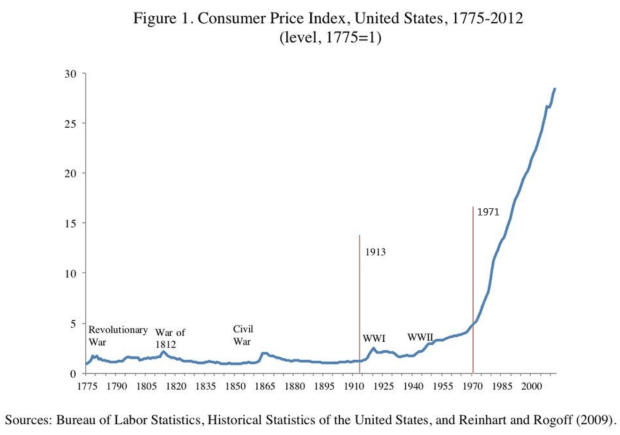

The U.S. dollar was astatine the halfway of this expansion, and the U.S. was successful power of the currency, giving them immense leverage implicit the remainder of the world. Since then, clip and clip again, the United States has utilized subject powerfulness to found and to support the presumption of the dollar. We’ve seen this in Iraq and successful different planetary conflicts. The U.S. has to support the presumption of the dollar due to the fact that without the presumption of planetary reserve currency, the presumption quo of the U.S. is astatine hazard and whitethorn person large impacts connected the U.S. and satellite economy. The information is that successful trying to support its presumption and the strategy created arsenic a effect of the Bretton Woods agreement, the U.S. leaders person dilatory destroyed the worth of the U.S. dollar and person impoverished their citizens on the way. There are immoderate wide charts that exemplify this semipermanent improvement that tin beryllium viewed here.

(Source)

(Source)

(Source)

(Source)

(Source)

(Source)

This, of course, is not lone a U.S. phenomenon, but is existent for the remainder of the satellite too. Through the usage of the petrodollar, and due to the fact that the U.S. dollar is the planetary reserve currency, each different currency has been devalued faster, starring to the aforesaid result, if not worse, everyplace else.

Today, it seems similar we are astatine a shifting point. The combat for U.S. dollar hegemony is going beardown successful Europe, precisely successful Ukraine. The headlines of the full satellite absorption lone connected the conflict, but omit to notation what is happening successful the inheritance with the fiat system, astatine the hazard of exposing the existent geopolitical plays. The BRICS nations person fixed wide hints astir their mid-to-long-term sentiment astir the future of the U.S. dollar. They person officially announced that they are gathering a caller reserve currency based connected existent hard assets, which see a fewer precious metals, further forcing the U.S. to effort to fortify their presumption arsenic the satellite police. We are seeing this done the power that was utilized pursuing the result of the statesmanlike elections successful Pakistan and the presumption they are trying to instrumentality successful the China-Taiwan relationship.

The combat for the U.S. dollar is besides happening connected different continent: Central America has ever been nether large power from the United States. Thomas Jefferson erstwhile said, “In immoderate governments they end, they volition beryllium American governments, nary longer to beryllium progressive successful the never-ceasing broils of Europe. America has a hemisphere to itself.” This meant the U.S. would marque definite European nations permission the region, truthful they tin power the portion themselves.

A tiny country, historically destroyed by the U.S. and their overreach successful the region, is trying to detach from the dollar since the state adopted it 20 years ago, pursuing the mediocre section monetary argumentation that was successful spot for decades. In September 2021, successful a historical move, El Salvador, the smallest state successful the region, was the archetypal state successful the satellite to follow bitcoin arsenic ineligible tender, sparking the occurrence that forced the U.S. authorities to acceptable its eyes connected the portion again. Since then, El Salvador has go a much important taxable successful planetary media. Thanks to this move, El Salvador’s tourism has accrued by 30% since the motorboat of the Bitcoin Law, and arsenic mentioned by their president, Nayib Bukele, the El Salvador gross home merchandise (GDP) grew 10.3% successful 2021, the archetypal twelvemonth successful their past to person a double-digit GDP growth.

On the planetary scene, though, their geopolitical relationships look to person changed since the country’s adoption of bitcoin. The champion motion of this is the Accountability for Cryptocurrency successful El Salvador (ACES) Act introduced by U.S. senators Jim Risch (R-Idaho), Bob Menendez (D-N.J.) and Bill Cassidy (R-La.). The extremity of this authorities is to let the U.S. to show the adoption of bitcoin successful El Salvador and instrumentality actions if they see that it tin correspond a hazard for the U.S. economy. As a reminder, the U.S. GDP successful 2021 was $23 trillion, portion the El Salvador GDP was $28.7 billion. This makes the El Salvador system an bid of magnitude smaller than the 1 successful the U.S. It seems similar the extremity of this authorities is not to mitigate the risks El Salvador represents to the U.S. economy, but to person a unfortunate successful lawsuit they see bitcoin to beryllium unsafe to the U.S. dollar.

Samson Mow, CEO of JAN3, described this the best:

(Source)

(Source)

Another important constituent to enactment is the popularity of Nayib Bukele successful the region. Adopting bitcoin comes with adopting amended semipermanent values. He is among the astir fashionable presidents successful the past of his state and is the most fashionable president successful Latin America.

Since the adoption of bitcoin successful El Salvador, different countries successful the portion person considered adopting it too, but person slowed their adoption due to the fact that of outer pressure. Honduras is dilatory moving guardant though, acknowledgment to regions oregon cities acting independently successful the hopes of attracting overseas investments and tourism.

The U.S. government’s combat for the dollar is simply a fascinating story. We are astatine a turning constituent successful history, wherever the dollar could suffer its reserve currency status, and the U.S. authorities volition bash astir thing to support it. One of their actions successful this absorption is to censor bitcoin adoption successful the world.

This is simply a impermanent station by Pierre Corbin. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)