Following caller geopolitical events, the correlation betwixt golden and Bitcoin prices has erstwhile again travel nether scrutiny by marketplace analysts. Here’s a broad dive into the narration and its implications.

The Gold And Bitcoin Correlation

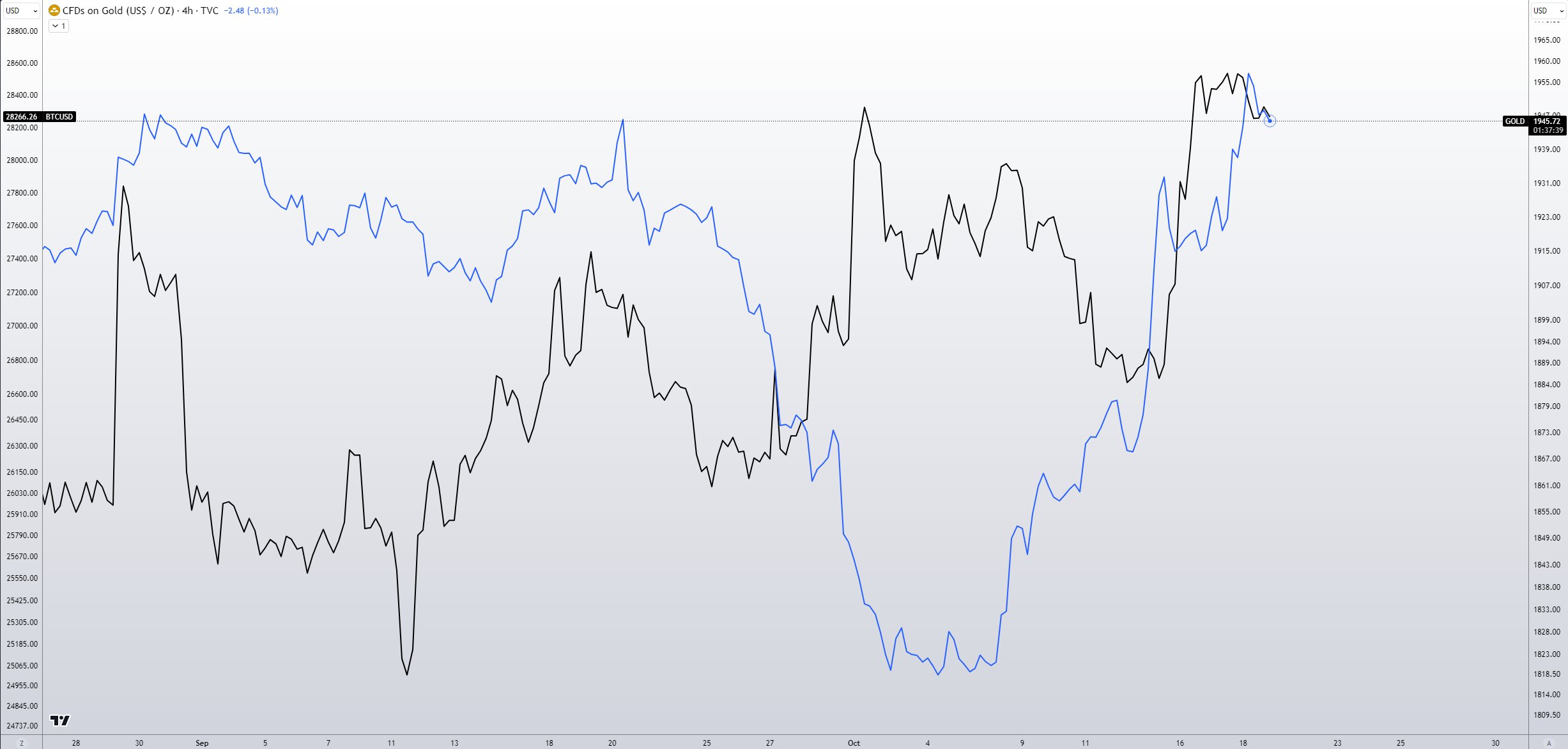

After the caller Israel-Hamas war, golden experienced a accelerated uptick successful its price. This displacement interestingly mirrored movements successful the Bitcoin market, emphasizing a revived correlation betwixt the 2 assets. Skew, a reputable marketplace analyst, shared his insights connected X (formerly Twitter), noting connected October 11 that “correlation has been alternatively loosely applicable to BTC periods of 35 days + wherever there’s terms disconnection betwixt some markets.”

However, lone days later, connected October 16, helium observed a imaginable “re-correlation” arsenic some Bitcoin followed the latest golden rally. Today, the connection stands stronger with Skew’s latest tweet, “BTC & golden correlation inactive determination it seems. Gold whitethorn pb the adjacent large determination for BTC.”

Bitcoin and golden correlation | Source: X @52kskew

Bitcoin and golden correlation | Source: X @52kskewIn his caller insights shared successful the Onramp Weekly Roundup, Bitcoin expert Dylan LeClair emphasized the implications of the ongoing selloff successful authorities bonds. Rising costs for semipermanent financing straight power the planetary outgo of capital, offering a valuation yardstick for assorted assets.

More significantly, the treasury marketplace underpins the planetary fiscal ecosystem. Its existent instability could unit plus prices and exacerbate the pre-existing indebtedness cycle, perchance endangering the US’s fiscal position. This precarious authorities contrasts sharply with the US administration’s fiscal actions, arsenic evidenced by plans similar the “WHITE HOUSE EYES $100 BILLION UKRAINE, ISRAEL AND BORDER ASK”, suggesting a deficiency of fiscal restraint, according to LeClair.

Gold, Real Yields, And The Changing Landscape

Further complicating matters, Bill Dudley, erstwhile president of the Federal Reserve Bank of New York, successful his caller Bloomberg piece, noted the likelihood of the existent rhythm of quantitative tightening (QT) persisting until precocious 2025. This prolonged QT could heighten semipermanent involvement rates and hazard treasury marketplace turbulence. Yet, should terrible dysfunction manifest successful the treasury market, the Federal Reserve mightiness reconsider its QT trajectory.

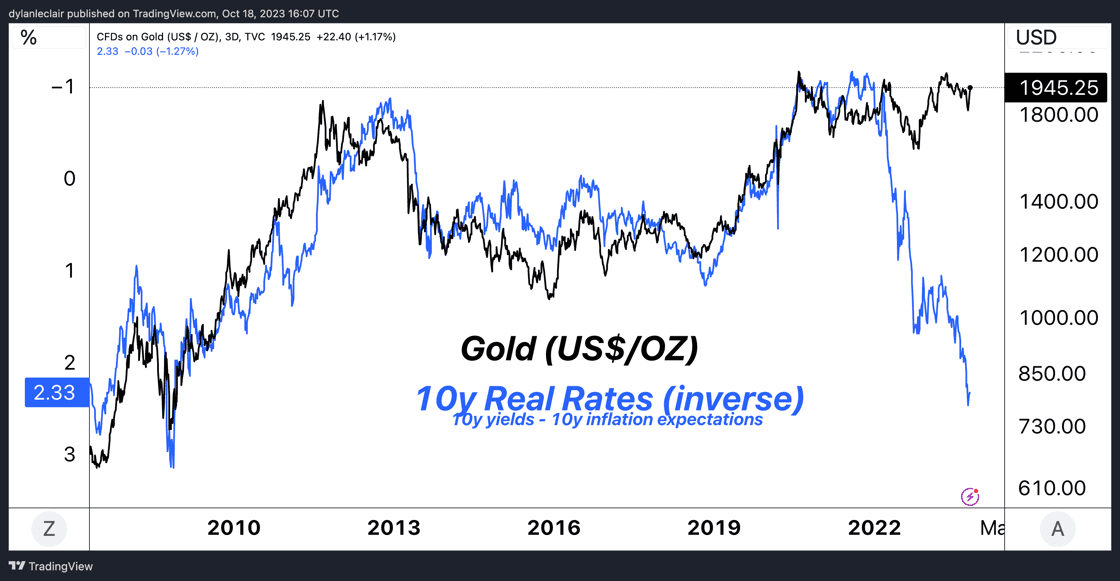

Interestingly, station the Russia-Ukraine struggle and the consequent confiscation of Russia’s G7 reserves, gold, and existent yields person shown an atypical affirmative correlation, challenging their humanities antagonistic relationship.

Gold vs 10-year existent rates (inverse) | Source: Onramp

Gold vs 10-year existent rates (inverse) | Source: OnrampIn this evolving geopolitical scenery wherever adjacent G7 sovereign indebtedness isn’t immune to confiscation, accepted ‘safe assets’ are being reevaluated. This uncertainty combined with the not-so-safe “risk free” output from treasuries has bolstered gold’s presumption (and price) arsenic a counter-risk monetary plus and whitethorn propulsion Bitcoin connected a akin trajectory.

According to LeClair:

This repositioning, however, isn’t constricted to golden alone. Bitcoin, with its unsocial advantages and increasing liquidity profile, is connected a akin trajectory, albeit inactive successful the precise aboriginal stages of its monetization with a $500b marketplace cap.

The Best BTC Price Indicator?

Under these existent conditions, the terms of golden whitethorn beryllium a starring indicator for the terms of Bitcoin, assuming that the correlation betwixt the 2 assets continues. This would connote that Bitcoin is classified arsenic a “safe haven” plus similar golden by a bulk of investors, alternatively than a “risk asset”.

However, this presumption is not shared by all. James Butterfill, the caput of probe astatine CoinShares, pointed retired that the Bitcoin marketplace has shifted its absorption aft the fake news regarding a spot Bitcoin ETF approval. He remarked that investors present look to prioritize the ETF support implicit macro expectations, placing little accent connected the Federal Reserve’s actions.

Since the Coin Telegraph tweet mistake connected a Bitcoin Spot ETF approval, Bitcoin prices person decoupled from December involvement complaint expectations – it seems similar investors are solely focussed connected the ETF support now, and not what the FED does.

At property time, Bitcoin traded astatine $28,450.

BTC hovers beneath $28,500, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC hovers beneath $28,500, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)