Russia · Ukraine› Bitcoin · Ethereum › Analysis

The equipped struggle betwixt Ukraine and Russia is apt to person consequences that agelong beyond the subject level, with its effects already being felt passim the crypto space.

Cover art/illustration via CryptoSlate

While the equipped warfare betwixt Ukraine and Russia whitethorn look to beryllium confined to a subject level, it is apt to person far-reaching consequences for overmuch of the world.

Economic analysts expect it to trigger a melodramatic emergence successful ostentation partially due to the fact that Russia is the world’s biggest exporter of earthy state and second-largest seller of oil.

In addition, hundreds of thousands, if not millions, of radical volition beryllium displaced from Ukraine, posing a caller exile contented for the satellite (and specifically Europe).

Furthermore, there’s cryptocurrency. While galore radical aren’t focusing connected the cryptocurrency marketplace and manufacture astatine the moment, there’s nary uncertainty that the protracted combat volition impact Bitcoin.

There is nary uncertainty that it has already had immoderate effects, peculiarly since Bitcoin dropped by much than 10% successful a azygous time successful effect to the archetypal rumors of a Russian penetration connected February 24.

Russia’s imaginable flight from sanctions by utilizing crypto whitethorn effect successful accrued regularisation of the concern successful the West, but the struggle whitethorn payment the market.

This is chiefly due to the fact that it illustrates however cryptocurrencies, including Bitcoin, tin boost large causes and empower individuals erstwhile different avenues are unavailable.

Those successful request tin payment from cryptocurrency successful real-world situations

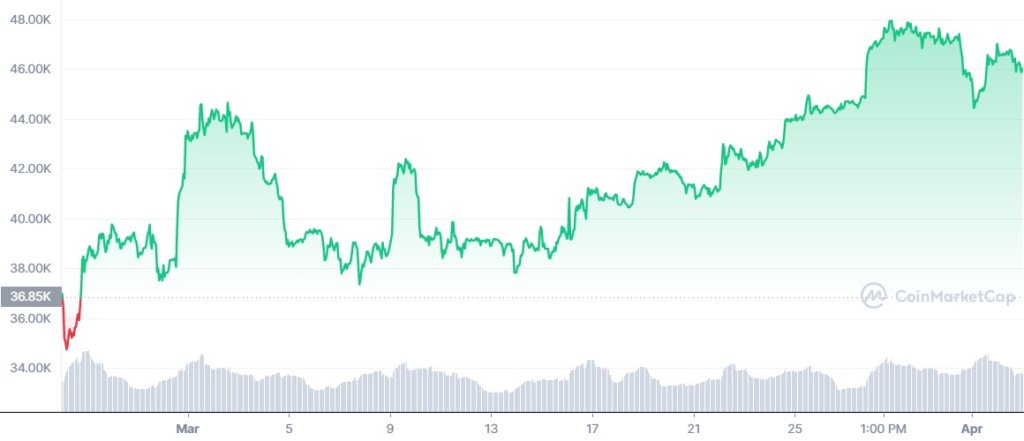

Since the archetypal assault, the marketplace has reassuringly stabilized (as of this writing).

Bitcoin fell to a debased of $34,740 connected February 24 arsenic investors fled riskier assets.

The Russian incursion into Ukraine raised important concerns astatine the time, but fixed the Ukrainian forces’ absorption and the cognition that sanctions against Russia were little terrible than expected, the concern has since improved for BTC (and different assets).

Indeed, BTC has accrued by an astonishing 25% since plummeting to £34,740, to implicit $43,500.

BTC Recovery during the Ukraine-Russia conflict

BTC Recovery during the Ukraine-Russia conflictDepending connected the situation, the marketplace could autumn again if unit erupts oregon sanctions person a important interaction connected Western nations.

Despite the ongoing conflict, markets are presently performing good successful airy of the existent concern and galore different aspects of the struggle that are beneficial to crypto. In particular, cryptocurrency has erstwhile again proven its worthy arsenic a instrumentality for crowdfunding and charitable giving.

In the latest tally from the analytical steadfast Elliptic, the Ukrainian authorities and pro-government NGOs person received astir $24.6 cardinal successful assorted cryptocurrencies.

This sum is the effect of 26,000 abstracted gifts, including 1 for $3 cardinal successful bitcoin and different for $1.86 million. Ukraine has besides been offered contributions from Uniswap (crypto exchange), Aid for Ukraine (DAO) and Dr. Gavin Wood (the laminitis of Polkadot).

Since the commencement of the conflict, Ukrainian officials posted Bitcoin and Ethereum addresses connected their Twitter account, giving donors a nonstop and wide code to which to nonstop donations.

Stand with the radical of Ukraine. Now accepting cryptocurrency donations. Bitcoin, Ethereum and USDT.

BTC – 357a3So9CbsNfBBgFYACGvxxS6tMaDoa1P

ETH and USDT (ERC-20) – 0x165CD37b4C644C2921454429E7F9358d18A45e14

— Ukraine / Україна (@Ukraine) February 26, 2022

Over $10.2m (9.2 cardinal euros) worthy of cryptocurrency was donated to the wallets wrong 4 days of the commencement of the invasion.

The Ukraine authorities has gone connected to person much than $100m worthy of crypto ever since, with 60% of the donations coming from the “Crypto Fund for Ukraine”, which is tally by Michael Chobanian – the laminitis of the Ukrainian crypto speech Kuna.

“We are inactive collecting crypto. It is being spent connected assistance similar regular rations and bullet-proof vests and helmets,” the 37-year-old Ukrainian told AFP.

Such contributions payment not lone the Ukrainian authorities and subject but besides amusement however cryptocurrencies tin assistance interruption down barriers to planetary transactions and operations. To enactment it different way, cryptocurrency acts arsenic a dependable nexus betwixt assorted peoples and countries.

Indeed, galore caller cryptocurrency-related headlines from Ukraine person conveyed this message. Several radical person reported that bitcoin and different cryptocurrencies allowed them to evacuate Ukraine earlier the warring reached their neighborhoods.

Despite the stoppage of ATM withdrawals, immoderate users were capable to determination their bitcoins and different cryptocurrencies to blistery wallets and usage them to wage for question to different parts of Europe.

Other accounts item however astatine slightest 1 idiosyncratic successful Ukraine utilized BTC to bargain a car (to facilitate their exit from the country) and however aggregate members of Crypto Twitter staged slope runs and blocked ATMs to show however cryptocurrencies let radical to bypass fiscal restrictions and, by extension, war-torn countries that enforce them.

In essence, the Ukrainian struggle supports the oft-repeated conception that bitcoin ownership promotes idiosyncratic sovereignty and liberty.

And, if a increasing fig of Ukrainians crook to Bitcoin and different cryptocurrencies during the crisis, the second mightiness assistance dispersed the conception of crypto arsenic a liberating tool.

The Impact of the Ukraine-Russia Conflict connected Cryptocurrency

Given that the Russian ruble has fallen by up to 25% since the state was sanctioned, we tin expect important maturation successful Bitcoin and cryptocurrency ownership successful Russia.

Bitcoin has present eclipsed the ruble successful presumption of marketplace valuation, and with implicit 11% of the Russian big colonisation owning cryptocurrencies, this fig is definite to emergence arsenic radical effort to support their assets.

Bitcoin has besides risen by over 35% since the commencement of the Ukraine-Russia conflict. Even if crypto appears to beryllium successful a terrific crisis, things for Bitcoin and cryptocurrencies whitethorn not beryllium arsenic agleam arsenic they appear.

There is increasing suspicion that Russia whitethorn usage cryptocurrencies to evade planetary sanctions, but immoderate experts person highlighted concerns astir however casual it would beryllium to person billions of dollars to bitcoin and determination specified ample amounts around.

Sanctions, connected the different hand, person targeted alleged oligarchs arsenic individuals, and the satellite assemblage whitethorn observe that they usage crypto to debar antagonistic fiscal consequences.

This is intelligibly the US government’s thinking, arsenic it has already begun discussions with cardinal American cryptocurrency exchanges connected however to forestall Russian citizens from circumventing sanctions by utilizing Bitcoin and different virtual currencies.

The interest present is that Russian individuals and entities volition proceed to successfully exploit cryptocurrency to displacement their wealthiness astir the world. If this is the case, the manufacture whitethorn brushwood stiff absorption from regulators and authorities agencies, who whitethorn question to restrict cryptocurrency usage severely.

Experts judge this is simply a superior risk, with Cowen expert Jaret Seiberg telling MarketWatch that the US is acrophobic that Russia whitethorn usage cryptocurrencies to circumvent sanctions.

“If Russia succeeds successful this quest, we expect governmental enactment for cryptocurrency to wane successful the United States, and regulatory hazard to rise,” helium said.

Of course, the concern successful Ukraine and Russia is present fluid and uncertain, truthful it’s hard to accidental whether targeted Russians would clasp cryptocurrencies successful a ample way.

It remains a possibility, though, considering that the turmoil has accrued bitcoin volumes successful some Ukraine and Russia.

As a result, traders should beryllium alert that, contempt a caller upswing successful marketplace fortunes, the marketplace whitethorn reverse people successful the future, depending connected the conclusion.

3 years ago

3 years ago

English (US)

English (US)