Footprint Analytics and DeGame, person released the 2022 Q1 GameFi Industry Report, providing a broad look into manufacture show during the past quarter.

Cover art/illustration via CryptoSlate

The crypto marketplace saw a important diminution successful 2022, but not each sectors faced the aforesaid trajectory. In 2022, the backing marketplace has shown to beryllium precise active, with superior flowing into the GameFi manufacture astatine an unprecedented rate. The wide Q1 backing magnitude of the GameFi roseate 194.19% twelvemonth connected year, with start-up crippled projects being hotly pursued by superior and the manufacture processing positively.

In its report, Footprint Analytics, the ocular information analytics platform, and DeGame, a Web 3.0 NFT crippled infrastructure platform, person provided a broad look astatine the GameFi industry’s show successful the archetypal 4th of 2022.

In it, they cover:

- Overall marketplace information and trends

- GameFi-related show connected assorted blockchains

- Investment and financing developments,

- A elaborate look astatine STEPN, the quarter’s biggest project

Here are the cardinal points that you indispensable cognize from the happenings of the GameFi manufacture successful the past quarter.

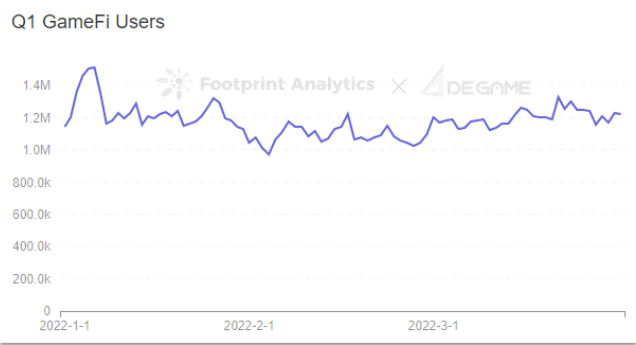

I. The GameFi marketplace was stable

The full marketplace capitalization of each GameFi tokens fell by 15% successful Q1 owed to marketplace trends, which correlated with fluctuations successful the BTC marketplace cap. However, the full fig of GameFi users remained astir the aforesaid arsenic successful 2021 Q4 astatine astir 1.2 million.

Footprint Analytics & DeGame – Q1 GameFi Users

Footprint Analytics & DeGame – Q1 GameFi UsersThe full transaction measurement of GameFi projects crossed each chains successful Q1 was $6.322 billion. The apical 3 chains by transaction measurement from GameFi were WAX, Hive, and BSC. WAX is successful the lead, accounting for 77.7% of the full crippled measurement of each concatenation combined.

The regular trading measurement peaked astatine $205.8 cardinal connected Jan. 9 and declined after.

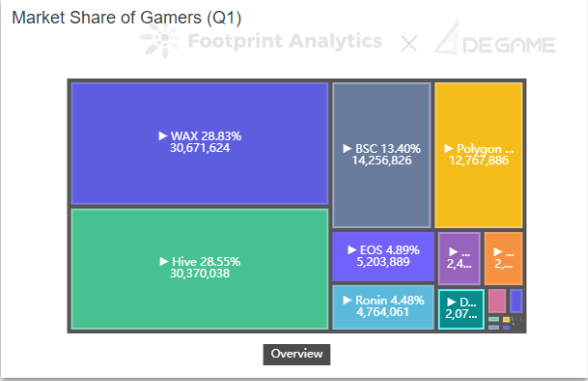

II. Many chains stay undiversified

In Q1, astir chains continued to beryllium dominated successful presumption of users by a azygous large, palmy project. BSC and Ethereum are exceptions to this inclination and person comparatively adjacent distribution.

Footprint Analytics & DeGame – Market Share of Gamers (Q1)

Footprint Analytics & DeGame – Market Share of Gamers (Q1)Here are immoderate of those unbalanced ecosystems and their respective caput games:

Wax: Alien Worlds (100% of full users)

Hive: Splinterlands (99.9% of full users)

Ronin: Axie (100% of users)

EOS: Upland (94.1% of users)

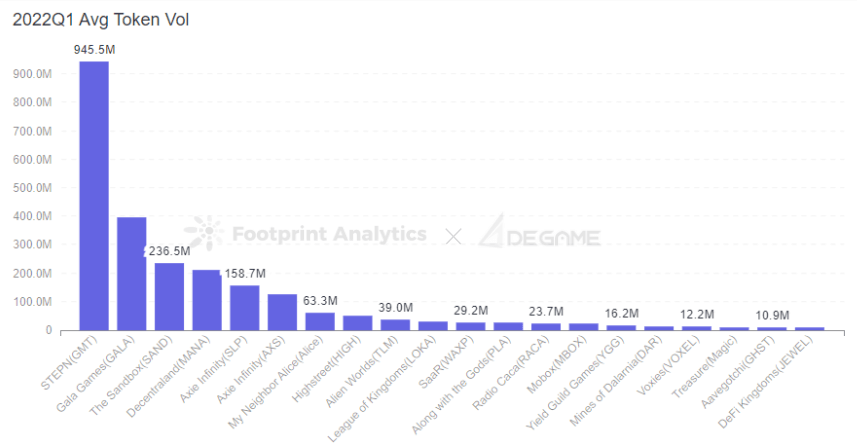

III. 2022 Q1 Game Token Liquidity

In Q1 2022, 20% to 30% of tokens listed connected centralized exchanges were GameFi task tokens, and the trading measurement of the caput crippled tokens is highly high, occupying the bulk of the marketplace share.

Footprint Analytics & DeGame – 2022Q1 Avg Token Vol

Footprint Analytics & DeGame – 2022Q1 Avg Token VolThe task with the highest regular token trading measurement was STEPN, whose governance token, GMT, had an mean regular trading measurement of astir $100 cardinal and was the champion performing concatenation successful presumption of token liquidity realization. It was followed by Gala Games, The Sandbox, and Decentraland.

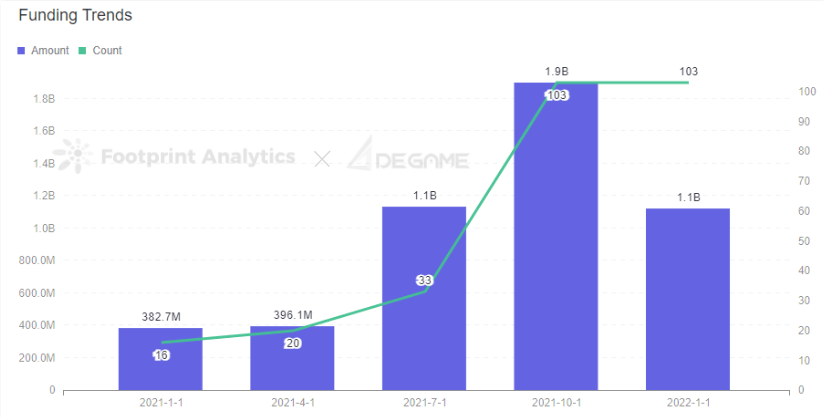

IV. 2022 Q1 GameFi Investment Jump by 194.19% YoY

The GameFi marketplace saw a 194.19% summation successful Q1 backing compared with the information past twelvemonth and a 40.78% alteration connected a season-over-season basis. Out of each task categories, indie games—those video games typically created by individuals oregon smaller improvement teams—were astatine the forefront successful presumption of some the fig and magnitude of backing than immoderate different class of GameFi project.

Footprint Analytics & DeGame – Funding Trends

Footprint Analytics & DeGame – Funding TrendsThere were much effect rounds than immoderate different benignant successful Q1 for GameFi, whereas strategical rounds raised the astir funds. Projects connected Polygon received the astir backing successful magnitude and quantity, and Animoca Brands was the astir progressive concern institution.

V. STEPN dominated the 4th with innovative gameplay

STEPN, a move-to-earn GameFi app built connected Solana, officially launched successful January and reached 21K regular and 66K monthly idiosyncratic activities successful February, which is ace fast.

Since its motorboat successful January, the fig of caller regular top-up users has been growing, and the maturation complaint has accelerated, with the existent regular top-up users astatine astir 5-8K. Official wallet GST regular incoming and outgoing amounts scope 10 cardinal USD, with regular withdrawals and deposits showing a stepped and important emergence astatine the extremity of March. However, the nett inflow and outflow person been successful a dynamic balance.

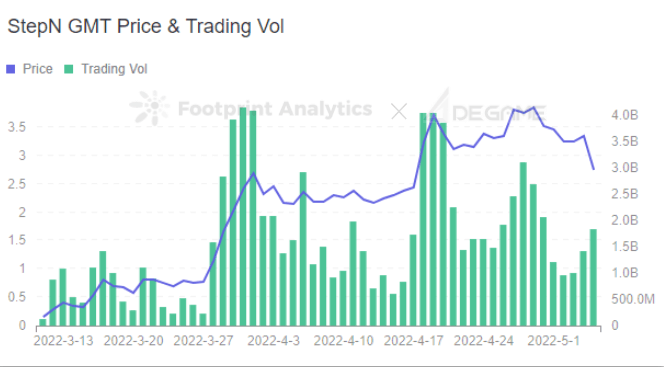

Footprint Analytics & DeGame – STEPN GMT Price & Trading Vol

Footprint Analytics & DeGame – STEPN GMT Price & Trading VolConclusion:

While it whitethorn look similar GameFi is successful a bubble, information from Q1 indicates that the assemblage has been comparatively beardown compared to the greater crypto industry. The marketplace headdress of gaming projects was stable, token liquidity increased, and VCs continued showing important involvement successful caller projects. Additionally, caller usage cases successful the signifier of move-to-earn person opened the anticipation for much wide adoption of GameFi.

However, galore chains inactive look trouble diversifying their ecosystem, which whitethorn airs a systemic hazard to some the concatenation and the caput GameFi projects that beryllium connected them.

To amended recognize each of these trends, work the afloat 2022 Q1 GameFi Industry Report by Footprint Analytics and DeGame.

About Footprint Analytics:

Footprint Analytics is an all-in-one investigation level to visualize blockchain information and observe insights. It cleans and integrates on-chain information truthful users of immoderate acquisition level tin rapidly commencement researching tokens, projects, and protocols. With implicit a 1000 dashboard templates positive a drag-and-drop interface, anyone tin physique their ain customized charts successful minutes. Uncover blockchain information and put smarter with Footprint.

About DeGame:

DeGame.com is simply a Web 3.0 NFT crippled infrastructure level nether Singapore-based blockchain institution L2Y Research. DeGame aims to go the astir broad aggregator of Steam and GameFi MarketCap successful the Web 3.0 world. With DeGame, players and investors tin amended place and observe high-quality games and Play-to-Earn earning opportunities done its one-stop solutions: crippled searching, information tracking & analysis, strategy, download, and much functions.

3 years ago

3 years ago

English (US)

English (US)