If the past 12 months successful cryptocurrency has taught america anything, it's that radical truly similar owning a portion of codification that proves they overpaid for a jpeg. And it's not conscionable astir monkey pictures either. Soon NFTs volition beryllium utilized to commercialized euphony rights, existent estate, and indebtedness instruments.

NFTs person a unusual narration with cryptocurrencies. It’s akin to that of a genitor and child. When the NFT marketplace was small, it depended connected the crypto markets for its terms action; but arsenic they person matured they person been breaking away.

When the cryptocurrency marketplace did its champion content of a downhill skis slope successful January, NFTs were booming, with NFT trading level OpenSea signaling $5 cardinal successful income volume, an all-time high. Some crypto observers thought this meant determination was a reverse correlation betwixt crypto and NFT markets: When Bitcoin and the remainder of the crypto marketplace goes up, NFTs spell down, and vice versa.

Others person pointed retired times erstwhile some markets person moved successful sync arsenic was the lawsuit precocious erstwhile NFTs sankalong with the remainder of the marketplace erstwhile the conflicts successful Ukraine began.

Professional probe connected NFTs is bladed connected the crushed because, conscionable a mates of years ago, astir of the marketplace didn’t exist. However, 1 survey that looked into the taxable is titled “Is Non-Fungible Token Pricing Driven by Cryptocurrencies?” by Dublin City University Professor Michael Dowling,

“Anyone progressive successful the NFT marketplace volition beryllium alert of the beardown crossover betwixt cryptocurrency marketplace participants and NFT marketplace participants,” says the paper.

This is partially due to the fact that to bargain an NFT you request to usage cryptocurrencies arsenic a means of payment, a non-trivial level of complexity for galore people.”

Of course, Coinbase plans to marque information easier. Its overmuch anticipated NFT marketplace volition let users to bargain these assets with fiat utilizing their recognition cards. Indeed, companies similar eBay, Reddit, and Instagram each person plans to integrate NFTs, besides apt utilizing fiat options that whitethorn origin NFTs to further decouple from crypto. But until that happens, the transportation betwixt the 2 markets remains pertinent, and besides, NFTs volition ever request a blockchain similar Ethereum and Solana to function.

“Immediately evident from the results is that, compared to cryptocurrencies, determination is overmuch little spillover from and to NFT markets,” says the paper. “Further, adjacent among the NFT markets determination is rather constricted spillover, suggesting these markets are rather chiseled from each other.”

A June 2021 study by Blockchain Research Lab agrees with Dowling. “A driblet successful cryptocurrency worth means little purchasing power, which is apt to depress the NFT market,” the survey says. “Conversely, erstwhile cryptocurrencies appreciate, investors thin to look for caller oregon alternate concern opportunities. This is particularly plausible successful the discourse of ETH, the modular denomination of NFTs.”

However, some papers were released successful the archetypal fractional of 2021, earlier the NFT marketplace took off. Data from 2022 suggests that determination mightiness not beryllium overmuch correlation betwixt the 2 aft all.

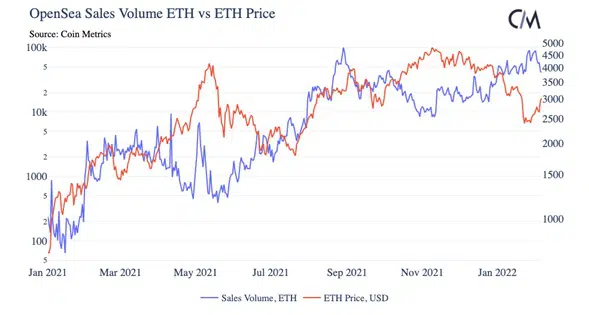

A Coin Metrics report from February 2022 looked astatine the correlation betwixt the terms of Ether (ETH) and the income measurement of OpenSea to spot if rising ETH terms caused a driblet successful NFT sales. “Looking astatine the information determination does not look to beryllium a accordant correlation betwixt OpenSea income measurement and ETH price,” the study says. “It appears that NFTs are a comparatively autarkic marketplace and may, for the astir part, determination separately from the remainder of the crypto market.”

DappRadar besides concluded that NFTs respond otherwise to macro factors than the remainder of the crypto markets. “The undeniable relation that NFTs play successful some the metaverse and the play-to-earn narratives has chiefly contributed to affirmative on-chain metrics contempt unfavorable macro indicators,” says a Jan. 2022 report.

However, immoderate salient traders inactive spot patterns betwixt NFTs and crypto markets. They reason that erstwhile Bitcoin and altcoins decline, wealth moves into NFTs. This could beryllium due to the fact that traders are looking for determination to instrumentality profits, oregon to pursuit much gains, oregon due to the fact that trading jpegs is simply a amusive diversion during times of marketplace turmoil.

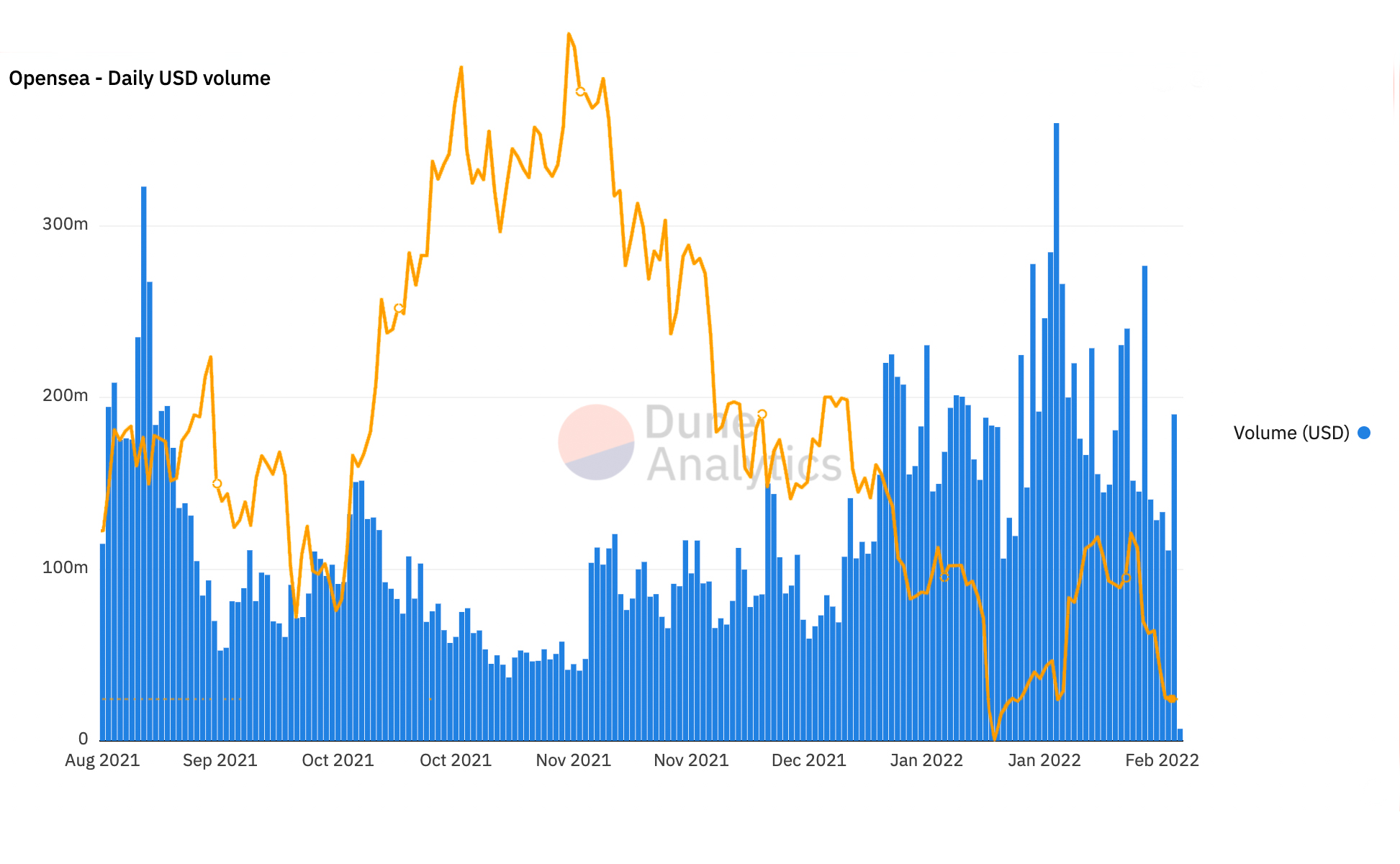

Using information connected OpenSea’s regular income measurement from Dune Analytics, we tin place 2 alleged “NFT bull runs.” The archetypal started successful precocious July 2021 and picked up steam successful August earlier declining successful September. A 2nd large NFT uptrend began successful mid-November 2021 and peaked connected Feb. 1, 2022.

While NFT measurement started to summation successful July erstwhile BTC terms was successful the doldrums, some crypto and NFTs posted gains In August 2021. Bitcoin gained 76% that period earlier declining successful September on with NFTs. So the lone wide lawsuit of inverse correlation has been November-February erstwhile NFT measurement boomed portion BTC and altcoins declined.

It’s absorbing that the colonisation astir apt to reason for patterns and correlations are traders whose occupation it is to spot patterns and enactment with conviction. On the different hand, analysts and academics are little cocksure successful their conclusions. “I don’t judge crypto markets are truthful easy related,” said Lennart Art, co-founder of Blockchain Research Lab. “If Bitcoin drops 10% nary 1 wants NFTs, radical would alternatively determination to stablecoins.”

What’s clearer, is erstwhile NFTs were successful their infancy – earlier March 2021 – determination was a spillover effect from the larger cryptocurrency markets. But since the precocious 2021 boom, the NFT marketplace has behaved differently.

Maybe it’s conscionable a bubble that has been large capable to elevate the NFT marketplace adjacent arsenic the remainder of crypto is floundering. Or possibly we are seeing a maturing NFT marketplace decouple from crypto and spell its ain way.“The January NFT roar was mostly driven by societal media hype and fearfulness of missing retired (FOMO),” said Art. “The roar could inactive person a mode to spell and you ne'er cognize however large thing tin get.”

NFTs look to beryllium moving distant from the cryptocurrency markets that birthed them but are besides not afloat autarkic They are behaving similar teenagers: experimental, rebellious, and keen to spell successful their ain direction.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Shows, amusement newsletter promo.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

2 years ago

2 years ago

English (US)

English (US)